Gold (XAU/USD) is one of the earliest known currencies and has long served as a reliable store of value, particularly during geopolitical and economic turmoil. It has limited practical use, but traders and investors recognise it as a form of wealth because it is a tangible asset, similar to fiat currency.

Recently, gold reached levels above USD3,500 per ounce, driven by renewed global trade tensions—particularly between the US and China—and growing concerns over central bank policies and inflation [1].

Gold remains relatively insulated from central banks and monetary policy shifts, which speaks to its inherent value as a hedge in diversified portfolios.

Key Points

- Central banks’ gold purchases can indicate changes in gold prices and provide trading volatility in the XAU/USD pair.

- Political and economic uncertainties often lead investors to consider gold as a safe haven, affecting its relationship with major currencies and presenting trading opportunities in the XAU/USD market.

- Trading gold CFDs during peak liquidity hours, utilising the symmetrical triangle chart pattern for breakouts, and monitoring gold’s industrial and commercial demand can strategically inform buy and sell decisions in the XAU/USD CFD pair.

What Is XAU/USD?

XAU/USD is the trading symbol for gold against the US dollar. It represents how much USD is needed to purchase one ounce of gold.

Trading the XAU/USD CFD pair is popular among gold traders who seek opportunities in fluctuating gold prices relative to the dollar. This trading pair is influenced by factors such as supply and demand, economic data, geopolitical events, and central bank policies.

Understanding these influences helps traders make informed decisions when buying or selling XAU/USD via CFDs.

Why Trade XAU/USD?

The gold market has expanded in recent years, providing opportunities for individuals who previously may not have considered trading gold. While investors can still purchase physical gold in the form of coins or bars, modern trading platforms like Vantage now offer faster, more flexible ways to gain exposure to the precious metal via CFDs.

Recent price surges, driven by political instability and changing monetary policy expectations, have brought renewed attention to gold markets. XAU/USD CFD is popular among traders due to its volatility, liquidity, and typically lower transaction costs compared to less active instruments.

With gold maintaining upward momentum in 2025, traders are exploring various timeframes—such as intraday moves, medium-term price fluctuations, and long-term macroeconomic trends—using online trading platforms to understand and participate in the market.

While gold can be traded through various instruments globally, Vantage offers access to the XAU/USD pair exclusively via CFDs, where gold is paired against the US dollar—offering high liquidity and active price movement similar to major forex pairs.

Want to explore gold ETFs through CFDs? Check out our educational guide on the 10 Best Gold ETFs and How To Invest in Them.

How to Trade XAU/USD

If you’re just getting started in the markets, here are several ways you can participate in trading gold:

- Gold Spot US Dollar or XAU/USD

- Gold Contract for Differences (CFDs)

- Gold ETFs

- Gold mining stocks

- Gold futures [2]

Although this list isn’t exhaustive, these are the most common ways to trade gold in the securities markets. While gold can be traded via several instruments, Vantage offers access to XAU/USD exclusively through CFDs. This allows you to speculate on gold price movements with leverage, without owning the underlying asset.

You can open a Vantage live account to access gold CFD trading, if it suits your trading goals and risk appetite.

6 Tips for Trading XAU/USD via CFDs You Don’t Want to Miss

With the diversification of gold markets, there are now many ways to trade gold online.

For traders using Contracts for Difference (CFDs), the XAU/USD pair—which reflects the price of gold against the US dollar—is a popular instrument. If you’re starting out with the XAU/USD pair, here are some tips to keep in mind.

1. Pay Attention to Gold Purchases Made by Central Banks

All central banks own gold because of its direct relationship with banknotes and coins. Also, most central banks store gold to diversify the financial risk of their countries. The reason they do this is to benefit from the stability both gold and foreign currency reserves give while together, rather than apart.

Central banks may purchase gold as part of broader risk management strategies, which can sometimes influence market sentiment. For this reason, look out for when central banks start buying massive quantities of gold as it may suggest potential changes in gold price.

Such a move potentially signals two things:

- Firstly, a government is acting on the assumption that major currency values will fall. For this reason, traders shift significant amounts of their investments to less volatile funds.

- Secondly, such movements usually lead to an increase in gold prices—at least in the short term.

A good example is the announcement by the Russian central bank in 2022 to buy gold from commercial banks at a fixed price to support the Russian Rouble [3].

Placing trades during such announcements may lead to increased volatility which traders can monitor for potential trading opportunities in the XAU/USD pair.

2. Observe the Effects of Geopolitics on Currencies

Political and economic instability around the world usually causes volatility in currency prices as seen from the US-China trade tensions. During such events, gold provides a safe haven for many other liquid assets.

Some traders view XAU/USD as a way to diversify during times of heightened geopolitical risk. After all, gold has a strong relationship with the US dollar and other stable currencies like the Euro, the Japanese Yuan, and the GBP.

Take the Russian invasion of Ukraine, for instance. It caused the price of the US dollar to skyrocket, while the Russian Rouble lost ground [4]. Another example: The global banking crisis in March 2023, triggered by low interest rates, slowing economic growth, and risky lending practices [5]. In this case, some traders might have viewed XAU/USD as a potential opportunity during such events, though outcomes are never guaranteed.

3. Target Previous Highs and Lows

The XAU/USD pair tends to follow trends and trade within a specific range. That provides you with an excellent opportunity to capitalise on buy and sell signals around previous support and resistance levels.

When gold is trending upwards, you may consider targeting a historical high as your potential exit price. In a downtrend, look to previous lows as reference points for profit-taking. Gold has historically shown tendencies to revisit key support or resistance levels in trending markets.

Although this strategy is generally lower risk, it’s less suited for day trading. Gold may take time to return to prior highs or lows, which can take away any opportunity for a quick upside.

4. Trade During New York Hours

Although gold trades 24 hours a day, you’ll find the highest liquidity typically occurs during New York trading hours. The market’s liquidity and your trading goals will determine your strategy [6].

If you prefer stable price action, trading during peak liquidity hours can offer tighter spreads and smoother execution. On the other hand, if you’re trading short term, after-hours sessions may provide you with the necessary volatility to potentially capitalise on quick price movements.

Just keep in mind that higher volatility comes with greater risk, so manage your XAU/USD CFD positions accordingly.

5. Analyse with the Symmetrical Triangle

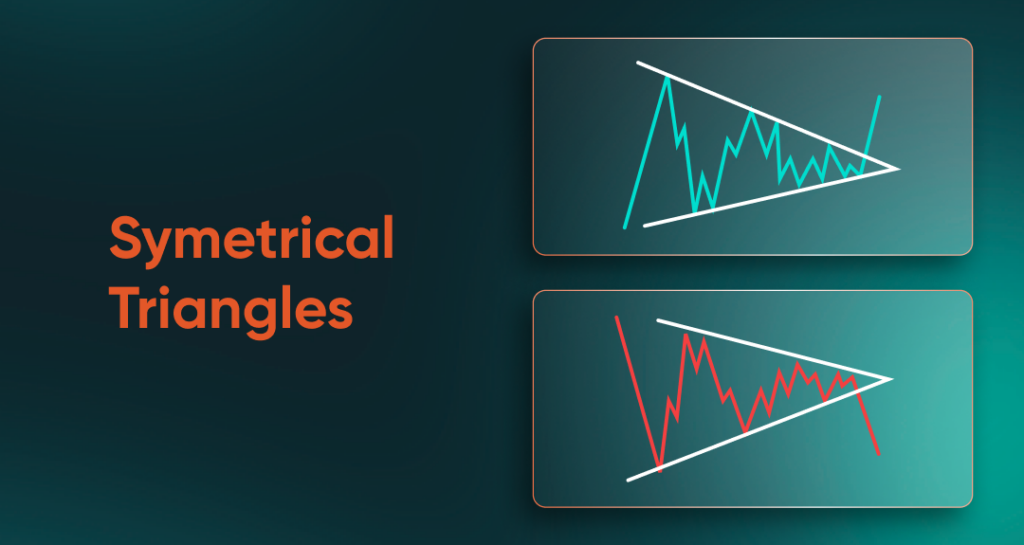

The symmetrical triangle is a straightforward chart pattern that shows a period of consolidation before a price breakout. When two trend lines with identical slopes but different directions converge, you have a symmetrical triangle [7].

This pattern may reflect a period of market indecision where buyers and sellers are relatively balanced. Traders can use this pattern to identify potential breakouts and make informed trading decisions based on the current market price movements between the XAU/USD pair.

By monitoring the trend lines and waiting for a breakout, traders may look for potential trading setups during price movements following such patterns.

When these two trendlines converge, price movements between the XAU/USD pair grows tighter, and open up a window of opportunity for you to take advantage of a breakout. Most times, you’ll use the symmetrical triangle pattern with other technical indicators like the Relative Strength Index (RSI).

When other indicators point to a possible price breakout, the symmetrical triangle can provide you with supporting confirmation and boosts your confidence in taking an XAU/USD position.

Once the two trend lines converge, put a stop-loss order slightly below the descending trend line.

Related Article: Guide To Technical Indicators: Types And Which To Use

6. Follow Gold Demand for Industrial and Commercial Uses

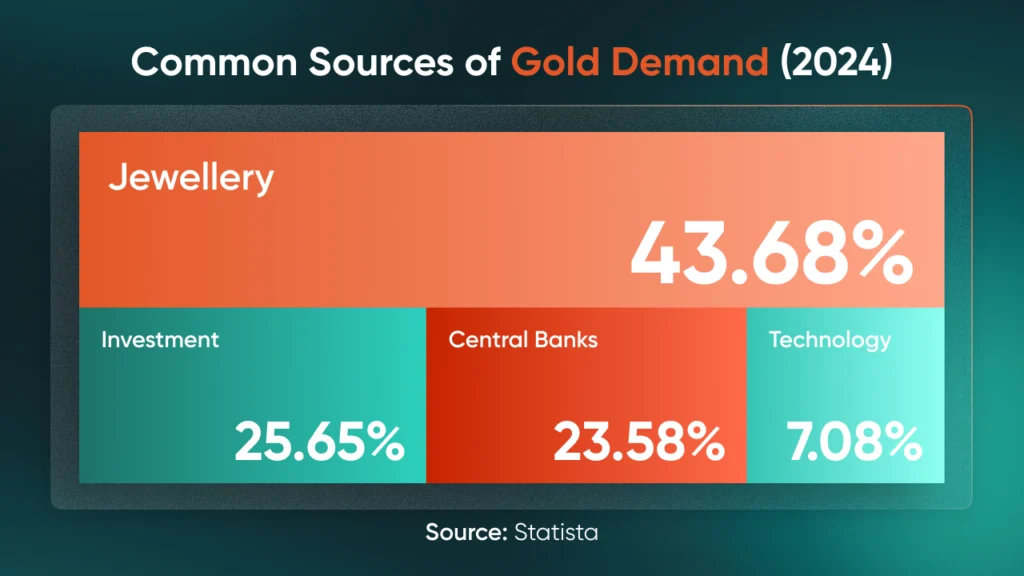

Gold isn’t just a safe-haven asset—it also has real-world demand that can impact its price.

A good example for gold demand comes from the jewellery industry. By tracking the demand for gold in consumer markets, we can gauge the fluctuations in the global gold trading price.

Case in point: When global demand for gold jewellery rises, prices often follow. And when demand cools down, prices tend to dip too.

Other uses of gold can also affect the price of gold in the financial markets.

For instance, gold is a key component of smartphones and other electronics because of its efficient electricity conduction. So, when demand for electronics surges, it can increase gold consumption—and in turn, push prices higher.

Keeping an eye on both consumer trends and industrial usage might give you an edge when trading XAU/USD CFD.

4 XAU/USD CFD Trading Strategies to Level Up Your Portfolio

Interested in learning more about strategies used when trading XAU/USD via CFDs? Here are four XAU/USD CFD trading strategies traders commonly use:

1. Trend-Following Strategy

One popular strategy for trading gold is trend following. This approach involves identifying and trading in the direction of the prevailing market trend—whether up or down—based on one’s goals. Traders use various tools, such as moving averages and trend lines, to determine the trend’s direction.

Some traders aim to capture sustained price movements by trading in the direction of a trend. For instance, if gold prices are on an upward trend, some traders look for potential setups when the price pulls back to a support level, anticipating continued momentum—but outcomes are not guaranteed.

2. Breakout Strategy

The breakout strategy focuses on capturing momentum when gold breaks through established support or resistance levels. Breakouts can signal the beginning of a new trend or the continuation of an existing one.

Traders often use technical indicators and chart patterns like triangles, rectangles, and channels to spot potential breakout points. They can manage their risk by placing stop-loss orders just below or above the breakout zone to potentially mitigate risk while allowing traders to capitalise on price movements in either direction.

This strategy is used by some traders to try entering positions early in a potential new trend, though its effectiveness can vary with market conditions.

3. News Trading Strategy

Gold prices are highly sensitive to macroeconomic news and geopolitical developments. The news trading strategy involves reacting to key events such as central bank decisions, inflation data, or geopolitical tensions that can move the XAU/USD pair sharply.

Traders using this strategy keep a close watch on economic calendars and real-time news feeds to anticipate market movements. For example, if the US Federal Reserve signals a potential rate cut, gold prices may rise if lower interest rates reduce the appeal of yield-bearing assets, although price direction is not guaranteed.

News trading requires quick decision-making and solid risk management due to its volatile nature.

4. Position Trading Strategy

Position trading is a long-term approach where traders hold positions for weeks or even months, focusing on broader trends rather than short-term market noise.

This strategy relies heavily on fundamental analysis, including factors like global economic health, inflation trends, monetary policy, and political stability. This approach is used by traders who aim to benefit from larger market moves over time, though it also involves significant risk.

Position trading is typically used by traders with a long-term outlook and interest in macroeconomic trends, but it may not suit all trading styles.

Note: The abovementioned strategies are commonly used by traders and are presented for educational purposes only. They do not constitute trading advice or recommendations.

Trade Gold CFDs with Vantage

There’s plenty to watch out for when trading the XAU/USD CFD pair. Whether you’re trend trading, watching economic data, or holding long-term positions, gold offers unique opportunities in any market condition.

At Vantage, you can consider opening a live account to trade gold CFDs with competitive spreads, flexible leverage, and powerful tools—all in one platform. Learn more about XAU/USD CFDs trading opportunities with Vantage.

RISK WARNING: CFDs are complex financial instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand the risks involved and carefully consider whether you can afford to take the high risk of losing your money before trading.

Disclaimer: The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

References

- “Gold takes a breather after hitting $3,500 on higher stocks, stronger dollar – Reuters” https://www.reuters.com/markets/commodities/gold-maintains-record-rally-following-trumps-criticism-fed-chief-2025-04-22/. Accessed 9 June 2025.

- “How to Start Day Trading in Gold – The Balance” https://www.thebalancemoney.com/how-to-start-day-trading-gold-1031364 Accessed 21 Apr 2022

- “Russia’s central bank says it will stop buying gold at a fixed price – Reuters” https://www.reuters.com/business/russias-central-bank-says-it-will-stop-buying-gold-fixed-price-2022-04-07/ Accessed 21 Apr 2022

- “Dollar jumps to near two-year high as Russia invades Ukraine – Reuters” https://www.reuters.com/world/india/euro-skids-versus-safe-havens-ukraine-tensions-ramp-up-2022-02-24/ Accessed 21 Apr 2022

- “Global banking crisis: What just happened? – CNN Business” https://edition.cnn.com/2023/03/17/business/global-banking-crisis-explained/index.html Accessed 21 Apr 2022

- “NYSE Trading Hours & Market Holidays – TradingHours.com” https://www.tradinghours.com/markets/nyse Accessed 21 Apr 2022

- “What Is a Symmetrical Triangle Pattern? Definition and Trading – Investopedia” https://www.investopedia.com/terms/s/symmetricaltriangle.asp Accessed 21 Apr 2022