When anyone thinks of an iconic consumer brand, one of the first companies that pops into their head is most likely Apple Inc (NASDAQ: AAPL).

The iPhone behemoth has built one of the most sophisticated global supply chains in modern business—anchored heavily in China and increasingly diversified into countries like India and Vietnam. But as geopolitical tensions escalate, that global footprint is becoming more of a liability.

While Apple has made significant strides in shifting iPhone production to India—nearly 3 million iPhones were exported to the US in April 2025 alone—this may not be enough to shield the company from a new wave of tariffs [1].

President Donald Trump has proposed a 25% tariff on all Apple products not made in the United States, a move that would apply even to iPhones manufactured in India [2]. That not only challenges the effectiveness of Apple’s supply chain diversification but puts additional pressure on the company to localise more production within the US—a far more costly and logistically complex undertaking.

For market watchers, this raises critical questions: Will Apple absorb the extra costs, or pass them on to consumers? Could rising prices dampen demand? And how might this influence Apple’s margins, guidance, and ultimately its stock performance?

In this article, we explore how tariffs could reshape Apple’s operations, test its manufacturing strategy, and alter perceptions of Apple’s long-term business prospects.

Key Points

- Proposed tariffs could significantly raise Apple’s production costs, even for iPhones made in India.

- Apple’s heavy reliance on China exposes it to geopolitical risks, despite efforts to diversify into India and Vietnam.

- Higher costs may pressure Apple’s margins or lead to price hikes, impacting consumer demand and stock performance.

Tariffs, China Dependence, and Apple’s Manufacturing Dilemma

Tariffs—essentially taxes imposed on imported goods—have long been used as a policy tool to protect domestic industries or to exert economic pressure on trading partners.

In recent years, they have re-emerged as a central theme in US trade policy, particularly in the technology sector where global supply chains are deeply intertwined. For a company like Apple, whose products are designed in California but largely assembled overseas, tariffs are more than a political talking point—they strike at the heart of its global business model.

The current trade backdrop has become increasingly hostile, with President Donald Trump pushing for aggressive protectionist policies as part of his broader “America First” agenda.

In a recent statement, Trump directly called out Apple, proposing a 25% tariff on all products not made in America. His message was blunt: “You want to build in India? That’s fine—but you won’t be selling in America without paying for it” [3].

This marks a pivotal shift in the risk landscape. Apple’s decision to shift more iPhone production from China to India was originally seen as a strategic hedge against China-specific tariffs. But under Trump’s broader proposal, even iPhones assembled in India would be subject to punitive duties, effectively undercutting Apple’s diversification efforts unless production moves fully onshore to the US.

That’s a problem. Apple remains deeply dependent on Chinese manufacturing hubs for everything from iPhones and MacBooks to components like batteries and screens.

Although Vietnam and India now play growing roles in Apple’s supply chain, the company still relies heavily on Chinese facilities for efficiency, scale, and specialised labor. Relocating this complex supply chain to the US would take years and cost billions, not to mention the challenges in workforce readiness and infrastructure.

A 25% tariff on non-US-made Apple products could create a ripple effect: higher production costs, potential price hikes for consumers, and thinner margins. Apple may be forced to decide between absorbing the hit, passing costs on to customers, or accelerating its costly domestic investment strategy. None of these paths are ideal, especially in a competitive global market.

Apple is already feeling the pressure. In its Q2 FY2025 earnings call, CFO Kevan Parekh revealed that current tariff structures are expected to add US$900 million in costs for the June quarter alone [4].

While Apple still forecasts a healthy gross margin of 45.5% to 46.5%, that’s a modest drop from the 47.1% margin reported in the previous quarter— indicating potential early effects from tariff pressures. [5].

In short, Apple’s once-untouchable supply chain advantage is now facing real political and economic headwinds. For investors, the concern isn’t just about short-term earnings—it’s about the long-term implications on Apple’s cost structure, product pricing, and strategic flexibility.

Tariffs may be a tax on trade but for Apple, they could also impact future growth plans.

Apple’s Vulnerability Due to Its Chinese Manufacturing Base [6]

Despite efforts to diversify, Apple remains heavily reliant on China. Around 80% of its global production capacity is based there, with 90% of iPhones, 55% of Macs, and 80% of iPads still assembled in the country.

Although China-based manufacturing sites declined between 2017 and 2020, the trend has reversed, with Chinese firms now making up about 40% of Apple’s supplier base.

China remains at the heart of Apple’s high-volume, cost-efficient manufacturing model. Any disruption—whether tariffs, COVID-style lockdowns, or political backlash—could ripple through its supply chain.

While production for many US-bound iPads, Macs, and AirPods has shifted to Vietnam, China still handles the bulk of global output, especially for markets outside the US.

Apple’s Shift to India: Status, Limitations, and Outlook [7]

Apple’s expansion into India is accelerating. In April 2025, it exported nearly 3 million iPhones to the US, a 76% year-on-year increase. The company aims to produce 25% of all iPhones in India, with 15% to 20% of global output expected by end-2025, a notable jump from just a few years ago.

However, India is still catching up. It lacks China’s scale, supplier depth, and advanced infrastructure. Key components like chips and displays are still sourced externally and assembled elsewhere, limiting local value-add. Bureaucratic delays and inconsistent logistics further complicate Apple’s localisation push.

India will likely take on more production of older or lower-end models. But replacing China as Apple’s main production hub, especially for premium products remains a long-term ambition.

In the meantime, proposed US tariffs on non-domestically made products could blunt India’s role and pressure Apple to reassess how fast it can scale up operations there.

Challenges of Moving Manufacturing to the US [8]

Apple’s newly-announced US$500 billion US investment plan is ambitious but doesn’t signal a near-term shift to assembling iPhones domestically. Recent announcements such as a 250,000-square-foot AI server plant in Texas and chip production at TSMC’s Arizona facility highlight a focus on infrastructure and silicon, not consumer hardware.

Mass-producing Apple devices in the US faces steep challenges: high labour costs, a limited electronics manufacturing workforce, and fragmented supply chains.

Apple’s 20,000 planned R&D jobs and new manufacturing academy in Michigan may build long-term capacity, but US-based iPhone assembly remains more symbolic than practical, at least for now.

Consumer and Market Impact: Will Apple Pass on the Cost? [9]

The imposition of a 25% tariff on iPhones manufactured outside the US could add approximately US$110 to the cost of each device.

Despite this, Apple may opt for selective price adjustments, potentially raising prices on higher-margin models while keeping base models relatively stable. This strategy aims to maintain competitiveness without significantly impacting demand.

Apple’s premium pricing strategy is integral to its brand image. Significant price increases could risk alienating price-sensitive consumers, potentially leading to a decline in demand. However, Apple’s strong brand loyalty and perceived value may mitigate some of these effects.

Apple’s stock has faced notable volatility amid escalating tariff concerns, posting a 19.8% year-to-date decline. The sell-off intensified in April following the Liberation Day announcement, with shares falling more than 20%, before rebounding roughly 16% since.

While near-term risks remain elevated, Wall Street remains broadly optimistic about Apple’s long-term prospects , noting its strong ecosystem and supply chain diversification efforts, including increased iPhone production in India.

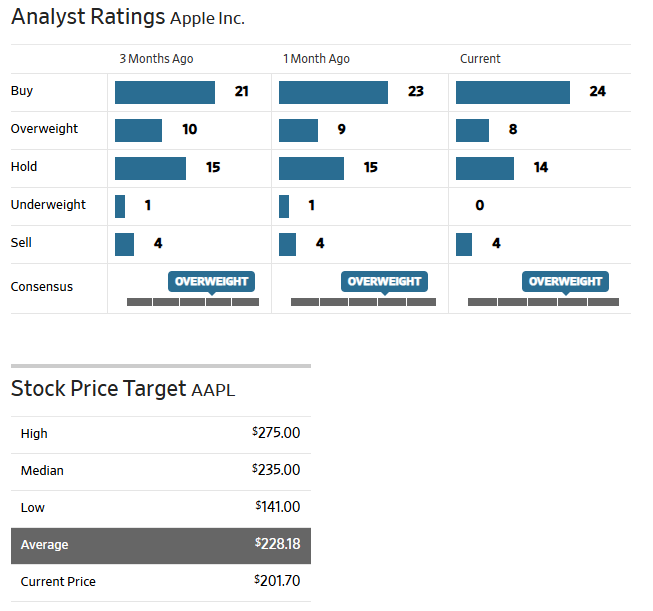

This sentiment is supported by analyst ratings: 64% of analysts covering Apple have a “Buy” call, 28% recommend holding, and just 8% suggest selling. The average 12-month price target of US$228.18 reflects analysts’ estimates and is subject to change from the current share price of US$200.85.

That said, the stock remains highly news-driven, with headlines around tariffs, geopolitics, and trade policy triggering sharp market reactions. For traders, this can present both opportunities and risk.

Some analysts note that tariff-related volatility has led to buying interest during selloffs and profit-taking during rebounds, though such conditions can change quickly.

Key Factors to Monitor in Apple’s Evolving Trade Landscape

For those monitoring Apple’s tariff developments, keep your eyes on these five signposts:

- White House Trade Policy: Will tariffs on China escalate? Watch out for announcements post-election season.

- Section 232 Investigation: Tariffs on semiconductor-heavy devices could expand, bringing more Apple products under the spotlight.

- Apple’s Supply Chain Updates: Any acceleration of Indian or US production could shift investor sentiment.

- iPhone Pricing Trends: If prices rise without a dip in demand, this may be viewed positively. If not, margin pressures may loom.

- Earnings Guidance: Tariff impact could cloud visibility. Watch for margin guidance in Q3 and Q4.

Understanding Market Volatility Amid Tariff Developments

Apple’s evolving tariff situation represents more than just a news headline—it reflects broader dynamics that can influence market sentiment and asset pricing. As trade policies continue to shift, such developments may introduce volatility across technology stocks, particularly those with global supply chains.

With uncertainty comes opportunity and risk. If you wish to learn about market volatility around tariff developments in tech-related instruments via CFDs you can find more about the tools and resources available on the Vantage platform.

Reference

- “India’s iPhone exports to the U.S. soared an estimated 76%. But Trump, Beijing won’t make further growth easy – CNBC” https://www.cnbc.com/2025/05/27/indias-iphone-exports-to-the-us-soared-an-estimated-76percent-in-april.html Accessed 3 June 2025

- “Trump threatens 50% tariffs on EU, 25% on Apple, ratcheting up trade war – Al Jazeera” https://www.aljazeera.com/economy/2025/5/23/trump-threatens-50-tariffs-on-eu-25-on-apple-ratcheting-up-trade-war Accessed 3 June 2025

- “Donald Trump expands tariff threat to Apple, says ‘Okay to go to India, but you’re not going to sell in US without tariffs’ – MSN” https://www.msn.com/en-in/news/other/donald-trump-expands-tariff-threat-to-apple-says-okay-to-go-to-india-but-you-re-not-going-to-sell-in-us-without-tariffs/ar-AA1Fo2sq?ocid=finance-verthp-feeds&apiversion=v2&noservercache=1&domshim=1&renderwebcomponents=1&wcseo=1&batchservertelemetry=1&noservertelemetry=1 Accessed 3 June 2025

- “Apple has managed tariffs so far, but Cook lacks long-term answers – CNBC” https://www.cnbc.com/2025/05/01/apple-has-managed-tariffs-so-far-says-tough-to-predict-beyond-june.html Accessed 3 June 2025

- “Apple girds for more trade war pain, trims buyback – Reuters” https://www.reuters.com/technology/apple-edges-past-expectations-world-girds-tariff-impact-2025-05-01/ Accessed 3 June 2025

- “Here’s where Apple makes its products — and how Trump’s tariffs could have an impact – CNBC” https://www.cnbc.com/2025/04/03/apple-iphone-production-in-china-india-in-focus-after-trump-tariffs.html Accessed 3 June 2025

- “Apple aims to build most iPhones for U.S. in India by end-2026 – Fortune” https://fortune.com/asia/2025/04/25/apple-aims-build-most-iphones-us-india-end-2026/ Accessed 3 June 2025

- “Apple plans $500 billion in US investment, 20,000 research jobs in next four years – Reuters” https://www.reuters.com/technology/artificial-intelligence/apple-plans-texas-factory-ai-servers-20000-research-jobs-2025-02-24/ Accessed 3 June 2025