For those following US technology companies, nothing comes bigger than Nvidia Corporation (NASDAQ: NVDA). The company’s shares have seen notable gains in recent months, attracting significant market attention.

Fuelled by the explosive demand for artificial intelligence and high-performance computing, the chipmaker has seen significant attention in financial markets.

Its GPUs are the lifeblood of modern AI systems, and the market can’t seem to get enough.

But behind the headline-grabbing revenue surge lies a much more complicated story shaped by geopolitics, trade wars, and a rapidly shifting regulatory landscape.

As the US doubles down on efforts to curb China’s access to advanced semiconductor technology, Nvidia has been directly affected by these evolving restrictions.

From Trump-era export controls to new proposals targeting chip design software and high-end AI chips, Washington’s policy moves are increasingly dictating how, where, and to whom Nvidia can sell its cutting-edge products.

Let’s explore how Nvidia’s strong earnings are clashing with rising US–China tech tensions and what this means for the company’s strategy, valuation, and long-term outlook.

US Export Controls and Geopolitical Pressures on Nvidia [1,2,3]

The US has dramatically intensified its efforts to restrict China’s access to cutting-edge semiconductor technologies—placing Nvidia at the centre of a growing tech cold war.

Over the past year, a series of export control measures have targeted everything from chipmaking equipment and chemical inputs to high-performance GPUs like those used for artificial intelligence workloads.

Most notably, on 9 April 2025, the US government imposed new export restrictions on Nvidia’s H20 data centre GPU—a product designed specifically for the China market and previously cleared for sale by the prior administration.

Notably, the policy was implemented without a grace period. Despite the fact that the H20 had been on the market for over a year and held no real demand outside China, the abrupt policy change left Nvidia unable to fulfil US$2.5 billion in pending Q1 revenue tied to pre-approved orders.

The impact was financially significant. While Nvidia managed to recognise US$4.6 billion in H20-related revenue before the 9 April cutoff, it was forced to take a massive US$4.5 billion charge to write down inventory and purchase obligations.

Although the final write-down was slightly less than expected—thanks to the reuse of certain components—the financial blow was real. More importantly, this development may present longer-term strategic challenges.

Nvidia now faces the possibility of losing access to the entire Chinese AI accelerator market, which it estimates could grow to nearly $50 billion. This development represents a material shift in Nvidia’s market exposure and strategic outlook.

As the company scrambles to evaluate limited options for supplying China with export-compliant products, CEO Jensen Huang has voiced concern that these policies could hand a long-term advantage to foreign rivals, both in China and globally.

With China previously accounting for 13% of Nvidia’s revenue or about US$17 billion in FY2025, this situation is significant given China’s historical contribution to Nvidia’s revenue.

Traders are closely monitoring whether Nvidia can adapt to the shifting geopolitical landscape or whether it is at risk of ceding one of the world’s largest growth markets to a new wave of local challengers.

Key Technologies Targeted by New Export Rules

The latest US export rules specifically target critical technologies such as AI chips, chip design software, advanced photolithography equipment, and essential chemical inputs used in semiconductor manufacturing. These restrictions aim to limit China’s progress in developing cutting-edge computing and AI capabilities.

For Nvidia, the tightening of export rules poses significant challenges, including disrupted supply chain collaborations, halted joint development with Chinese firms as well as direct revenue losses from restricted sales of high-performance GPUs like the H100 and A100 to China.

As the US seeks to preserve its technological edge and prevent military-grade applications, Nvidia’s ability to engage with one of its largest markets could face lasting constraints, potentially forcing the company to redesign or downgrade products for compliance.

Diversification and Strategic Adjustments

Nvidia isn’t sitting still as US export restrictions tighten their grip on China-bound shipments. In true Nvidia fashion, the company is already adapting—by designing a lower-spec version of its next-gen Blackwell chip specifically for the Chinese market.

While it won’t pack the same punch as the US$10,000 H20 model, this new GPU (expected to cost between US$6,500 and US$8,000) will be stripped of advanced packaging and rely on conventional GDDR7 memory to comply with export rules [4].

This represents a strategic adjustment aimed at partially offsetting the impact of lost China-bound sales. It may not fully replace what was lost, but it is a reminder of how quickly the company pivots under pressure.

Meanwhile, Nvidia is going full throttle in the Middle East. With China sales curtailed, the company is forging powerful new partnerships in Saudi Arabia and the UAE.

In a large-scale partnership, it’s teaming up with Humain (backed by Saudi’s Public Investment Fund) to deliver hundreds of thousands of AI chips over the next five years, starting with 18,000 Blackwell GPUs [5]. The UAE is also in on the action, reportedly importing 500,000 chips a year to power its growing AI ambitions.

In addition, Nvidia’s efforts to expand supply chains and AI infrastructure outside China may reflect a strategic response to current regulatory developments.

Nvidia’s Earnings Strength Amid Global Uncertainty [6]

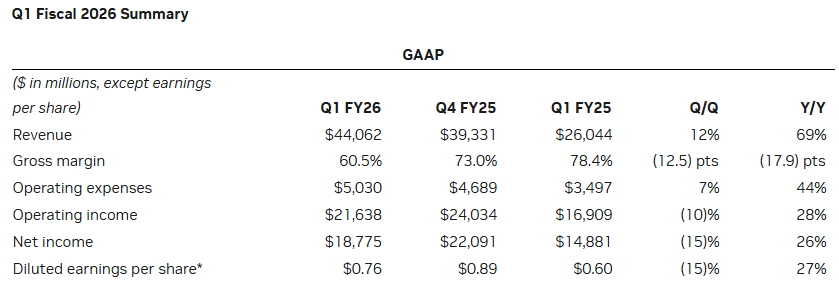

Nvidia delivered another blockbuster quarter despite facing headwinds from tightened US export controls. In Q1 FY2026, revenue surged to US$44 billion, up 69% year-on-year, while Data Center revenue jumped 73% to US$39 billion— a clear sign that the AI boom is still gaining steam.

Despite recording a US$4.5 billion write-down related to its Arm acquisition attempt, Nvidia’s quarterly results exceeded analyst expectations, reflecting resilient demand in certain segments. The company reported continued strength in its data center business, where demand for the newly launched Blackwell chips has remained elevated, contributing to revenue growth in that division.

Major cloud providers like Microsoft are deploying tens of thousands of these chips every week, powering AI services like OpenAI and others. And with over 100 AI factories in development globally, demand remains strong as of the latest reports.

Other segments also performed strongly. Gaming revenue hit a record US$3.8 billion, up 42% year-on-year, boosted by the launch of new GeForce RTX 5060 and 5060 Ti GPUs.

Automotive revenue climbed 72% year-on-year to US$567 million, reflecting stronger demand for AI-based driving systems. Even the networking business posted sharp growth, up 64% quarter-on-quarter, driven by the need to connect massive AI workloads.

Despite regulatory challenges in China, Market confidence remains strong according to analyst commentary. Nvidia guided for US$45 billion in revenue in Q2 FY2026, even with an expected US$8 billion loss from blocked H20 sales. Gross margins are expected to improve to 72%, driven by higher Blackwell volumes.

Q2 FY2026 Outlook: Key Highlights from Nvidia

- Projected Revenue: Estimated at US$45 billion, ±2%, even after factoring in an ~US$8 billion reduction from blocked H20 chip exports.

- Gross Margins:

- GAAP: Expected at 71.8%

- Non-GAAP: Expected at 72.0%, both ±50 basis points

- Margins are anticipated to reach the mid-70% range later in the fiscal year, driven by Blackwell chip adoption.

- Operating Expenses:

- GAAP: ~US$5.7 billion

- Non-GAAP: ~US$4.0 billion

- Full-year operating expense growth forecasted in the mid-30% range.

- Other Income/Expense:

- Expected income of ~US$450 million, excluding gains/losses from equity investments.

- Tax Rate:

- Projected at 16.5%, ±1%, excluding discrete items.

*Past performance is not indicative of future results.

Following the earnings announcement, Nvidia’s share price rose by approximately 5% the next day, Resulting in a share price increase, reaching levels not seen since January. Analysts cheered management’s upbeat tone, with Huang highlighting soaring demand for AI infrastructure and “reasoning” AI models that require significantly more compute.

In short, while regulatory turbulence is real, AI-related demand has continued to support Nvidia’s performance despite regulatory challenges, though the long-term impact of these headwinds remains to be seen.

Navigating Volatility: Nvidia’s Strategic Positioning

Nvidia is doing more than just riding the AI wave — it is navigating one of the most volatile policy environments in tech history. In response to increasing geopolitical risk, the company has been quick to adapt its product lines and go-to-market strategy.

With its China-focused H20 GPU now under a strict US export ban, Nvidia is exploring the development of alternative chips that comply with the latest regulatory limits, though Huang admitted options are limited.

At the same time, the company is doubling down on non-China markets and pushing for faster deployment of its most advanced products, like the Blackwell platform, across the US, Europe, and the Middle East.

Policy support from Washington is also helping. Under the CHIPS and Science Act, Nvidia has committed to reshoring parts of its AI supply chain, including packaging, assembly, and advanced manufacturing partnerships in Arizona and Texas.

These moves aim to localise production, reduce geopolitical exposure, and align with national security goals. But Geopolitical risks remain, including the potential for retaliatory measures by China, from restrictions on rare earth minerals to a push for full independence from US tech.

Key Factors to Watch Going Forward

Looking ahead, traders and analysts will want to monitor several key dynamics. First and foremost is the evolving landscape of US–China tech policy. New or expanded export controls, especially if they extend into broader tech sectors could materially affect Nvidia’s sales and market share, particularly in Asia.

Closely related will be the company’s future earnings guidance and regional revenue breakdowns, especially with China sales expected to decline sharply in the quarters ahead.

Another critical area to watch is Nvidia’s investment in R&D and alternative markets. From sovereign AI infrastructure in the Middle East and Europe to enterprise and industrial AI platforms, Nvidia is rapidly building out new growth verticals to diversify away from politically sensitive regions.

Market sentiment may also influence Nvidia’s valuation and future performance, especially as AI remains one of the most crowded trades in tech. Any shift in macro conditions, regulation, or competitive dynamics could quickly impact valuation multiples.

Analyst views remain mixed, with some highlighting Nvidia’s continued relevance in the AI and semiconductor sectors. However, geopolitical developments continue to create uncertainty for global semiconductor businesses.

Reference

- “Nvidia braces for billions in losses over H20 chip export rules – Techedt” https://www.techedt.com/nvidia-braces-for-billions-in-losses-over-h20-chip-export-rules Accessed 3 June 2025

- “NVIDIA Announces Financial Results for First Quarter Fiscal 2026 – Nvidia” https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-first-quarter-fiscal-2026 Accessed 3 June 2025

- “Nvidia’s Top Executive Warns of China’s AI Gains Post-U.S. Sell-Off – Yahoo! Finance” https://finance.yahoo.com/news/nvidias-top-executive-warns-chinas-123442377.html Accessed 3 June 2025

- “Nvidia to launch cheaper Blackwell AI chip for China after US export curbs: Sources – The Straits Times” https://www.straitstimes.com/business/companies-markets/nvidia-to-launch-cheaper-blackwell-ai-chip-for-china-after-us-export-curbs-sources-say Accessed 3 June 2025

- “Saudi Arabia and NVIDIA to Build AI Factories to Power Next Wave of Intelligence for the Age of Reasoning – Nvidia” https://nvidianews.nvidia.com/news/saudi-arabia-and-nvidia-to-build-ai-factories-to-power-next-wave-of-intelligence-for-the-age-of-reasoning Accessed 3 June 2025

- “NVIDIA Corporation (NVDA) Q1 2026 Earnings Call Transcript – Seeking Alpha” https://seekingalpha.com/article/4790673-nvidia-corporation-nvda-q1-2026-earnings-call-transcript Accessed 3 June 2025