A Volume Footprint chart visualises the distribution of trading volume across different price levels for each candle on a specified timeframe. It is sometimes called a multi-dimensional type of candlestick.

This type of chart allows traders to analyse buying and selling pressure at specific price levels within a candle, offering greater insight into underlying market behaviour.

Key Points

- Footprint charts display volume at each price level within a candlestick, offering deeper insight into market activity.

- They help traders identify imbalances, absorption zones, and institutional moves that may not be visible on standard candlestick charts.

- When combined with other tools on TradingView, footprint charts can enhance trade entries, exits, and overall market understanding.

What Is a Footprint Chart?

A footprint chart shows how much trading happens at each price level within a single candlestick. It helps traders see where buyers and sellers are most active, giving a clearer picture of what’s happening in the market.

Who Uses a Footprint Chart

Footprint charts are useful for traders looking to identify areas of high liquidity or high trading activity. By analysing the interaction between buyers and sellers, traders may uncover potential opportunities within the market.

Does TradingView Support Footprint Charts?

Yes, TradingView supports footprint charts, although access may depend on your subscription level and the data provider you are using. These charts can be accessed through TradingView’s advanced charting features when connected to supported exchanges that offer detailed volume and order flow data.

How to Access Footprint Charts on TradingView

Users with a Premium or higher-tier TradingView plan can view volume footprint charts by selecting the “Volume Footprint” option from the chart type dropdown menu. For those who would like to explore this feature before subscribing, TradingView offers a free 30-day trial of its Premium plan.

Third-party integrations

TradingView and footprint charts can be integrated with third-party platforms. This offers traders access to real-time data and order book information. Enhanced analysis tools and features may also be available, over and above what can be accessed in TradingView. This may give traders a more comprehensive understanding of trading opportunities and market dynamics.

How to read a Footprint Chart?

A footprint chart shows the volume traded at each price level within a candlestick, allowing traders to see where buying and selling activity is concentrated. By highlighting imbalances between buyers and sellers, this can help identify areas of market interest, such as support, resistance, or potential reversals.

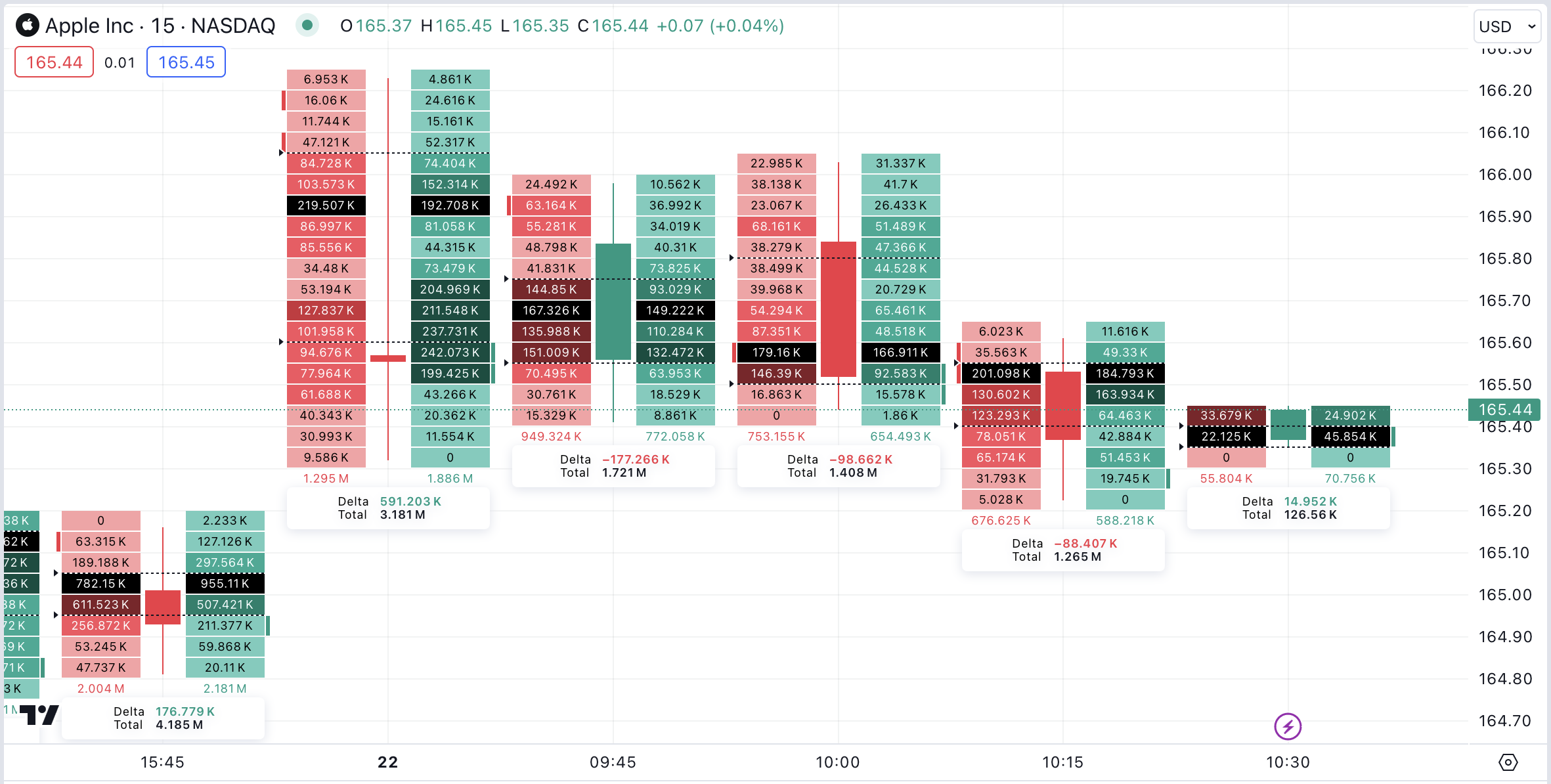

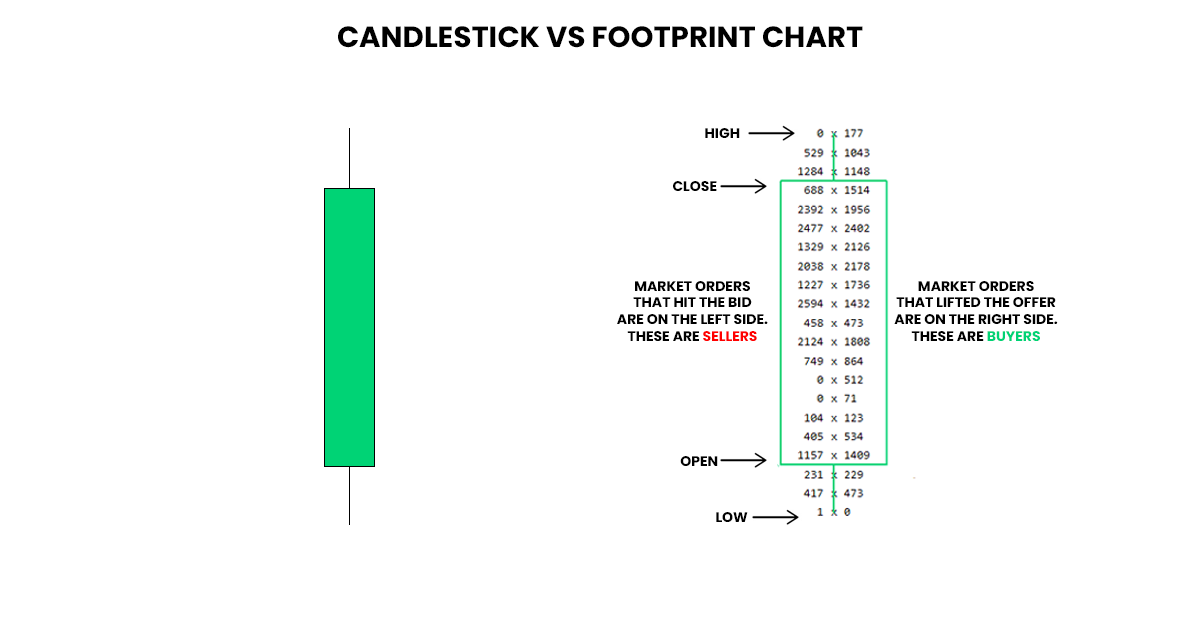

Bid/Ask Volume at Each Price Level

The distribution of seller volume, in red, is on the left of each candle, and the buyer volume, in green, is to the right. Gradient colours show the relative intensity of the volume on each level. Vertical lines are placed beside levels in the distributions to highlight major areas of imbalance.

Delta Analysis

Delta is the difference between buying and selling volume for a particular price. On a footprint chart, both the volume delta and total volume are typically shown below each candlestick.

By knowing the volume differences initiated by buyers or sellers at different price levels, delta can help traders identify which side is showing more aggression. This may assist in confirming the strength or direction of an emerging price trend.

Identifying Absorption or Imbalance

Footprint charts expand on volume within a certain timeframe to help build up a demand picture of buyers and sellers. Two areas which offer analysis are absorption and imbalance.

- Absorption means prices where one side, either buying or selling, ‘absorbs’ the other side’s pressure.

- Imbalance shows lopsided amounts of buying and selling.

TradingView has a feature which specifies the percentage by which buyer volume must exceed seller volume, so as to detect a significant imbalance.

Understanding either of these areas can help traders identify areas of support/resistance or a point that precedes expansion in price. For example, a level where strong buying previously occurred may attract renewed buying interest in the future.

Use Cases for Traders

Footprint charts offer traders deeper insights into market activity by showing how volume behaves at key price levels. These insights can be applied in various trading scenarios to improve decision-making, from identifying breakout strength to spotting potential reversals.

Detecting Breakout Strength

Volume footprint charts help confirm the strength of breakouts by exposing whether institutional money supported the price move.

For example, a resistance level might have been repeatedly tested, forming higher lows which is bullish. When an upside breakout occurs, the volume footprint may show huge buying pressure (positive delta). This confirmation in volume makes the breakout more reliable than just watching price action alone.

Spotting Institutional Moves

Large volumes normally associated with institutional activity can often be seen in block trades. These can be key market moves that are not always apparent through standard price charts alone.

Enhancing Entries/exits

Using volume footprint charts adds another level of information for traders to use in determining their entries and exits into and out of trading positions.

Traders often combine them with traditional technical analysis to identify support/resistance levels. Understanding exactly how buyers and sellers behave at certain price points may enhance trading outcomes.

Footprint Chart vs Traditional Candlesticks

A volume footprint chart is a more detailed form of candlestick that displays trading volume at specific price levels within a given time period. It provides a clearer view of the interaction between buyers and sellers, helping traders better understand market behaviour and dynamics.

In contrast, a traditional candlestick shows only the open, high, low, and close prices, without revealing any information about volume distribution or intrabar transactions.

When to Use Which

Volume footprint charts are particularly useful in highly liquid markets where market structure and volume data are well-established. However, they may be less reliable when applied to thinly traded instruments or assets with limited volume.

It’s also important to avoid relying solely on volume data. Combining footprint charts with other technical tools and price action analysis can provide a more balanced and comprehensive view of market conditions.

Understanding the Value of Footprint Charts

Volume footprint charts can be valuable tools for analysing price structure and understanding the behaviour of buyers and sellers in actively traded markets. By interpreting the pressure between buying and selling activity, traders can gain insights into the factors driving price movements—offering greater context and potentially a strategic advantage.

Open an account with Vantage and create a user profile on TradingView to start exploring these tools in live market conditions.

Disclaimer: This material is provided for educational purposes only and does not take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The views and opinions expressed in this article are those of the interviewee and the author, and do not necessarily reflect the opinions of Vantage. This article is based on information the author considers reliable; however, Vantage does not warrant its accuracy or completeness, and it should not be relied upon as such. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. It may contain historical or past performance data, which should not be relied upon as an indicator of future results. Additionally, any estimates, projections, or forward-looking statements are not guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any jurisdiction where such distribution or use would be contrary to local law or regulation.