-

AllTradingPlatformsAcademyAnalysisAbout

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

What is forex?

Why Trade Forex CFDs with Vantage?

Vantage is regulated in Australia, offering a compliant and secure trading environment for all Australian traders. With Vantage, you can leverage your positions, controlling larger trades with less capital. However, it's important to note that leverage can amplify both potential gains and losses. Forex CFD trading involves risk, with currency values affected by political, global, and economic factors. Vantage provides essential risk management tools, including stop-loss orders and negative balance protection, ensuring a safe and secure trading experience.

For more information on the terminology used in forex trading, see our forex terminology guide.

Ready to get started? Open a live account with Vantage and begin trading forex CFDs today!

Forex Trading Strategies For Beginners

Here are some popular forex trading strategies to consider:

1. Day Trading

Day trading involves entering and exiting trades within the same trading day. The goal is to profit from short-term price fluctuations without holding positions overnight. This strategy works best in volatile markets with clear trends.2. Swing Trading

Swing traders focus on capturing medium-term price movements by holding positions for several days or weeks. This strategy involves technical analysis to identify trends and potential reversals. It's ideal for traders who want to balance between short-term and long-term strategies.3. Trend Following

Trend following is a strategy based on identifying and trading in the direction of the market trend. Traders use tools like moving averages and trendlines to confirm the trend and enter positions in the same direction.4. Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This strategy focuses on fundamental analysis, such as economic reports and geopolitical events, to make decisions.Popular Foreign Exchange Markets

|

Symbol |

Spread |

Commission |

Leverage |

Trade |

|---|---|---|---|---|

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

- |

- |

- |

- |

TRADE FOREX NOW |

EXPLORE ALL CURRENCY PAIRS

Why Trade Forex CFDs with Vantage

-

Over 50+

see more

Currency PairsVantage offers over 50 currency pairs, providing a wide selection for forex traders in Australia to choose from. This allows traders to diversify their strategies and capitalise on various market opportunities.

-

RAW Tight

see more

Spreads AccountForex traders benefit from extremely tight spreads starting from 0.0. This enables traders to execute forex trading at lower cost.

-

Mobile

see more

Trading AccessVantage offers over 50 currency pairs, providing a wide selection for forex traders in Australia to choose from. This allows traders to diversify their strategies and capitalise on various market opportunities.

-

Affordable

see more

PricingExplore the potential of taking both long and short positions across a variety of forex pairs, starting from just $1 per lot, per side on a Raw Premium Account. Learn about our competitive commission fees on our "All Instruments" page.

-

Free Educational

see more

MaterialsVantage places a strong emphasis on education, offering Australian forex traders with free access to comprehensive educational materials through our academy.

-

Trade Bull & Bear

see more

MarketsForex traders at Vantage can take advantage of both bull and bear markets, offering the flexibility to trade in fluctuating market conditions.

-

Risk Management

see more

ToolsVantage equips traders with essential tools such as negative balance protection, price alerts, and stop-loss tools to effectively manage and mitigate risks.

-

Advanced Trading

see more

PlatformsAccess global forex markets with ease through the renowned MT4, MT5, and TradingView platforms, known for their robust features and user-friendly interfaces.

How to Start Forex CFD Trading with Vantage Australia

-

1

Open a Live Account

Sign up with Vantage and complete the verification process for your forex CFD trading account.

Open Account Now -

2

Deposit Funds

Securely fund your trading account using multiple payment options.

-

3

Analyse Forex Markets

Gain insights with Vantage’s advanced tools and charts to identify potential currency pairs to trade via CFDs.

-

4

Open & Monitor Your First Trade

Place your first order by speculating on price movements of CFDs—buy (long) or sell (short).

-

5

Close Your Position to Complete the Trade

Exit your forex trade to realise potential profits or manage risk.

Award-Winning Broker

-

Best Broker

AustraliaInternational Business Magazine

-

Best Customer

Support AustraliaInternational Business Magazine

-

Best Overall Broker –

AustraliaInternational Business Magazine

Trade Forex CFDs On Different Types of Trading Platforms

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

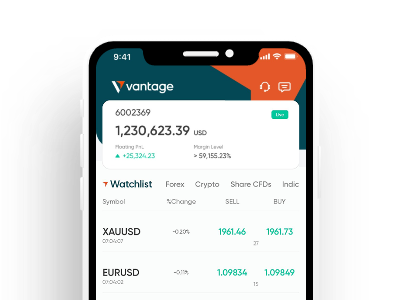

Vantage Mobile App

- 55 deposit methods globally

- 220+ daily product analysis

- 16 TradingView indicators

- 80,000+ copy traders

Choose a Trading Account Based on Your Experience Level

-

1

Novice

-

2

Experienced

-

3

Professional

High Volume Traders

- For traders looking for low and competitve commission, with only $1 per standard FX lot per side.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account with an extensive choice of deposit methods.

-

3

Trade

Trade with spreads starting as low as 0.0 and gain access to over 1,000+ CFD products.

Frequently Asked Questions

-

1

Is forex trading an option for beginners?

Forex trading can be an appealing option for beginners who are eager to learn and understand the currency financial markets. This is because the forex markets can be traded with small amounts of capital, as the use of leverage allows traders to control larger positions, with limited capital. Traders can also trade small lot sizes, starting from 0.01 lot.

Moreover, the forex market is easily accessible online, allowing beginners to trade conveniently from anywhere with an internet connection. Brokers like Vantage also provide educational resources ranging from online courses, webinars and educational articles. These resources can help beginners to learn about trading fundamentals, technical analysis as well as the tools and indicators used in forex trading.

By dedicating time to learning and practising, beginners can build a solid foundation and improve their trading skills. However, it is important for beginners to exercise caution and conduct their own due diligence before engaging in any trades. Like any form of trading, forex trading carries inherent risks, particularly if you trade with leverage. Here’s a beginner’s guide to trading forex. -

2

How do I start trading forex as a beginner?

Beginner can start forex trading with just a few simple steps:

1. Find a reliable broker to trade with

As a beginner, you can do your own research on the offerings of different brokers, including their account options and the features of their trading platforms. This will help you to find the one that best suits your needs and preferences.

Some key factors to look out for in a broker include:

- Low fees

- Wide variety of trading products

- Fast execution speed

2. Open a demo account

Practise trading forex on the demo account offered by the broker. This allows beginners to gain trading experience by making trades using virtual credit.

Alternatively, if you’re a seasoned trader, you can go straight to opening a live account with Vantage.

3. Educate yourself on forex trading

Take advantage of online courses, webinars, and educational articles offered by the broker. Use this opportunity to learn and enhance your knowledge about forex trading. Visit Vantage Academy for the latest forex trading articles.

4. Open a live account and start trading

Once you feel confident enough to trade the live markets, open a live account with the broker and fund your account to start trading forex.

-

3

Can I start forex trading with a small amount like $100?

Yes, it is possible for you to start trading forex with as little as USD$100. Many brokers like Vantage offer trading accounts that allow traders to start with a small initial capital.

With a Vantage live account, you have the option to begin trading with a minimum deposit of USD$50. However, the specific amount required to trade forex will vary based on factors, such as the type of forex pairs, leverage employed, and your personal risk tolerance. -

4

What are the pros and cons of forex trading?

Forex trading offers some unique advantages:

a). 24-hour market

Enjoy the convenience of round-the-clock trading with the forex market. Unlike stock or commodity markets, it operates 24 hours a day, five days a week, allowing you to trade at your preferred time, whether it's morning or night.

b). High liquidity

The large trading volume in the forex market represents high liquidity for traders. This also means there are a large number of buyers and sellers at any time of the day. So, under any usual market conditions, you can instantly open or close your trade.

c). Low trade costs

Forex markets typically have very narrow spreads – the difference between the bid price and the ask price and what a broker will charge. This reduces the costs you incur for your trade, leading to potential greater profit margins.

d). Leverage

Traders have the option to utilise leverage, which allows them to amplify their trading potential beyond their initial deposit. Leverage enables traders to open positions in the forex market by providing only a fraction of the total value of the position upfront.

Read more about the advantages of trading forex here.

-

5

What is leverage in forex trading and how does it work?

Leverage is a tool that allows traders to control larger positions using a smaller amount of capital. This is usually expressed as a ratio, such as 50:1, where the first number represents the amount you can control, and the second number represents the capital you have.

To illustrate this concept, let's have a look at an example:

Imagine you have $100 and use a leverage of 50:1. With this leverage, your $100 investment can control a position valued at $5,000. This means that you can potentially take advantage of the price movements of a much larger position than you could not have accessed with your initial capital alone.

However, please bear in mind that leverage is a double-edged sword, as it not only magnifies potential profits but also amplifies potential losses. To gain a deeper understanding of how leverage operates in forex trading, you can learn more here. -

6

Which is better for beginners? Forex or Stocks?

Both forex and stocks have their pros and cons. Forex trading offers benefits such as a 24-hour market, high liquidity, and lower entry costs. Stocks, on the other hand, provide opportunities to invest in well-known companies. Trade popular US shares like Palantir and Nvidia with $0 commission today.*

*Other fees may apply.

At Vantage, you can trade both forex and stocks via CFDs with our user-friendly platform, educational resources, and competitive spreads. -

7

How many hours a day can you trade forex on Vantage?

At Vantage, you can trade forex 24 hours a day, 5 days a week. The market opens Sunday evening (GMT) and closes Friday night (GMT), giving you flexibility to trade at any time. -

8

When not to trade forex?

Avoid trading forex during:

- Low liquidity periods (e.g., weekends or major holidays).

- High-impact news events (e.g., economic reports or central bank announcements), as volatility can be unpredictable.

- When you’re unsure or unprepared—always trade with a plan.

-

9

Which currency pairs are best to trade?

Beginners can consider trading major pairs like EUR/USD, GBP/USD, and USD/JPY. They are highly liquid, have tight spreads, and are potentially less volatile compared to exotic pairs. However, the ‘best’ currency pair to trade varies based on an individual’s goals, risk appetite and other factors.

At Vantage, you can trade a wide range of currency pairs via CFDs with competitive pricing and fast execution.