The year 2025 has been nothing short of a rollercoaster for Tesla, Inc. (NASDAQ: TSLA). Once the undisputed leader of the EV revolution, Tesla is entering a significant period of transition — a 71% decline in profits, alongside political controversy related to Elon Musk’s government involvement, and an aggressive challenge from China’s BYD Company Ltd [1].

The Chinese company’s global sales and technology edge have surged to new heights, threatening Telsa’s hegemony in EVs. As Tesla navigates a wave of factory transitions, tariff shocks, and a fiercely competitive landscape, Musk has announced a major shift: scaling back his government commitments to refocus on Tesla’s future.

But with BYD surging and Tesla’s brand facing scrutiny, the question looms — can Musk’s return spark a new era for Tesla, or has the EV crown already begun to slip away?

Musk’s Robotaxi Vision Drives Tesla Stock Higher

On 22 June 2025, Tesla officially launched its long-awaited robotaxi service, debuting autonomous vehicles aimed at reshaping the future of urban mobility. The market responded swiftly—Tesla’s stock surged 10%, adding nearly US$100 billion to its market capitalisation [2]. Musk’s move comes at a critical juncture: with profits under pressure and BYD pulling ahead in EV sales and technology, Tesla is making a high-stakes pivot toward new revenue streams.

The robotaxi initiative could help offset shrinking margins and restore investor confidence—but it also raises execution risks, particularly as Chinese rivals like BYD race to develop cost-competitive autonomous solutions. In a fractured global market, whether Tesla’s robotaxi strategy can deliver remains to be seen.

Tesla’s Financial Downturn [3]

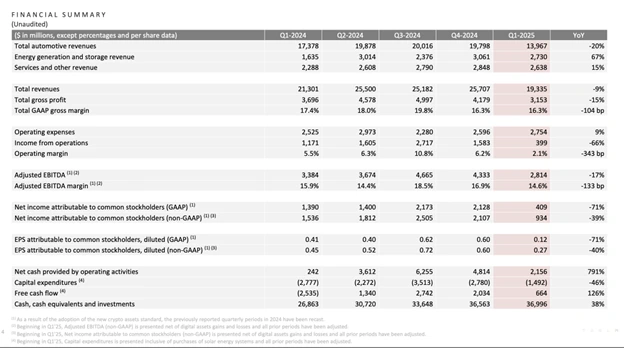

Tesla’s Q1 2025 earnings report showed a significant decline. Net income declined by 71% year-on-year to US$409 million, with revenue sliding 9% to US$19.3 billion. Vehicle deliveries slumped 13% to 336,681 units, marking the largest drop in the company’s history.

Adjusted earnings per share of US$0.27 missed Wall Street’s US$0.41 forecast, and automotive revenue took a 20% hit. The culprits? Weakening demand, rising costs from global tariffs, and a PR storm tied to Musk’s political engagements, which have drawn criticism from some stakeholders.

Tesla’s operating margin shrivelled to 2.1% from 5.5% a year ago, signalling profitability is under siege.

Fundamental Reality Check

Fundamentally, Tesla’s valuation is a head-scratcher. Despite a trailing twelve-month PE ratio of 128x and an even higher forward PE of 149x (based on non-GAAP EPS), the company’s growth story is faltering.

Sales and profits are shrinking, yet the stock continues to trade at a premium — over 90x earnings — as if it were a hyper-growth powerhouse. In Q1 2025, Tesla leaned heavily on US$595 million in regulatory credits to stay in the black; without them, it would have posted a loss.

Meanwhile, rising competition, shrinking margins, and escalating geopolitical risks are steadily chipping away at its competitive edge. On the bright side, Tesla’s US$2.2 billion in free cash flow highlights its underlying resilience, and its energy storage division delivered a standout quarter.

While dreams of affordable EVs and robotaxis keep the bulls energised, the path forward is littered with significant execution risks.

Tesla’s share price is down by 29.4% year-to-date but saw a rebound of around 10% on April 25, 2025

From a technical perspective, Tesla’s stock has clawed its way back to US$284.95, notching a nearly 10% gain on April 25, 2025, as Musk’s return to the helm sparks cautious optimism.

The chart hints at a possible recovery, with the stock breaking out of a US$227–$263 trading range on solid volume, but the rally feels shaky amid swirling uncertainties.

Tesla remains below its 200-day moving average of roughly US$291, a sign that the long-term trend is still wobbly, and recent misses on earnings—coupled with tariff threats and fierce competition from rivals like BYD—cast a shadow over the rebound.

While Musk’s focus and autonomous driving buzz offer some hope, the stock faces stiff resistance at US$288, and without clearer catalysts, this uptick could fizzle, leaving investors wondering if the worst is truly behind Tesla.

Public Backlash and ‘Tesla Takedown’

Elon Musk’s political involvement, including his role with DOGE and public stances on European politics, has drawn controversy and sparked debate among stakeholders. His alignment with President Trump’s administration and controversial political positions in Europe have sparked protests at Tesla showrooms worldwide.

A movement known as The “Tesla Takedown”, as referred to in media reports a boycott aimed at tanking Tesla’s stock, has gained traction among progressive owners, with some owners reportedly selling their cars despite reduced resale values. Vandalism at Tesla stores and charging stations has surged, prompting Trump to label such acts “domestic terrorism.” In California, Tesla’s EV market share dropped from 55.5% to 43.9% in a year [4].

This backlash has dented investor confidence. Tesla’s stock tumbled 7% after Trump’s tariff announcements, and analysts like Wedbush’s Dan Ives call it a “code red moment” [5].

Musk has suggested that protests are fueled by “fraudulent money” hasn’t helped, alienating liberal buyers who once flocked to Tesla’s eco-friendly mission. The brand damage is real— According to Electrify Research, Tesla was ranked 7th in a recent EV desirability study, with brands like Audi and BMW rated higher by surveyed consumers [6].

BYD’s Market Ascendancy

While Tesla stumbles, China’s BYD is hitting the accelerator. In Q1 2025, BYD’s net income soared to 9.2 billion yuan, surpassing Tesla in profitability [7]. Although BYD’s EV sales were just shy of one million units globally for the quarter — including both battery electric and plug-in hybrid vehicles — it outsold Tesla in pure battery EVs for the second consecutive quarter.

BYD’s global EV market share continues to expand, powered by a winning formula of affordable models, a vertically integrated supply chain, and rapid technological innovation. Its new battery system, capable of delivering 400 km (about 250 miles) of range with just five minutes of charging, positions it at the cutting edge of EV tech, challenging Tesla’s dominance in performance and autonomy.

BYD’s home-field advantage in China, the world’s largest EV market, and its growing presence in Europe and Southeast Asia, give it strategic insulation from the US trade tensions. Meanwhile, its new luxury offerings — such as the Yangwang U8L SUV and the Denza Z sports car — are aimed at fattening margins and broadening appeal beyond mass-market vehicles.

Competitive Pressure in a Fractured Global Market

The EV market is a battleground, and Tesla’s global footprint is both a strength and a vulnerability. BYD’s localised supply chains and domestic dominance insulate it from trade disruptions, while Tesla’s reliance on Chinese battery cells and Mexican parts exposes it to tariff chaos.

BYD’s cost advantage—EVs as low as US$9,600—puts pressure on Tesla’s pricing power. Meanwhile, Tesla’s ageing lineup and Cybertruck flop aren’t helping. The refreshed Model Y, launched in Q1 2025, hasn’t reversed the sales slide, and the promised US$25,000 EV remains elusive.

Protectionism is reshaping the landscape. Trump’s tariffs and China’s retaliatory levies are hiking costs for Tesla, which imports over 20% of its components. BYD, with its China-centric model, sidesteps much of this pain, positioning it to gobble up market share in Europe and Asia.

Navigating Geopolitical Risk: Tariffs and Trade Tensions

Trump’s Tariff Policy and Tesla’s Exposure

President Trump’s trade war is hitting Tesla where it hurts. A 25% tariff on auto imports and 145% duties on Chinese goods have forced Tesla to pause some component shipments [8].

While Tesla’s US factories shield it from vehicle tariffs, imported parts from China and Mexico are driving up costs. CFO Vaibhav Taneja warned that the energy business, reliant on Chinese battery cells, faces “outsized” impacts.

Musk, a free-trade advocate, admits he’s failed to sway Trump, saying, “The tariff decision is entirely up to the President.”

Chinese Retaliation and Market Access Threats

China, Tesla’s second-largest market, isn’t sitting idly by. In response to US tariffs, China slapped 125% duties on American goods, halting Tesla’s Model S and X orders on its Chinese website. With Tesla’s Shanghai factory pumping out vehicles for Asia, retaliatory tariffs could choke market access, squeezing revenue.

BYD, immune to these pressures, is capitalising on Tesla’s woes, unveiling tech that undercuts Tesla’s pricing and innovation edge. Trade tensions could widen this gap, especially if China ramps up EV subsidies.

Final Thoughts: Tesla’s High-Stakes Gamble on the Future

Tesla’s 2025 journey so far has been turbulent — a dramatic fall from its once untouchable pedestal, battered by profit declines, political backlash, intensifying competition from BYD, and mounting tariff pressures.

The brand’s prestige has taken a hit, and its competitive edge, once razor-sharp, now looks dulled by operational missteps and geopolitical headwinds. Yet, betting against Tesla (and Elon Musk) has never been simple. Musk’s decision to scale back his government commitments signals a crucial pivot: he is doubling down on Tesla’s next chapter.

The company’s future increasingly hinges not just on selling EVs, but on transforming into a broader tech and robotics powerhouse. Musk remains fixated on two bold frontiers: robotaxis — Tesla’s autonomous vehicle network that some speculate could play a role in reshaping urban transport — and Optimus, Tesla’s humanoid robot project, which aims to tackle labor shortages and revolutionise manufacturing.

Some analysts speculate that If Tesla can deliver meaningful breakthroughs in autonomy and robotics, it could potentially open new markets. However, such outcomes remain speculative and highly uncertain. But execution risks are sky-high, and investor patience is wearing thin.

In many ways, Tesla is at a crossroads: either it achieves a significant transformation— or risks facing greater competitive challenges of disrupted disruptors.

Interested in market movements around companies like Tesla? Learn more about trading share CFDs with Vantage by opening a live account today.

Reference

- “Tesla profits drop 71% amid anti-Musk backlash – Yahoo! Finance” https://finance.yahoo.com/news/tesla-earnings-show-whether-anti-091003122.html Accessed 29 April 2025

- “Tesla’s $4.20 Robotaxi Just Shook Wall Street — $100 Billion Added Overnight – Yahoo! Finance”. https://finance.yahoo.com/news/teslas-4-20-robotaxi-just-192519869.html . Accessed 24 June 2025.

- “Tesla reports 20% drop in auto revenue as first-quarter results miss Wall Street estimates – CNBC” https://www.cnbc.com/2025/04/22/tesla-tsla-earnings-report-q1-2025.html Accessed 29 April 2025

- “Tesla Slumps Below 50% Share of California’s Electric Car Market – Bloomberg” https://www.bloomberg.com/news/articles/2025-04-16/tesla-slumps-below-50-share-of-california-s-electric-car-market Accessed 29 April 2025

- “Markets News, April 21, 2025: Stocks Fall Sharply as Trump Ramps Up Criticism of Fed Chair Powell; Dollar Slides to 3-Year Low, Gold Jumps to New High – Investopedia” https://www.investopedia.com/dow-jones-today-04212025-11718673 Accessed 29 April 2025

- “More trouble for Tesla – Electrify Research” https://www.electrifyresearch.co.uk/blog/more-trouble-for-tesla Accessed 29 April 2025

- “BYD’s quarterly profit surges at fastest pace in nearly two years – The Straits Time” https://www.straitstimes.com/business/companies-markets/byds-quarterly-profit-surges-at-fastest-pace-in-nearly-two-years Accessed 29 April 2025

- “Exclusive: Trump’s tariffs on Chinese parts for Cybercab, Semi disrupt Tesla’s US production plans, source says – Reuters” https://www.reuters.com/business/autos-transportation/trumps-tariffs-chinese-parts-cybercab-semi-disrupt-teslas-us-production-plans-2025-04-16/ Accessed 29 April 2025