Hawkish Powell pushes USD to two-month highs

* Dollar climbs as Fed’s Powell holds off on September rate cut verdict

* Two Fed Governor’s dissent for the first time in 32 years

* Stocks mixed, Nasdaq futures jump on blockbuster Meta and Microsoft results

* BoJ to stand pat, but could line up post-summer rate hike

FX: USD jumped again, initially surging above a resistance area on the Dollar Index around 99.57/63 after Q2 GDP beat estimates rising 3% versus 2.4%. Fed Chair Powell then helped the buying some more, saying he was in no rush to ease, policy would remain restrictive to combat inflation while a data dependent stance would be maintained. The first double Governor dissent since 1993 did little to trouble the rising bulls. The greenback closed very close to its highs, with market’s focus next on core PCE figures and then NFP on Friday. Powell sees downside risk around the labour market but does not predict a weakening.

EUR fell for a sixth straight day and has lost 2.88% of its value versus the dollar this week, easily the biggest loss by a major peer. Heavy bullish positioning is having to readjust among the speculative community. The shift in sentiment has also been notable, which was further kicked off by yesterday’s stronger than expected US GDP print contrasting with the EZ Q2 print of 1.4%, even if that was a beat. Germany’s growth actually declined 0.1% on a quarterly basis. There is not a lot of major support after the mid-1.14s until around 1.12 in EUR/USD.

GBP fell again for a sixth day, though it once more outperformed the majority of its peers. There was little specific UK news with the strong dollar driving all the major currency pairs. Markets have been assessing the extent of additional BoE easing by year end and have lowered expectations by more than 5bps over the past week.

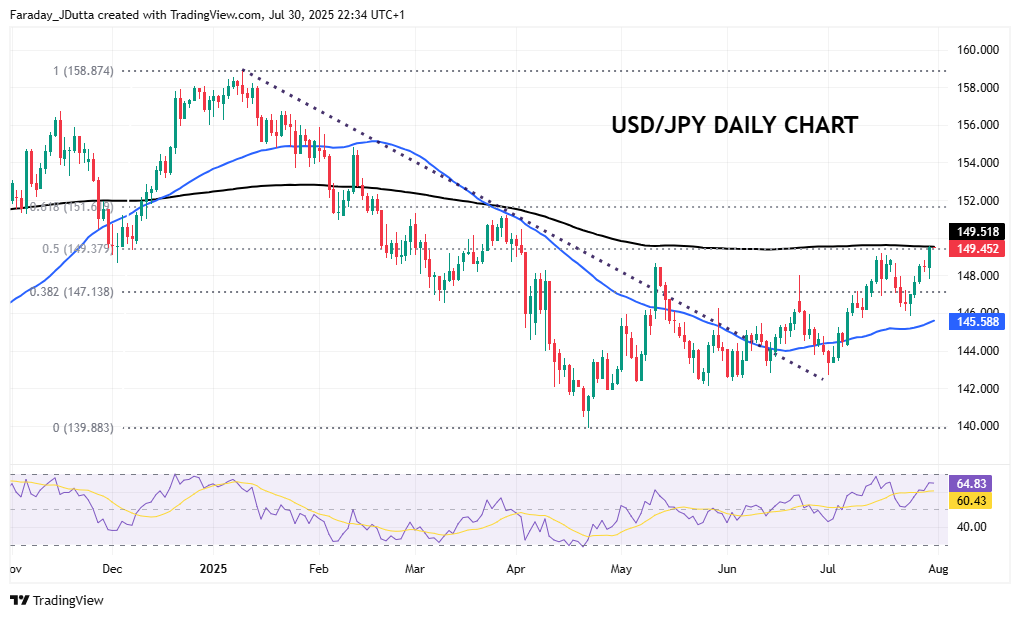

JPY hit a resistance zone as the dollar pushed the major higher. All eyes are on the BoJ meeting, with NFP also likely to heavily influence the pair. See below for more details.

AUD was the second worst major on the day after softer than expected CPI data. The annual print was the lowest since Q1 2021 and the figures cemented an August RBA rate cut. The major broke down through support at the 50-day SMA. CAD saw a muted reaction after the BoC on hold rate decision. US trade actions remain unpredictable with negotiations fluid. Policymakers have to balance the risks of continued trade policy uncertainty against the challenges of persistent underlying inflationary pressures.

US stocks: The S&P 500 printed down 0.12% at 6,363. The Nasdaq settled higher, by 0.16% at 23,345. The Dow Jones finished down at 44,461, losing 0.38%. Sectors were mainly lower with only three in the green – utilities, technology and communication services. Materials led the losers, with real estate and energy all down between 1.99% and 1.35%. We got a deluge of earnings, with Meta and Microsoft after the closing bell smashing estimates. The latter saw profits soar almost 25% on a boom in cloud computing revenues as the company posted a beat on the top and bottom lines. Meta also jumped double-digits initially to fresh all-time highs after guiding revenue and capex higher. It’s Apple and Amazon’s turn to report after Thursday’s closing bell. The former could face tariff issues while it didn’t give out any guidance at the last earnings report. Amazon’s AWS will obviously be key and if it is increasing capex, while sustaining record margins.

Asian stocks: Futures are mixed. APAC equities were again mixed after the muted Wall Street handover and big risk events ahead. The ASX200 rose on strength in consumer staples and real estate. CPI printed lower than expected causing softer yields. The Nikkei 225 lacked any kind of conviction ahead of the BoJ meeting. The Shanghai Comp and Hang Seng were mixed with eyes on the China-US talks and a truce extension. President Trump gave off positive signals about how talks went.

Gold tumbled over 1.6% as the more hawkish Fed Chair Powell caused a strong dollar and Treasury yields. Price have recently fallen below the long-term upward trendline from the December low. They have also broken down through the 50-day SMA which has been long-term support this year. The late June low sits at $3,246 with a major Fib level of this year’s rally at $3,149.

Copper prices plunged after the White House issued more details on the 50% tariffs. Trump’s announcement saw universal 50% tariffs on imports of semi-finished copper products and copper-intensive derivative products, effective August 1st.

Day Ahead – BoJ meeting, US Core PCE

The BoJ will keep its interest rate unchanged at 0.5% Median forecasts for real GDP and core CPI will be released with upgrades likely. Policymakers will weigh up current hot inflation and an easing in US trade policy uncertainty after the recent deal. Focus will be on any signals about rate hikes ahead, with little impact seen from the domestic election. But that is still another source of uncertainty, with a change in PM possibly meaning a greater focus on debt sustainability. Will the BoJ back those looking for an October rate hike?

The Fed’s favoured inflation metric, core PCE, is forecast to rise 0.3% m/m in June, the same as the headline print. That translates to 2.8% and 2.6% y/y respectively. Some of the tariff pass through seen in CPI should be evident in this data, but there are differences for weighted components. We also get personal income which is expected to accelerate a touch and personal consumption which is forecast to post continued modest growth in July.

Chart of the Day – USD/JPY hits the 200-day SMA

USD/JPY has risen for the past four days out of five. Prices have now touched a resistance zone at the 200-day SMA at 149.52 and the midpoint of this year’s sell-off at 149.37. The major hasn’t moved above that long-term momentum indicator since February. The next big Fib retracement level (61.8%) is at 151.61, which is just above the late March top. Treasury yields have correlated again with the pair in recent days. A more hawkish Powell has helped, with focus next on the BoJ and then non-farm payrolls data on Friday.