Anyone who has owned or traded digital assets will know that there are multiple exchanges where you can hold them or trade. In that space, no exchange comes bigger than Coinbase Global Inc (NASDAQ: COIN).

It’s the largest publicly-listed digital asset platform in the US, is set to join the S&P 500 Index—a major milestone that signals how far digital finance has come in earning institutional recognition.

Once seen as speculative and fringe, the sector is now being welcomed into the financial mainstream as digital asset-focused ETF launches are becoming increasingly common from large institutional fund managers.

But what does this inclusion really mean for the digital asset sector, Coinbase, and broader market participants?

Key Points

- Coinbase is set to join the S&P 500 Index, marking the first time a digital asset-native company has been included in the benchmark.

- Its inclusion brings increased legitimacy to the digital finance sector and paves the way for greater institutional investment.

- This milestone signals a broader shift toward integrating blockchain-based firms into traditional financial markets.

What Is Happening – Coinbase Joins the S&P 500 Index [1,2]

On 12 May 2025, S&P Dow Jones Indices announced that Coinbase will be added to the S&P 500 Index, replacing Discover Financial Services (NYSE: DFS), which is being acquired by Capital One.

The inclusion will take effect before markets open on 19 May. It’s a headline moment for both the company and the industry — and it’s coming at a time when Bitcoin just topped US$100,000, and institutional adoption of digital assets is hitting new highs.

The S&P 500 Index is widely viewed as the most important benchmark for US equities, comprising 500 of the largest and most profitable companies in the country. To qualify, firms must meet strict criteria, including consistent profitability, a minimum market capitalisation of US$8.2 billion, strong liquidity, and a high public float—at least 50% of outstanding shares must be available for public trading.

Coinbase meets all of these standards, having reported US$66 million in net income on US$2.03 billion in revenue for the first quarter, and boasting a market cap above US$65 billion.

Beyond prestige, inclusion in the index brings tangible benefits: automatic buying by index-tracking funds, broader analyst coverage, and increased visibility among institutional investors. For Coinbase, this means more stable demand for its shares, greater liquidity, and a stronger foothold in the financial mainstream.

Coinbase to Join S&P 500: What It Means for the Digital Asset Sector

Coinbase’s inclusion in the S&P 500 matters — here are five reasons why it’s a game changer for the digital asset sector:

1. A Major Vote of Confidence

Inclusion in the S&P 500 Index requires strong financials, liquidity, and a sizable market cap. Coinbase’s entry signals that digital finance firms can meet — and exceed — these standards. It legitimises the space and proves these businesses can operate within established financial frameworks.

2. Institutional Money Must Follow

With its new status, Coinbase will be added to ETFs and index funds tracking the S&P 500 Index, bringing in billions of dollars worth of passive investment. Even investors who don’t actively seek digital exposure in their ETF holdings may gain indirect exposure through index-tracking portfolios.

3. Bridging Two Financial Worlds

Coinbase blends blockchain infrastructure with public market oversight, acting as a bridge between traditional finance (TradFi) and decentralized financial models. Its inclusion underscores that both worlds can — and increasingly do — coexist.

4. Policy Impact

Regulators now face a reality where a digital asset company stands alongside blue-chip names like Apple Inc (NASDAQ: AAPL) and JPMorgan Chase & Co (NYSE: JPM). That could accelerate efforts to build clearer, more balanced rules for the sector.

5. A Pathway for Others

Coinbase’s inclusion has set a precedent. Firms focused on digital custody, infrastructure, and tokenisation now have a playbook: operate transparently, stay profitable, and recognition from mainstream finance may follow.

In short, Coinbase’s S&P 500 Index debut isn’t just about one company — it’s a turning point for the entire digital finance ecosystem.

Why This Signals a Shift for Digital Finance

Coinbase’s addition to the S&P 500 Index isn’t just a corporate achievement; it represents a larger shift in how digital finance is perceived. This is the first time a company, whose core business is built entirely on digital assets and blockchain infrastructure, has entered one of the world’s most closely-watched equity benchmarks.

This development legitimises the space for other players as well. Companies focused on tokenisation, digital asset custody, and blockchain infrastructure may now find greater access to venture funding and institutional partnerships.

Traditional fintech firms, seeing the acceptance of digital-focused models like that of Coinbase, may be more inclined to deepen their integration with blockchain technology.

Moreover, this move raises the compliance and governance bar. Coinbase’s successful inclusion proves that companies in digital finance can meet stringent regulatory and financial standards—and those aiming to follow suit will be expected to do the same.

In terms of placement within the index, Coinbase now stands shoulder to shoulder with established giants such as JPMorgan Chase, Apple, and Microsoft Corporation (NASDAQ: MSFT).

But unlike these firms, Coinbase’s entire business is rooted in blockchain, signaling a shift in what types of companies the financial markets now consider foundational.

Market Response and Industry Reactions

Coinbase shares surged nearly 15% on 13 May 2025 after news broke of its upcoming inclusion in the S&P 500 Index — making it the first digital asset-focused company to join the benchmark index [3].

The rally helped erase much of the stock’s earlier losses from February’s steep decline. More importantly, the move is widely viewed as a milestone for digital finance, signaling its growing acceptance within mainstream capital markets.

Investor Sentiment: A Ripple Effect Across Digital Finance

The optimism wasn’t limited to Coinbase. Broader digital asset markets responded positively, with the price of Bitcoin climbing above US$104,000 — a clear reflection of rising investor confidence in the future of digital finance [4].

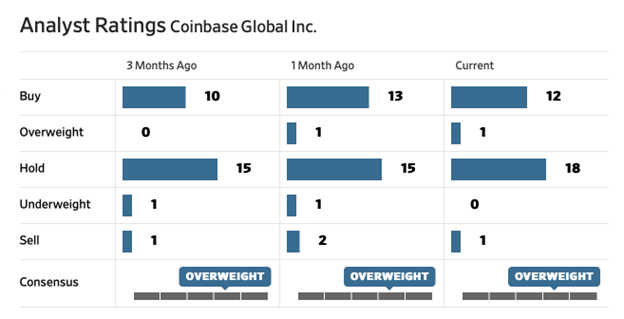

Analyst sentiment on Coinbase is turning more upbeat. Just three months ago, only 10 analysts had a “Buy” rating on the stock, compared to 15 “Hold” calls and 2 “Sell” recommendations.

Fast forward to today, and 13 analysts are now bullish, 18 remain on the fence with a “Hold,” and just one still advises selling. Interestingly, the average target price currently sits below Coinbase’s latest share price of US$263.41, suggesting the recent rally may have outpaced expectations — but price targets go as high as US$400, reflecting optimism about its longer-term prospects.

Much of that optimism is tied to Coinbase’s entry into the S&P 500 Index, which is viewed by some as a significant step forward for both the company and the broader digital assets industry. For many, it marks a turning point for the industry’s journey from speculative asset class to mainstream financial infrastructure.

From a technical perspective, Coinbase just pulled off a breakout that’s hard to ignore. After months of choppy trading and a prolonged downtrend, the stock rocketed past the US$260 mark on significantly higher-than-usual volume, closing at US$263.41, indicating increased market optimism.

This isn’t your average uptick; it’s a high-conviction surge that came with a massive gap-up, likely triggered by major catalysts like index inclusion or a broader rally in digital assets. The chart shows a clear break from resistance around US$200, turning previous ceilings into new floors.

With volume spiking to 18.34 million shares — well above the norm — institutional interest seems to be pouring in. While short-term traders might eye a pullback toward the US$240–250 range to cool off what’s likely an overbought RSI, the bigger picture points upward.

As long as Coinbase holds above its gap, this breakout could have legs — Some market watchers may view US$280 and US$300 as potential future resistance or milestone levels.

The Bigger Picture: Integration of Digital Finance and Traditional Markets

Coinbase joining the S&P 500 Index isn’t just a headline moment — it’s a signal flare for the future of finance. The wall between digital and traditional financial systems is coming down, and this is one of the clearest signs yet. For years, digital finance firms have operated in parallel to Wall Street. Now, they’re starting to become part of it.

This move could trigger a new wave of institutional interest in digital finance. With Coinbase now a core part of the benchmark index, pension funds, ETFs, and passive investors are gaining exposure to a digital asset-native business whether they intended to or not.

That exposure, even if indirect, helps normalise the presence of digital asset companies in portfolios built by the world’s most risk-averse investors.

At the same time, this milestone brings enhanced visibility to other companies building digital financial infrastructure — whether in custody, compliance, tokenisation, or smart contract platforms.

If Coinbase can meet the profitability and regulatory standards required to join the S&P 500 Index, others in the ecosystem may soon follow. This could fuel more capital allocation, more public listings, and faster development across the entire decentralised finance (DeFi) stack.

In short, the inclusion of Coinbase marks a deeper integration of digital and traditional finance, and it’s likely just the beginning.

A Marker of Growing Maturity in the Sector

Coinbase’s inclusion in the S&P 500 Index is a clear signal that the digital asset sector is coming of age. What was once viewed as speculative and peripheral is now evolving into a structured, utility-driven, and institutional part of the financial and investing landscape.

As regulators, investors, and traditional financial institutions reassess their approach to digital finance and blockchain technologies, this milestone reinforces a simple truth: digital assets are no longer on the sidelines. They are becoming a foundational element of modern financial systems.

While market volatility remains a reality, the long-term trajectory of digital finance is continuing to evolve. For some investors, this development may be seen as a key milestone in the growing connection between traditional financial markets and blockchain-based technologies.

Open a live account with Vantage to explore trading opportunities in Coinbase stock CFDs. With $0 commission* on all US share CFDs, you can gain exposure to a company operating at the intersection of digital and traditional finance.

*Other fees may apply.

Reference

- “Coinbase joining S&P 500 days after bitcoin soared past $100,000 – CNBC” https://www.cnbc.com/2025/05/12/coinbase-joining-sp-500-replacing-discover-financial.html Accessed 15 May 2025

- “S&P 500 Index – CFI” https://corporatefinanceinstitute.com/resources/equities/sp-500-index/ Accessed 15 May 2025

- “Coinbase shares jump on addition to S&P 500 index – Reuters” https://www.reuters.com/business/coinbase-shares-jump-addition-sp-500-index-2025-05-13/ Accessed 15 May 2025

- “Coinbase stock rockets 24% on S&P 500 inclusion – Finance news network” https://www.finnewsnetwork.com.au/archives/finance_news_network1642197.html Accessed 15 May 2025