Stocks choppy amid more Trump tariff letters

* Japan and US lock horns over new tariffs, Trump says no August tariff extension

* Wall Street bank stocks’ furious rally spurs HSBC downgrade

* RBNZ to take a wait-and-see attitude to the outlook for the OCR

* Copper hits record high as Trump says tariff will be 50%

FX: USD had a relatively quiet day as tariff letters dropped on 14 countries, but few deals seemed to have been made. The deadline for the majority of countries has been pushed back to the start of August with tariffs more or less the same as the Liberation Day levels. The delay means US economic data may take even longer to be impacted, so policy changes could be pushed back too. The September FOMC meeting now has roughly 17bps priced in, versus near 30bps at the start of last week. That won’t please the President.

EUR outperformed with the swissie and aussie, benefitting from reports which suggest 10% baseline tariffs remain an option for the EU, even though Trump said late in the day that he is probably two days from sending the EU a letter. There might be some better carve-outs for the aircraft or drinks industries too, though auto and pharma tariffs remain a big sticking point. The outlook for relative central policy is supportive for the euro, as markets fade ECB rate cut expectations. Recent comments have leaned neutral, endorsing a continued hold.

GBP printed a doji after retracing from an intraday low at 1.3524. The 50-day SMA sits at 1.3476. Markets have one eye on domestic political developments and uncertainties over the fiscal outlook.

JPY was the weakest major currency versus the dollar again, as the 10-year Treasury yield rose for a fifth consecutive day. Trade tensions remain crucial as investors adjust to President Trump’s announcement of an increase in US tariff hikes for Japan, from 10% (ex. sectoral) to 25% on August 1st. Resistance sits at a major Fib level (38.2%) of this year’s decline at 147.13.

AUD outperformed as the RBA surprisingly kept rates unchanged in a 6-3 vote, despite markets pricing in a 95% chance of a 25bps rate cut pre-release. Inflation was a little stickier than it would have liked, and the labour market remains tight. AUD/USD moved back above 0.65 but didn’t breach Monday’s 0.6564 peak.

US stocks: The S&P 500 printed down 0.07% at 6,225. The Nasdaq closed up 0.07% at 22,702. The Dow Jones finished lower at 44,240, losing 0.37%. Sectors were mixed – Energy was the standout winner, while Consumer Staples, Utilities, and Financials led the losses. The latter was weighed on by weakness seen in Goldman Sachs, JP Morgan, and Bank of America after all three were downgraded by HSBC on stretched valuations. Amid the megacap tech stocks, Amazon Prime Day spending was reportedly down 14% in early hours versus 2024 levels. President Trump criticised the EU for suing Apple and Google.

Asian stocks: Futures are in the red. APAC equities treaded cautiously on tariff news, and which countries have received trade letters from President Trump. The ASX200 was relatively muted considering the surprise on hold rate decision by the RBA. Losses in defensives offset strength in gold producers and tech. The Nikkei 225 retraced initial losses as investors shrugged off a fresh 25% tariff, which was marginally higher than the 24% Liberation Day announcement. The Shanghai Comp and Hang Seng was supported by PBoC measures to help more onshore investors into offshore bonds.

Gold continued to trade around the 50-day SMA at $3,320. This have been a decent indicator of support on a number of occasions this year. Prices remain stuck in a consolidation phase between $3,245 to $3400, which is extending into a twelfth week.

Day Ahead – RBNZ Meeting, FOMC Minutes

The RBNZ is expected to sit on its hands and leave the OCR unchanged at 3.25%. Its easing bias is expected to remain, but there will probably be little forward guidance. Economic activity has been stronger than expected in the first half of 2025 and headline inflation has firmed up, but risks to growth are to the downside. Going forward, the output gap will probably remain deeply negative, which means underlying price pressures should continue to soften.

The FOMC minutes are likely to highlight uncertainty around the outlook and wide-ranging policy expectations. Fedspeak since the meeting saw both dovish and hawkish comments after the updated dots showed a range of assessments later this year. We could see a ‘couple’ of participants highlight the potential for cuts in July, while more might note that rates could stay on hold for longer. That said, Fed Chair Powell recently stated “a solid majority” of policymakers expect it will become appropriate to begin cutting rates later this year.

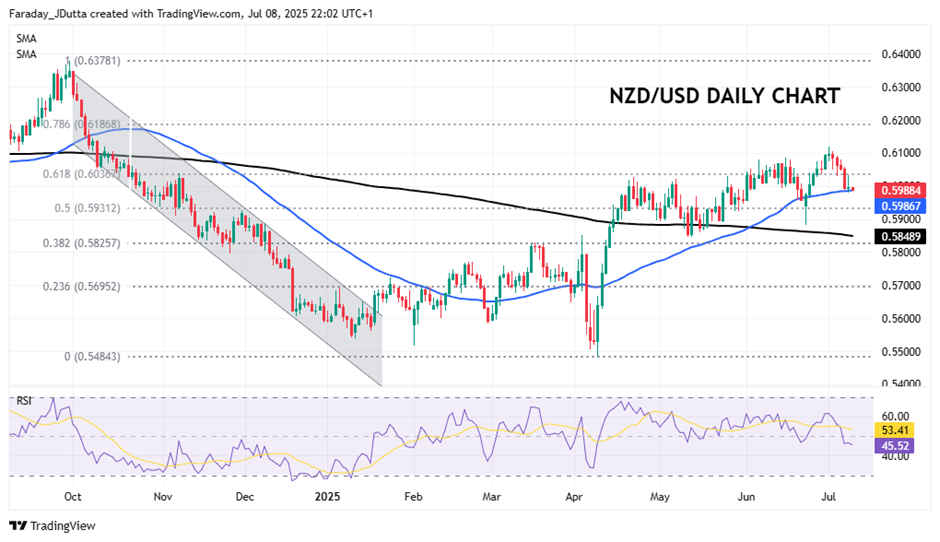

Chart of the Day – NZD/USD bounces off 50-day SMA

This chart is similar to the one we looked at yesterday – AUD/USD. The kiwi recently moved to the upside through the major Fib retracement level (61.8%) of the September 2024 to April 2025 move at 0.6036. But after making a high at 0.6119, the major succumbed to four straight days of selling. Initial support has been found at the 50-day SMA at 0.5986, with the midpoint of that long-term move at 0.5931. Tuesday’s retrace of its gains back near to the intraday lows is a bearish sign, especially of course of we lose the 50-day moving average.