The US semiconductor industry is facing one of its most critical turning points in years. That’s because the geopolitical tensions between the US and China have thrown chipmakers into a bind.

With fears of a recession on the horizon, compounded by various export controls on shipping to China, the semiconductor industry is experiencing various headwinds.

From the sweeping workforce cuts at Intel Corporation (NASDAQ: INTC) to the heavy blow of new export restrictions reshaping markets for giants like Nvidia Corporation (NASDAQ: NVDA) and Advanced Micro Devices, Inc (NASDAQ: AMD), the landscape is shifting fast—and not without consequence.

At the same time, Nvidia is making a historic US$500 billion bet on US manufacturing, signaling a fierce race to secure technological dominance [1]. In this analysis, we’ll dive deep into how these developments are reshaping America’s semiconductor future—and what they could mean for investors betting on the next era of tech leadership.

Intel’s Workforce Restructuring: Efficiency or Erosion? [2]

Intel, a cornerstone of the semiconductor industry, announced a significant restructuring in April 2025, planning to cut over 20% of its workforce—more than 21,000 employees—under the leadership of new CEO Lip-Bu Tan (Intel Layoffs Announcement).

This follows a 15,000-employee reduction in August 2024, signaling a concerted effort to streamline operations and rebuild an engineering-driven culture. The layoffs aim to eliminate bureaucracy and reduce operating expenses, projected to drop to US$17 billion in 2025 and US$16 billion in 2026.

Intel’s Turnaround Effort Begins: Solid Q1 Results but Cautious Outlook Ahead

Intel delivered a better-than-expected Q1 2025, posting revenue of US$12.67 billion (beating estimates by US$354 million) and non-GAAP EPS of $0.13, surpassing breakeven forecasts.

Under new CEO Lip-Bu Tan, Intel is aggressively restructuring—cutting costs, flattening leadership layers, and refocusing on core products—to reignite innovation and competitiveness.

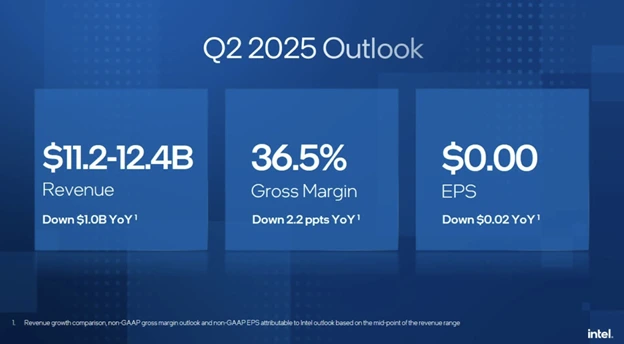

However, the company issued cautious Q2 2025 guidance, projecting revenue between US$11.2 billion and US$12.4 billion, as macro uncertainty, tariffs, and supply constraints loom large.

Intel’s shares fell 6.7% post-earnings, highlighting investor scepticism as the company embarks on a multi-year turnaround journey emphasising efficiency, AI integration, and foundry trust rebuilding.

The stock breached a key support level at US$21, testing the US$20 mark. Technical analysis shows previous support at US$19.34, the day’s low on 25 April, and the 52-week low of US$17.67. Resistance is observed at the former support of US$21, with additional resistance around US$23 based on recent analyst price targets.

Fundamental Analysis

Intel’s financial health is under strain, with annual revenue declining from US$79 billion in 2021 to US$53.1 billion in 2024. The company reported a full-year GAAP EPS loss of US$4.38 in 2024, with non-GAAP EPS at -US$0.13.

Intel’s debt stands at approximately US$50 billion, with long-term debt at US$46.28 billion and short-term debt at US$3.73 billion, yielding a debt-to-equity ratio of about 0.48 (Intel Debt 2025).

While cost-cutting measures and government grants, such as US$1.1 billion from the US Department of Commerce, provide some relief, Intel’s ability to regain market share in CPUs and expand its foundry business will be critical. The layoffs, while aimed at efficiency, risk eroding innovation if key talent is lost.

Nvidia’s $500 Billion US Investment: Strategic Sovereignty [3]

Nvidia, the dominant player in AI chips, announced a US$500 billion investment in US-based AI infrastructure over the next four years, a move to bolster domestic manufacturing and reduce reliance on foreign supply chains.

The initiative includes building supercomputer manufacturing plants in Texas with partners Foxconn and Wistron, and producing Blackwell AI chips at TSMC’s Arizona facilities. This strategic pivot aligns with US government efforts to enhance technological sovereignty amid trade tensions, particularly with China.

Financial Performance

Nvidia’s FY2025 results showcased its strength, with revenue of US$130.5 billion, up 114% year-over-year, and Q4 FY2025 revenue of US$39.3 billion, a 78% increase. GAAP EPS for the year was US$2.94, up 147%.

Nvidia forecasted Q1 FY2026 revenue at US$43 billion, plus or minus 2%. However, new export restrictions to China, announced in April 2025, are expected to result in a US$5.5 billion revenue hit, with some analysts estimating up to US$10 billion in lost sales over coming quarters.

Nvidia’s stock initially reacted positively to the investment announcement, rising from US$110.71 on April 14, 2025, to $112.20 on April 15. However, news of export restrictions triggered a sharp decline, with the stock falling to US$96.91 by April 21 before recovering to US$111.01 by April 25.

Technical analysis indicates support around US$95, where the stock rebounded, and resistance at US$112-114, near pre-announcement levels. The rapid recovery suggests institutional buying, with the Relative Strength Index (RSI) likely moving from oversold to neutral levels.

Fundamental Analysis

Nvidia’s fundamentals remain robust, driven by its leadership in AI GPUs. The company’s market cap is around US$2.71 trillion, reflecting strong investor confidence despite a 17.3% year-to-date decline in 2025.

The US$500 billion investment is expected to enhance long-term growth by securing US-based supply chains, though short-term challenges from export restrictions could impact Q1 FY2026 earnings, scheduled for May 28, 2025.

Analysts have issued a consensus price target of US$173.86. This reflects their outlook based on current performance expectations. At current levels, Nvidia is trading at approximately 25 times its forward earnings, below its 5-year average PE level.

AMD’s Balancing Act: Innovation Amid Export Uncertainty

AMD is confronting export restrictions that could cost US$800 million, particularly affecting its MI308 AI chips, as the US requires licenses for sales to China [4].

The company is applying for licenses, but uncertainty persists. Despite this, AMD continues to innovate, with its MI300 series gaining traction in key AI and data centre markets.

Financial Performance

The market consensus is for AMD to continue to report strong growth in its revenue and earnings per share (EPS) to US$7.12 billion and US$0.93 for Q1 2025, respectively, as compared to a year ago [5].

This growth is expected to be driven by strong demand for AMD’s data centre and AI products. The US$800 million hit from export restrictions is notable but represents a small fraction of projected revenue, suggesting resilience.

AMD’s stock fell from US$95.29 on April 15, 2025, to US$88.29 on April 16, a 7.3% drop, following the export restriction news. It reached a low of US$85.56 on April 21 before recovering to US$96.65 by April 25.

Technical analysis identifies support around US$85 and resistance at US$95, which was breached by April 25, with AMD reclaiming prior resistance levels.

Fundamental Analysis

AMD has been gaining market share in CPUs and GPUs, competing effectively with Intel and Nvidia. Its focus on AI and data centre solutions positions it for growth, though export restrictions pose a risk. The company’s financial health is strong, with revenue growth outpacing Intel’s. The upcoming Q1 2025 earnings report on May 6, 2025, will be closely watched for signs of sustained momentum.

Export Restrictions: The Geopolitical Headwind

The US has tightened export controls on high-end semiconductors to China, targeting chips like Nvidia’s H20 and AMD’s MI308 to prevent their use in advanced AI and military applications.

These restrictions, implemented in April 2025, aim to safeguard US technological leadership but limit market access for US firms, as China is a major consumer of semiconductors.

China’s Response [6,7]

China has responded by accelerating its quest for semiconductor self-sufficiency, a goal outlined in the “Made in China 2025” plan, which targeted 70% self-sufficiency by 2025.

However, progress has been slow, with only 16% of chips produced domestically in 2020 and significant challenges in advanced chip manufacturing due to US restrictions on equipment like EUV lithography machines.

Recent reports suggest China’s equipment self-sufficiency could reach 50% by 2025, but advanced chips remain a hurdle for the world’s second-largest economy.

Investment Race

Both the US and China have invested heavily in semiconductor manufacturing from 2020 to 2025. The US, through the CHIPS Act and private investments, has committed over US$100 billion, including US$52.7 billion in federal funding and projects like TSMC’s US$40 billion Arizona fabs (CHIPS Act Impact) [8].

China has invested over US$140 billion, primarily through the National IC Fund and state-backed initiatives, though much of this focuses on less advanced nodes [9].

Volatility in the Semiconductor Space

The export restrictions have introduced volatility in the semiconductor sector, with Nvidia and AMD stocks dropping significantly in April 2025. The PHLX Semiconductor Index (SOX) was up only 0.5% year-to-date as of April 24, 2025, lagging the S&P 500’s 1.7% gain, reflecting cautious investor sentiment.

The DeepSeek saga, where a Chinese AI firm claimed to use cheaper chips, further dented confidence in AI chipmakers. However, strong demand for AI and data centre chips continues to drive optimism, with companies like Nvidia and AMD seen as long-term beneficiaries.

Can the US Hold Its Lead?

The US semiconductor sector is navigating a complex landscape. Intel’s layoffs, while aimed at efficiency, risk undermining innovation if not managed carefully. Nvidia’s proposed US$500 billion investment and AMD’s focus on AI position them as leaders, but export restrictions and China’s self-sufficiency efforts pose challenges.

Export controls may drive US innovation by forcing companies to develop new markets and technologies, but they also risk accelerating China’s domestic industry.

If China achieves significant self-sufficiency, US firms could lose market share in the world’s largest chip consumer market. The controls also strain global supply chains, potentially increasing costs for US companies.

Future Outlook

The US benefits from the CHIPS Act, strategic investments, and a robust innovation ecosystem. Collaboration with allies like Taiwan and South Korea, home to TSMC and Samsung, will be crucial.

However, political crosswinds, including trade policies under the Trump administration, add uncertainty. The sector’s ability to balance national security with global competitiveness will determine its leadership in the coming decades.

In conclusion, the US semiconductor industry faces significant challenges but also has opportunities to solidify its position through innovation, investment, and policy support. The interplay of domestic strategies and geopolitical dynamics will shape its future trajectory. In short: expect turbulence—but don’t count American chipmakers out.

Interested in accessing global semiconductor markets through CFDs? Learn more about trading CFDs today with Vantage.

Resources:

- “Nvidia to produce AI servers worth up to $500 billion in US over four years – Reuters” https://www.reuters.com/technology/artificial-intelligence/nvidia-says-working-with-partners-make-ai-supercomputers-us-2025-04-14/ Accessed 29 April 2025

- “Intel to Announce Plans This Week to Cut Over 20% of Staff – Bloomberg” https://www.bloomberg.com/news/articles/2025-04-23/intel-to-announce-plans-this-week-to-cut-more-than-20-of-staff Accessed 29 April 2025

- “NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2025 – Nvidia” https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-fourth-quarter-and-fiscal-2025 Accessed 29 April 2025

- “AMD flags $800 million hit from new US curbs on chip exports to China – Reuters” https://www.reuters.com/technology/amd-flags-800-million-hit-new-us-curbs-chip-exports-china-2025-04-16/ Accessed 29 April 2025

- “Investors Heavily Search Advanced Micro Devices, Inc. (AMD): Here is What You Need to Know – Nasdaq” https://www.nasdaq.com/articles/investors-heavily-search-advanced-micro-devices-inc-amd-here-what-you-need-know-3 Accessed 29 April 2025

- “CNA Explains: What is the ‘Made in China 2025’ policy and why is it making the West so uneasy? – CNA” https://www.channelnewsasia.com/east-asia/cna-explains-made-china-2025-industrial-policy-global-manufacturing-powerhouse-trade-war-west-4326416 Accessed 29 April 2025

- “’Made in China’ chip drive falls far short of 70% self-sufficiency – Nikkei Asia” https://asia.nikkei.com/Business/Tech/Semiconductors/Made-in-China-chip-drive-falls-far-short-of-70-self-sufficiency Accessed 29 April

- “Trump and TSMC announce $100 billion plan to build five new US factories – Reuters” https://www.reuters.com/technology/tsmc-ceo-meet-with-trump-tout-investment-plans-2025-03-03/ Accessed 29 April

- “Exclusive: China readying $143 billion package for its chip firms in face of U.S. curbs – Reuters” https://www.reuters.com/technology/china-plans-over-143-bln-push-boost-domestic-chips-compete-with-us-sources-2022-12-13/ Accessed 29 April