Caught in the Crossfire: Fed Stays Cautious as Oil Surges, Tariffs Bite, and Dollar Wobbles

The Fed continues to maintain a cautious stance, with Chair Powell walking a tightrope. While the central bank kept interest rates unchanged at the June 17-18 meeting, the broader message was one of restraint and vigilance. Pressure from the Trump administration for earlier rate cuts is expected to persist. However, it is still too early to assess the full impact of tariffs on the U.S. economy, with the first set of May data painting a tentatively optimistic picture.

Latest inflation dynamics bolster this caution. The May CPI rose a modest 0.1% month-on-month, lifting annual inflation to 2.4%, while Core CPI held steady at 2.8%. Similarly, a 0.1% rise in producer prices suggests underlying price pressures remain tame. However, this early set of data only reflects the initial effects of tariffs as they move through the broader economy.

Adding to the mix is the recent surge in crude oil prices, driven by renewed Middle East tensions. Higher energy costs often seep into broader price categories, potentially stalling disinflation progress. On the other hand, tariffs tend to exert downward pressure on growth while pushing up input costs, creating a conflicting macroeconomic backdrop for the Fed to navigate.

Consequently, the Fed would be more inclined to err on the side of caution when it comes to cutting interest rates. While markets are still pricing in two rate cuts this year, the timeline may be pushed further out in light of recent global developments and the need for more conclusive data.

EURUSD Testing Key Resistance Level

The strength of the Euro against the U.S. dollar has been a strong theme in the past few weeks. With the U.S. dollar losing its shine, the Euro is gaining traction as a viable alternative, helping to fuel EURUSD bullish momentum.

EURUSD remains in an uptrend, holding steadily above both the 50-EMA and Ichimoku Cloud. The price is now testing the 1.1600 swing high resistance zone, in line with the 61.8% Fibonacci Retracement level. A clear break and close above this level could see price continue on its bullish path towards the next resistance level at 1.1880, in line with a Fibonacci confluence zone.

However, a deeper retracement could see the price pull back towards the 1.1050 support level, in line with the 50% and 61.8% Fibonacci Retracement levels, or even towards the 1.0750 support level, in line with the 78.6% Fibonacci Retracement level.

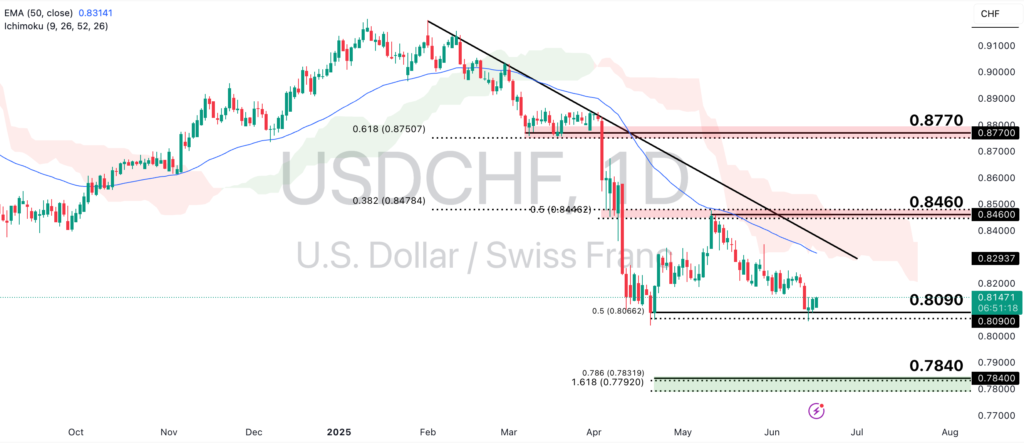

USDCHF Potentially Finding New Lows

Safe-haven alternatives such as the Swiss Franc have benefitted from the declining appeal of the U.S. dollar. Heightened Middle East risk and political noise at home have weighed on demand for the greenback, keeping USDCHF under bearish pressure.

USDCHF remains in a clear downtrend, trading below its descending trendline, 50-EMA, and Ichimoku Cloud. As the price continues to test the 0.8090 swing low support, which is in line with the 50% Fibonacci Extension level, further bearish pressure could prompt a decline towards the 0.7840 support zone, in line with the 78.6% Fibonacci Extension and 161.8% Fibonacci Retracement levels.

If a retracement occurs, the 0.8460 resistance zone would be the level to watch, as it aligns with a confluence of the 38.2% and 50% Fibonacci Retracement levels. However, unless we see a significant shift in sentiment and market structure, the bearish momentum is likely to prevail.

The Fed may be standing still for now, but the path ahead is anything but stable. Rising oil prices threaten to reignite inflation, while tariffs risk undercutting growth just as global demand shows signs of strain. Adding in political uncertainty at home and mounting geopolitical risks abroad, the U.S. dollar’s dominance is starting to look increasingly fragile. For markets, this means more volatility and less visibility, and for the Fed, the margin for error keeps shrinking.