Elon Musk and President Donald Trump, once aligned in the lead-up to the 2024 election, have dramatically parted ways. This coincided with shifts in market sentiment during the period, prompting speculation around its potential impact.

Their alliance was widely viewed as strong when Musk leveraged his newly-acquired social media giant, X (formerly Twitter), to help Trump rally voters, fuelling the momentum behind his victorious second presidential run. The Elon Musk-Trump connection was influential, contributing to market news.

Here, we explore how their fallout went far beyond social media drama, exposing Tesla to unprecedented political risks, and why some market participants are closely watching to how politics, personal rivalries, and policy can reshape the future of a trillion-dollar automaker.

Background of the Musk–Trump Fallout [1,2,3,4]

Elon Musk and Donald Trump weren’t always close—but over time, their relationship evolved from cautious distance to full-blown political alliance. Many observers now reflect on how this Elon Musk–Trump bond shaped political tech discourse. In 2016, Musk criticised Trump’s candidacy and favoured Hillary Clinton’s policies.

Yet after Trump’s election, Musk joined two presidential advisory councils, only to resign in 2017 over Trump’s withdrawal from the Paris Climate Accord, tweeting: ”Climate change is real. Leaving Paris is not good for America or the world.”

They briefly aligned again during the pandemic when Trump backed Musk’s fight against California’s COVID-19 restrictions. But the real turning point came in 2022 when Musk acquired Twitter (now X), reinstated Trump’s banned account, and later endorsed him following a failed assassination attempt in 2024.

Media reports indicated that Musk contributed significantly to pro-Trump super PACs and was named head of the Department of Government Efficiency (DOGE) after Trump’s re-election. This close alignment saw Trump and Elon Musk share public platforms, with Musk even jokingly adopting the title of “First Buddy.”

By mid-2025, the bromance imploded. Musk publicly criticised the GOP’s “Big Beautiful Bill” for cutting EV subsidies, describing it as, in his words, a “disgusting abomination.” Trump retaliated on Truth Social, branding Musk disloyal and threatening to strip federal contracts from Tesla and SpaceX.

Some analysts noted the timing of the fallout coincided with market volatility and raised concerns among investors about Tesla’s exposure to political risks.

Market Reaction – Is Tesla Exposed to Political Risk?

Tesla’s stock has always been known for its volatility—but never quite like this.

In early 2025, Tesla shares began a sharp descent as Elon Musk deepened his role in Donald Trump’s administration as the face of the Department of Government Efficiency (DOGE)—a move that further tied the Trump–Elon Musk narrative to Tesla’s valuation.

Despite its quirky name, Media reports noted that DOGE faced backlash, and some Protesters associated Tesla with the Trump administration’s policies. By March, the stock had lost over 20% from its year-to-date high as consumer sentiment turned and fears of reputational damage mounted.

* For illustrative purposes only. Past performance is not indicative of future results.

Interestingly, Tesla’s share price started to recover in late April—just as Musk announced he would step back from DOGE duties to focus more on Tesla. That short-lived relief rally saw the stock climb back toward US$358.43 as investors bet political risks were cooling [5].

But the calm didn’t last.

The $152 Billion Market Value Drop

On 5 June 2025, the feud between Musk and Trump exploded into full public view. Musk unleashed a scathing critique of Trump’s signature budget legislation, calling it “a disgusting abomination.” The Trump–Elon Musk DOGE cuts controversy, particularly surrounding EV tax credits, was reported in some media attributed the movement to a possible catalyst.

While many speculated that Musk was reacting to the bill’s rollback of EV tax credits and introduction of a new US$250 annual fee for electric vehicle drivers, Musk insisted that his outrage was rooted in the bill’s reckless fiscal impact [6].

“I was disappointed to see the massive spending bill, frankly, which increases the budget deficit, not decreases it, and undermines the work that the DOGE team is doing,” Musk said in an interview with CBS News.

Trump retaliated swiftly, threatening to strip Tesla and SpaceX of their federal contracts. Within 48 hours, Tesla’s shares fell 14%, erasing approximately US$152 billion in market value— marking one of the company’s steepest single-day losses. It pushed Tesla’s market cap below the US$1 trillion mark, with the tech automaker’s market cap closing at US$916 billion that day [7].

Key Timeline of Volatility

| Date | Event | TSLA Reaction |

| Jan–Mar 2025 | DOGE backlash, showroom protests | –20% from YTD highs |

| Late April 2025 | Musk announces DOGE exit | Rebound to ~$340 |

| 5-Jun-25 | Trump threatens Tesla contracts | –14% in one day, $152B wiped out |

Tesla’s Dependence on US Policy & Subsidies

Tesla’s success story isn’t just built on sleek EVs and breakthrough technology—it has also leaned heavily on supportive US policy. Over the years, Tesla has benefited from federal EV tax credits (up to US$7,500 per vehicle), Inflation Reduction Act (IRA) subsidies for domestic battery and vehicle production, and funding from infrastructure programmes that helped expand its Supercharger network.

These policy tailwinds have been vital in making Tesla’s products more competitive and fueling its growth. However, that support has come under scrutiny following recent policy proposals. Trump’s recent budget proposal signals a rollback of clean energy incentives and introduces new costs for EV drivers, including a proposed US$250 annual fee.

Trump also publicly warned that SpaceX’s government contracts could be revoked—raising concerns that Tesla, too, could become politically vulnerable.

This tension comes at a critical juncture for Tesla, as it prepares to launch its long-awaited Robotaxi service in Austin, Texas—a project that relies not only on cutting-edge technology but also regulatory approval and public infrastructure partnerships.

For a company whose future leans heavily on autonomy and electrification, the Elon Musk–Trump rift has raised questions over the stability of future subsidies and policy support.

The Trump Factor – Could a Second Term Hurt Tesla?

Trump’s second term is already shaping up to be a challenging one for Tesla. His administration has proposed rolling back key climate regulations, cutting EV tax credits, and doubling down on fossil fuel–friendly policies—moves that directly undermine Tesla’s clean energy mission.

The latest federal budget includes provisions to slash renewable energy funding and impose new costs on EV ownership, including a proposed $250 annual fee for electric vehicle drivers.

But the risks go beyond climate policy. Following a high-profile feud between President Trump and Elon Musk, the President publicly threatened to revoke SpaceX’s government contracts, Raising concerns among observers that Tesla could face similar challenges.

There is also a growing risk of antitrust scrutiny toward tech platforms like X (formerly Twitter), which Trump has criticised since the fallout. In parallel, Tesla’s Q1 sales fell 13%, a period that also saw increased political scrutiny and public criticism.

To make matters worse, Trump’s administration has floated new tariffs on imported goods and materials, which could raise Tesla’s production costs, especially if applied to battery components or vehicles sourced from overseas markets.

In sum, this isn’t just a hypothetical risk down the road—Tesla is already navigating the sharp edge of political and economic policy in Trump’s second term. As the fallout between Donald Trump and Elon Musk deepens, the automaker is at the crossroads of policy and personal rivalry.

Investor Sentiment and Tesla’s Global Positioning [8,9]

Investor sentiment toward Tesla in 2025 has taken a sharp turn—marked by a collapse in US political goodwill and weakening performance across its core global markets. In Q1 2025, Tesla’s vehicle deliveries fell 13% year-over-year to 336,681 units, well below expectations and company guidance.

Production also dropped to 362,615 vehicles, down from over 433,000 a year prior, due in part to planned Model Y factory upgrades. The disappointing numbers was followed by a 4% stock drop on results day and have contributed to a 36% decline in Tesla’s share price for the quarter—the company’s steepest fall since 2022, Resulting in a US$460 billion decline in market value.

Elsewhere, the picture isn’t much brighter for the automaker. In Europe, Tesla’s EV market share declined in several European markets, with notable reductions in Germany. This decline has been attributed to rising competition from local brands like BYD and Skoda, as well as political backlash following reports of Musk’s support for controversial political figures, which led to protests and boycotts at Tesla showrooms and charging stations.

Meanwhile, in China, Tesla sold 78,828 EVs in March, down 11.5% year-on-year, as local brands like BYD continue to outpace the U.S. automaker in pricing and consumer loyalty.

Yet even amid this volatility, Tesla’s near-term catalyst—the highly anticipated Robotaxi launch in Austin—remains in focus for investors. With political noise growing louder in the US, many are shifting attention away from Musk’s headlines and back toward fundamentals like vehicle margins, delivery growth, and autonomous technology execution.

For Tesla, regaining investor confidence may depend less on its founder’s influence in Washington and more on proving it can still lead in EV innovation on the global stage.

* For illustrative purposes only. Past performance is not indicative of future results.

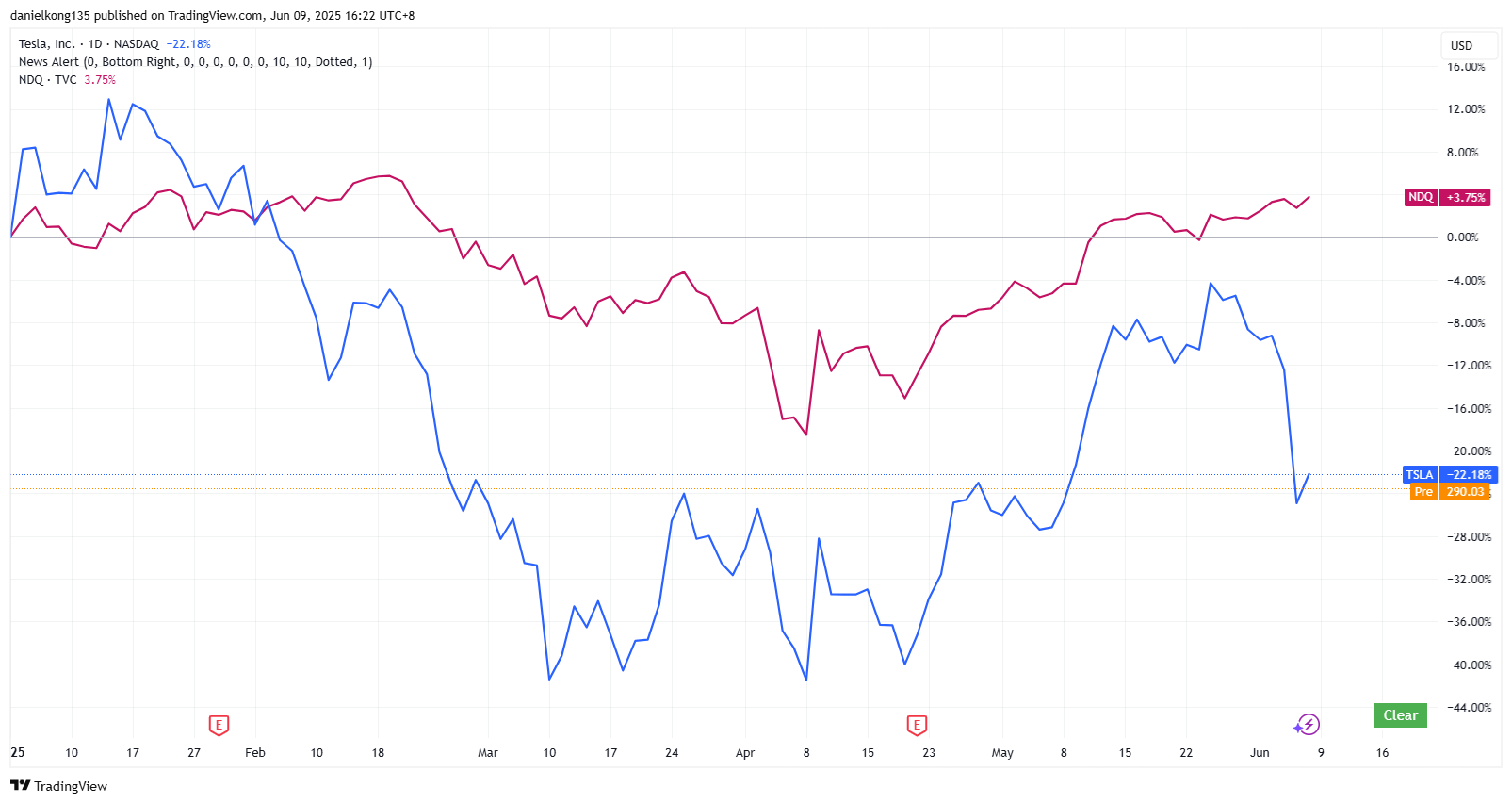

As of early June 2025, Tesla’s shares have significantly underperformed the broader tech market. Year-to-date, Tesla shares are down 22.09%, while the Nasdaq 100 (NDX) is up 3.75% over the same period.

This wide divergence reflects both company-specific challenges and broader market sentiment. While the Nasdaq has benefited from AI optimism and strong earnings from Big Tech, Tesla has faced mounting pressure due to a combination of delivery shortfalls and broader political attention.

The sharp contrast highlights how political risk and missed expectations have weighed on Tesla even as tech stocks rally.

Will the Feud Matter in the Long Term?

While the Musk–Trump fallout has drawn significant media attention, the long-term impact on Tesla may be more limited than headlines suggest. In the short term, the feud has amplified political risk, triggered a US$152 billion selloff, and sparked fears of regulatory retaliation or lost subsidies.

But zooming out, Tesla’s valuation over time will still depend on core fundamentals: vehicle delivery growth, operating margins, technological execution, and expansion into autonomy—not political drama alone.

Tesla has weathered storms before. From production delays to executive controversies, the stock has historically bounced back when operational results are delivered. Investors should keep in mind that correlation does not imply causation: while political clashes may coincide with market drops, it doesn’t mean they’re the sole driver.

Long-term shareholders would be wise to evaluate the bigger picture—including global EV adoption, competitive positioning, and the success of initiatives like Robotaxi—rather than reacting solely to short-term noise.

Ultimately, Tesla’s long-term future is more likely to be shaped by its technology and global strategy than political developments.

Explore Vantage’s tool to analyse market trends and access educational resources.

Reference

- “Donald Trump’s character reflects poorly on United States, Elon Musk says – CNBC”. https://www.cnbc.com/2016/11/04/donald-trumps-character-reflects-poorly-on-united-states-says-elon-musk.html . Accessed 9 June 2025.

- “Elon Musk steps down from Trump advisory councils over Paris climate decision – The Verge”. https://www.theverge.com/2017/6/1/15726292/elon-musk-trump-advisory-council-paris-climate-decision . Accessed 9 June 2025.

- “From bromance to bitter feud — a timeline of Trump and Musk’s relationship – CNBC”. https://www.cnbc.com/2025/06/06/a-timeline-of-donald-trump-and-elon-musks-relationship.html . Accessed 9 June 2025.

- “Elon Musk says he’s “disappointed” by Trump’s “big, beautiful bill” and what it means for DOGE – CBS News”. https://www.cbsnews.com/news/elon-musk-disappointed-by-trump-big-beautiful-bill-doge/ . Accessed 9 June 2025.

- “Elon Musk exits DOGE, Tesla shares begin slow recovery – IDN Financials”. https://www.idnfinancials.com/news/54922/elon-musk-exits-doge-tesla-shares-begin-slow-recovery . Accessed 9 June 2025.

- “Elon Musk slammed Trump’s ‘Big Beautiful Bill.’ The stakes are high for Tesla if it becomes law. – Business Insider”. https://www.businessinsider.com/trump-big-beautiful-bill-impact-tesla-xai-elon-musk-2025-6 . Accessed 9 June 2025.

- “Tesla loses $152 billion in market cap after Musk-Trump spat, biggest hit ever – CNBC”. https://www.cnbc.com/2025/06/05/tesla-shares-musk-trump.html . Accessed 9 June 2025.

- “Tesla reports 13% drop in first-quarter vehicle deliveries from a year ago – CNBC”. https://www.cnbc.com/2025/04/02/tesla-tsla-q1-2025-vehicle-delivery-and-production-numbers.html . Accessed 9 June 2025.

- “Tesla Delivery Numbers Q1 2025: What Investors Need to Know – Yahoo! Finance”. https://finance.yahoo.com/news/tesla-delivery-numbers-q1-2025-013017490.html . Accessed 9 June 2025.