‘Animal spirits’ evident as crypto and small caps surge

* More record closing stock indices highs, Russell 2000 jumps again

* Dollar slides again on political heat and Fed rate cuts bets

* Trump agreed only Ukraine can negotiate territorial concessions

* Bitcoin and Ether close to fresh record highs above $122,000 and $4,700

FX: USD slid again as political pressure on the Fed to cut rates ramped up in various guises. President Trump said he might allow a lawsuit against Chair Powell to proceed concerning the Fed refurb, Treasury Secretary Bessent called for a series of rate cuts and a 50bp move next month, while the new likely BLS head suggested ditching monthly NFP reports for more accurate quarterly ones during a methodology review period. This all begs questions around Fed independence, data integrity and ultimately increased politicisation. Rate cut expectations increased with 70bps+ now predicted by year end with just three FOMC meetings remaining in September, October and December.

EUR was mid to lower pack against its peers. The major reclaimed 1.17 though gave back some gains in the US session. The initial move was driven mostly by dollar weakness more than any euro news or relative strength. Central bank divergence is also playing out. Soft ZEW German business data didn’t stop the bulls.

GBP is currently the strongest major on the week and month. Solid jobs data and the reining in of BoE rate cut bets, versus more Fed easing is boosting sterling. In fact, the US-UK spread has hit a fresh three-month high. Cable has reached the late July highs around 1.3584/8 which could offer resistance, but momentum is firmly bullish.

JPY strengthened again but the major remains in its range seen over the past week or so. Domestic developments have been limited, so softer US rate expectations and narrower US-Japan spreads are helping the yen.

AUD was bid on the positive risk mood. Focus is on job figures out today. CAD underperformed again even though there’s positive risk appetite and narrower US/Canada spreads.

US stocks: The S&P 500 printed up 0.32% at 6,466. The Nasdaq settled higher, by 0.04% at 23,849. These were both record highs just after the open, with gains given up thereafter. The Dow Jones finished up at 44,922 gaining 1.04%. The DJIA is near is record high just above 45,000. Megacap tech stocks struggled for once, with sector gains led by defensives like healthcare, materials and consumer cyclicals. Palantir and Meta closed lower by 1.4% with Microsoft the leading laggard, off 1.6%. AMD was the standout tech leader, jumping 5.4%. Investors will check out PPI data and also the weekly initial jobless claims figures which continue to add to the picture of a ‘low firing, low hiring’ labour market.

Asian stocks: Futures are mixed. APAC equities were mostly higher after US inflation data boosted Fed rate cuts and US stocks indices hit record highs. The ASX200 was the outlier and underperformed with financials and utilities dragging, the former hit by disappointing CBA results. The Nikkei 225 continued higher for a sixth straight session above 43,000, driven by chip-related exporters. The Shanghai Comp and Hang Seng rallied on optimism over the extended tariff truce and on noise around Chinese officials supporting consumption.

Gold traded just above the 50-day SMA at $3,355 supported by the in-line CPI print underpinning hopes for a September Fed rate cut. Gold-backed holdings in ETFs rose to a fresh two-year high.

Day Ahead – Australia Jobs, UK GDP

Expectations are for a recovery in Australia employment growth of 25k, after the flat prints in May (-1.1k) and June (+2.0k). Those two months do point to obvious employment growth weakening in the quarters ahead. That said, jobs data is volatile, so a likely gradual softening trend is in play. Unemployment is forecast at 4.2%, after jumping up to 4.3% in June. The jobless rate had held steady at 4.1% for five straight months, with notably youth unemployment surging. Economists say that sharp moves like this precede grinds higher in total unemployment. The RBA didn’t recently impact AUD too much, with more rate cuts data dependent but priced in by money markets.

UK GDP for June m/m is predicted to print at 0.1% from -0.1% in May, which came after a -0.3% reading in April. Industrial production fell for a third month while services rebounded strongly after a decline in May. The quarterly reading is forecast at 0.1% from 0.7% though revisions to previous data could change that. The first quarter was boosted by front-loading exports ahead of US tariffs. Annual growth could be a touch higher than the OBR’s 1% estimate.

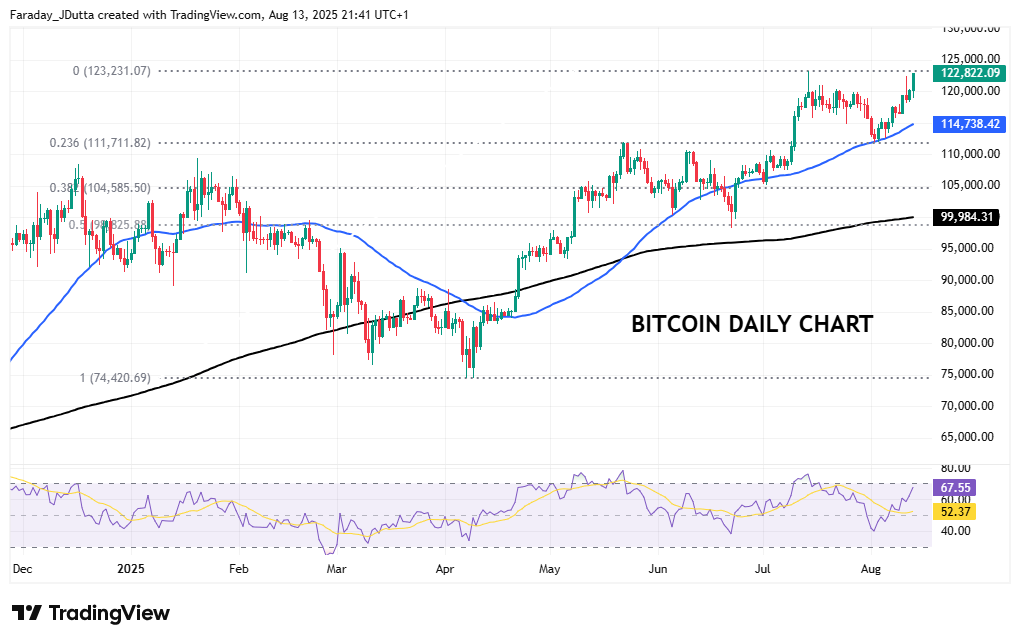

Chart of the Day – Bitcoin eyes fresh highs

The world’s most popular cryptocurrency is nearing record highs made last month at $123,231. Bullish sentiment has picked up again this month after prices found support at the May top at $112,000 and the 50-day SMA, now at $114,725. Real world adoption and capital confidence have been key. President Trump has signalled that BTC will be included in 401k retirement portfolios. This opens up possibly $9trn of new capital investment. Rising institutional demand underpins support for Bitcoin too, with ETF fund inflows continuing to hit record levels. Interestingly, the BTC Fear & Greed Index is not overblown, and not levels at previous all-time highs.