Markets choppy ahead of US CPI and RBA

* Dollar jumps, gold dumps as stocks slide ahead of data

* President Trump extends China tariff deadline by 90 days

* Trump downplays expectations for summit deal with Putin

* Economists eye tariff-driven price gains in July’s US inflation data

FX: USD made modest gains to kick off the week, with focus on the Fed, inflation and the US-Russia Ukraine peace talks. If there is no Ukraine or European representation at the Friday meeting in Alaska, then any agreement reached should only be preliminary at best. Trump’s main leverage appears to be the threat of sanctions and protectionist pressure on Russia’s trading partners, such as India. US inflation is expected to pick up amid strong Fed rate cut expectations as the FOMC changes to a more dovish composition tilt.

EUR sold off to trade just above the 50-day SMA at 1.1608. The daily RSI has turned neutral reflecting the major’s’ recovery and subsequent consolidation. Focus is on the US-Russia summit with a possible ceasefire likely giving a bid to the euro versus the dollar, yen and Swiss franc. Today’s ZEW survey is expected to deteriorate following the US-EU trade deal which was poorly received in the region.

GBP struggled at the top of the descending channel band that has taken shape since the multi-year high at the start of July at 1.3788. We get jobs data out today with risks of a softer-than-expected initial payroll print followed by an upward revision in the coming months, as we’ve seen in recent instances. Markets may treat those with a bit more caution for this reason, as well as the BoE’s lack of concern about jobs, even though wages are predicted to remain sticky.

JPY remains in relatively quiet consolidation mode though the major picked up above 148 during the US session. BoJ tightening is back on the agenda after its recent pause with around a 40% chance of a hike in October.

AUD was a relative outperformer but still finished marginally in the red. All eyes are on the expected 25bps RBA rate cut and guidance. CAD weakened versus the dollar for a third straight day as bears built on the weak jobs data seen on Friday, that prompted concerns over domestic demand.

US stocks: The S&P 500 printed down 0.2% at 6,377. The Nasdaq settled lower, by 0.36% at 23,527. The Dow Jones finished down at 43,976, losing 0.45%. Sectors were mixed, as Consumer Discretionary, Staples and Health Care outperformed and were the only ones in the green, while Energy, Tech and Real Estate lagged. Nvidia and AMD were volatile as they agreed to pay 15% of China chip sales to the US government. This potentially set a precedent for the White House to tax critical US exports in other areas of the economy. Separately, Wall Street analysts at UBS and Citigroup upped their year-end S&P 500 targets to 6,100 from 5,500 and 6,600 from 6,300 respectively. These moves follow similar upgrades from other major brokerages. The highest target is 7,100 and the just one has a level below 6,000, at 5,600. The bulls say tax benefits form President Trump’s spending bill should improve corporate earnings while the tariff drag has mostly played out.

Asian stocks: Futures are mixed. APAC equities were positive though gains were limited amid a Japanese market holiday. The ASX200 posted a fresh intraday top ahead of the RBA’s virtually fully priced in rate cut. The Nikkei 225 was closed. The Shanghai Comp and Hang Seng were green on reports that Nvidia is to be licensed to export chips to China.

Gold sold off sharply (-1.6%), hitting the 50-day SMA at $3,348. There was initially some confusion about gold tariffs though Trump later confirmed there would be no tariffs. It was though levies might disrupt the flow of physical gold but their impact on supply and demand would be minimal. The safe haven bid reduced on the hopes for a US-Russa peace deal for Ukraine.

Day Ahead Highlight – US CPI

US July CPI is expected to rise by one-tenth to +0.2% m/m at the headline level with the annual rate also seen rising one-tenth to 2.8%. Core inflation is forecast to rise up one-tenth by +0.3% m/m, with the annual predicted to rise to 3.0% from 2.9%. The data is predicted to bring further signs of higher tariffs pushing up prices, though it is still early in the price adjustment process to see how higher import taxes will ultimately be distributed between the end-customer, domestic sellers and foreign exporters. At the same time, growing consumer fatigue is making it more difficult to raise prices in general.

Markets will be watching the core goods prices excluding autos, which rose 0.6% m/m last time, the biggest monthly increase since February 2022. Auto prices may play a part after surprisingly falling last time, while cooling housing rents could offset the tariff impact increase in the months ahead. There is much speculation about whether the levies are a one-off price impact or something more long lasting. Fed officials may be wary of calling price pressures ‘transitory’ after the pandemic, when CPI rocketed to 9% while policymakers thought it would pass.

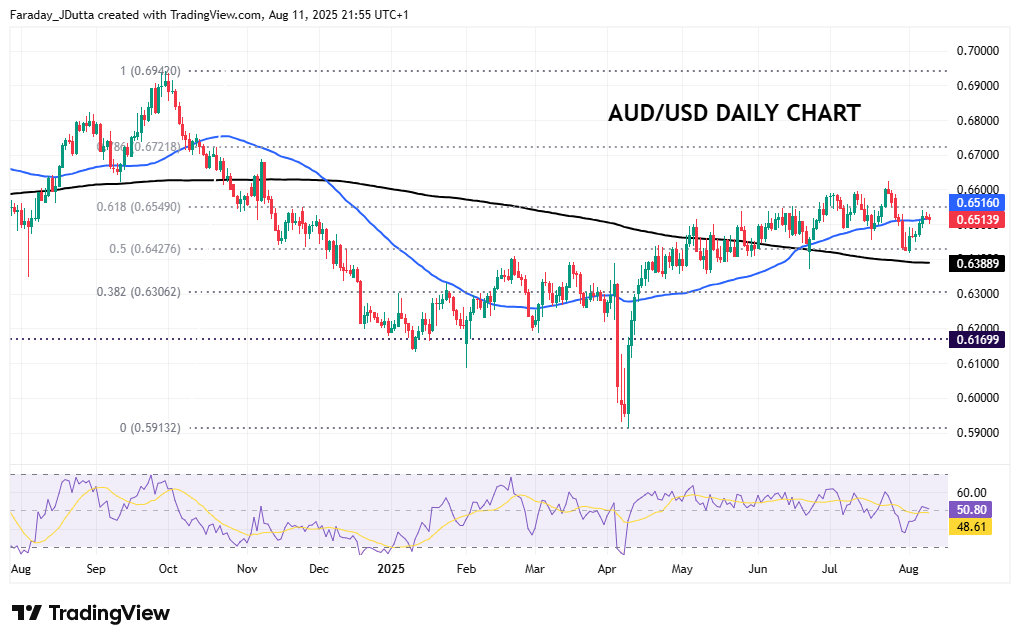

Chart of the Day – AUD/USD mid-range ahead of RBA meeting

The RBA is likely to cut rates at its meeting today by 25bps to 3.60%, with the move virtually fully priced. The bank surprised markets at the last meeting by pausing amid wide expectations for a cut, saying the Board will be attentive to the data and evolving assessment of risks to guide its decisions. Since then, the data releases support the case for a rate reduction after disappointing jobs data and cooler inflation. The unemployment rate unexpectedly rose to 4.3% in June to its highest in three and a half years. Just 2k jobs were added against a 20k consensus estimate, while inflation continued to soften in Q2 with headline CPI inflation coming in at 1.9% y/y in June, while trimmed mean CPI fell to 2.1%.

Key for markets will be what guidance the RBA give, and if they offer signals that bring forward the next cut from November to September. AUD will likely move lower towards support at 0.6427, the halfway point of the October to April bear trend. Resistance on a more “hawkish cut” sits above 0.66.