Earnings Pulse & Price Setups: Bank of America, Goldman Sachs, Morgan Stanley in Focus

Major U.S. banks posted strong Q2 2025 earnings, supported by market volatility and a more favourable regulatory environment. In June, the Federal Reserve, along with the OCC and FDIC, proposed easing capital requirements by adjusting the enhanced supplementary leverage ratio. The changes would lower requirements for low-risk assets such as U.S. Treasuries. While the proposal is still under review, it could give banks more flexibility to support lending, trading, and other revenue-generating activities.

Recent earnings calls confirm these banks are thriving amid market turbulence. Bank of America delivered strong Q2 results, while Goldman Sachs and Morgan Stanley posted double-digit EPS growth.

Bank of America (BAC) – Solid Growth Despite Challenges

Bank of America reported Q2 2025 EPS of $0.89, beating the consensus estimate of $0.86. Net income reached $7.1 billion, up 3% YoY. Net interest income hit a record $14.7 billion, growing 7% YoY for the fourth consecutive quarter. Rising interest income signals strength in Bank of America’s core lending business, which is a key revenue driver less dependent on market swings and offers some stability amid uncertain markets.

Consumer banking remained resilient while the markets division benefited from heightened trading activity. Investment banking fees declined YoY as deal-making stayed cautious before a modest recovery toward quarter-end. The subdued investment banking activity highlights how tariff uncertainty still impacts corporate decisions, but signs of recovery suggest improving confidence ahead.

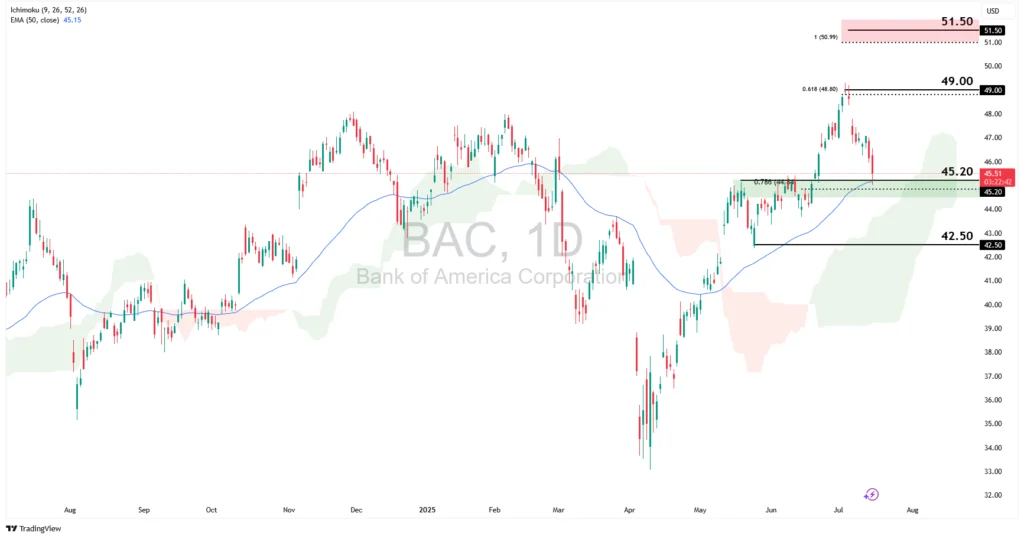

BAC retreated below the $49.00 resistance but remains above the 50-EMA and Ichimoku cloud. The price is currently testing the $45.20 support, in line with the 78.6% Fibonacci Retracement and 50-EMA. A rebound above this support zone could prompt further upside moves towards the $49.00 swing high resistance, in line with the 61.8% Fibonacci Extension, and subsequently the $51.50 resistance. However, a deeper retracement would see further downside in the price. A break below the $45.20 level could drive BAC toward the $42.50 swing low support.

Goldman Sachs (GS) – Record Trading Performance

Goldman Sachs posted exceptional Q2 2025 results with EPS of $10.91, well above the $9.48 consensus. Revenue rose 15% YoY to $14.58 billion, driven by a record-breaking trading performance. Goldman’s strength in trading revenues underscores its ability to capitalise on market volatility, making it a standout performer when markets are choppy.

Equities trading revenue hit $4.3 billion, up 36% YoY, marking the firm’s best quarterly result. Investment banking fees increased 26% to $2.19 billion, led by strong advisory revenues. The jump in advisory fees indicates growing corporate deal-making momentum, signalling an improving environment for Goldman’s investment banking pipeline.

GS also sees bullish momentum, holding above key indicators such as the Ichimoku cloud and 50-EMA. The price is near the $725.00 swing high resistance – a key level to watch here. A convincing break above this level could prompt a further rally toward a new high at $775.00, in line with the 78.6% Fibonacci Extension level.

However, a loss in bullish momentum could lead to a deeper retracement, where we could see the price retest the key support at the $673.00 level. A break below this level could lead to a retest at the $618.50 support, in line with an area of strong Fibonacci confluence.

Morgan Stanley (MS) – Balanced Strength Across Divisions

Morgan Stanley reported Q2 2025 EPS of $2.13, beating estimates of $1.98. Revenue grew 12% YoY to $16.79 billion, powered by solid results in institutional securities and wealth management. Morgan Stanley’s diversified revenue base helps cushion it from volatility spikes and smooths earnings, providing balanced growth drivers.

Equity trading revenue jumped 23% to $3.72 billion, the firm’s strongest second quarter on record. Wealth management added $59.2 billion in net new assets, surpassing expectations. Strong asset inflows show growing client trust and steady fee income, which supports long-term stability beyond trading.

Going forward, its diversified business lines are expected to help it sustain growth amidst prospects of resilient financial markets and solid deal pipelines for its investment banking business.

MS retreated below the $144 resistance, in line with the 61.8% Fibonacci Extension level, which is close to the swing highs previously reached in February this year. An extension of its price retracement could prompt a retest of the $132.50 pullback support, in line with the 61.8% Fibonacci Retracement and 100% Fibonacci Extension levels.

Conversely, if MS regains bullish momentum, we could see a potential retest of the $144.00 resistance with a break above this zone prompting a push higher towards the $150.00 resistance, in line with the 78.6% Fibonacci Extension level.

While Q2 2025 results were strong, the outlook for the second half remains uncertain. Federal Reserve officials are divided on rate cuts, with most anticipating lower rates later in 2025 but wary of tariff-driven inflation risks. For banks, rate cuts could squeeze net interest margins, but lower rates may also boost loan demand and refinancing activity, creating a delicate balance.

Industry leaders are optimistic about increased deal activity as tariff uncertainty eases, but remain cautious about the broader economic impact. Deal flow is a key driver for investment banking fees, so any improvement here will be closely watched.

The Trump administration’s regulatory rollbacks offer a boost for banks, but the full impact of tariff policies on the economy and markets is still unfolding. It will be important to watch how these regulatory changes translate into actual capital flexibility and growth opportunities while staying alert to risks from ongoing trade tensions.