Wall Street rallies to new heights on moderate CPI

* S&P 500, Nasdaq end at record closing highs, small caps jump

* Rate cut bets increase after US inflation data see limited tariff impact

* Dollar turns lower as more policy easing expected

* Ethereum nears $4,500 as treasury company aims to rais $20bn

FX: USD fell in what has been choppy price action over the last few sessions. US CPI was probably not hot enough for those positioned that way, so September rate cut bets ramped up to around a 95% chance from 85% at the start of the day. President Trump threatened a lawsuit against Fed Chair Powell after the data, due to the construction of the Fed buildings. We had more Fed officials on the wires, with Schmid rather hawkish and preferring a wait-and-see stance.

EUR was the strongest major versus the dollar as the single currency found a bid late on in the European session. The current market narrative is one of the ECB holding policy steady with inflation under control but mindful of any potential growth headwinds in the third quarter, in contrast increasing expectations of rate cuts by the FOMC.

GBP also outperformed as the latest jobs figures failed to show a marked deterioration in the labour market that some had been positioned for. Wage growth printed a touch softer, but payrolls change surprised to the upside, hitting its highest level since September. Cable moved up to highs last seen in late July. The 50-day SMA looked to have been pierced, though the major closed pretty much on it at 1.3498. Next resistance sits at those late July highs around 1.3584/8.

JPY strengthened modestly as USD/JPY fell back below 148. The most recent futures positioning data pointed to a further drop in long yen positions, which has been seen since April.

AUD underperformed after the RBA cut rates and downgraded productivity and trend GDP growth. The major did manage to move above the 50-day SMA at 0.6517. CAD was the weakest major versus the dollar. The Bank of Canada’s Q2 survey of market participants reflected a consensus expectation of two 25bps cuts from the Bank over the balance of this year and a slightly firmer CAD (1.35) by year end.

US stocks: The S&P 500 printed up 1.13% at 6,446. The Nasdaq settled higher, by 1.33% at 23,839. The Dow Jones finished up at 44, 458 gaining 1.1%. The majority of sectors were green, with notable outperformance in Communication and tech stocks, while Real Estate and Consumer Staples lagged. There were new record closes on the Nasdaq and S&P 500. The broad-based benchmark enjoyed its 16th record close of this year. Stocks are now up 7.5% from the day Trump was inaugurated and 13.7% from Liberation Day on April 2. With core inflation still not feeling any major effects of tariffs, any levy-induced price pressures are only expected to feed through over time. With rent acting as a disinflationary force going forward, markets are taking the view that tariffs are a one-off price event with softer wage growth and weaker housing helping soften CPI. Around 61bps of Fed rate cuts are priced in for this year. That means a 44% chance of a third 25bps move by year end. Stock wise, China urged firms not to use Nvidia H20 chips in new guidance over security concerns.

Asian stocks: Futures are green. APAC equities rallied with some indices hitting fresh record highs after President Trump extended a trade war truce with China. The ASX200 posted a new high after the RBA rate cut while signalling more easing may be coming. The Nikkei 225 jumped 2.2% to an all-time top after its Monday holiday. As well as the trade news, strong corporate earnings, clarity on a trade deal with the US and potential normalising of monetary policy are all boosting the record equity run. The Shanghai Comp and Hang Seng were kept afloat after the 90-day tariff truce extension.

Gold found support at the 50-day SMA at $3,350 as spreads returned to normal after Trump announced that gold would not be tariffed. There had been a lot of confusion recently, which threatened to disrupt the triangular flow of gold between New York, London, and Zurich.

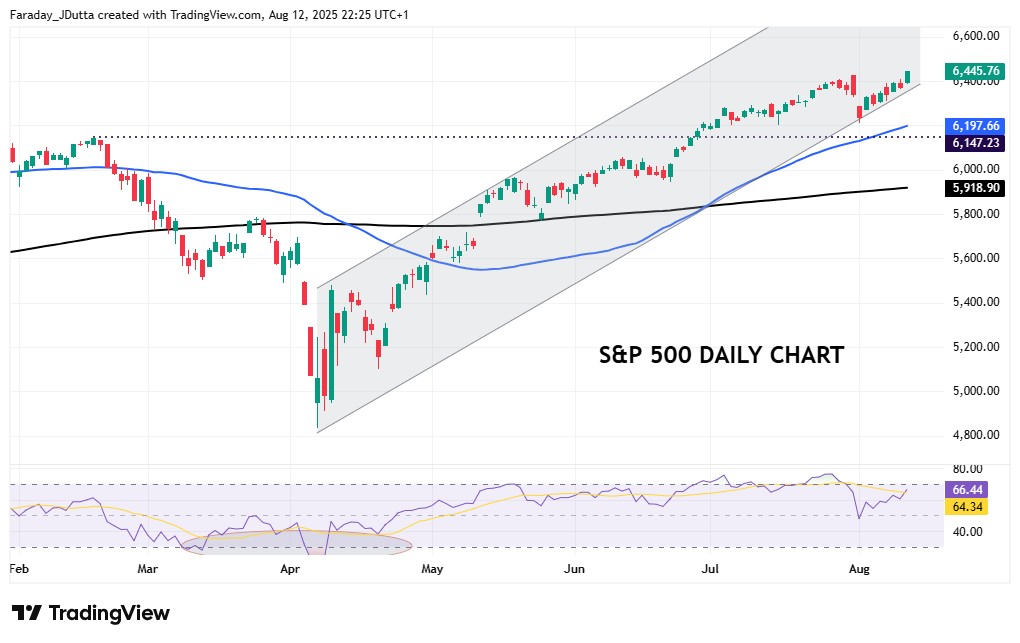

Chart of the Day – S&P 500 bull channel continues

As the earnings season draws to a close, stock indices have hit fresh record highs. Interestingly, Goldman Sachs noted that the average post-earnings move for S&P 500 constituents exceeded options-implied expectations for the first time in at least 18 years. That, they say is a rare sign of upside surprise outpacing market pricing.

Of course, it is the Magnificent 7 stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – leading the gains. They continue to justify their elevated valuation multiples, having regularly beaten analysts’ consensus earnings expectations. The one exception to this seems to be Tesla. Collectively, these seven stocks now account for roughly a third of the market cap of the S&P 500, 23% of its aggregate forward earnings, and 12% of its aggregate forward revenues. Narrow breadth is only an issue when it becomes an issue. It is a brave person to make that call of when will that be, with bullish momentum still so strong.