On 2 April 2025, President Donald Trump announced what he referred to as “Liberation Day”, unveiling a sweeping tariff policy that imposed a universal 10% tariff on all imports, plus a 34% hike on Chinese goods, raising their total tariff burden to around 54% [1].

Other countries, many of them exporters in Asia, also faced punitive tariffs ranging from 20% to 46% [2]. Global markets reacted with volatility as major trading partners such as China, the EU, and Canada introduced retaliatory tariffs, prompting concerns about potential trade tensions and economic slowdown.

While President Trump later paused elevated tariffs for most nations, China was left facing a punitive 145% rate after Beijing retaliated with countermeasures [3].

As volatility rises and uncertainty spreads, long-term investors are left asking: how will Trump’s tariffs affect the economy and what’s the smartest way to navigate the storm ahead?

Key Points

- Trump’s sweeping tariffs have triggered global market volatility and raised recession fears.

- Higher import costs are fuelling inflation and reducing consumer purchasing power across the US economy.

- Some market participants have shown increased interest in traditionally defensive assets like gold and utility stocks, often perceived as hedges during periods of economic uncertainty.

How Tariffs Work

At their core, tariffs are just taxes on imported goods. Let’s say a US retailer (like Walmart) imports sneakers from Vietnam.

Under Trump’s new policy, Walmart now has to pay a tariff on the value of that good—potentially a significant amount—just to bring those shoes into the country. The tariff is calculated based on the declared value of the item, not its retail price.

These fees go to the US Treasury, much like regular taxes. But while the government collects the revenue, businesses and consumers feel the pinch. Companies may either:

- Raise prices to offset costs,

- Absorb the hit, reducing profit margins, or,

- Cut costs, which may include layoffs or investment freezes

Tariffs are nothing new. They’ve been used for centuries to protect domestic industries. But since the 1990s, the US has moved towards free trade—lowering barriers to reduce costs and boost global supply chain efficiency.

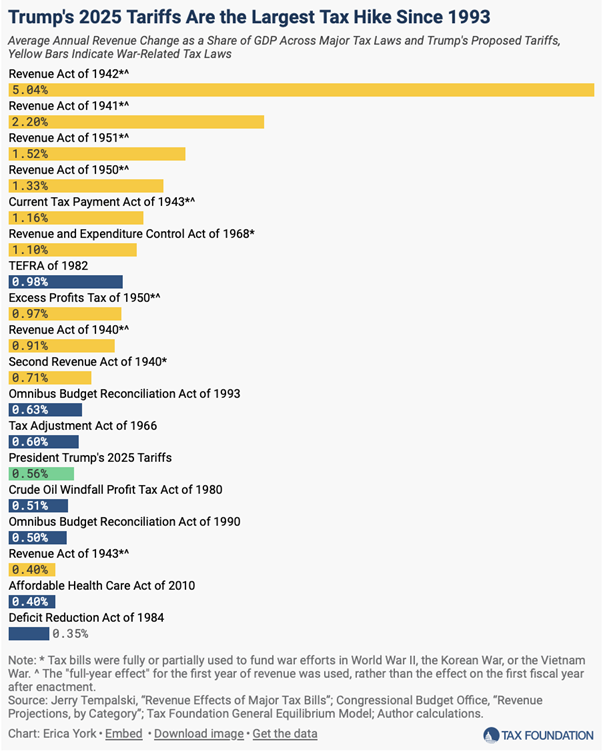

President Trump has indicated a desire to shift away from free trade principles, suggesting that tariffs could potentially replace income taxes. If fully implemented, President Trump’s plan would mark the largest US tax hike since 1993.

Timeline of Trump’s 2025 Tariffs [4]

Here’s a quick overview of how this current trade war, instigated by the US, escalated in 2025:

| Date | Event |

| Jan | President Trump signs executive orders to evaluate trade relationships. |

| 1-Feb | President Trump imposes a 25% tariff on all goods from Mexico and Canada, and an additional 10% tariff on Chinese imports, citing concerns over drug trafficking and trade imbalances. A reduced 10% tariff is applied to Canadian energy products. |

| 3-Feb | After negotiations, the US agrees to a 30-day pause on tariffs against Mexico and Canada as both nations pledge to enhance border security and combat drug trafficking. |

| 4-Mar | The US enforces tariffs on Canada, China, and Mexico, leading to immediate retaliatory measures from these countries. |

| 4-Mar | China responds with tariffs of up to 15% on US goods, including agricultural products, escalating the trade conflict. |

| 2-Apr | Dubbed “Liberation Day”, President Trump imposes a universal 10% tariff on all imported goods, with higher rates for 57 specific trading partners. This action prompts significant international backlash and market volatility. |

| 4-Apr | The US increases tariffs on Chinese imports to 104%, intensifying the trade war. |

| 7-Apr | President Trump threatens an additional 50% tariff on Chinese imports if China does not withdraw its 34% retaliatory tariffs by April 9. |

| 9-Apr | The US raises tariffs on Chinese imports to 125% after China fails to meet the deadline to withdraw its retaliatory tariffs. |

| 9-Apr | President Trump announces a 90-day pause on elevated tariffs for over 75 countries that showed willingness to negotiate, maintaining a universal 10% tariff during this period. China is excluded from this pause. |

| 10-Apr | The White House clarifies that the total tariff on Chinese goods is now 145%, combining previous tariffs with the latest increase. |

| 10-Apr | China retaliates by increasing tariffs on US goods to 84% and imposes new restrictions on critical resources. |

| 10-Apr | The European Union approves a set of retaliatory tariffs on US imports, targeting products like steel and aluminum, in response to US tariffs. |

| 10-Apr | The European Union announces a 90-day pause on its planned retaliatory tariffs to align with President Trump’s tariff suspension, aiming to create a negotiation window. |

| 10-Apr | Treasury Secretary Scott Bessent emerges as a key figure in negotiating trade agreements to prevent further tariffs, engaging with approximately 75 countries during the 90-day pause. |

| 11-Apr | China raises tariffs on US goods to 125% from 12 April 2025, escalating a trade war that could disrupt global supply chains. |

How Trump’s Tariffs Affect the Economy

President Trump’s tariffs have introduced significant uncertainty to global markets, with some analysts expressing concern about the potential for economic slowdown if trade tensions persist. But why is this the case?

Let’s break down how tariffs can negatively impact the economy.

Inflation pressures return

As stated earlier, tariffs are simply taxes—and like most taxes, they eventually make their way to consumers in the form of higher prices. With sweeping duties now covering everything from electronics and smartphones to clothing and car parts, inflation is once again rearing its ugly head.

For many Americans, especially those who supported President Trump for his vow to “end the inflation nightmare” of the post-pandemic years, this resurgence is particularly painful [5].

Economists warn that the latest round of tariffs could hit lower-income households hardest, potentially leading to higher annual living costs.

Everyday products—like Apple’s iPhones, predominantly assembled in China, and Vietnam-made apparel—are expected to see sharp price increases, especially with the high reciprocal tariffs.

While some luxury brands may choose to absorb the added costs to protect their market share, most consumers shopping for basic necessities won’t be so lucky. For the average American, the cost of living is likely to climb, one tariffed product at a time.

Recession risk: Higher tariffs, lower growth [6]

What happens when consumers stop spending?

The economy slows and that’s a big issue given that consumer spending makes up over two-thirds of US GDP. As it currently stands, the US economy is the world’s largest consumer economy.

Economists estimate that retaliatory tariffs could knock approximately 2% off the US GDP and hike up unemployment rates to 7.5% in a worst-case scenario.

Even under moderate conditions, unemployment could rise to 5.5%, a noticeable jump from the current level of 4.1%. The longer tariffs linger, the more likely businesses are to hold off on hiring or expanding their workforce.

Jobs: Protectionism comes at a price

Tariffs are supposed to bring jobs home. But the numbers tell a more nuanced story.

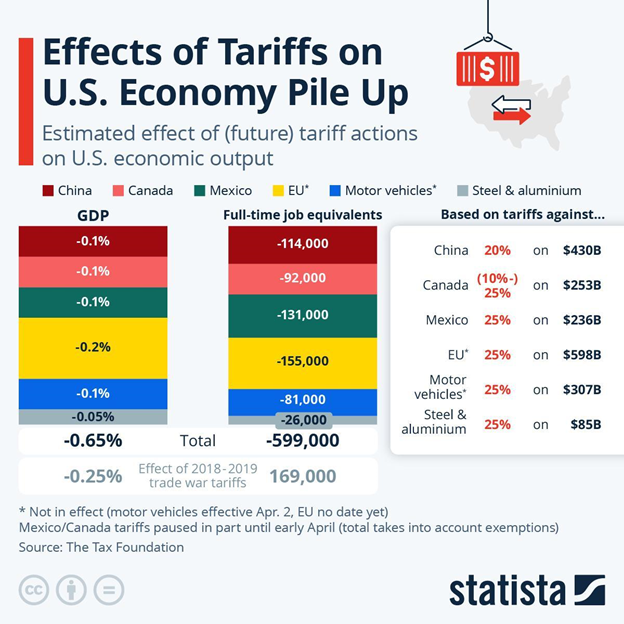

According to the Tax Foundation, Trump’s tariffs could result in a net loss of 740,000 full-time jobs [7]. Why?

Some sectors like steel may gain jobs. But other industries that rely on imported parts (like auto or electronics) will more than offset these gains. The latter sectors will likely face significantly higher costs, leading to layoffs.

Plus, modern manufacturing is more automated, meaning fewer jobs even when factories do come back.

Purchasing power: The invisible tax

When prices go up but wages don’t, your money doesn’t stretch as far as before. That’s how purchasing power works because it’s how far your dollar goes in today’s prices, rather than focusing on the nominal value of your dollar.

Tariffs can reduce consumers’ purchasing power. For investors, this may be significant—because consumer spending accounts for about 70% of US GDP [8].

Less spending could mean slower growth, leading to lower corporate earnings and an accompanying decline in stock valuations.

Impact on global markets

Markets hate uncertainty—and tariffs bring plenty of it.

In the days following the 2 April announcement:

- The benchmark S&P 500 Index fell nearly 10%, wiping out over $5 trillion in market cap [9].

- The VIX Index, used to measure market volatility, spiked above 50 [10]. That signaled extreme volatility.

Other global stock market indices followed suit, from Tokyo to Frankfurt. This is more than a trade dispute—it’s an economic tremor with global aftershocks.

Some analysts suggest that recent events are prompting a reassessment of the global free trade framework and whether the golden age of growth is finally coming to an end with Trump’s protectionist measures.

Market analysis: Where do investors turn to?

During periods of economic uncertainty and volatility, investors seek assets that can protect their wealth and reduce risk exposure.

Gold: The classic safe haven

When fear takes over, gold often attracts interest from investors.

In the weeks following Trump’s tariff escalation, gold prices surged past the US$3,000 level and hit a new record high of over US$3,350 on 16 April 2025 [11]*. Historically, Gold has historically attracted interest during periods of inflation, conflict, or political uncertainty.

* Past performance is not indicative of future results. Currency and commodity markets can be extremely volatile. Consider the risks before trading.

For educational purposes, exchange-traded products such as SPDR Gold Shares (NYSE: GLD) or iShares Physical Gold ETC (LSE: IGLN) are examples of how investors can gain exposure to gold as part of a diversified strategy.

Note: These examples are for informational purposes only and do not constitute investment advice.

With potential uncertainty over the future role of the US dollar in the global economy, more investors are also looking at gold to make up a larger portion of their long-term portfolio (as opposed to US government bonds).

Stock market: Defensive plays win

US

For investors looking for stocks that have some level of defensive nature to them, many traditionally defensive sectors have one (if not all) of these three traits:

- Pricing power

- Operate primarily in the US

- Offer essential goods and services

Companies such as Costco, Procter & Gamble, PepsiCo, Coca-Cola* are sometimes viewed as examples of defensive holdings due to their size and established market presence. These types of firms may offer more stability in uncertain environments, though past performance is not indicative of future results.

Beyond that, traditional defensive sectors like Utilities should hold up better given they are providing everyday services to the American economy.

* These examples are mentioned strictly for illustrative purposes and are not endorsements or investment advice.

Asia (Japan, Hong Kong, China)

Export-reliant economies will suffer. Chinese and Hong Kong tech firms like Alibaba and JD.com are directly exposed.

Instead, investors should focus on domestic consumption trends within China. Sectors like healthcare and utilities might hold up better. Having said that, on a fundamental level, all the large-cap tech stocks in China that have sold off (like Alibaba and Tencent) have almost no material exposure to the US economy.

Instead, what’s hitting them is likely a broader downdraft in investor sentiment in China and fears that this trade war will spark a further slowdown in the Chinese economy.

If that’s the case, large state-owned enterprises (SOEs) that pay reliable dividends could come back into vogue. That could mean companies like China Mobile.

The EU and UK

European automakers—especially Volkswagen, BMW, and Renault—are under pressure from US auto tariffs. In this environment, as with any economy, sectors like healthcare and utilities should perform better than the broader market.

Forex: The Dollar Dilemma

The US dollar might strengthen initially due to capital inflows. However, some analysts suggest that if the US economy slows and fiscal deficits increase, the US dollar could come under pressure over the longer term.

Export-heavy currencies like the yuan, won, and peso have already fallen in value, amplifying inflation in their home markets.

Long-term thinking wins, even in trade wars

So, where should investors go from here? For those with a long-term perspective, this moment may not be about panic— but about positioning.

Here are a few commonly discussed strategies:

1. Diversify globally – Rather than focusing on a single region, maintaining exposure to both domestic and international companies may help manage risk.

2. Consider defensive sectors – Areas like consumer staples, utilities, and healthcare are often viewed as more resilient in times of uncertainty.

3. Look for quality – Companies with strong balance sheets and pricing power are sometimes seen as better positioned in high-cost environments.

4. Include hedges like gold – A small allocation to precious metals is often used to help manage volatility.

5. Stick to long-term plan – Trying to time the market can be risky. Staying invested with a disciplined approach is a common principle among long-term investors.

Trade wars are rarely “won.” But investors who stay focused on fundamentals and avoid reactive decisions may be better positioned over time.

While volatility can lead to rapid market movements, it also increases trading risk. Traders should be cautious and ensure they fully understand the implications of leveraged trading during such periods.

While long-term investing remains a widely used strategy, some investors may seek to manage volatility through diversified portfolios and risk mitigation techniques. It’s important to stay informed and understand how global events might impact market conditions.

To explore more educational content and trading tools available through our platform, visit the Vantage Academy.

Reference

- “April 2, 2025 – Liberation Day tariff announcements – CNN”. https://edition.cnn.com/business/live-news/tariffs-trump-news-04-02-25/index.html . Accessed 18 April 2025.

- “Trump tariffs list in full: Every country hit and the surprising exemptions – Independent”. https://www.independent.co.uk/news/world/americas/trump-tariffs-countries-list-china-uk-canada-russia-b2729975.html . Accessed 18 April 2025.

- “Trump signals tit-for-tat China tariffs may be near end; TikTok deal on ice – Reuters”. https://www.reuters.com/technology/trump-says-china-has-reached-out-tariffs-tiktok-deal-may-wait-2025-04-17/ . Accessed 18 April 2025.

- “A Timeline of Trump’s On-Again, Off-Again Tariffs – The New York Times”. https://www.nytimes.com/2025/03/13/business/economy/trump-tariff-timeline.html . Accessed 18 April 2025.

- “Trump ordered the U.S. government to lower prices for Americans. Can he deliver? – CBS News”. https://www.cbsnews.com/news/trump-inflation-executive-orders-cost-of-living/ . Accessed 18 April 2025.

- “Trump’s High-Stakes Tariff Gamble Created A Jobs And Economy Crisis – Forbes”. https://www.forbes.com/sites/jackkelly/2025/04/07/trumps-high-stakes-tariff-gamble-created-a-jobs-and-economy-crisis/ . Accessed 18 April 2025.

- “Trump Tariffs: The Economic Impact of the Trump Trade War – Tax Foundation”. https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/ . Accessed 18 April 2025.

- “Surprising Trends in American Spending Habits You Need to Know – Investopedia”. https://www.investopedia.com/surprising-trends-in-american-spending-habits-8750291 . Accessed 18 April 2025.

- “S&P 500 loses $5 trillion in two days in Trump tariff selloff – Reuters”. https://www.reuters.com/markets/global-markets-wrapup-1-2025-04-04/ . Accessed 18 April 2025.

- “S&P 500 Posts Modest Losses to End Day of Wild Tariff Swings – Bloomberg”. https://www.bloomberg.com/news/articles/2025-04-06/us-stock-futures-tumble-with-trump-team-digging-in-on-tariffs . Accessed 18 April 2025.

- “Why Gold Prices Surged to a Record High on Wednesday – Investopedia”. https://www.investopedia.com/why-gold-prices-surged-to-a-record-high-on-wednesday-11716665 . Accessed 18 April 2025.