For nearly six decades, Warren Buffett, the “Oracle of Omaha,” has been the beating heart of Berkshire Hathaway, transforming a faltering textile mill into a US$1.1 trillion juggernaut that redefined value investing [1].

His resignation as CEO, announced on 3 May 2025, at age 94, closes an unparalleled chapter in corporate history, leaving investors, analysts, and shareholders grappling with a seismic shift. Buffett’s genius—rooted in discipline, patience, and an uncanny knack for spotting enduring businesses—built a conglomerate spanning insurance, railroads, and iconic brands like Apple and Coca-Cola.

Now, as Greg Abel prepares to take the helm, the question looms: Can Berkshire sustain its legendary success without Buffett’s guiding hand? With a robust succession plan and a fortress-like balance sheet, the stage is set for a new era—but what lies ahead for this American titan?

Key Points

- Warren Buffett’s resignation as CEO of Berkshire Hathaway ends a six-decade era defined by disciplined value investing, decentralised leadership, and extraordinary shareholder returns.

- Greg Abel, Buffett’s long-time successor, brings operational strength and continuity, with a commitment to Berkshire’s conservative capital strategy and diversified portfolio.

- Despite initial market volatility, Berkshire’s robust balance sheet, succession plan, and Buffett’s continued role as chairman provide long-term stability for investors.

A Historic Leadership Transition [2]

For six decades, Buffett transformed a struggling textile mill into a US$1.1 trillion conglomerate, achieving a staggering 5,502,284% return for shareholders since 1965, far outpacing the S&P 500’s 39,054% over the same period.

His investment philosophy—centered on value investing, long-term ownership, and a keen understanding of businesses—shaped Berkshire into a diversified powerhouse with treasured holdings like Geico, BNSF Railway, and a massive stock portfolio including Apple and Coca-Cola.

This unparalleled success cemented Buffett’s reputation as one of history’s greatest investors, with his annual shareholder letters and meetings—known as the “Woodstock for Capitalists”—drawing global audiences eager to glean his wisdom.

Buffett’s investment principles were the bedrock of Berkshire’s transformation. His commitment to value investing—buying high-quality businesses at fair prices and holding them for decades—guided iconic investments like Coca-Cola, American Express, and, later, Apple, which became Berkshire’s largest holding.

He prioritised companies with strong economic moats, predictable cash flows, and competent management, often acquiring them outright, as seen in landmark deals like Geico (1996), BNSF Railway (2009), and Precision Castparts (2016).

His disciplined capital allocation—eschewing dividends to reinvest profits or repurchase shares—maximised shareholder value. By 2025, Berkshire’s nearly US$350 billion cash pile stood as a testament to Buffett’s unwavering commitment to a “fortress-like balance sheet” built for resilience and opportunity.

Buffett’s leadership style was equally transformative. Rejecting bureaucratic hierarchies, he empowered subsidiary managers with autonomy, fostering a decentralised culture that allowed businesses like Dairy Queen, Duracell, and See’s Candies to thrive independently.

His trust in managers, coupled with minimal interference, cultivated loyalty and efficiency across Berkshire’s 70+ subsidiaries. Buffett also pioneered a unique approach to acquisitions, offering sellers simplicity and permanence, which attracted family-owned businesses seeking a stable home.

Beyond financial metrics, Buffett’s legacy lies in his ability to democratise investing wisdom. His annual letters, laced with humour and clarity, distilled complex concepts into timeless lessons that many great investors abide by even today. By stepping down at 94, Buffett leaves a conglomerate built on resilience, diversification, and an enduring philosophy that will guide Berkshire into its next chapter.

Meet the Successor: Greg Abel’s Rise

Warren Buffett’s name has long been synonymous with Berkshire Hathaway. But behind the scenes, the legendary investor has already passed the baton to a man he once called his clear successor: Greg Abel. At 62, the Canadian-born businessman is poised to lead one of the world’s most powerful conglomerates.

A 25-year Berkshire veteran, Abel has been the designated successor since 2021, when Buffett and the late Charlie Munger confirmed his readiness. At that time, Buffett said, “The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning.”

From Alberta to Omaha [3,4]

Greg Abel’s rise began far from Wall Street, earning a commerce degree from the University of Alberta in 1984 and starting his career at PricewaterhouseCoopers. In 1992, he joined CalEnergy, which later acquired MidAmerican Energy—just as Berkshire took a controlling stake in 1999.

Abel steadily climbed the ranks, becoming CEO of the rebranded Berkshire Hathaway Energy (BHE) in 2008, where he led major acquisitions and built it into a US$25.9 billion energy giant.

From 2018, Abel has served as vice chairman overseeing Berkshire’s non-insurance businesses—including railroads, utilities, and retail—cementing his role as Buffett’s clear successor. Known for his operational discipline and long-term thinking, Abel has earned high praise from both Buffett and the late Charlie Munger, who called him “just as good as Warren at learning all kinds of things.”

Now poised to lead, Abel inherits not only one of the world’s most admired companies but also the challenge of deploying Berkshire’s US$350 billion cash reserve. Though he maintains a lower public profile than Buffett, insiders already see him as the steady hand guiding Berkshire’s future.

What Changes Can Investors Expect?

While Abel has pledged to maintain Berkshire’s investment philosophy, emphasising a “fortress-like balance sheet” and disciplined capital allocation, his leadership may introduce subtle shifts.

Unlike Buffett, who delegated day-to-day operations, Abel’s more active management style involves tougher questions for managers and greater collaboration among subsidiaries. His deep expertise in utilities and energy could lead to increased focus on organic growth or acquisitions in these sectors, especially given Berkshire’s massive cash pile.

However, Abel’s oversight of the US$300 billion equity portfolio, including top holdings like Apple, may stretch his bandwidth, as managing Berkshire’s diverse operations is a full-time role. There is an expectation that the oversight of Berkshire’s vast equity portfolio will transition to Ted Weschler and Todd Combs.

Weschler joined the firm after winning Buffett’s charity lunch auction twice—in 2010 and 2011—paying millions for each. Combs, meanwhile, was brought on board in 2010 after impressing Charlie Munger with a thoughtful letter requesting a meeting.

A tech-forward pivot is also unlikely, as Abel has emphasised sticking to Buffett’s value-driven approach, though he may explore opportunities in industries like renewable energy, where Berkshire Hathaway Energy (BHE) already invests heavily.

Market Reactions and Investor Sentiment

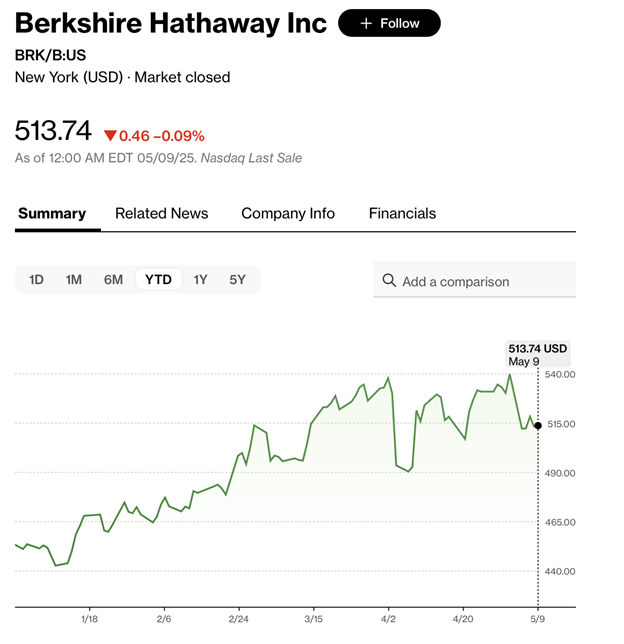

Buffett’s announcement sent ripples through the market, with Berkshire’s shares dropping by roughly 5% on 5 May 2025, reducing its market value by US$59 billion to US$1.11 trillion [5].

The decline reflected investor uncertainty, compounded by Berkshire’s first-quarter earnings missing analyst estimates due to insurance losses from wildfires and broader market concerns over trade policies under the Trump administration.

Morningstar analyst Greggory Warren called the retirement “a shocker,” noting that while the succession plan was long expected, the actual timing of the announcement took most by surprise—including members of Berkshire’s own board, who reportedly were informed only a day before the public disclosure.

Despite the sell-off, analysts view the transition as stable, with Abel’s respected leadership and Buffett’s continued chairmanship reassuring investors.

While the leadership transition introduces a new chapter for Berkshire Hathaway, investors will be watching closely to see how Abel manages capital allocation and whether he can maintain the performance standard set by Buffett—whose disciplined, long-term approach has helped Berkshire stock nearly double the annualised returns of the S&P 500 since 1965.

The Future of Berkshire’s Portfolio

Berkshire Hathaway’s equity portfolio—anchored by Apple, Coca-Cola, Bank of America, and American Express—has been central to its long-term success. Greg Abel has signaled continuity, stressing a focus on a steady, concentrated investment approach while showing interest in stable, predictable businesses, as seen in Berkshire’s growing stakes in Japanese conglomerates.

With an unprecedented US$348 billion cash pile, Berkshire faces both opportunity and constraint. Like Buffett, Abel must navigate high valuations and macroeconomic uncertainty, making large-scale acquisitions challenging.

However, sectors like energy, infrastructure, and insurance—where Berkshire has expertise—could offer strategic targets. Abel’s background aligns with BHE’s US$18 billion push into renewables, hinting at growth potential.

While Buffett historically rejected dividends, Abel has left the door open. In a 2024 shareholder Q&A, he acknowledged that if compelling investments remain elusive, returning cash to shareholders could be considered.

For now, Berkshire’s portfolio remains stable, with Abel steering policy and Combs and Weschler handling stock picks. The firm’s diversified holdings and capital flexibility leave it well-positioned for both resilience and opportunity.

Buffett’s Ongoing Influence

Though stepping down as CEO, Buffett will remain chairman, providing reassurance to shareholders and a resource for Abel, particularly for major acquisitions.

His presence is seen as a stabilising force, with analysts noting that his advisory role could guide Berkshire through volatile markets or significant deals. Buffett’s US$160 billion stake in Berkshire, which he has vowed not to sell, underscores his confidence in Abel’s leadership [6].

Post-retirement, Buffett’s fortune will be distributed over a decade through foundations led by his children, ensuring long-term support for Berkshire’s culture. His son, Howard Buffett, is expected to become non-executive chairman after Warren’s passing to preserve this legacy.

What This Means for Long-Term Investors

For retail investors, Berkshire’s structural strengths—its diversified portfolio, massive cash reserves, and decentralised management—provide a solid foundation despite the leadership transition.

Abel’s alignment with shareholders, evidenced by his US$185 million Berkshire stock holdings and US$870 million from selling his BHE stake, reinforces his commitment to the company’s ethos. The board, including Buffett’s children, is dedicated to maintaining Berkshire’s unique culture, making a corporate breakup unlikely.

While Abel may face scrutiny as he steps into Buffett’s shoes, his operational expertise and Buffett’s ongoing guidance position Berkshire for continued stability. Investors should remain focused on the company’s long-term fundamentals rather than short-term market fluctuations.

Conclusion

Warren Buffett’s exit as CEO marks the end of an extraordinary chapter for Berkshire Hathaway, but the company’s clear succession plan, robust financial position, and Abel’s proven leadership suggest a promising future.

As Berkshire navigates this transition, its commitment to value investing and long-term growth remains unwavering, offering investors confidence in the next era.

Reference

- “Warren Buffett Grew Berkshire Into a $1 Trillion Company. Can Greg Abel Take It to $2 Trillion? – Nasdaq” https://www.nasdaq.com/articles/warren-buffett-grew-berkshire-1-trillion-company-can-greg-abel-take-it-2-trillion Accessed 13 May 2025

- “Warren Buffett’s return tally after 60 years: 5,502,284% – CNBC” https://www.cnbc.com/2025/05/05/warren-buffetts-return-tally-after-60-years-5502284percent.html Accessed 13 May 2025

- “Buffett Hands Successor a Giant Cash Pile and Many Questions – Bloomberg” https://www.bloomberg.com/news/articles/2025-05-04/buffett-hands-his-successor-a-giant-cash-pile-and-many-questions Accessed 13 May 2025

- “Berkshire Hathaway director Olson says Abel has the board’s total confidence – Reuters” https://www.reuters.com/business/berkshire-hathaway-director-olson-says-abel-has-boards-total-confidence-2022-04-28/ Accessed 13 May 2025

- “Buffett to remain Berkshire chairman but shares fall after Abel named CEO – Reuters” https://www.reuters.com/markets/us/berkshire-hathaway-shares-fall-buffett-step-down-ceo-year-end-2025-05-05/ Accessed 13 May 2025

- “Who is Greg Abel, the Canadian tapped to succeed Warren Buffett as CEO of Berkshire Hathaway? – Financial Post” https://financialpost.com/investing/who-is-greg-abel-berkshire-hathaway-new-ceo Accessed 13 May 2025