The Q2 earnings season has arrived, offering fresh insight into how US corporations are responding to ongoing trade tensions. Following a strong rally from the April “Liberation Day” lows, several major US stock indices have been trading at record highs.

Individual names have also reached new peaks. Nvidia, for instance, recently became the first company to hit a $4 trillion market valuation. The AI chipmaker has played a key role in the recent rebound in US tech stocks.

This increases market attention on the technology and communication services sectors—particularly the megacap firms that tend to lead broader index movements. While the US economy appears resilient amid the current trade environment, investors will be closely monitoring these earnings for signs of underlying strength and forward-looking commentary from CEOs on consumer sentiment and business conditions.

Key Points

- The Q2 US earnings season is expected to influence stock indices and the US dollar, especially through results from major tech firms.

- Market reactions are likely to be driven by how earnings results compare to expectations amid trade policy uncertainty and slower growth forecasts.

- Sector rotation trends highlight strength in technology and communication services, while energy and consumer-related sectors face downward revisions.

Introduction: Why Earnings Season Matters

Earnings season provides valuable insights into US companies, their outlook and sector performance, offering market watchers insight into sector trends and company performance. This period takes place four times a year after each financial quarter finishes. Firms are required to report various important financial data like revenue and profits, from the prior three months.

Earnings announcements often coincide with increased volatility, as market participants react to results that differ from expectations. This will all have an influence on risk sentiment and the major US stock indices.

This year’s second quarter earnings season for the S&P 500 kicks off amid several key market drivers that are likely to influence sentiment and price action. Slowing earnings momentum, ongoing macroeconomic and geopolitical uncertainty and lofty expectations for the tech sector are some of the key ingredients in the investment mix.

Earnings Results vs Market Expectations

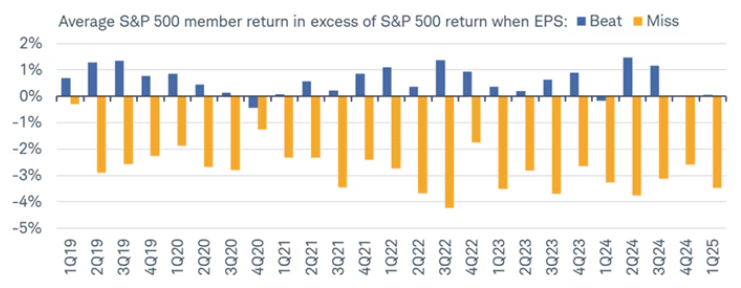

As with most market forecasts, price movements tend to depend on how significantly actual results ‘beat’ or ‘miss’ expectations. In the current environment of ongoing policy and tariff uncertainty, this dynamic is likely to be a key driver of post-earnings price volatility.

Price action on the first trading day after a company’s earnings release often shows asymmetry. Historically, markets have reacted more strongly to earnings ‘misses’, with greater downside risk, than to ‘beats’, where the upside response tends to be more muted.

In terms of stock indices, the S&P 500 is currently trading at around 22 times forward earnings—well above its 10-year average of 18 [1]. This raises questions about whether current earnings growth can support such valuations, or if there is potential for a market correction.

Indices Performance: A Technical View

Positive earnings growth this quarter would mark the eighth consecutive quarter of expansion. However, the estimated year-on-year increase of under 5% would represent the slowest pace since Q4 2023. Meanwhile, forecast revenue growth would extend the streak to 19 consecutive quarters.

From a technical perspective, the weekly S&P 500 chart shows a long-term upward trend, interrupted by periodic pullbacks whenever the weekly RSI exceeded 75—indicating overbought conditions. A more pronounced correction occurred in April following ‘Liberation Day’, with prices falling into oversold territory as the weekly RSI dipped below 25, before staging a sharp rebound.

Sector Impact and Rotation Trends

This earnings season will inevitably see focus turn to the Technology and Communication Services sectors, as they include the megacap ‘Magnificent Seven’ and are expected to show strong year-over-year growth. The tech sector is forecast to report the Q2 earnings growth of 17.7% and Communication Services is expected to surge 31.8% [2].

Notable weakness is predicted in the Energy sector with year-over-year negative earnings growth of 25.4%. The Consumer Discretionary sector is expected to print negative too (-3.5%), along with Materials, Consumer Staples (-2.7%), and Utilities (-0.2%).

USD and Risk Sentiment Correlation

Reports from the largest companies in stock indices like the S&P 500, Nasdaq 100 or Dow Jones Industrial Average can cause their index to sharply rise or fall. This can dictate risk sentiment, either good or bad, which may have an influence on the US dollar.

For example, the Magnificent Seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) have commanded an outsized influence over the broad-based S&P 500 index in recent years, currently accounting about 34.1% of the S&P 500 as of May 2025 [3].

Nvidia and Microsoft each contribute over 7% with the release of the former’s results recently being compared to a major risk event like US non-farm payrolls.

The impact on the dollar has typically been a “risk on” move, with the greenback selling off when these megacap tech titans results were generally seen as positive and beating expectations. In recent years, the misses versus expectations have been more infrequent, which has caused barely a bid to the dollar, except in the very short term.

The safe haven characteristics of the greenback has also been questioned in recent months, essentially due to the uncertainty over US policy making.

Key Takeaways from the last earning season

FactSet states that [4]:

- 78% of S&P 500 companies reported actual EPS above estimate EPS – above the five-year average of 77%.

- The S&P 500 reported growth in earnings of 12.9% – the second straight quarter of double-digit growth.

- The term “tariffs” was mentioned at least once during the earnings conference calls of 427 S&P 500 companies from mid-March through to the end of May.

- 68 S&P 500 companies issued negative EPS guidance for Q1 – above the five-year average of 57.

What to Watch This Earnings Season?

According to LSEG, equity analysts expect S&P 500 earnings to rise 4.8% y/y in the second quarter, down sharply from 13.7% in the first quarter [5]. We note that over recent months, forecasts have been steadily lowered, reflecting caution over tightening financial conditions, and policy and trade uncertainty.

FactSet data states that between March and June, analysts cut EPS forecasts for 10 out of 11 sectors, with estimates falling by 4.4% [6]. Energy and consumer discretionary stocks saw the biggest downward revisions.

However, Lower expectations can sometimes lead to upside surprises in earnings, which may influence investor sentiment— as has historically been the case for S&P 500 firms.

A weaker dollar may support US exporters by making goods more competitively priced abroad, potentially impacting revenues. Cheaper US goods may drive sales abroad, partially offsetting tariff worries.

It is also worth keeping an eye on profit margins. One theory is that tariffs may not initially pass through to inflation if relatively high profit margins are allowed to erode, at least for a time.

As always, guidance from firms will be crucial too, as many companies suspended their guidance during the last earnings season because of uncertainty around the impact of US trade policies. Will this still be the case, or will markets decide to look through some of this as uncertainty is still evident – it promises to be a fascinating earnings season!

RISK WARNING: CFDs are complex financial instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand the risks involved and carefully consider whether you can afford to take the high risk of losing your money before trading.

Disclaimer: The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Reference

- “S&P 500 Needs Profit Boom or Fed Cuts to Justify Lofty Levels – Bloomberg” https://www.bloomberg.com/news/articles/2025-06-25/s-p-500-needs-profit-boom-or-fed-cuts-to-justify-lofty-levels Accessed 17 July 2025

- “S&P 500 EARNINGS SCORECARD – LSEG” chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://lipperalpha.refinitiv.com/wp-content/uploads/2025/07/TRPR_82201_20250716.pdf Accessed 17 July 2025

- “The Magnificent Seven’s Market Cap Vs. the S&P 500 – The Motley Fool” https://www.fool.com/research/magnificent-seven-sp-500/ Accessed 17 July 2025

- “S&P 500 Earnings Season Update: July 11, 2025 – FactSet” https://insight.factset.com/sp-500-earnings-season-update-july-11-2025 Accessed 17 July 2025

- “EARNINGS INSIGHT – FactSet” chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071125.pdf#:~:text=For%20the%20second%20quarter%2C%20S&P%20500%20companies,of%207.3%25%20and%20revenue%20growth%20of%204.8%25 Accessed 17 July 2025

- “Analysts Made Larger Cuts Than Average to EPS Estimates for S&P 500 Companies for Q2 – FactSet” https://insight.factset.com/analysts-made-larger-cuts-than-average-to-eps-estimates-for-sp-500-companies-for-q2 Accessed 17 July 2025