Solid NFP pushes stocks and USD higher into Independence Day

* Bond traders scrap bets on July Fed rate cut after better NFP and ISM

* Stocks bid with more new record highs for the S&P 500 and Nasdaq

* ECB wary of rising global trade uncertainty, June accounts show

* Iran says won’t retaliate against US, but will keep enriching uranium

FX: USD rose for a second straight day, which hasn’t been seen in over two weeks. Prices continued their rebound from long-term trendline support after better-than-expected NFP, ISM Services and initial jobless claims data. Money markets pared back their rate cuts bets with now just 1bp priced into the July meeting from 6bps yesterday, and 51 bps for 2025 versus 65bp prior to the data. A solid June jobs report indicated no Fed rate cut before September despite President Trump’s demands and strong disapproval, with the wait-and-see stance still vindicated. But economists say households are becoming more pessimistic on employment prospects with the risk of layoffs rising in the second half of the year.

EUR fell further from its recent high at 1.1829, though it again rebounded off a long-term Fib level at 1.1749. EZ final services PMI surprised to the upside. Recent comments from ECB officials have highlighted the disinflationary impact of the strength in the euro. The next ECB meeting is in three weeks, with no action predicted.

GBP outperformed with the pound the only major currency rising versus the dollar. Wednesday’s panic selling which drove long-term Gilt yields sharply higher, reversed as the government renewed its full backing for Chancellor Reeves. There are likely to remain questions about the UK’s commitment to fiscal responsibility in the run up to the Autumn budget – raise taxes, cut spending, change the fiscal rules or increase borrowing? The prior multi-year high at 1.3631 is proving to be initial support in cable.

JPY underperformed as the major rose above its 50-day SMA at 144.48. US Treasury yields rose sharply after the US data, with the 10-year, which typically has a strong positive correlation with this pair, ticking up to 4.34% after this week’s low at 4.18%. Pricing for BoJ hikes has slipped recently, with now just 13bps of tightening priced, versus around 20bps a month ago. Trade developments are also at key juncture.

AUD continued to consolidate its recent break higher. Next week’s RBA meeting gives the bank another chance to cut rates as persistent inflation continues to cool amid global growth uncertainty. CAD outperformed its major peers as the major settled below 1.36. The broader technical tone for USDCAD remains bearish, with trend strength indicators aligned negatively for the USD across a range of timeframes.

US stocks: The S&P 500 printed up 0.83% at 6,279, a record close. The Nasdaq closed up 0.99% at 22,867, also an all-time high. The Dow Jones finished higher at 44,829, adding 0.77%. Its record top is just above 45,000. All sectors were in the green, except Materials which closed unchanged. Tech and Financials led the gainers. There weren’t any standout moves or news on the Mag 7, although Telsa finished marginally lower as it traded around the 50-day and 200-day SMAs as the former crossed above the latter.

Asian stocks: Futures are positive. APAC equities were muted ahead of the NFP release and after China Caixin PMIs. The ASX200 slid amid weakness in telecoms and financials. The Nikkei 225 was also subdued after mixed rhetoric on trade talks. The Shanghai Comp and Hang Seng were mixed as Hong Kong dropped on tech sector weakness, with Alibaba and Meituan leading declines after news of heavy e-commerce subsidies. The mainland index was helped by healthcare stocks and fresh stimulus hopes ahead of the Politburo meeting.

Gold sold off as it traded back to the 50-day SMA at $3,320. That indicator has proved to be decent support on a number of occasions this year.

Day Ahead – US Markets are closed for July 4 holiday, focus on July 9

Is the broader dollar mood appearing to shift a little after the six successive months of declines seen through the first half of this year? Frankly, it’s not surprising that we’ve seen a mild rebound in the dollar this week after such a strong downside break and also so many consecutive days of selling recently. It seems consensus is very, very heavily in favour of more weakness in the world’s reserve currency in the second half of 2025. We suspect there is unsurprisingly, more volatility to come but also when consensus is so severely positioned one-way, then we can see quite violent moves in the other direction – short squeezes.

Consolidation is possible then, but a major recovery seems a stretch in the medium-term. The tariff deadline on July 9 is the next major risk event, with markets fully expecting some kind of ‘TACO’ (“Trump Always Chickens Out”) trade to play out, eventually, though that could mean Trump starts threatening 50% tariffs again for some trading partners in order to raise the heat. That means temporary tensions potentially between the US and Japan over auto tariffs and the US and EU, with the digital tax issue re. Canada a pointer to a possible outcome, with symbolic retaliation in return. We’ll have more on this next week.

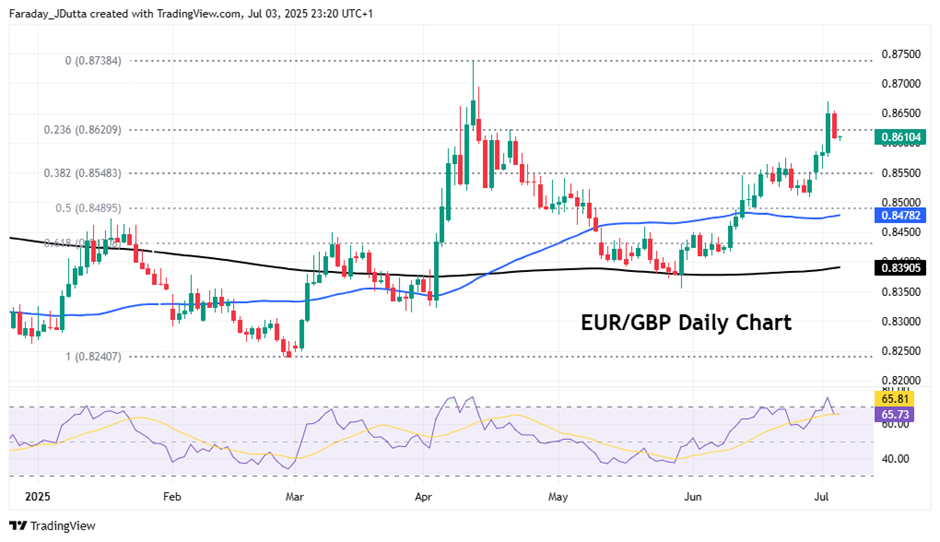

Chart of the Day – EUR/GBP moves higher

Long end UK government bond underperformance due to fiscal risks weighed on sterling earlier this year. Some relief kicked in as President Trump seemed to be more forgiving towards the UK when it comes to tariffs. That saw EUR/GBP dip to its 200-day SMA, now at 0.8390, which acted as support. But recent soft UK economic data led money markets back to discounting an additional two, rather than one, BoE rate cuts this year. That contrasts with just the possible one more move by the ECB. Sterling suffered a new setback this week as investors recalled the panic of 2022 though the Gilt situation seems to have calmed. Prices have steadied at a minor Fib level of this year’s move higher at 0.8620. Bulls will target above 0.8650 on the way to the spike high in April at 0.8738. Major support sits at the 38.2% Fib level at 0.8548.