US Labour Market in Flux: Can NFP Sway Market Sentiment?

The US labour market has been under intense scrutiny, swinging between upbeat and disappointing data. As July rolls in, market participants are closely monitoring economic indicators to gauge how the lingering effects of past tariffs will impact the economy.

Amid this uncertainty, new political developments have further complicated the outlook. On Wednesday, Bill Pulte, head of the Federal Housing Finance Agency, called on Congress to investigate Fed Chair Jerome Powell, alleging that Powell’s recent testimony regarding the central bank’s planned renovations to its headquarters was “deceptive” and misleading. This growing political scrutiny of Powell highlights the tensions surrounding the Fed’s role and its leadership, an issue that has been at the forefront of political debate for some time.

Although the Fed is designed to operate independently from political influence, repeated calls for Powell’s ouster, including those from Trump, underscore the ongoing tension between the central bank’s autonomy and political intervention. The potential impact of these pressures on future monetary policy could add another layer of uncertainty for market participants, as they await economic data like the NFP report to gauge the Fed’s next move.

The US Nonfarm Payrolls (NFP) report, released on the first Friday of each month, is a key event that can shake up the market. It shows the number of jobs added or lost (excluding farm workers and some other sectors) and serves as a crucial gauge of the overall health of the U.S. labour market. This month, the NFP report will be released a day early due to the June 4th holiday.

April’s NFP surpassed expectations, adding 139K jobs (vs. 126K expected) while the unemployment rate held steady at 4.2%. At first, this seemed to confirm a robust labour market, but recent data shifted the narrative.

In a bid to douse enthusiasm over the state of the US labour market, the June ADP report stunned markets with a plunge of 33K (vs. est +95k), revealing possible weaknesses emerging. It remains to be seen whether the US labour market can withstand restrictive monetary conditions with a Fed that is still on hold, a weaker economic outlook amidst waning enthusiasm for all things American, and an unpredictably volatile White House.

Nevertheless, keep an eye on the US dollar. The weakening trend is clear, perhaps even cheered on by American policymakers looking to boost the attractiveness of US exports. Against this backdrop, key major pairs like USDJPY and GBPUSD are showing interesting setups as they trade near key levels.

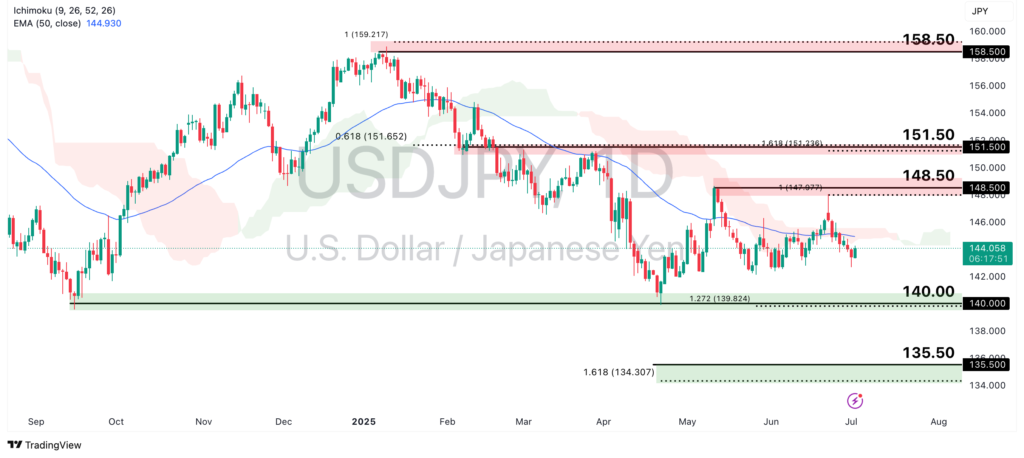

USDJPY Now Trading Sideways

USDJPY is facing bearish pressure, with demand for the U.S. dollar slipping as traders hedge oversized USD-based positions, while the Japanese yen benefits from tightening policy expectations from the Bank of Japan.

USDJPY continues to range between 148.50 resistance and 140.00 support. The price is now trading below both the Ichimoku cloud and the 50-EMA, suggesting that bearish momentum could return. After a recent reversal below the 148.50 resistance, aligned with the 100% Fibonacci Extension level, a move lower toward 140.00 support seems likely. If that breaks, 138.50 becomes the next key support, coinciding with a strong Fibonacci confluence area.

However, a deeper retracement could push the price back toward 151.50 resistance, in line with the 61.8% Fibonacci Retracement and 161.8% Fibonacci Extension levels. If that happens, bearish pressure might ease temporarily.

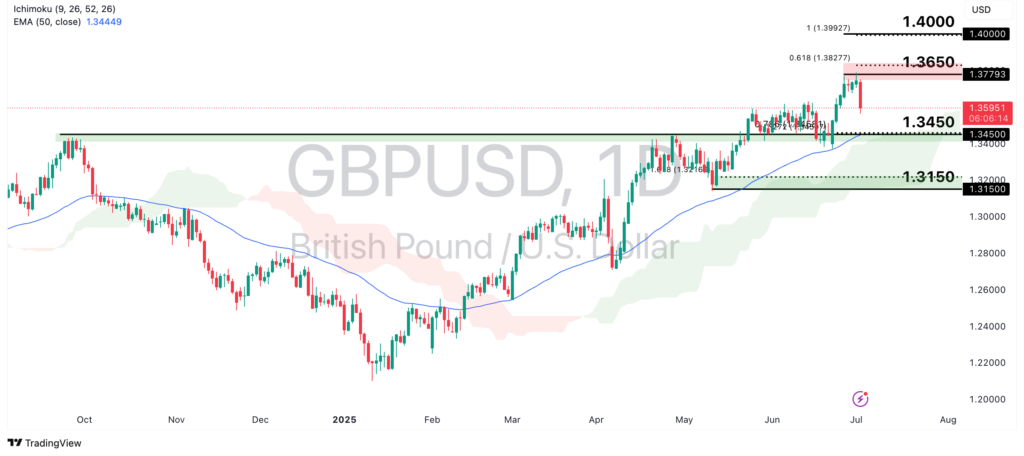

GBPUSD Showing Strong Bullish Momentum

GBPUSD continues to benefit from the weakening dollar, with the pair climbing and breaking key resistance levels. However, watch for potential issues in the U.K.’s fiscal landscape that could impact momentum.

GBPUSD sees strong bullish momentum as the price trades above the Ichimoku cloud and 50-EMA. As the price approaches the 1.3450 support level, in line with the 78.6% Fibonacci Extension level, we could see a bounce and further move towards the 1.3650 swing high resistance, in line with the 61.8% Fibonacci Extension level.

However, if the bullish momentum fades and GBPUSD closes below the 1.3450 support zone, a deeper retracement toward the 1.3150 support, which aligns with the 161.8% Fibonacci Extension level, may occur.

With the US labour market sending mixed signals, traders are closely monitoring economic data for clues on the market’s direction. The weakening US dollar, a dip in the ADP report, and lingering tariff effects add to the uncertainty. As the US NFP report approaches, all eyes will be on the data. It could provide critical insights into the labour market’s resilience and set the tone for major currency pairs like USDJPY and GBPUSD. Whether the US economy can withstand current conditions and how the markets react could shape sentiment in the months ahead.