The S&P 500 Index has been setting fresh record highs, propelled forth by the Artificial Intelligence (AI) boom, healthy consumer spending, and growing belief in a smooth landing for the US economy.

But while the market may look unstoppable on the surface, not everything looks so sunny when investors peer under the hood.

President Trump’s renewed tariff threats, stubborn inflation, and signs of softening earnings growth are raising red flags. The Q2 2025 earnings season might just be the biggest stress test Corporate America has faced in over a year.

Valuations are stretched. The S&P 500 is trading at 22.3 times forward earnings, well above its historical norm [1]. That’s a market priced for perfection.

That means that any disappointment, be it shrinking margins, soft guidance, or weakness in a key sector, could shake investor confidence and trigger a pullback in this AI-fueled rally. So, here’s what investors should be watching as we head into this critical juncture for the US market.

Key Points

- S&P 500 earnings growth is expected to slow to 4.8% in Q2 2025, marking the weakest pace since Q4 2023 amid rising input costs and elevated valuations.

- Trade tensions, particularly new US tariffs, are beginning to affect corporate margins and forward guidance across sectors.

- Sector-specific pressures—ranging from cautious consumer demand to weak energy pricing—are shaping a more uncertain earnings landscape for the second half of 2025.

Big picture: Slowest growth since late 2023

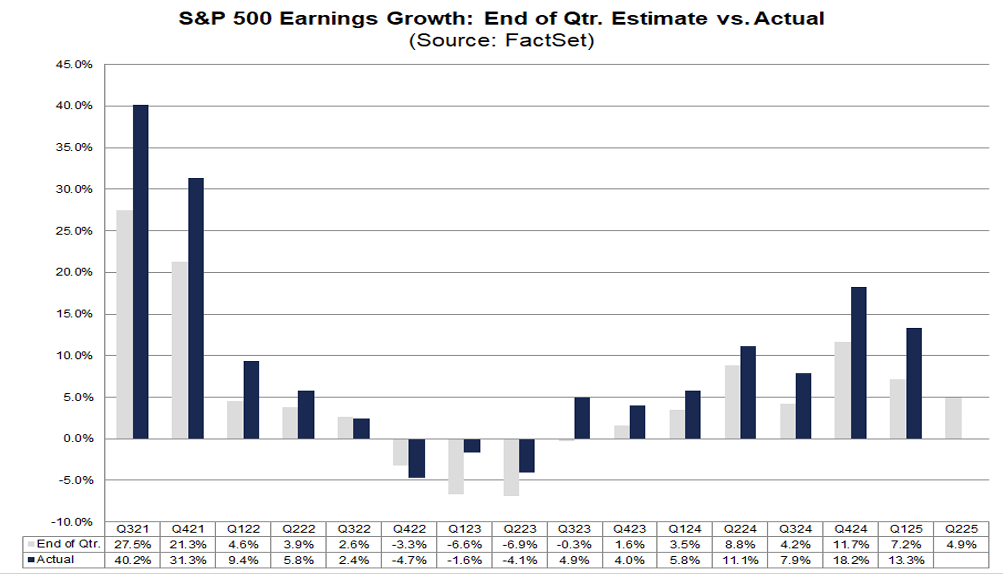

Let’s talk numbers, first off. Analysts expect S&P 500 earnings to grow just 4.8% year-on-year in Q2 2025, a sharp deceleration from the 13.3% growth in Q1 2025 [2].

That would make it the slowest pace of earnings growth since Q4 2023. Still, if these estimates hold, it would be the eighth consecutive quarter of earnings growth–no small feat given the macroeconomic headwinds.

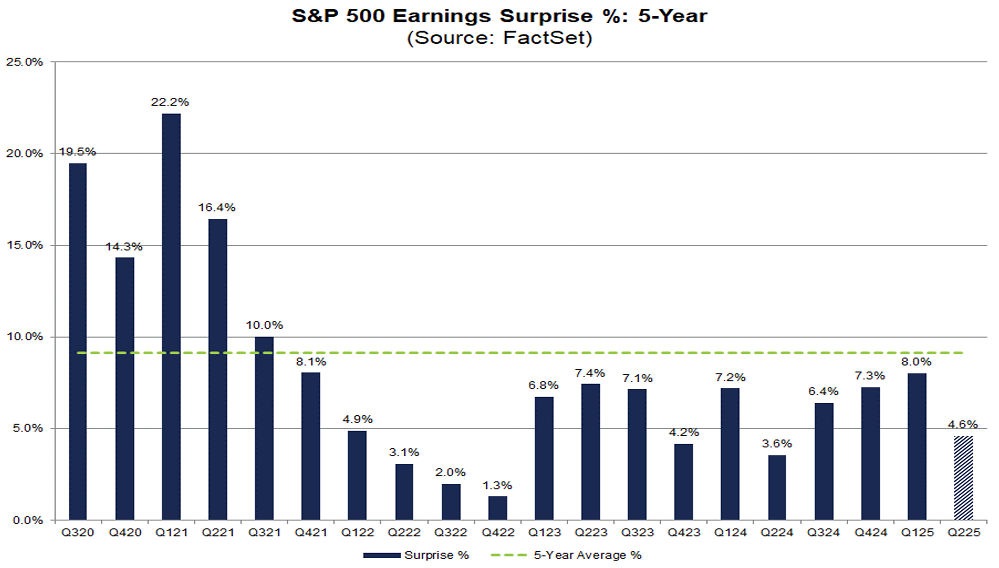

Over the last five years, S&P 500 companies have outperformed earnings estimates by an average of 9.1%, proving they often provide overly-conservative guidance. But this quarter is different.

President Trump’s new tariffs are just starting to hit the books. Costs are rising. Supply chains are under pressure. And with valuations this high, any shortfall could lead to outsized negative reactions in the market.

Key themes to watch

The Q2 2025 earnings season provides a timely opportunity to assess how ongoing policy shifts, economic conditions, and sector-specific developments are reflected in corporate results. Analysts and market participants may be observing how companies are managing costs, adjusting guidance, and responding to broader macroeconomic pressures. The sections below outline several recurring themes that have emerged in this reporting cycle.

1. Tariffs take centre stage

This Q2 2025 period is the first earnings quarter where we should begin to see the impact of President Trump’s updated tariff regime.

While some of the more aggressive tariffs, like copper, semiconductors, and pharmaceuticals, are only set to take effect from August, other duties, like higher levies on autos, aluminum, and steel, were already in place during Q2 2025.

Companies across sectors have begun adjusting. Retailers and manufacturers have introduced selective price hikes, while others are relying on pre-tariff inventory stockpiles to shield margins temporarily.

But this strategy is limited, and not all firms have the same pricing power or supply chain flexibility.

Early signals suggest that profit margins are starting to come under pressure, especially in sectors most exposed to rising input costs.

Not all tariff costs are being passed to consumers, with some companies choosing to absorb them to protect market share. Forward guidance is becoming more cautious, as firms reassess demand, cost inflation, and future earnings visibility.

Bottom line: The Q2 2025 numbers will offer the first clues into how trade policies are starting to dent corporate performance, and how firms plan to navigate what’s coming next.

2. Watch for earnings guidance and inventory moves

This earnings season isn’t just about how the second quarter played out. It is also about how the rest of the year looks.

Investors will be combing through calls for clues on guidance, cost outlooks, and how companies are managing inventory amid the tariff overhang.

What to pay attention to:

- Gross margins in autos, retail, and basic materials, where the tariff impact is most direct and obvious

- Earnings guidance revisions as management teams factor in cost inflation and uncertain demand to tweak forward guidance

- Inventory commentary as some firms built up Q1 stockpiles to dodge Q2 2025 tariffs, but if demand slows, they risk an inventory hangover

Meanwhile, capital expenditure trends are diverging. AI and infrastructure plays are still ramping up, but other industries are holding back on capital spending and investment, wary of trade risks and rising costs.

3. Financials set the tone

As always, banks will take the spotlight early in earnings season, and this time, their influence is even more pronounced given their role in the US economy and the prospect of interest rate cuts in the second half of the year.

Major institutions like JPMorgan, Bank of America, Citigroup, and Goldman Sachs collectively represent a significant portion of S&P 500 earnings, meaning their results could shape investor sentiment for the rest of the quarter.

Key Areas to Watch:

- Net Interest Margins (NIMs): While margins are stabilising as interest rates plateau, banks continue to face pressure from deposit repricing and rising funding costs.

- Credit quality: Consumer credit is showing signs of stress, particularly in credit cards and auto loans. Rising delinquency rates at some major banks may hint at broader credit tightening.

- Loan growth: This remains a key indicator of confidence in both consumer and business activity. Slowing loan demand could suggest hesitance in the face of higher rates and geopolitical uncertainty.

- Capital return: With the latest stress tests out of the way, many expect to see an uptick in share buybacks and dividend increases, especially among well-capitalised names.

- Trading activity and wealth management: Watch for trends in trading activity and wealth management. The most recent Q2 period saw mixed signals with some banks benefitting from market volatility, while others saw a pullback in IPOs and M&A activity. Wealth segments may hold up better given stable equity markets and high-net-worth (HNW) client stickiness.

The twist? While headline numbers, especially at the megabanks, may appear soft due to tough year-on-year comparisons, regional banks and consumer lenders could deliver more upbeat results.

4. Tech’s resilience and the AI tailwind

Tech continues to carry the market. But with lofty valuations, these companies need near-flawless execution to avoid a reversal.

Key names to watch:

- Nvidia, AMD, ASML: All eyes are on AI server buildouts and data centre capex, with the sentiment for the big names supported by some impressive Q2 2025 numbers from TSMC.

- Microsoft, Salesforce, Oracle: Updates on cloud spending and corporate IT budgets will be crucial.

- Apple: Its iPhone sales serve as a bellwether for global consumer sentiment. It is also interesting to see how Apple will adopt some of the AI features into its iOS ecosystem after a slow start to the AI revolution.

Tech posted the highest earnings beat rate in Q1 2025. Expectations are high once again. But the margin for error is razor-thin, especially for richly-priced AI darlings.

Keep an eye on:

- Export controls

- Delivery delays

- Supply chain bottlenecks

The execution risk is real. And with investor patience running thin, even minor hiccups could cause outsized moves in share prices.

5. Consumer strength vs. discretionary pressures

The consumer picture is becoming increasingly mixed, with a clear divergence between staples and discretionary sectors.

- Consumer Staples are facing earnings pressure as pricing power begins to fade, especially among food and beverage names. The rising adoption of weight-loss drugs is also starting to reshape consumer behavior and reduce demand in key product categories.

- Consumer Discretionary names, meanwhile, are grappling with tariff-related cost pressures and ongoing margin volatility. Apparel, autos, and retail categories face uncertainty around inventory planning and input costs.

Still, some names continue to show resilience. Companies with strong direct-to-consumer models, such as Nike, CarMax, and Carnival, have delivered positive surprises in recent quarters, thanks to brand strength, pricing control, and improved digital execution.

Names like Costco, Walmart, and Amazon will be key barometers of the health of the US consumer, these giants of consumer spending and their numbers will shine a light on how much of an impact tariffs are really having on their core customers.

In a world of rising costs and thinner margins, it’s likely that scale and pricing power will become even more valuable in the world of consumer stocks.

Investors will no doubt be looking for signals on whether the resilience seen in some of these giants is sustainable in a more volatile second half.

6. Energy’s drag deepens

Energy could be one of the biggest earnings drags this quarter, with the sector expected to post a sharp year-on-year decline.

The downturn is driven primarily by lower crude oil and natural gas prices, which have compressed margins across the value chain.

Sector breakdown:

- Integrated oil & gas giants are facing weaker upstream performance and slimmer downstream margins

- Refining and marketing firms are contending with narrower spreads and fluctuating demand

- Oilfield services and equipment providers are seeing project delays and reduced capital spending from clients

The bright spots? Storage, transport, and midstream operators have held up slightly better, thanks to steady fee-based revenue.

Still, the overall impact on index-level earnings will be negative, with the sector unlikely to contribute meaningfully to growth this quarter.

Macroeconomic crosswinds

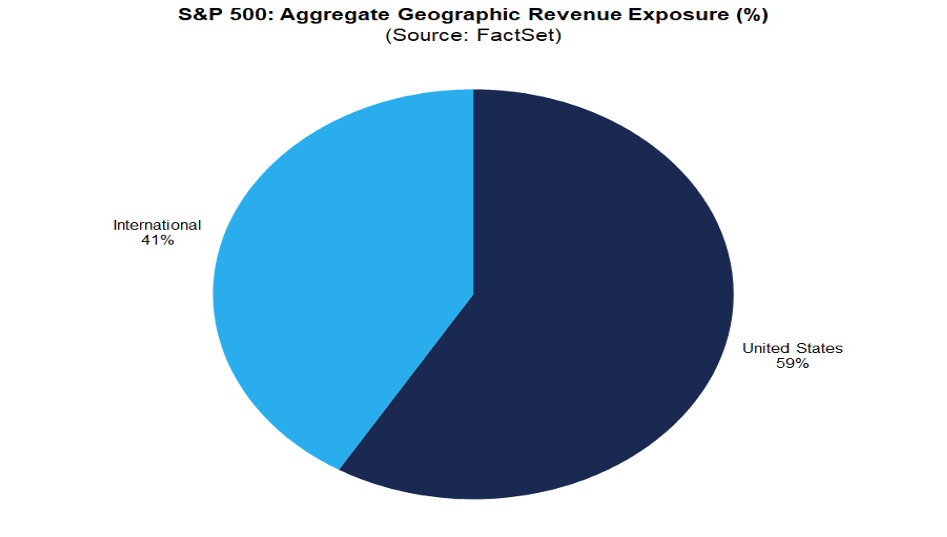

Let’s not forget that 41% of S&P 500 revenues come from outside the US.

Multinational earnings don’t live in a vacuum. They are shaped by macroeconomic developments such as foreign exchange (FX) movements, trade policies, monetary policies and global growth.

Here’s a quick rundown of what’s in play.

Interest rate outlook

Markets are still pricing in a potential Fed rate cut in September. However, if corporate commentary signals resilient demand or sticky inflation, rate-cut hopes may be pushed further out.

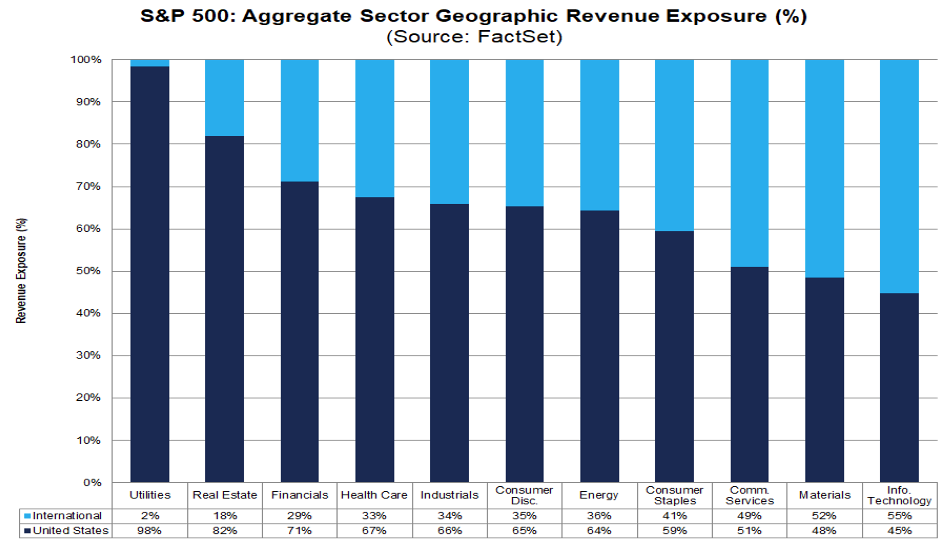

This could weigh especially on interest rate-sensitive sectors such as real estate and utilities, which generate the bulk of their revenues domestically (98% for utilities, 82% for real estate) and are more exposed to US monetary policy.

On the flip side, recent comments from one or two Fed governors (not named Jerome Powell) suggest that a surprise July rate cut could be on the table. If that unlikely scenario does transpire, these rate-sensitive sectors could get a boost.

Inflation pressures

Rising input costs, especially for commodities like copper and aluminum, are eroding margins in manufacturing-heavy sectors.

The industrials and materials sectors, which derive 34% and 52% of revenues internationally, respectively, are likely to feel the pinch of both global commodity inflation and rising trade friction, especially with President Trump’s tariffs starting to bite.

Guidance sensitivity

Uncertainty around tariffs, cost inflation, and rate direction is prompting companies to tread cautiously with forecasts. The number of companies offering positive earnings guidance ahead of Q2 2025 is well below historical norms, underscoring how fragile sentiment is.

Sectors like consumer discretionary, which gets 35% of its sales abroad, and tech, with 55% global exposure, are particularly vulnerable to any shift in spending patterns or export demand.

The weak dollar

A softening US dollar could serve as a tailwind for multinational firms, boosting the dollar value of overseas sales.

This is especially important for export-driven sectors like information technology (55% international revenue), materials (52%), and communication services (49%), where foreign income makes up nearly or more than half of overall revenue.

Conversely, more domestically-anchored sectors like utilities and financials (98% and 71% US-based revenue, respectively) benefit less from currency moves.

Final thoughts heading into Q2 2025 earnings

For investors, this Q2 2025 period isn’t just another earnings season—it’s a gut check for valuations, macro assumptions, and investor sentiment.

With so much riding on near-perfect execution, the stakes couldn’t be higher. We’re entering a stretch where earnings quality, forward visibility, and management strategy will be scrutinised more than ever. Miss the mark, and markets may not be forgiving.

So, investors should buckle up. What companies report and how they guide for the rest of 2025 could shape sentiment for the remainder of the year on Wall Street.

RISK WARNING: CFDs are complex financial instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand the risks involved and carefully consider whether you can afford to take the high risk of losing your money before trading.

Disclaimer: The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Reference

- “The Stock Market Is Doing Something It Has Done Only 2 Times Since 1985, and History Is Clear About What Happens Next – Nasdaq” https://www.nasdaq.com/articles/stock-market-doing-something-it-has-done-only-2-times-1985-and-history-clear-about-what Accessed 14 July 2025

- “EARNINGS INSIGHT – Fact Set” https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071125.pdf Accessed 14 July 2025