The Japanese Yen has had a volatile journey over the past two years. After hitting a 38-year low against the US dollar in July 2024, the yen staged a modest comeback in early 2025, only to find itself once again under pressure.

While Japan’s inflation has remained above the Bank of Japan’s (BOJ) 2% target for more than three years, monetary policy normalisation remains cautious and tentative.

With global investors closely watching both the BOJ’s next move and US-Japan trade tensions under a protectionist Trump administration, the key question remains:

Can inflation and monetary tightening finally stabilise the yen?

Key Points

- Japanese inflation remains above target, but the BOJ sees it as cost-driven and continues to move cautiously on rates.

- The yen’s recovery in 2025 has been unstable, shaped by US-Japan trade tensions and shifting interest rate expectations.

- Market participants monitoring USD/JPY, including those using CFDs, are closely watching BOJ signals, US policy shifts, and the risk of renewed currency intervention.

Japan’s Inflation: More Than Three Years Above Target [1]

Inflation in Japan has remained stubbornly above target since April 2022. By January 2025, headline inflation reached 4%, its highest point in two years.

Even more telling is the “core-core” inflation index, which strips out volatile items like fresh food and energy, climbing steadily to 3.3% in May 2025.

Inflation in Japan

| Month | Headline inflation | Core inflation | “Core-core inflation” |

| Jan ’25 | 4.00% | 3.20% | 2.50% |

| Feb ’25 | 3.70% | 3.00% | 2.60% |

| Mar ’25 | 3.60% | 3.20% | 2.90% |

| Apr ’25 | 3.60% | 3.50% | 3.00% |

| May ’25 | 3.50% | 3.70% | 3.30% |

How Rice Prices Are Driving The Surge

But this inflation isn’t the kind central bankers prefer. It’s not driven by booming consumer demand or robust wage growth. Instead, it’s cost-push inflation—particularly from food.

One item stands out: rice. In May 2025, rice prices surged 101.7%, the steepest increase in over 50 years due to back-to-back poor harvests [2].

Rice, a staple in Japan’s diet and CPI basket, is estimated to contribute nearly half of Japan’s current core inflation. This single commodity has become a symbol of Japan’s inflation dilemma.

Why The BOJ Still Sees Inflation as Temporary

Here’s the twist. Despite all this, the BOJ isn’t panicking. Why? Because officials, including BOJ Governor Kazuo Ueda, believe that this is mostly cost-push inflation, not demand-driven.

Translation: the spike in prices is due to import costs and weather-related food supply issues, not the kind of inflation that lingers due to rising wages and consumer demand.

Ueda has made it clear that “underlying inflation” is still below 2%, though the BOJ doesn’t publicly define exactly what goes into that number. But as long as that internal gauge remains subdued, the central bank is in no rush to hit the brakes hard.

The BOJ’s cautious rate policy explained

How far has the BOJ moved since ending negative rates?

While the Federal Reserve and European Central Bank (ECB) were busy hiking interest rates aggressively in 2022 and 2023, the BOJ stood apart.

It only ended its negative interest rate policy in March 2024, making it the last major central bank to tighten.

Since then, the BOJ has lifted rates by just 60 basis points, bringing its short-term policy rate to 0.5% as of June 2025. That’s still near historic lows and far from restrictive territory.

What’s holding the BOJ back from more aggressive hikes?

There’s more than one reason the BOJ is walking on eggshells: soft domestic demand, a vulnerable yen, unresolved US trade tensions, and a deep-seated fear of mistaking temporary inflation for a lasting trend.

- Weak Demand: Consumer spending and wage growth remain sluggish, casting doubt on the sustainability of inflation.

- Currency Risk: The yen has rebounded in 2025 after hitting a 38-year low in 2024, but further tightening could hurt exports in a weak global environment.

- Tariff Uncertainty: With US trade talks ongoing, the threat of a 25% tariff looms, raising concerns that rate hikes could worsen the slowdown.

- False Dawns: After years of failed inflation takeoffs, the BOJ remains cautious—though some, like board member Tamura, now advocate decisive hikes if inflation risks grow.

Japan’s economic challenges in 2025

Japan’s economy enters 2025 facing a complicated mix of structural and cyclical headwinds. While policymakers had hoped for a more stable post-pandemic recovery, recent data reveals persistent vulnerabilities in both domestic and external sectors.

From sluggish growth to volatile currency moves and ongoing deflation concerns, these challenges are testing the resilience of Japan’s economic framework and the credibility of its policy response.

1. Slowing growth and falling exports

Japan’s economy is facing mounting pressure in 2025, as growth momentum weakens and exports struggle.

The government recently slashed its full-year GDP forecast to 0.9%, down from an earlier estimate of 1.3%, citing soft household consumption and one-off disruptions like car production halts and lingering impacts from a major New Year’s Day earthquake [3].

Compounding the slowdown is a tepid export environment, with global demand undercut by tariff threats and uncertain US-Japan trade negotiations. This combination of domestic and external headwinds underscores the fragility of Japan’s recovery and complicates the Bank of Japan’s already narrow path for policy normalisation.

2. How US-Japan trade tensions are shaping the yen’s wild ride in 2025

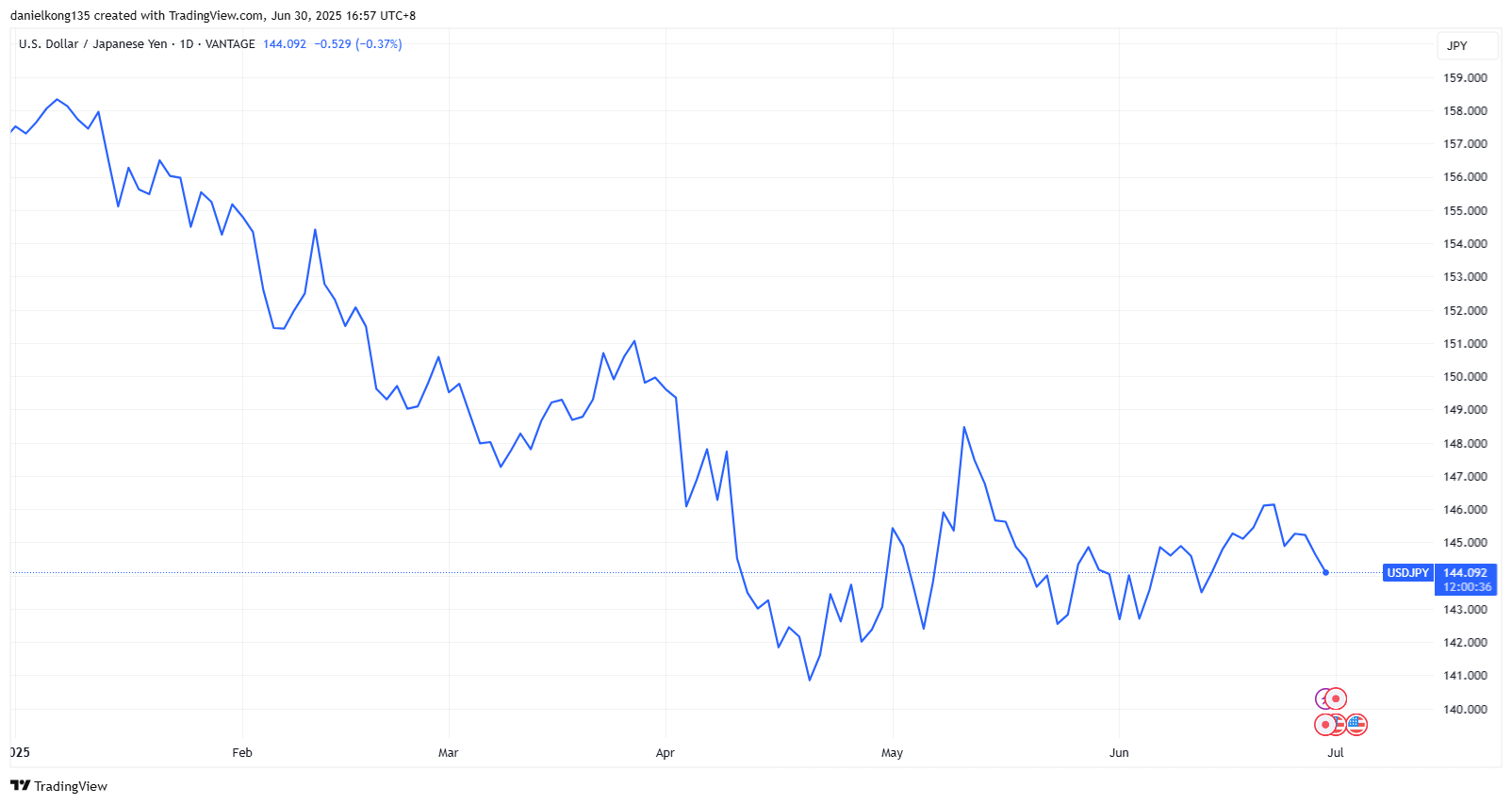

The Japanese yen has staged a notable rebound in 2025 after plunging to a 38-year low crossing the 161 mark against the dollar [4].

However, the recovery has been uneven, with ongoing volatility fueled by trade tensions, rate differentials, and geopolitical uncertainty, especially under President Trump’s renewed protectionist stance. The threat of a 25% tariff on Japanese exports to the US continues to pressure sentiment.

Suspected intervention and narrowing US-Japan yield spreads supported the yen earlier this year, pushing USD/JPY down to around ¥144 by late June, a nearly 8% rise for the Japanese currency from January levels.

Yet, the outlook remains fragile. While a weaker yen supports exports, it also inflates import costs, especially for energy and food, fueling inflation and eroding household purchasing power.

For policymakers, it’s a delicate balancing act between currency stability and inflation control amid lingering global uncertainty.

3. Deflation fears: A long shadow over BOJ policy

Despite inflation staying above target for over three years, the BOJ has only raised its policy rate by 60 basis points to 0.5% since March 2024. Governor Kazuo Ueda attributes the price surge to temporary factors like rice and energy costs, not sustained wage growth or demand.

The deeper hesitation stems from Japan’s long battle with deflation, the “Lost Decades”, making the BOJ cautious about tightening too soon.

Some economists even argue a temporary inflation overshoot is needed to shift entrenched expectations. Still, Some BOJ board members have expressed support for more decisive action if inflation risks rise.

What’s driving USD/JPY movements now?

Despite the yen’s broader rebound earlier in 2025, recent moves have favoured the dollar again, with USD/JPY climbing as markets reassess Fed policy and the BOJ’s cautious stance.

Here’s an overview of current market influences.

The role of US-Japan yield spreads

One of the most consistent drivers of USD/JPY is the interest rate differential between US and Japanese bonds. Simply put, when US yields are high and Japan’s yields are low or falling, the dollar becomes more attractive.

That’s what we’re seeing now. US yields remain elevated amid sticky inflation and tariff-related price pressures, while Japan’s long-end yields slipped after Finance Minister Shunichi Kato signaled a reduction in long-term bond issuance.

The result: renewed demand for higher-yielding US assets, weakening the yen after its earlier gains.

Could a Stronger Yen Return? Key Factors to Watch

While the path of least resistance may currently favour dollar strength following a good start to 2025 for the Japanese Yen, several factors could influence future yen strength:

- BOJ Rate Hikes: If inflation and wage growth stay resilient, the Bank of Japan may be forced to tighten more decisively. BOJ board member Naoki Tamura recently hinted at the possibility of rate hikes if underlying conditions justify it.

- Government Intervention: Authorities have shown they’re willing to act to support the yen, as seen in 2024. Another bout of yen weakness could spark a repeat of that intervention.

- Risk-Off Sentiment: Should global markets face a sharp correction or another geopolitical shock, the yen could regain its safe-haven appeal, a dynamic that historically favours sharp, short-term yen strength.

Market Factors of Interest to USD/JPY CFD Traders

With so many moving parts, short-term price movements in USD/JPY are often influenced by several key indicators, which may be of interest to market participants using instruments like contracts for differences (CFDs).

Tracking BOJ statements and inflation data

The BOJ may be cautious, but it’s not asleep. Governor Kazuo Ueda continues to reiterate that if wage growth and core inflation strengthen, rate hikes are still on the table. Meanwhile, Tokyo’s core CPI (excluding fresh food and fuel) remains at 3.1%, well above the BOJ’s target.

Watch for:

- Upcoming inflation prints

- BOJ pressers and policy meeting notes

- Surprises in rice prices, wage growth, and energy imports

Watching US policy shifts and dollar strength

The US dollar remains the dominant global currency in 2025, though it’s facing pressure. The DXY Index has slipped below 100 at times, weighed down by softer US growth, expectations of Fed rate cuts, and rising concerns over fiscal stability amid the Trump administration’s proposed budget plans. Tariff tensions have only added to market uncertainty.

Yet the dollar’s safe-haven status remains intact. During the brief Israel-Iran conflict, the greenback surged as investors sought safety, underscoring its role as the go-to currency in times of crisis—even as structural cracks begin to show.

Market participants may monitor:

- Fed guidance and CPI data: A dovish tilt could weaken the dollar, but sticky core inflation may delay cuts.

- Real yields and bond auctions: These drive capital flows and investor appetite for US assets.

- Market sentiment: A shift from expecting cuts to a prolonged Fed hold could send the dollar higher again.

Trade developments and intervention risks

Geopolitical developments remain an important factor to monitor. Here’s what to watch on the geopolitical front.

- If US-Japan tariff negotiations fail, a 25% reciprocal tariff could go into effect, potentially hurting Japan’s exports and economy.

- This could reinforce the BOJ’s dovish tone, keeping the yen under pressure.

- However, another yen intervention as seen earlier in 2024 could surprise markets.

Final thoughts: Yen outlook still uncertain

The yen’s early 2025 rebound reflected dollar weakness and hopes for a BOJ rate hike. But recent losses highlight how fragile that recovery is, with USD/JPY still vulnerable to trade tensions, shifting rate expectations, and risk sentiment.

Volatility may continue in the absence of clear policy direction from the BOJ or progress on US-Japan trade tensions.

Reference

- “Japan’s inflation has been above target for over 3 years, but where is the BOJ? – CNBC”. https://www.cnbc.com/2025/06/25/japans-inflation-above-target-for-over-3-years-but-where-is-boj.html . Accessed 30 June 2025.

- “Rice prices in Japan more than double in May — core inflation jumps to highest levels since 2023 – CNBC”. https://www.cnbc.com/2025/06/20/japans-core-inflation-hits-highest-level-since-jan-2023-putting-pressure-on-boj-to-raise-rates.html . Accessed 30 June 2025.

- “Japan Cuts Growth View for This Year on Weak Consumption – Bloomberg”. https://www.bloomberg.com/news/articles/2024-07-19/japan-cuts-growth-view-for-this-year-on-weak-consumption . Accessed 30 June 2025.

- “Japanese yen weakens to fresh 38-year lows; top currency diplomat replaced – CNBC”. https://www.cnbc.com/2024/06/28/yen-hits-161-against-us-dollar.html . Accessed 30 June 2025.