Oil is back in the headlines, and not for the reasons most of us would like. Prices are climbing, volatility is creeping back in, and geopolitical flashpoints are flaring up in ways that could reshape global supply dynamics.

While many market participants have been laser-focused on Artificial Intelligence (AI) and tech, the crude reality is this: oil still runs the world. Whether you are an energy trader, a commuter, or a policymaker trying to tame inflation, the trajectory of oil prices could determine a lot more than your next fuel bill.

So, what is going on in the oil market right now? And more importantly, what does it mean for traders? Let’s unpack this.

Key Points

- Geopolitical tensions in the Middle East and beyond are pushing oil prices higher and adding volatility to the market.

- OPEC+ is keeping supply tight, while US shale output is slowing, giving producers more control over global pricing.

- Rising oil prices are fuelling inflation concerns and could influence central bank decisions on interest rates.

Geopolitical Tensions: The Pressure Cooker is Hissing

If you’re wondering why oil prices have become so volatile again, start by opening a world map. The Middle East, home to some of the largest oil reserves and critical shipping lanes, is heating up, literally and politically.

In June 2025, Israeli air strikes on Iranian nuclear facilities triggered a series of retaliations and countermeasures [1]. The geopolitical fallout has put the global oil supply on red alert.

Why? Because nearly 20% of the world’s oil flows through the Strait of Hormuz, a narrow channel between Iran and Oman [2]. Any military disruption there sends oil markets into a frenzy.

Add in Houthi attacks on commercial ships in the Red Sea and broader unrest in the Gulf, and you get a perfect storm of instability. These are not just isolated events. They are chokepoints in the arteries of global energy trade.

Related Article:

- Trading Brent Crude Oil: A Complete Guide

- Trading West Texas Intermediate (WTI) Crude Oil: A Complete Guide

Will there be a global supply squeeze?

Even outside the Middle East, geopolitical tension is creating ripple effects. The US and China continue to trade jabs on tariffs, creating friction across global supply chains.

Russia, a major oil and gas exporter, remains under sanctions, limiting its access to key markets. And Venezuela, once a major oil producer, is struggling to ramp up output despite recent diplomatic thawing.

The bottom line? The world isn’t just dealing with demand and supply. It’s dealing with fear – fear of sudden outages, shipping delays, and unpredictable political escalation. And when fear enters the oil market, prices rarely stay calm.

OPEC’s chess game: Tight leash, tight market

While geopolitics spark the fire, OPEC often pours—or withholds—the fuel. The Organization of the Petroleum Exporting Countries (OPEC), along with its allies (collectively known as OPEC+), still plays a pivotal role in setting the tone for global oil supply. And lately, that tone has been tight.

Saudi Arabia and Russia: United in Cuts

Saudi Arabia, the de facto leader of OPEC, has taken a firm stance on keeping oil prices elevated. Alongside Russia, it has extended voluntary production cuts deep into 2025. The logic? They aim to keep prices elevated to support domestic initiatives and maintain economic stability.

The most recent OPEC+ meetings reinforced this strategy. Rather than flooding the market with more oil to gain market share, the group is doubling down on supply discipline.

As of June 2025, total OPEC+ output is near multi-year lows. Compliance remains high. In a market where spare capacity has shrunk and demand is still resilient, this translates into significant pricing power.

US Shale: Losing its Swagger

Historically, US shale producers could flood the market and counter OPEC’s price hikes. Not anymore. Capital discipline has reshaped the American oil patch. Traders are demanding profits, not production. That means slower ramp-ups even when prices rise.

In fact, US production has plateaued in recent quarters. Regulatory hurdles, labour shortages, and rising costs are also curbing supply growth. So, unlike in past cycles, there’s no cavalry riding in from Texas to balance the market quickly.

That gives OPEC more influence over pricing, at least for now.

Market Expectations: How Current Trends Are Shaping Oil Prices

Brent crude recently surged 7% to settle at US$74.23 per barrel, marking one of its biggest single-day gains in years, as escalating conflict between Israel and Iran reignited fears of a broader Middle East war and potential disruptions to global oil supply [3].

At its peak, Brent spiked as much as 13% intraday, underscoring the market’s sensitivity to geopolitical shocks in energy-critical regions [4]. Despite the sharp increase, the oil price is not at a crisis-level yet but it is a clear uptick from the low-US$70s seen earlier in the year, and it reflects growing uncertainty.

With supply tight and risks high, what are markets expecting?

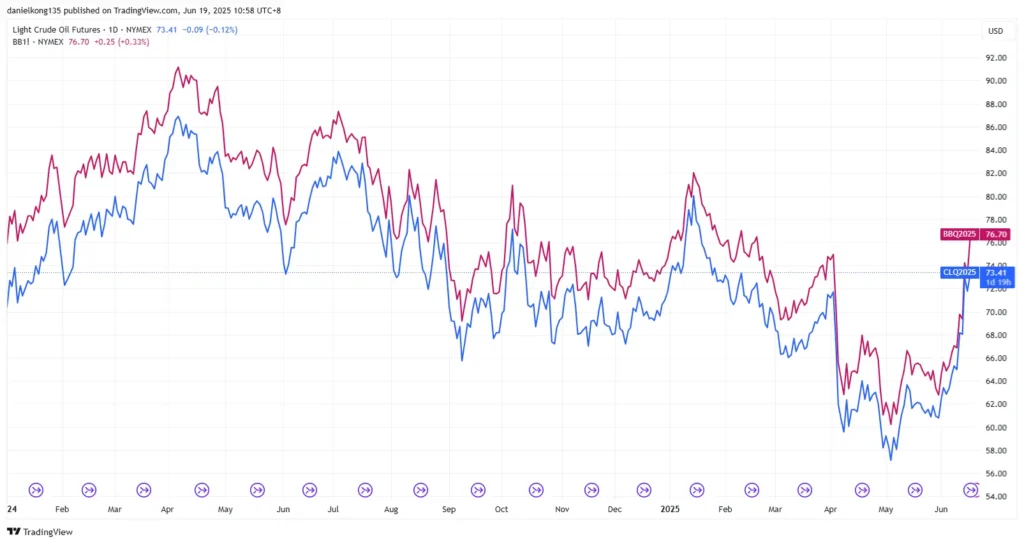

Chart 1: WTI oil futures and Brent oil futures price chart. Source: https://www.tradingview.com/x/a6WisU81/

Futures markets show a slight backwardation pattern. That is, near-term prices are higher than future contracts, suggesting the market sees current tightness as temporary but still worrisome.

Just a month ago, the US Energy Information Administration (EIA) slashed its oil price and demand forecasts, citing weaker global trade sentiment and expectations of higher OPEC+ supply, projecting Brent crude to average just US$68 in 2025 [5]. But markets have since flipped dramatically.

The sudden escalation in geopolitical tensions, most notably the outbreak of war between Israel and Iran, has upended that bearish narrative, highlighting how quickly sentiment in oil markets can shift in response to news-driven developments.

What was once a story of slowing demand and softening prices is now dominated by fears of supply disruption and conflict spillovers, underscoring the volatile and unpredictable nature of global energy markets.

Oil’s Winners and Losers

Note: Examples cited below are for illustrative purposes only. This does not constitute investment advice.

So where should traders be looking? Here’s how we break it down. Among the potential winners are the integrated energy giants such as ExxonMobil, Chevron, and Shell. These companies stand to benefit from higher crude prices and stable downstream operations, which provide a buffer during periods of volatility.

Oilfield services firms like Halliburton, Baker Hughes, and TechnipFMC could also gain as higher prices typically incentivise more exploration and production activity.

On a macro level, energy-rich nations, particularly in the Middle East and parts of Africa, could experience stronger fiscal positions and budget surpluses if elevated oil prices persist.

On the other hand, higher oil prices are likely to put pressure on several sectors. Transportation and airline companies, such as Delta and American Airlines, are particularly vulnerable due to the sharp rise in jet fuel costs, which significantly impacts their bottom line.

Emerging markets that rely heavily on energy imports, including India and Turkey, may face deteriorating trade balances, weaker currencies, and inflationary pressures. Additionally, consumer-facing sectors like retail and staples could take a hit; higher fuel costs tend to reduce disposable income and weigh on consumer spending, squeezing profit margins for companies such as Walmart and Target.

What About Inflation?

Higher oil prices feed directly into inflation expectations. Central banks around the world, including the US Federal Reserve, are closely watching energy prices as they weigh interest rate decisions. A sustained rally in oil could delay rate cuts or even trigger more hawkish rhetoric.

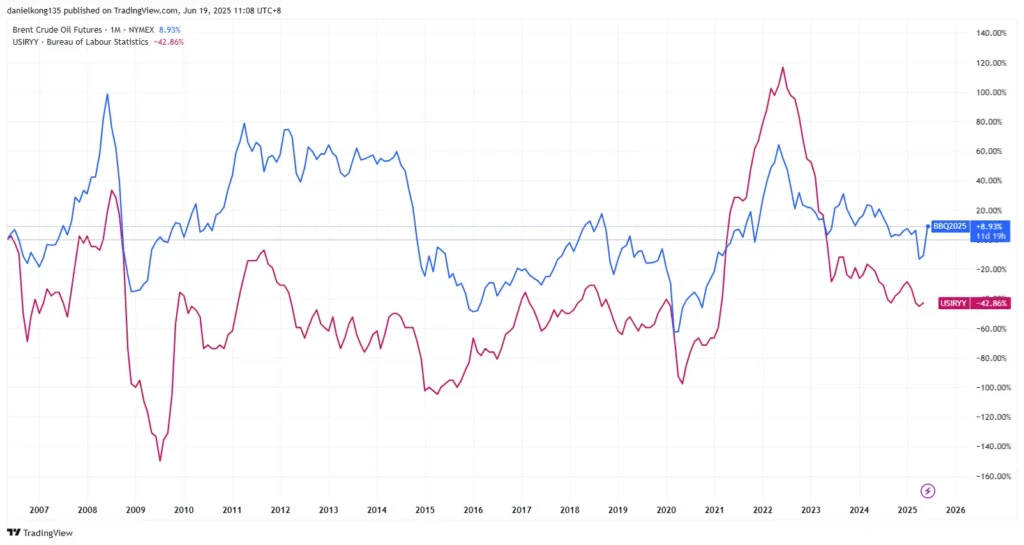

Fueling Inflation? A Side-by-side Look at Oil Prices and Cost of Living

Chart 2: Chart of Brent Crude Oil Futures and US inflation. Source: https://www.tradingview.com/x/cLhXDPB3/

That’s a problem for both equity and bond markets. Rising oil costs hurt consumer spending, corporate margins, and government budgets, particularly in oil-importing nations.

In short: oil is not just an energy issue; it’s a macroeconomic one.

What to Watch:

- OPEC+ Announcements – Any hints of easing production cuts or internal disagreements can send prices swinging.

- Middle East Headlines – A military escalation around Hormuz or Iran could raise the risk of oil prices spiking toward or above US$100, according to market analysts.

- Inventory Data – Weekly EIA reports from the US offer a glimpse into short-term supply/demand imbalances.

- Shale Production Trends – Watch rig counts and capex updates from major US producers for signs of a turnaround.

- Central Bank Reactions – Oil-driven inflation might change the timeline for global rate cuts.

Oil is still king but the throne is wobbly

For all the talk about decarbonisation, EVs, and clean energy, the simple truth is that oil remains the lifeblood of the global economy. In times of peace, it powers growth. In times of tension, it becomes a weapon, a liability, or a hedge, depending on your vantage point.

The current backdrop such as tight supply, strong demand, and geopolitical fragility, has made oil a key focus for traders in 2025. But don’t just watch the headlines. Look at the fundamentals. Look at inventory data, producer discipline, and shipping patterns.

As a trader or market observer, you don’t need to predict the next missile strike or OPEC plot twist. But you should understand how these developments affect pricing power, inflation risk, and portfolio positioning.

Sometimes, the most powerful investment decisions come not from reacting to noise, but from understanding what drives the signal.

Open a live account with Vantage and unlock a wealth of educational resources through Vantage Academy.

Frequently Asked Questions

1. Why oil prices fell?

Oil prices can fall when demand weakens or market sentiment shifts. In 2025, soft global trade data and forecasts of higher OPEC+ supply temporarily weighed on prices, despite underlying geopolitical risks.

2. What is crude oil?

Crude oil is a naturally occurring, unrefined petroleum product made of hydrocarbons and other organic materials. It is processed in refineries to produce fuels such as petrol, diesel, and jet fuel, as well as various chemical products.

3. What does OPEC stands for?

OPEC stands for the Organization of the Petroleum Exporting Countries, a group of major oil-producing nations that coordinate policies to manage global oil supply and prices.

RISK WARNING: CFDs are complex financial instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand the risks involved and carefully consider whether you can afford to take the high risk of losing your money before trading.

Disclaimer: The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Reference

- “Israel hits Iran’s nuclear program and military leadership in unprecedented strikes – CNN” https://edition.cnn.com/2025/06/12/middleeast/israel-iran-strikes-intl-hnk Accessed 19 June 2025

- “Strait of Hormuz: Iran threatens 33-km wide key oil lifeline for the world – The Economic Times” https://economictimes.indiatimes.com/news/international/world-news/strait-of-hormuz-iran-israel-war-world-key-oil-lifeline-33-km-wide/articleshow/121923203.cms?from=mdr Accessed 19 June 2025

- “Oil settles up 7% as Israel, Iran trade air strikes – The Business Times” https://www.businesstimes.com.sg/international/global/oil-settles-7-israel-iran-trade-air-strikes Accessed 19 June 2025

- “Oil settles up 7% as Israel, Iran trade air strikes – Reuters” https://www.reuters.com/world/china/oil-prices-jump-more-than-4-after-israel-strikes-iran-2025-06-13/ Accessed 19 June 2025

- “Oil Price and Inflation: What’s the Correlation? – Nasdaq” https://www.nasdaq.com/articles/oil-price-and-inflation-whats-correlation Accessed 19 June 2025