ASX Heavyweights in Focus: Can CBA, BHP, and WOW Keep the Momentum?

Three of Australia’s market giants, namely Commonwealth Bank of Australia (CBA), BHP Group (BHP), and Woolworths Group (WOW), are making waves on the ASX, and many market participants will want to watch out for their next moves closely. They sit in different corners of the economy in banking, mining, and retail, but all three have had notable developments worth a closer look.

CBA – Australia’s Banking Giant

CBA has been on an impressive run, pushing past the A$300 billion market cap briefly in June 2025 after a share-price surge in the past year. In the half-year up to December 2024, the bank posted A$5.14 billion in cash net profit, up 6.3% year-on-year, with total operating income climbing to A$14.1 billion.

Margins remain strong, and return on equity sits at 13.7%. As the leading stock on the ASX, its next move on earnings and dividend payouts will be closely watched as Australia’s dominant mortgage lender could also reveal indications of how resilient the Australian housing market is. CBA is expected to pay a final dividend of $2.58 per share, which would bring the full-year payout to $4.84.

CBA is showing some potential for a bullish turnaround, as MACD is showing a bullish crossover that could be an early signal for a bullish pivot. As the price continues to hover above the $167.50 support level, which is in line with the 50% Fibonacci Retracement and 78.6% Fibonacci Extension levels, we could see a push higher in price towards the next resistance at $191.50, in line with a swing high resistance and 61.8% Fibonacci Extension.

However, a convincing break and close below the $167.50 support could send the price lower towards the $157.00 support level, in line with an area of strong Fibonacci confluence. Any further downside from here could mean that bullish momentum has failed to take hold of CBA’s stock price.

BHP – Mining Looks to Maintain Momentum

BHP’s shares are sitting around A$40, up nearly 15% from April’s lows but still down a few percent compared to last year. The mining giant’s dividend yield is a healthy 4.7% – 4.8%, even after cutting its interim payout to the lowest in eight years. Management is keeping more cash in-house to fund big projects, hence projections for the mining giant are expected to be more reserved compared to other companies. Nevertheless, BHP’s mix of income and potential value appeal could be interesting, even as commodity price swings remain the key driver of volatility.

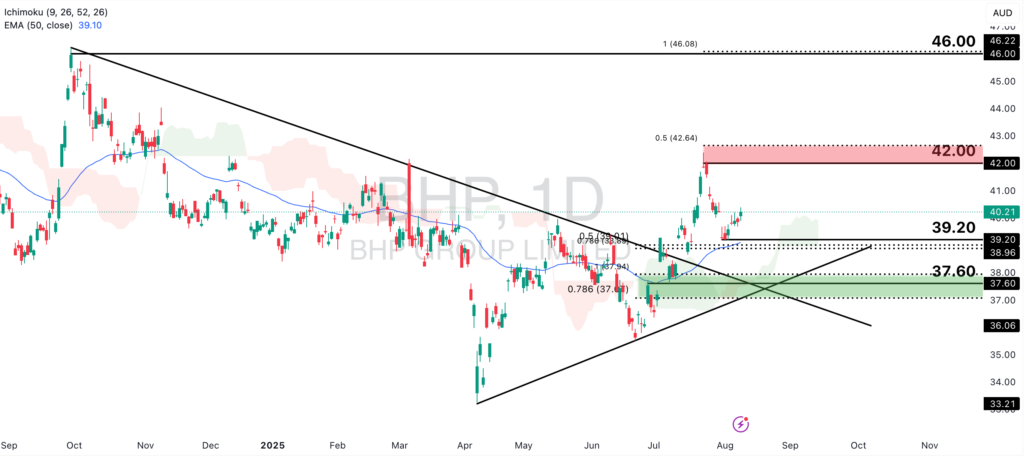

BHP’s stock price has recently seen a bullish breakout above the descending trendline resistance, and is now holding above the Ichimoku cloud and 50-EMA, indicating that bullish momentum is in effect. As the price continues to hold above the $39.20 swing low support, we could see a further leg to the upside, towards the $42.00 swing high resistance, in line with the 50% Fibonacci Extension level.

However, we could potentially see the price make a deeper retracement closer to the ascending trendline support, nearer to the $37.60 support level, in line with an area of strong Fibonacci confluence.

WOW – Trouble Brewing in the Retail Space

WOW has been facing troubles, as group sales rose 3.7% in the first half of FY25, but profit took a hit, dropping by a whopping 20.6% to A$739 million while and EBIT fell 14.2%. Chief executive Amanda Bardwell said that group was aiming to achieve A$400 million in cost savings and would achieve that by examining how Big W and its New Zealand supermarket arm could “reach their full potential” over the next 3-5 years. For the retail crowd, this could mean some slowdown and tepidness over the company’s projections in the short to medium term, even as WOW maintains its spot as an incumbent retail powerhouse.

WOW’s stock price is testing both the descending trendline resistance and Ichimoku cloud. A rejection at this level could mean that bearish momentum continues to hold, and the price could push lower towards the $30.60, in line with the 50% Fibonacci Retracement and 61.8% Fibonacci Extension levels, and even further towards the $29.00 support level.

However, a convincing break and close above the descending trendline resistance could mean that there was a change in the bearish trend. Here, we could potentially see the price move slightly higher towards the $33.30 swing high resistance level, in line with the 50% Fibonacci Extension level.

For the retail audience, these three are more than just household names. They can be seen as bellwethers for the broader Australian market. CBA offers momentum, BHP offers yield with cyclical upside, and Woolworths is a turnaround story in motion. Keep an eye out for next earnings reports and management comments that could reveal more about the company’s outlook.