Atlantic Currencies: Opportunities Amidst U.S. Dollar Woes

Amidst deepening troubles for the U.S., currencies bordering the Atlantic Ocean are gaining prominence. As the U.S. dollar continues to lose its lustre given volatile U.S. trade policy and reduced demand for U.S. assets, currencies like the Euro, Sterling and Swiss franc emerge as robust alternatives. While the Euro and Sterling are more commonly seen as risk-on currencies, the Swiss franc stands out as a safe haven against the weakening U.S. dollar.

Uncertainties continue to cloud the outlook for the U.S. dollar. Moody’s recent downgrade of the U.S. government’s credit rating from Aaa to Aa1, aligning with earlier moves by Fitch and S&P Global Ratings, adds to a growing list of warning signs about the country’s fiscal trajectory. Markets are also anticipating a confirmation that the U.S. government favours a weaker dollar, reinforcing the likelihood of further downside in the greenback.

EURUSD finds its footing

The Euro’s outlook continues to shine bright against the back of a weaker U.S. dollar. The EU-UK summit which recently concluded on Monday signalled the start of repairing a fractured relationship between the two parties since Brexit. Although only minor agreements were made on top of tariff-free trade already available since 2020, the move is in stark contrast to punitive trade policies implemented by the U.S., pushing the Euro towards a more favourable position compared to the U.S. dollar.

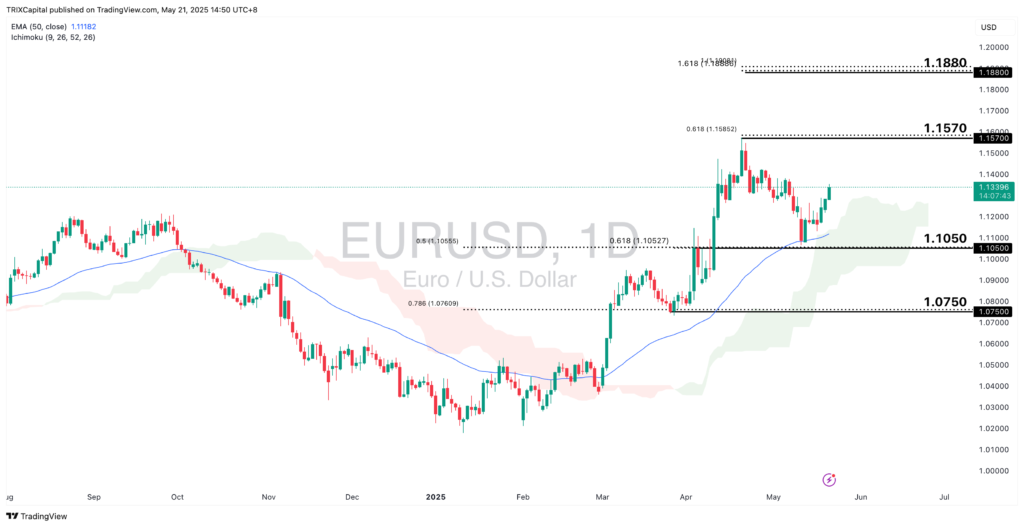

Ticker: EURUSD, Timeframe: Daily

EURUSD continues to see strong bullish momentum as the price continues to hold above both the 50-EMA and Ichimoku cloud. Given that the price has bounced above the 1.1050 level, in line with the 50% and 61.8% Fibonacci Retracement levels, further bullish momentum could bring the price to key resistance levels at 1.1570, in line with the 61.8% Fibonacci Extension level, and 1.1880 resistance in line with a key Fibonacci confluence zone.

However, a deeper retracement could see the price retest the 1.0750 support level in line with the 78.6% Fibonacci Retracement instead.

GBPUSD continues to show strength

The British pound also continues to benefit from bullish momentum, especially after the recently-concluded EU-UK summit on Monday. However, the UK’s CPI data release showed that annual inflation surged to 3.5% in April as household bills spiked, a figure which exceeded most analysts’ estimates. Increasing cost pressures on British households could influence rate decisions from the Bank of England (BoE), which has noted that any further interest rate cuts would be “gradual and careful”. Thus, traders would do well to keep an eye on key levels of GBPUSD and monitor the BoE’s stance going forward.

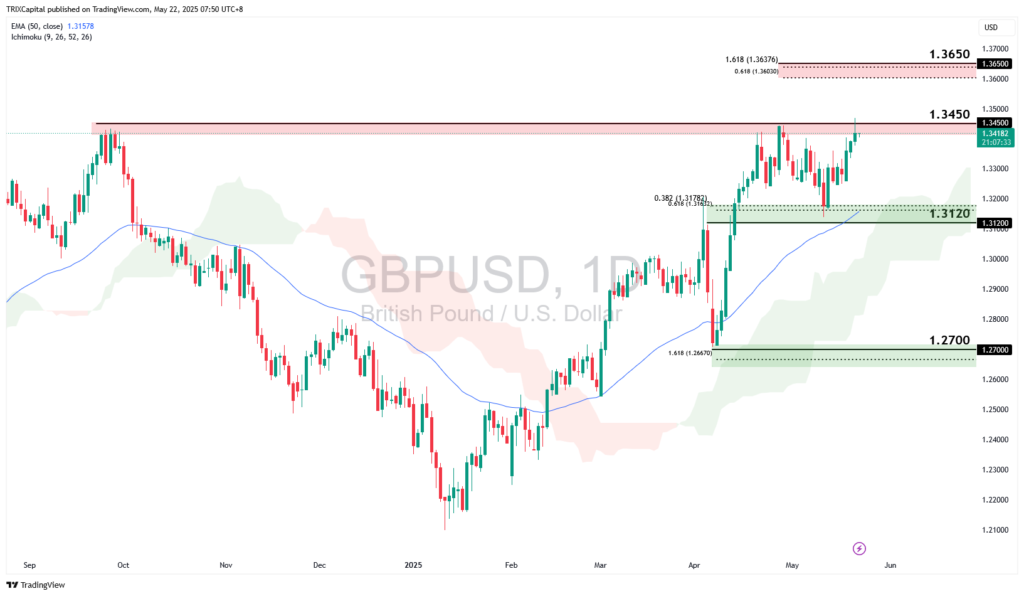

Ticker: GBPUSD, Timeframe: Daily

GBPUSD is on a similarly bullish trajectory compared to EURUSD, also holding above both 50-EMA and Ichimoku cloud indicators. A clear break and close above the 1.3450 swing high resistance could see the price move higher towards the 1.3650 resistance zone, in line with 61.8% Fibonacci Extension and 161.8% Fibonacci Retracement levels.

However, a deeper retracement could see the price move closer towards the 1.3120 support zone, in line with the 38.2% Fibonacci Retracement, 61.8% Fibonacci Extension levels and 50-EMA, or even lower towards the 1.2700 swing low support in line with 161.8% Fibonacci Extension level.

USDCHF faces bearish headwinds

The Swiss franc continues to outperform the U.S. dollar, as U.S. exceptionalism fades and demand for the U.S. dollar declines. However, expectations of further monetary easing from the Swiss National Bank (SNB) continue to weigh on the franc. Markets widely anticipate a 0.25% rate cut to zero at the SNB’s next policy meeting on June 19. Traders should continue to watch key data releases and policy comments from the SNB for further signals going forward.

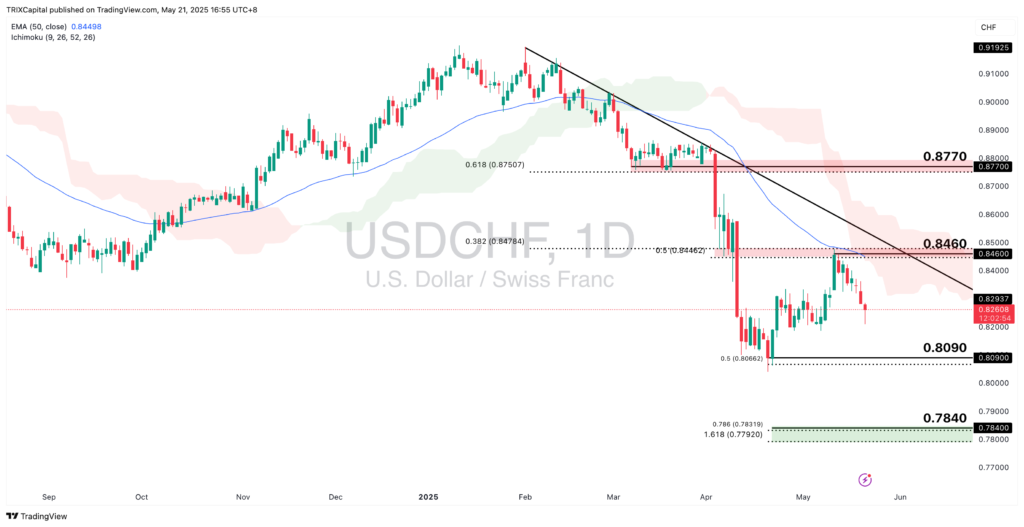

Ticker: USDCHF, Timeframe: Daily

USDCHF is showing strong bearish momentum, holding below the descending trendline and two key indicators – the 50-EMA and Ichimoku cloud. A continuation of this trend on the back of U.S. dollar weakness could see the price approach 0.8090 swing low support, in line with the 50% Fibonacci Extension level.

However, a pullback could see the price retest the 0.8460 resistance zone, in line with descending trendline resistance and both 38.2% and 50% Fibonacci Retracement levels. A breakout of the descending trendline and retracement towards the 0.8770 resistance zone could see a potential reversal of this bearish trend.

As key data and policy comments continue to emerge throughout the month, traders should watch closely for signs of whether Atlantic currencies can sustain their bullish momentum against the weakening U.S. dollar.