Positive data boosts stocks and the greenback

* S&P 500 and Nasdaq nab record closing highs on earnings and data

* Netflix earnings top estimates as streamer raises full-yar revenue forecast

* Fed officials resist Trump, reaffirm go-slow approach to rate cuts

* Dollar gains broadly, yen dips before Japan weekend vote

FX: USD found a bid after yesterday’s ‘Powell’s getting fired’ vibes. With Trump shutting this down after leaks, it seems the bar could be even higher to taking Fed independence threats seriously next time it rears its head. Yesterday’s US data also helped the greenback with softer initial jobless claims and firmer retail sales suggesting the Fed will keep rates on hold for now as officials need more time to assess the impact of tariffs on inflation. Rate cut odds got pared back with now only 42bps for 2025, versus 46bps at the start of the day. The 50-day SMA is at 98.74.

EUR found support at the April high at 1.1572 again. Markets await any breakthroughs in EU-US trade talks after US President Trump threatened a 30% tariff on the EU over the weekend. On the fiscal front, Germany has rejected the EU’s proposed EUR 2trn budget, setting up a negotiation phase with the European Parliament and European Council. Next Thursday’s ECB meeting is likely to see rates remain on hold. But markets are still pricing in 25bpts of easing by year-end.

GBP outperformed its peers as the jobs data was broadly positive. Wage growth saw an upside surprise and the shock plunge in May payrolls was revised a lot higher. This should take some heat off the BoE to ease rates at a quicker pace than its current quarterly cadence. Support is a minor Fib level of this year’s rally at 1.3386 and a prior long-term cycle high at 1.3434.

JPY softened as USD/JPY consolidated just below the 200-day SMA and the 50% level of this year’s decline around 149.37/60. Focus is on the weekend’s upper house election.

AUD underperformed with the latest jobs data showing an unexpected jump in the jobless rate to 4.3% from 4.1%, the highest in three and a half years. The major dipped below the 50-day SMA at 0.6490 but retraced back above it late on. CAD was weaker as the major tried to push above the 50-day SMA at 1.3734.

US stocks: The S&P 500 printed up 0.54% at 6,297, a fresh record closing high and its ninth of the year. The Nasdaq settled higher, also at an all-time top, by 0.74% at 23,078. The Dow Jones finished up at 44,484, adding 0.52%. Sectors were almost exclusively in the green, with only Health and Real Estate in the red; the former weighed by disappointing Elevance Health (-12%) earnings. Technology, Financials, and Industrials sit atop the pile. TSMC lifted the risk mood initially as its net profit beat and rose to a record high, driven by strong demand for AI chips, while there was also a strong next quarter revenue outlook. PepsiCo was one of the best performers on the S&P 500, after a surprise revenue increase and an improved full-year earnings outlook amid easing forex headwinds.

Asian stocks: Futures are mixed. APAC equities were mixed after two-way price action Stateside. The ASX200 rose with stocks unphased by disappointing jobs data. The Nikkei 225 fell initially on yen strength but reversed that later on. The Shanghai Comp and Hang Seng lacked conviction.

Gold traded rangebound overnight, finding some footing after extending higher on Wednesday amid reports that US President Trump would fire Chair Powell. The yellow metal generally traded with a downward bias thanks to the firmer dollar and positive risk tone across equities.

Day Ahead – Japan CPI

National Japan CPI data is scheduled for release today, with the headline expected to moderate to 3.3% from 3.5% y/y. The gradual disinflation trend is expected to push the figure closer to the 2% target by the end of this year. But rice prices, which have doubled since last year, continue to drive up overall inflation and show no signs of abating, despite government policies.

The BoJ will be closely watching the June inflation data ahead of its next policy meeting at the end of July. That said more immediately, Japan’s upper house election remains a core near-term risk for both the currency and the bond market, as market participants consider the fiscal implications of this weekend’s vote. USD/JPY technicals are currently bullish with eyes on the 200-day SMA at 149.60.

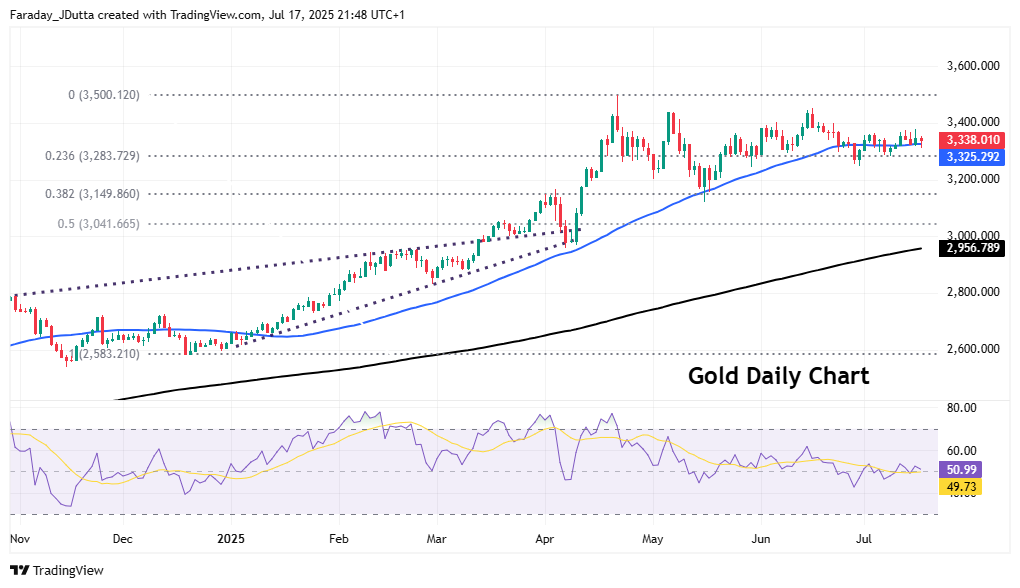

Chart of the Day – Gold stuck in a range

Bullion continues to track around the 50-day SMA at $3,325 and remains rangebound between roughly $3,200 and $3,400. Since hitting the all-time high above $3,500 in April, price have stalled as traders await the next major catalyst to challenge that level again. Prices are still up some 28% this year, handsomely outperforming global stock markets and other commodities. Geopolitical risks linger, the global trade war is ongoing and central bank buying continues to underpin support for the yellow metal. China added to its official golds reserves in June, for an eight straight month. Diversifciation away from USD should remain a key factor.

ETF buying has cooled in recent weeks after the first half of the year saw strong positive flows, marking the strongest semi-annual performance since the first half of 2020. But safe haven demand is likely to further help gold, espcially if trade talks deteriorate into the start of August. Support is the 50-day SMA and the first Fib level if this year’s rally at $3,283.