Choppy markets navigate US politics and fiscal worries

* G7 seeks to cut “excessive imbalances” in global economy

* US House passes Trump’s “Big Beautiful” tax and spending bill

* Dollar modestly recovers but sentiment still tense, euro wobbles

* Stocks rebound as Treasury yields back off recent highs

FX: USD found support at the long-term low from July 2023 at 99.57 and enjoyed a first green day in four. Better-than-expected PMIs helped, which saw manufacturing and services rise further into expansionary territory. The US tax bill was passed through the House, with the Senate next to have to approve it. With investor focus on US fiscal policy increasing amid US budget negotiations, the performance of US Treasuries will likely continue to influence the USD and risk appetite. A further rise in US yields may weigh on risk appetite but fail to provide the USD with much support

EUR fell back below 1.13. The latest round of PMIs were generally disappointing with contractionary (sub-50) prints for the euro zone, Germany, and France. Germany’s IFO business sentiment offered a better read, improving and surprising on the both the business climate (current) and expectations sub-components. The ECB Minutes revealed that a few members would have felt comfortable with a 50bps rate cut at the April meeting.

GBP printed a doji candle denoting indecision, just below the three-year high made on Wednesday. PMI figures were mixed with marginally better services, rising above 50 but manufacturing poor. Bullish momentum remains relatively strong.

USD/JPY found a bid after a seven-day losing streak. BoJ’s Noguchi spoke, noting they should not move on rates when there is a lack of clarity on the economic outlook. This adds to the growing debate over whether the BoJ has room to continue with the hiking cycle, especially since the May meeting noted the uncertainty surrounding the economy.

AUD tapped the 200-day SMA again, now at 0.6451. NZD underperformed on the weaker budget and outlook. CAD was strong again as the major dropped for a fifth straight day. Mareket expectations for a June rate cut have been pared back after the hot core inflation data.

US stocks: The S&P 500 lost 0.04% to settle at 5,842. The tech-heavy Nasdaq finished up 0.15% at 21,112. The Dow closed unchanged at 41,859. Stocks were choppy, with initial weakness pared later on. The upside in stocks was led by the Nasdaq, while sectors were ultimately mixed -only three sectors, consumer discretionary, communication services and tech were in the green. Utilities was by far the biggest underperformer, down 1.41%. However, in the final minutes of trade, stocks pared all of the earlier comeback to finish flat. Cryptocurrency exchange Coinbase Global’s shares were up 5%, the top gainer on the S&P 500. Alphabet faces a DoJ antitrust probe over AI technology, according to Bloomberg.

Asian stocks: Futures are mixed. Asian markets traded lower after the sell-off Stateside. The Hang Seng and Shanghai Composite conformed to the downbeat sentiment in the absence of any fresh bullish catalysts and after recent earnings results failed to inspire. The Nikkei 225 gapped below 37,000 due to a firmer yen. The ASX 200 was hindered by tech and energy front running the declines.

Gold slid after making fresh near two-week highs. Concerns about Washington’s ballooning deficit has been driving declines in US stocks, government bonds and the dollar, which have all helped gold bugs.

Day Ahead – Japan CPI, UK Retail Sales

Japan will release national CPI data for April. The core is expected to tick up to 3.4% y/y, versus the prior 3.2%. Economists expect the figures to reflect residual effects from the reduction in energy subsidies and fresh fiscal year price hikes. The Tokyo numbers, a forerunner to nationwide data, jumped beyond 3% and raised the pressure on the BoJ if inflation remains sticky. But global risks, especially from US tariffs and softening external demand, may limit the BoJ’s near-term scope.

Hot on the heels of “hot” UK inflation data (which in truth probably wasn’t as hot as the headlines and many initially thought), we get UK retail sales data. This will give us a guide on how ‘hot’ the consumer is currently in the UK and is the first hard data on the sector since Trump’s tariffs. A more moderate pace is seen though favourable weather and the Easter period may help.

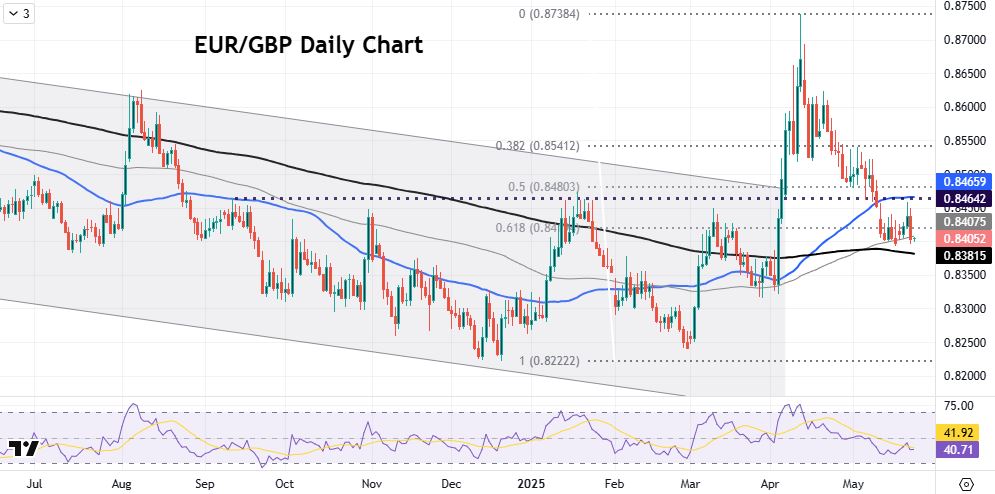

Chart of the Day –EUR/GBP steadies after April vol

Long end Gilt underperformance due to fiscal risks weighed on sterling earlier this year. Prices broke out of the long-term bear channel in early April, eventually spiking to 0.8737. Some relief kicked in as President Trump appeared to be more forgiving towards the UK when it comes to tariffs. Recently, UK economic data has been mildly better than expected, while the Bank of England at its recent May meeting, held onto a path of gradual easing. This is in contrast to a dovish ECB, whose officials continue to want more easing. This helped has sterling to further regain some lost territory. Prices have dipped below support/resistance at 0.8464. Below here is support at the 100-day and 200-day SMAs at 0.8407 and 0.8381. There is also a Fib level of the December to April rally at 0.8419.