On 7 May 2025, the Federal Reserve (Fed) announced its decision to maintain the federal funds rate at a range of 4.25% to 4.5%, marking a continuation of its cautious stance amid economic uncertainties driven by trade policies and inflation pressures [1].

This decision, widely anticipated by markets, reflects the Fed’s ongoing effort to balance its official “dual mandate” of maximum employment and price stability. With President Trump’s tariff initiatives introducing volatility, the Fed’s pause has sparked discussions about its implications for markets, sectors, global central banks, and investor strategies.

Here’s a detailed look at some of the Fed’s rationale, how investors can assess the implications across asset classes, and a guide on how to position their portfolios in a prolonged high-interest-rate environment.

Key Points

- The Federal Reserve has held interest rates steady amid persistent inflation and tariff-driven uncertainty, signalling a cautious policy stance.

- Market reactions remain mixed, with shifting rate cut expectations, sector-specific impacts, and ongoing volatility driven by economic data and trade developments.

- Global central banks are responding differently to the Fed’s pause, reflecting diverging economic conditions and rising recession risks.

The Fed’s Hold – A Strategic Delay or Policy Caution? [2]

The Fed’s decision to keep interest rates unchanged stems from a complex interplay of economic indicators and policy uncertainties. In his opening remarks, Fed Chair Jerome Powell acknowledged the resilience of the US economy while warning of persistent inflation risks, particularly amid growing global uncertainty fueled by escalating tariffs.

Powell emphasised that the labour market remains robust, with unemployment at 4.2% and moderate job gains averaging 155,000 per month. Wage growth has also stabilised, easing concerns about inflationary pressures from the labor market.

Meanwhile, inflation has declined notably from its 2022 peak but remains above the Fed’s 2% target, with core PCE inflation currently at 2.6%. Recent tariff hikes have raised short-term inflation expectations and added to economic uncertainty, prompting the Fed to closely monitor the data for signs of persistent price pressures.

Despite a slight decline in first-quarter GDP, largely driven by trade distortions as businesses accelerated imports ahead of tariffs, the underlying domestic demand remains strong.

Private domestic final purchases rose by a healthy 3%, and business investment showed encouraging signs of recovery. However, weakening consumer sentiment and uncertainty around the impact of tariffs on future growth have led the Fed to adopt a wait-and-see approach.

Holding rates steady allows policymakers to preserve flexibility, avoiding premature action that could either reignite inflation or risk a downturn in employment and economic activity.

Market Expectations vs. Reality [3]

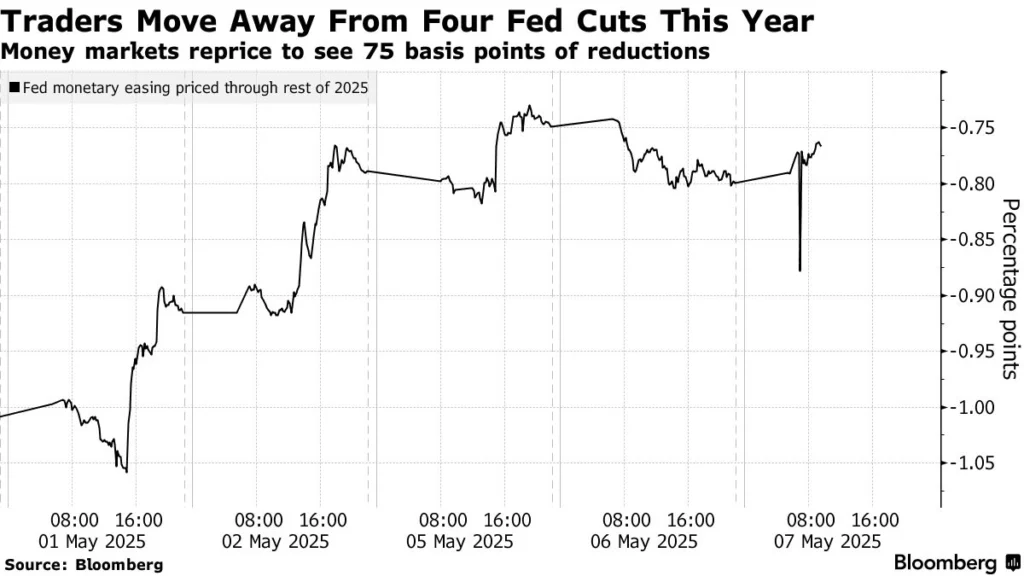

Market expectations for US interest rate cuts have shifted, with traders now pricing in three quarter-point reductions for 2025—down from earlier forecasts of four cuts—and an additional half-point of cuts in 2026, the most aggressive projection for that year so far.

Hopes for a June rate cut have faded after stronger-than-expected US employment and ISM services data point to ongoing economic resilience. Investors now anticipate the first cut in July 2025, contingent on clearer economic data.

The Fed’s forward guidance remains data-dependent, with Powell emphasising flexibility to maintain restrictive policy if inflation persists or ease if the labour market weakens unexpectedly.

Uncertainty surrounding President Donald Trump’s trade policies, particularly higher tariffs that could temporarily boost inflation, has further complicated market positioning.

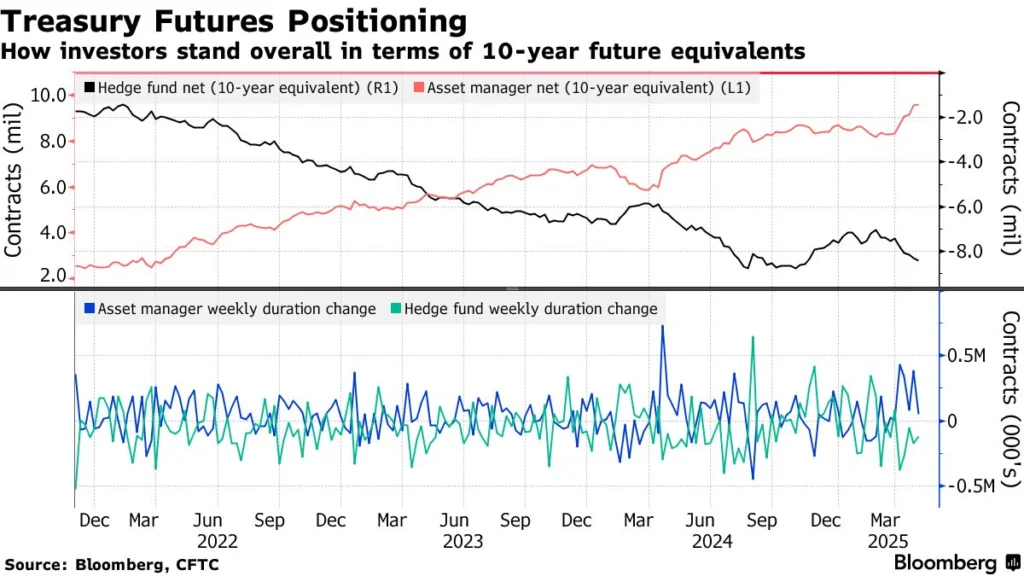

Futures data show asset managers increasing long positions while hedge funds continue to build up short positions, especially in 5-year and 10-year Treasury notes, underscoring mixed views on the timing and magnitude of future Fed easing.

Post-announcement, US Treasury yields surged on Thursday (8 May 2025) as investors responded to strong job market data and a newly announced US-UK trade framework by shifting toward riskier assets and reducing expectations for near-term Federal Reserve rate cuts.

Meanwhile, 2- to 10-year yields climbed at least 10 basis points, while 30-year bond yields rose about eight basis points to 4.85% following a lacklustre auction.

President Donald Trump’s call to “buy stocks” amid trade progress further bolstered risk sentiment. On Thursday, the Dow Jones Industrial Average was up by 0.62% while the S&P 500 Index increased by 0.58%. The tech-heavy NASDAQ Composite Index was up 1.07%, reflecting market optimism about potential tariff de-escalation.

However, volatility persists, as stocks have dipped in and out of correction territory since President Trump’s inauguration. The Fed’s cautious stance has tempered expectations for aggressive easing, shifting market focus to incoming economic data like inflation reports and GDP figures.

Sector Analysis – Potential Impacts of the Fed’s Decision

The Fed’s decision to maintain elevated rates has varied implications across sectors, driven by interest rate sensitivity, inflation expectations, and dollar strength. Below is a breakdown of key sectors, supported by technical and fundamental analysis.

Technology and Growth Stocks

Tech and growth stocks, highly sensitive to interest rates, face challenges as elevated rates increase borrowing costs and reduce the present value of future cash flows. The Fed’s pause, coupled with tariff-driven inflation risks, raises concerns about margin compression for tech firms reliant on global supply chains.

Companies in infrastructure technology, particularly those with significant export exposure and supply chains tied to China, could face additional near-term pressure due to ongoing tariff uncertainties and geopolitical tensions.

However, optimism around AI-driven productivity and continued technological innovation has helped stabilise sentiment, with investors viewing the sector’s long-term potential as intact. It remains a highly news-driven market; any positive developments or breakthroughs in US-China trade negotiations could quickly spark a relief rally across the sector.

The latest slew of earnings reports from major tech companies have reinforced this optimism. Giants like Apple, Microsoft, Nvidia, and Alphabet posted strong quarterly results, with many exceeding market expectations despite macro headwinds.

Much of this resilience is being driven by structural breakthroughs in Artificial Intelligence (AI) and cloud computing, which are transforming business models and unlocking new revenue streams. Microsoft, in particular, reported significant adoption of its AI-powered Copilot platform across enterprise customers, contributing meaningfully to growth.

The combination of solid fundamentals and the transformational promise of AI continue to underpin earnings growth, offering investors some compelling reasons to stay engaged with the sector–even as near-term pressures from tariffs and supply chain disruptions persist.

Technical Analysis

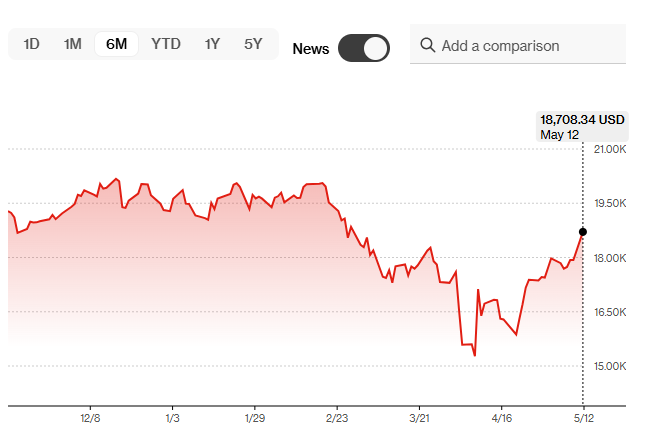

The tech-heavy Nasdaq rebounded sharply from a double-bottom near the 15,000 level in April, reflecting improving sentiment as interest rates stabilised and early signs of trade de-escalation emerged.

The Fed’s decision on 7 May to hold rates steady, coupled with a US-UK trade agreement offering a template for future negotiations, further supported risk appetite. The index has surged over 10% since its April lows, breaking above key short-term moving averages and confirming a bullish trend [4].

Looking ahead, a moderation in inflation and potential Fed rate cuts could further lift growth stocks by lowering discount rates and expanding valuation multiples. However, any inflation resurgence or delays in policy easing could reignite volatility and put pressure on high tech valuations.

For now, Fed Chair Powell’s “we think we can be patient” stance offers a green light for tech, though disciplined investors should stay alert to macro risks, prioritise diversification, and focus on quality growth names with strong earnings amid elevated valuations.

Financials Benefitting from Elevated Rates

Financials, particularly banks, benefit from higher interest rates, which widen net interest margins. The Fed’s decision to maintain rates at 4.25%-4.5% supports profitability for institutions like JPMorgan Chase and Bank of America. However, tariff uncertainty and potential economic slowdown could increase loan default risks, tempering gains.

The Financial Select Sector SPDR Fund (XLF) is in an uptrend, trading above its 200-day moving average. RSI indicates overbought conditions near 70, suggesting a potential pullback. Key resistance is at $46, with support at $42.

Commodities Like Gold and Oil Responding to Dollar Strength

Gold prices, which hit all-time highs in Q1 2025, are supported by safe-haven demand and central bank purchases but face headwinds from a stronger US dollar and higher rates. Oil prices are volatile, with tariffs potentially reducing global demand while geopolitical tensions provide upside risk.

Gold (XAU/USD) has been on a strong uptrend since late 2024, climbing from around $2,800 to above $3,400 before pulling back in April. The price found solid support between $3,000 and $3,100 and has rebounded sharply to around $3,320, forming a potential bullish flag pattern.

If gold breaks above $3,400, it could resume its rally toward the $3,500 mark. Key support levels to watch are $3,200 and $3,000. Momentum remains positive, but failure to clear $3,400 soon may trigger another pullback.

Global Implications: How Other Central Banks May React

The Federal Reserve’s decision to keep interest rates unchanged is likely to trigger varied responses from global central banks, each navigating its own economic landscape. The European Central Bank (ECB) is expected to maintain a dovish trajectory, with multiple rate cuts anticipated in 2025 amid sluggish economic growth.

Germany, Europe’s largest economy, has already slashed its growth forecast to 0%, citing the disruptive impact of Trump’s sweeping tariffs; notably, the US remains Germany’s largest trading partner.

Meanwhile, the Bank of England (BoE) is grappling with similar tariff-driven inflationary pressures but may hold off on cutting rates as it assesses the potential spillover effects of US monetary policy.

In contrast, the Bank of Japan (BoJ) stands apart, expected to continue its gradual rate hikes as a strengthening yen and stabilising inflation offer room for cautious tightening.

Emerging market central banks, such as those in India and Brazil, face challenges from a stronger dollar and capital outflows, potentially forcing tighter policies despite growth concerns.

The Fed’s cautious approach may lead to policy divergence, with developed markets easing faster than emerging ones, though synchronised caution could emerge if global trade tensions escalate. The IMF’s warning of a 40% probability of a US recession underscores the need for coordinated vigilance.

How Investors Can Navigate the Current Rate Environment

With global uncertainty elevated and U.S. rates remaining steady, a more cautious and defensive approach may serve investors well. Key strategies include:

- Rebalance Towards Value and Dividend Plays: Consider high-quality, dividend-paying companies in defensive sectors such as utilities, consumer staples, and healthcare. These sectors tend to offer stability and reliable income even in volatile markets.

- Favour Domestic Consumption and Fiscal Project Exposure: Prioritise companies with strong domestic demand and limited reliance on US-China trade flows. Construction and infrastructure players tied to local government projects and fiscal stimulus offer relative insulation from global headwinds.

- Evaluate Bond Duration: With rate paths uncertain, a balanced bond strategy—mixing short-duration bonds for stability and select longer-duration bonds for yield—can help manage interest rate risk.

- Monitor Forex and Commodity Trends: Currency markets remain volatile, with the US dollar recently weakening but still prone to sharp rebounds amid shifting global trade and interest rate expectations. A weaker dollar generally supports emerging market currencies and boosts commodity prices like gold and oil, while any sudden dollar strength could pressure these assets. Investors should stay flexible and adjust exposure accordingly.

- Stay Nimble and Data-Driven: The Fed’s data-dependent stance means that economic releases could rapidly shift expectations. Flexibility and ongoing portfolio reviews are essential to nimbly navigate changing conditions.

The Bigger Picture – Is the Soft Landing Still on Track? [5]

The Federal Reserve’s decision to pause interest rate hikes reflects its aim of achieving a soft landing—reducing inflation without causing a recession. The IMF has downgraded its US GDP growth forecast for 2025 to 1.8% from 2.7% in January, citing the drag from increased tariffs.

While unemployment remains low at 4.2% and consumer spending is holding up, declining business confidence and weakening consumer sentiment point to emerging risks. The IMF’s forecast also assigns a 40% probability of a US recession, underlining the economy’s vulnerability.

Looking ahead, prolonged tariff uncertainty could further disrupt supply chains and raise costs, while potential fiscal policy changes, including possible Trump-era tax cuts, may reignite inflation.

The Fed, as ever, remains data-dependent and prepared to adjust policy as conditions evolve. However, stagflation—a scenario where inflation stays high as growth slows—remains a key concern. For now, a soft landing appears possible, but much depends on the resolution of trade tensions and broader global economic stability.

In such an environment, staying informed and agile is key. Open a live account with Vantage today to gain access to global markets—including stocks, indices, commodities, and currencies—all in one place. Access real-time market data, a range of analytical tools, and flexible trading features designed to help you better understand and navigate periods of market uncertainty.

Reference

- “Fed meeting recap: Powell rules out a preemptive rate cut to blunt any tariff impact – CNBC” https://www.cnbc.com/2025/05/07/fed-meeting-live-updates-traders-await-insight-from-powell-on-next-rate-cut-tariff-impact.html Accessed 9 May 2025

- “Powell Speaks on Interest Rates – Rev” https://www.rev.com/transcripts/powell-speaks-on-interest-rates Accessed 9 May 2025

- “Traders Bet It Will Take Longer for Fed to Start Cutting Rates – Bloomberg” https://www.bloomberg.com/news/articles/2025-05-06/traders-bet-it-will-take-longer-for-fed-to-start-cutting-rates Accessed 9 May 2025

- “Trump, Starmer hail limited US-UK trade deal, but 10% duties remain – Reuters” https://www.reuters.com/world/europe/us-britain-expected-announce-tariff-deal-thursday-2025-05-08/ Accessed 9 May 2025

- “IMF slashes 2025 U.S. growth forecast to 1.8% from 2.7%, citing trade tensions – CNBC” https://www.cnbc.com/2025/04/22/imf-slashes-us-growth-forecast-by-nearly-one-percentage-point.html Accessed 9 May 2025