If you’re looking to practice trading strategies without risking real capital, paper trading is for you. Whether you’re new to trading or refining advanced techniques, TradingView’s built-in paper trading module offers a powerful simulation environment to help you gain experience and confidence.

In this article, we’ll walk you through how to paper trade on TradingView, explore its key features, and show how you can use it to prepare for real-world trading.

What Is Paper Trading?

Paper trading simulates trades without using real money. It allows you to execute hypothetical trades and monitor market outcomes in real time, helping you test strategies and build trading discipline in a risk-free environment.

Why It Matters for Experienced Traders

Even seasoned traders use paper trading to test new approaches or unfamiliar markets. It offers a way to:

- Validate new strategies without financial exposure

- Build confidence before scaling to larger positions

- Analyse potential performance outcomes under different market conditions

Paper trading is not only for beginners—it is a professional-grade tool for continuous improvement.

What Is Paper Trading on TradingView?

TradingView, one of the most popular charting and analysis platforms used by traders and investors, includes a free built-in paper trading feature. It mirrors real-time market conditions, allowing users to practise strategies, manage trades, and track performance all within the TradingView interface.

4 Noteworthy Features of TradingView’s Paper Trading Module

- Real-Time Market Data: Simulate trades based on live prices and movements.

- Customisable Balance: Set your virtual capital to match your real-world account goals.

- Full Trading Panel: Use advanced order types and position management tools.

- Cross-Device Access: Practise from your desktop or mobile via the TradingView app.

Is Paper Trading the Same as Live Trading?

While paper trading mimics real conditions, it lacks the emotional and psychological pressures of real money trading (aka live trading).

When paper trading, executions are instant and free of factors that may affect live trading outcomes such as slippage, spreads, or liquidity issues. Still, it’s an invaluable training ground before risking actual capital.

6 Key Features of Paper Trading Every Trader Should Know

Paper trading provides a realistically interactive environment for traders to refine their skills. Here are six features that make it a powerful tool for both beginners and professionals:

1. Simulated Order Execution

Paper trading on TradingView allows you to place market, limit, and stop orders in a simulated environment—mirroring how they would behave in real market conditions. This helps you gain practical experience and better understand how each order type works without risking actual capital.

2. Customisable Starting Balance

You can reset your paper trading account to any virtual balance, allowing you to practise with an amount similar to your intended live trading capital. This creates a more realistic and personalised trading experience.

3. Performance Tracking

TradingView automatically logs each trade’s outcome, allowing you to review your performance over time. This includes analysing metrics [1, 2] such as:

- Win rate

- Net profit

- Gross profit/loss

- Max profit/loss

- Buy & hold return

4. Access to Full Charting Tools

While paper trading, you still have full access to TradingView’s advanced charting capabilities, indicators, and drawing tools that are essential for technical analysis and strategy development.

5. Integrated Trading Panel

TradingView’s built-in trading panel offers real-time trade management, including position sizing, P&L tracking, and order editing. It closely replicates the experience of managing a live trading account, making it ideal for practice and strategy testing.

6. No Risk of Financial Losses

With paper trading, there is no real capital at stake. This allows you to test strategies, learn from mistakes, and develop trading discipline without the stress of losing money.

How to Set Up Paper Trading on TradingView

Getting started with paper trading on TradingView is straightforward. Follow these steps to set up your simulation environment and begin trading with virtual funds.

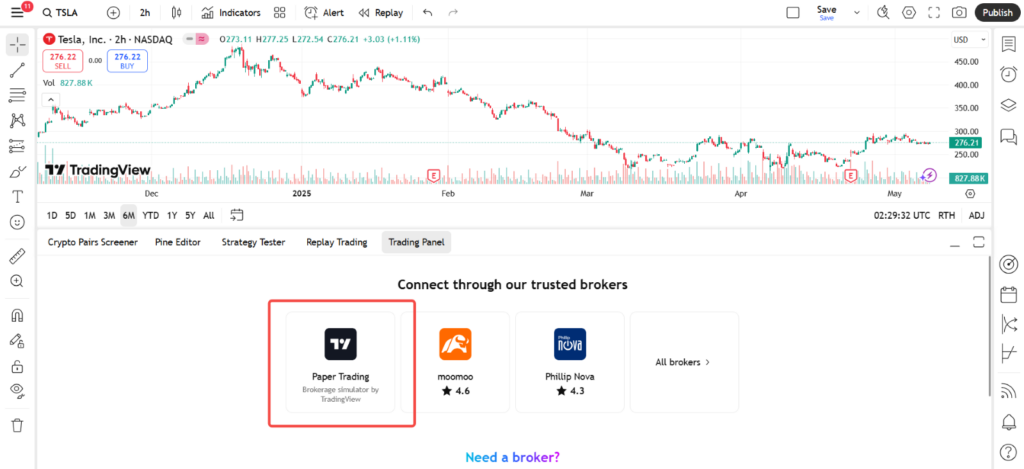

Connect to the Paper Trading Account

1. Log in to your TradingView account.

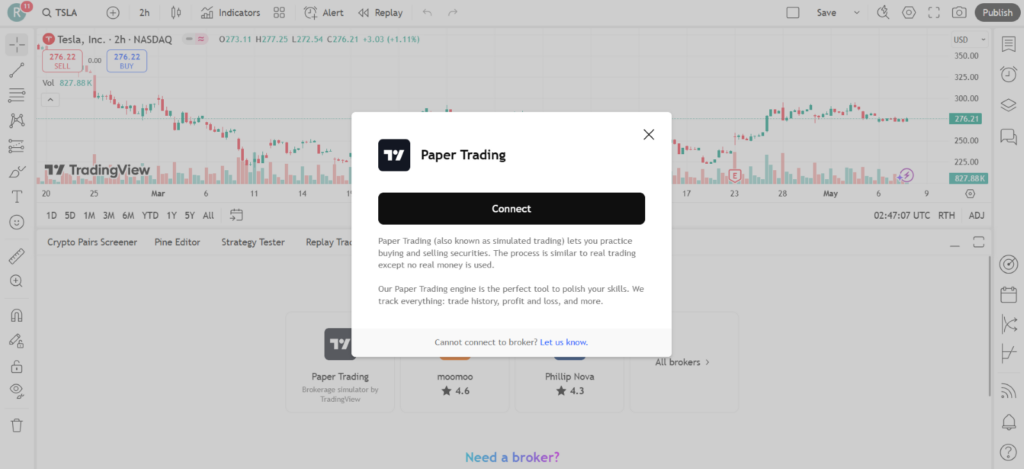

2. Click on the Trading Panel tab at the bottom of your chart window.

3. Select Paper Trading by TradingView and click Connect.

This will create a simulated trading environment with a default virtual balance.

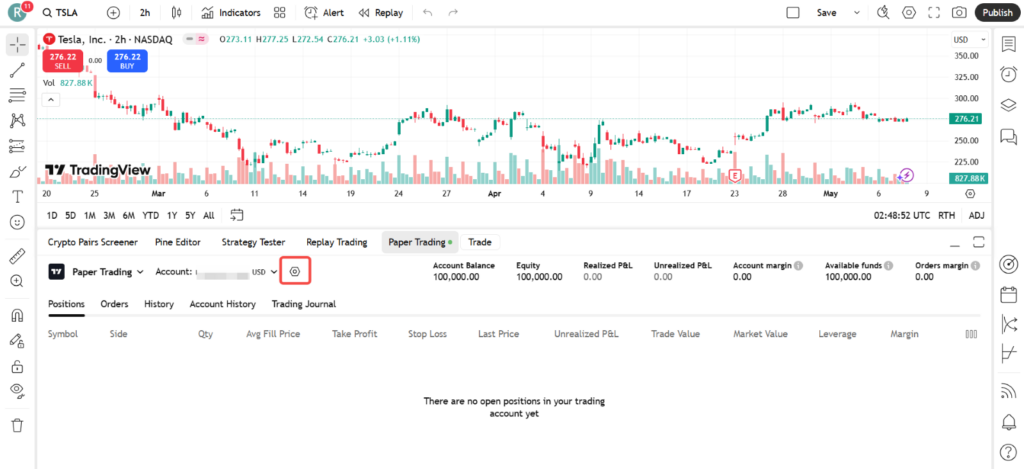

Reset Your Account to the Desired Balance

To tailor the experience to your personal trading goals:

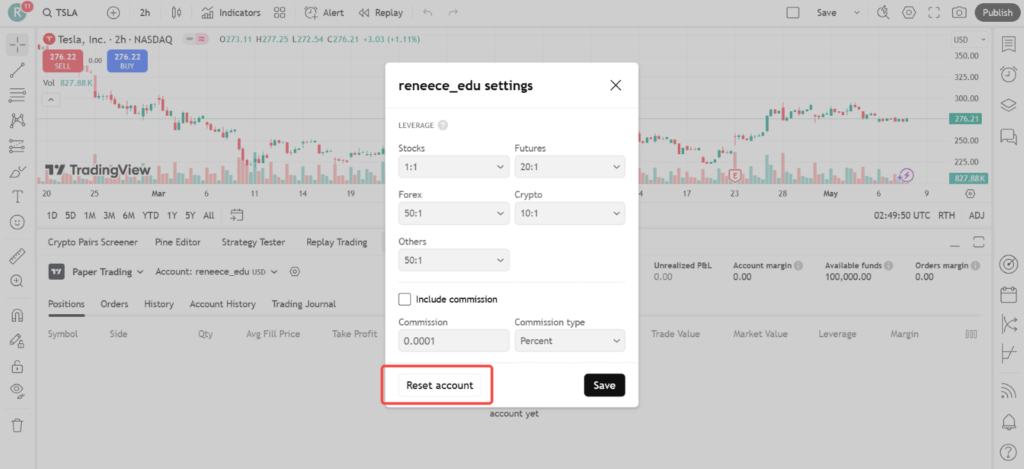

1. Click on the account settings icon next to the paper trading connection.

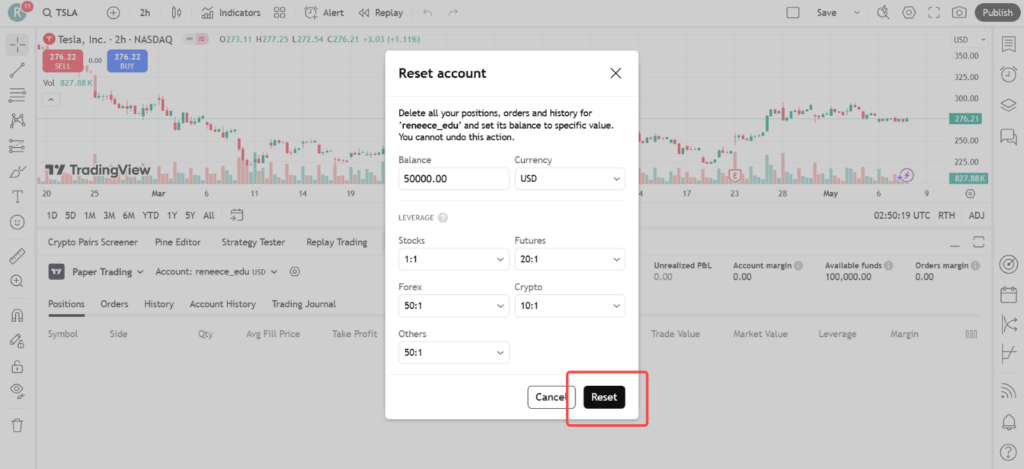

2. Choose Reset account.

3. Enter your preferred starting balance and click Reset.

This helps ensure your practice environment reflects the size of the account you plan to trade with.

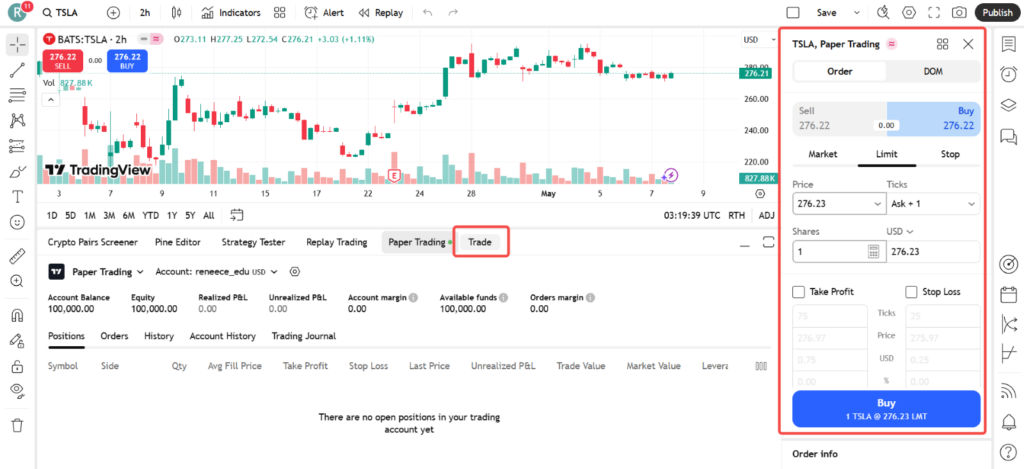

Understanding the Trading Panel

The trading panel replicates the key functions of a live brokerage platform. You can:

- Place market, limit, and stop orders

- Monitor open positions and order history

- Review your account’s equity, margin usage, and profit/loss

Becoming familiar with this interface prepares you for live trading workflows.

Simulate Trading

You can now begin placing simulated trades directly from your charts. Use the Trade menu in the trading panel to:

- Enter and exit trades

- Modify or cancel orders

- Set take-profit and stop-loss levels

Treat this process as if you were using real money to build proper trading habits.

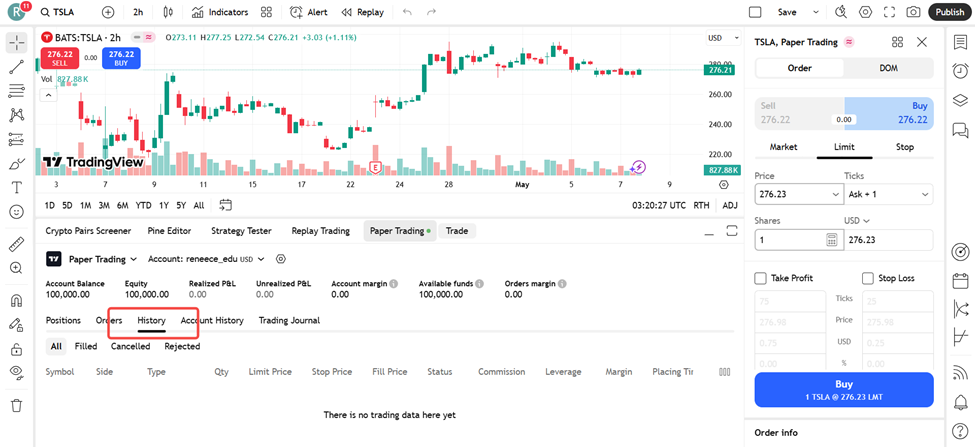

Track Performance

TradingView automatically records your trade history. Use the History tab in the trading panel to:

- Review closed trades

Regularly reviewing your performance is critical to improving your strategy.

Reset or Adjust

You may wish to reset your account periodically to test new strategies or simulate different capital scenarios. However, avoid doing so too often, as it can distort your long-term performance data and reduce the realism of your practice.

How to Get Real Trading Experience with Paper Trading on TradingView

To make the most of TradingView’s paper trading feature, it’s essential to approach it as seriously as you would a live trading account. Below are three practical ways to maximise your learning and simulate real trading conditions:

1. Choose Realistic Lot Sizes

Avoid the temptation to trade oversized positions just because you’re using virtual funds. Choose lot sizes that reflect your actual capital and risk tolerance.

This approach helps you develop proper risk management habits and better prepares you for live market conditions.

2. Time Your Trades Properly

Practise entering trades during the same market hours you would follow in a real scenario.

For instance, if you intend to trade the EUR/USD pair, simulate trades during the most active sessions—which is typically the London and New York overlap.

3. Limit Account Restarts

While TradingView allows you to reset your virtual balance at any time, doing so too often can lead to unrealistic expectations.

Set clear rules for when to reset your account, for example, after a full month of trading to preserve the integrity of your performance tracking.

3 Common Mistakes to Avoid When Trading

Even in a simulated environment, many traders often fall into habits that could hinder their success when transitioning to live markets. Be mindful of these common pitfalls:

1. Overtrading

With no real financial consequences, it’s easy to enter multiple trades without a clear plan. This can create false confidence and poor trading habits.

Always approach each trade with discipline using a well-defined strategy.

2. Emotional Trading

Paper trading is the perfect opportunity to observe how emotions influence your decisions. Even without real money on the line, you may still experience frustration after a loss or overconfidence after a win.

Identifying these emotional patterns early helps you build control before moving to live markets.

Related Article: The Basics of Trading Psychology

3. Treating Paper Trading Like It’s a Game

Paper trading should be taken seriously instead of treating it as entertainment. Avoid gambling-style behaviour as it can undermine your development as a trader.

Instead, treat the simulation as seriously as a real account. Keep in mind that your goal is to replicate the conditions, decision-making, and discipline of live trading as closely as possible.

5 Factors Traders Often Consider Before Moving to Live Trading

Once you’ve spent time developing healthy trading habits and practicing a disciplined strategy, some traders begin considering live trading. If you’re evaluating that step, here are five factors that may help guide your personal assessment:

1. You Can Consistently Simulate Profitable Trades

Generating simulated profits consistently over time—especially in varying market conditions— may suggest that your approach is working well in a demo environment. It can also indicate a level of consistency in your execution.

2. You Follow Your Trading Guidelines Without Exception

Discipline is crucial in live trading. If you diligently follow your trading plan during paper trading, it may indicate that you’re prepared to manage real-market conditions with the same level of control.

3. You Stay Calm During Losing Trades

Remaining calm and rational during periods of simulated loss may reflect strong emotional discipline. This mindset can help you avoid impulsive decisions, even when trading becomes more challenging.

4. You Don’t Take Your Losses Too Hard

Losses are an inevitable part of trading. If you can accept them without abandoning your strategy or chasing losses, it may show emotional resilience. This is also why it’s important that you only trade what you can afford to lose.

Related Article: How do you manage emotions while trading?

5. You’re Confident in Your Broker and Trading Platform

Confidence in your broker and trading platform helps reduce hesitation and supports smoother execution. Make sure you’ve familiarised yourself with your tools and features before going live trading.

Turn Practice Into Real Trading Confidence

Paper trading on TradingView offers a realistic, risk-free environment to develop and refine your trading strategy. By leveraging the platform’s robust features, tracking your performance, and treating your practice with discipline, you build the habits and confidence needed for long-term success in the live markets.

Want to explore further? You can Open a demo account with Vantage and connect it to your TradingView profile to continue practising in a risk-free environment. Practise with purpose, monitor your progress, and prepare to trade live with clarity and control.

References

- “Performance Summary Tab – TradingView” https://www.tradingview.com/support/solutions/43000681683-performance-summary-tab/. Accessed on 14 May 2025.

- “Win Rate – TradingView” https://www.tradingview.com/support/solutions/43000708134-win-rate/. Accessed on 14 May 2025.