Earnings reports often make headlines. But what really moves markets is what comes next — the forecast. Investors don’t just look at what happened. They want to know what could happen next.

This is where forecasts come in. They help businesses plan, investors decide, and markets respond. And in many cases, they weigh more heavily on stock price than the actual earnings.

Key Points

- Earnings reveal a company’s past performance, but forecasts shape future expectations and market sentiment.

- Stock prices often react more strongly to forward guidance than actual results, especially if forecasts miss or exceed expectations.

- Accurate, well-communicated forecasts help investors make informed decisions and reflect a company’s strategic clarity.

What’s the Difference Between Earnings and Forecasts?

Earnings refer to a company’s real financial results. They include revenue, expenses, and what’s left — the bottom line. These figures show how the business performed over a specific period.

Forecasts, on the other hand, are forward-looking. They reflect where the company thinks it’s heading. It’s a prediction, shaped by data, trends, and internal expectations.

Both matter. But while earnings look back, forecasts help predict future revenue. They influence how analysts update earnings estimates and how investors value a company in the short term and long term.

A mismatch between forecast and actual earnings often affects stock price more than the numbers themselves. That’s why many companies spend just as much effort preparing their forecasts as they do reporting earnings.

Earnings vs Forecast: A Quick Comparison

| Aspect | Earnings | Forecast |

| Definition | Actual financial results achieved by the company | Estimated future performance, usually revenue or profit |

| Timeframe | Past or current reporting period | Short term or long term outlook |

| Data Basis | Confirmed data from financial statements | Predictive inputs such as trends, sales forecast, customer behaviour |

| Purpose | Shows what the company earned | Helps project revenue and guide business expectations |

| Influence on Market | Often reacts to surprises (positive or negative) | Can drive stock price movement based on sentiment |

| Key Components | Revenue, expenses, profit, cash flow, bottom line | Revenue forecasts, financial models, forecasting methods |

| Users | Investors, analysts, regulators | Business leaders, planners, analysts, investors |

How Forecasts Are Made

Forecasts aren’t based on guesswork. Companies rely on structured methods to project revenue, profits, and other financial figures. These forecasts shape business decisions, investor expectations, and long-term financial planning.

The most common starting point is trend analysis. By looking at past performance, companies try to spot patterns they expect to continue. This includes analysing seasonal cycles, customer behaviour shifts, and historical sales data.

For more precision, many use regression analysis. This method connects one variable — like revenue — to another, such as advertising spend or economic indicators. It helps identify which factors actually influence performance.

Larger companies often build predictive models. These models combine different data sources — internal pipeline numbers, current sales forecasts, customer engagement metrics — to create a clearer view of what’s likely to happen next.

Accuracy depends on the quality of inputs. Poor data or unrealistic assumptions can lead to misleading revenue forecasts. But when the models are built on real trends and up-to-date information, they can accurately predict both short term and long term outcomes.

Why Forward Guidance Often Drives Stock Prices

- Explain how markets anticipate performance based on forward-looking data.

- Highlight how stock price movement often hinges on earnings guidance, not just results.

- Include examples of companies that beat earnings but fell due to weak guidance.

Understanding Earnings: The Bottom Line

Earnings show what a company actually made during a specific period. It’s the result of revenue minus costs — a clear measure of performance. Whether it’s a quarterly report or a full-year summary, earnings reveal how efficient and profitable the business really is.

At the core are three components: revenue, expenses, and cash flow. Revenue reflects total sales or income. Expenses include everything from salaries and rent to marketing and raw materials. Cash flow shows how much money is coming in and out — and whether the company can cover its operations.

Earnings can vary depending on timing. Some businesses report strong short-term results but struggle to maintain growth. Others might post weaker numbers now but show signs of long-term improvement.

That’s why analysts compare current earnings against past performance and future projections. A single number never tells the full story. But it does give a snapshot of the company’s financial health — and a reason for the market to react.

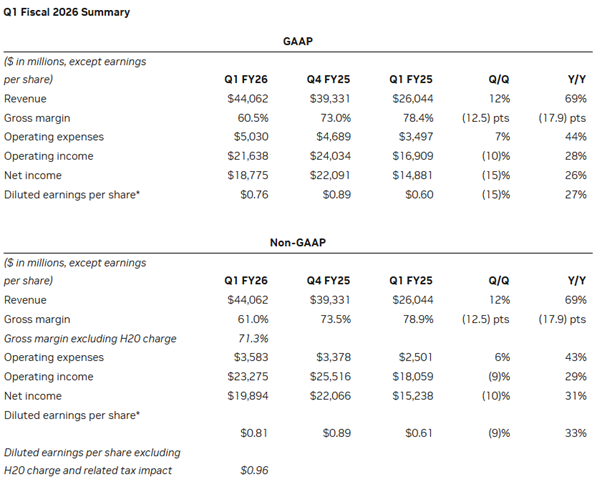

Below is an example of quarterly earnings from Nvidia’s report, comparing GAAP and non-GAAP figures.

Forecasting Accuracy vs Real Results [1,2]

Forecasting is never perfect. Even the most detailed financial models can miss the mark. That’s why investors always compare forecasts with actual earnings — to see how close the prediction came to reality.

When a company meets expectations, markets often stay steady. If it beats forecasts, especially on earnings per share or revenue, the stock price may jump. But when results fall short — even slightly — shares can drop fast. These movements reflect how much faith the market places in forecasting accuracy.

For businesses, the stakes are just as high. Missed forecasts can affect future planning, hiring decisions, and cash flow management. It can also impact investor confidence and drive changes in leadership or strategy.

A real-world example came from Nvidia in Q1 2026. The company posted revenue of $44.06 billion, topping the $43.32 billion analysts had forecasted. Its data centre revenue hit $39.1 billion — up 73% year‑over‑year — despite missing the $39.36 billion estimate. Shares rose around 5% in after‑hours trading on the news. This highlights how even slight beats or misses can sway market sentiment.

Why Forward Guidance Often Drives Stock Prices [3]

Earnings tell us what just happened. But forward guidance shapes what people expect to happen next. And in financial markets, expectations often drive action more than facts.

When companies issue forecasts, they give investors a sense of direction. Will revenue grow? Are margins under pressure? Is demand holding steady? These signals help analysts build models and investors decide whether to buy, hold, or sell.

Stock prices often react more to the tone of the guidance than to the numbers themselves. A company can post strong earnings, but if it warns of weaker future sales, the market may respond negatively. The opposite is also true — modest results can be overlooked if the outlook is upbeat.

Stock price moves are frequently tied to guidance, not just results. For instance, in May 2024, Salesforce exceeded its quarterly adjusted earnings—US $2.44 per share vs. the US $2.38 expected—and revenue of US $9.13 billion, up 11% year‑on‑year. Yet it forecast Q2 revenue at US $9.20–9.25 billion, below the US $9.37 billion analysts anticipated. Following the guidance miss, Salesforce shares declined over 16% in after-hours trading — highlighting how markets may react to revised expectations, even when earnings meet targets.

This pattern is common. Markets move on sentiment, and forward guidance shapes that sentiment. It’s why forecasting accuracy — and how it’s communicated — matters just as much as the numbers on the balance sheet.

What This Means for Investors and Businesses

Earnings and forecasts serve different roles — but both are critical. Investors use actual results to measure how a company performed. Forecasts, meanwhile, help gauge whether that performance is likely to continue.

Strong earnings might grab attention, but reliable forward guidance builds confidence. It shapes how financial models are adjusted, how companies are valued, and how strategies are put into motion. A business that consistently meets or beats its forecasts is often perceived as more stable and well-managed by market participants.

Still, strong earnings don’t always guarantee investor confidence. In uncertain market conditions, even solid financial results can be overshadowed by vague or cautious forecasts. Investors often look beyond the figures, asking whether the outlook makes sense — and whether it’s grounded in real, trackable data.

From a company’s perspective, two things carry weight: performance and communication. It’s not just about delivering results — it’s also about signalling what’s ahead with credibility. A well-supported forecast helps steady market expectations, supports planning, and shows that leadership has a firm grip on where things are heading.

Why the Forecast Can Matter More Than the Numbers

Forecasts set the tone. They shape market expectations before a single result is published. And when actual earnings arrive, it’s the gap between forecast and reality that often decides how investors react.

Even strong earnings can disappoint if they come with weak guidance. And weak earnings can be overlooked if the forecast shows signs of strength ahead. That’s why many in the market focus more on what’s next — not just what’s been achieved.

Forward guidance plays a bigger role than many realise. For investors, it signals how a company sees the road ahead. For businesses, it shapes how strategies are received. In many cases, this outlook drives market moves more than the earnings report alone.

Getting the balance right between results and projections helps investors and decision-makers focus on what counts — clear direction, credible assumptions, and steady communication about what’s to come.

FAQ

1. What is the difference between earnings and forecasts?

Earnings are historical figures that show how much a company made in a specific period — including revenue, expenses, and net profit. Forecasts, on the other hand, are forward-looking estimates that indicate where the company believes it’s headed. While earnings confirm what has happened, forecasts help investors anticipate what might come next.

2. Why do markets react more to forecasts than earnings?

Because markets are forward-looking. Investors are constantly pricing in expectations, not just current facts. Even if a company delivers strong earnings, weak guidance can dampen sentiment. Forecasts set the tone for future valuation, which is why they often drive more immediate price action than the reported numbers.

3. Can a company report strong earnings and still see its stock price fall?

Yes. This often happens when the forward guidance suggests challenges ahead — such as slower revenue growth, margin pressure, or declining demand. In such cases, markets may overlook the good results and focus instead on the risks implied by the forecast.

4. How are financial forecasts created?

Creating a financial forecast usually starts with looking back. Companies review past sales figures, recurring seasonal trends, and any changes in customer behaviour. These insights help form the base of the projection.

From there, they often bring in wider data, such as industry developments, competitor performance, and broader economic signals. Some also apply predictive modelling or AI tools to sharpen their outlook. Ultimately, the forecast aims to offer a realistic view of what’s ahead, giving both the business and its investors a clearer sense of direction.

5. What happens if a company’s actual earnings miss the forecast?

When results fall short of expectations, the market usually takes notice. Even a slight miss can cause a sharp reaction if it shakes confidence in the business.

For investors, it may raise red flags — are costs rising, is demand falling, or were earlier projections too optimistic? If this happens more than once, it can start to damage how investors view the management team’s ability to deliver on promises.

Reference

- “Nvidia beats on earnings and revenue as data center sales jump 73% – CNBC”. https://www.cnbc.com/2025/05/28/nvidia-nvda-earnings-report-q1-2026.html . Accessed 9 July 2025.

- “Nvidia earnings recap: Stock jumps after revenue tops estimates as chip titan expects $8 billion hit from lost China sales – Business Insider”. https://www.businessinsider.com/nvidia-earnings-call-report-nvda-stock-live-updates-2025-5?utm_source=chatgpt.com . Accessed 9 July 2025.

- “Salesforce shares tumble as soft cloud demand hurts forecasts – Reuters”. https://www.reuters.com/technology/salesforce-forecasts-second-quarter-revenue-below-estimates-2024-05-29/?utm_source=chatgpt.com . Accessed 9 July 2025.