Aussie Alert – Are RBA Rate Cuts Incoming?

The Australian economy is losing steam, and this has huge implications for both the Aussie and the Reserve Bank of Australia (RBA). June’s employment report revealed a surprise dip in Australian jobs, with net employment falling by 2,500, a far cry from the expected 22,500 increase. The unemployment rate held at 4.1%, but underemployment ticked higher, signalling softening labour demand. Meanwhile, retail sales also saw a fourth consecutive month of soft prints.

On top of that, inflation is dropping faster than expected. May’s monthly CPI came in at just 2.1% YoY, comfortably within the RBA’s target range. This paves the way for the RBA to cut the cash rate further in a bid to revive economic momentum. The RBA’s tone has already turned more dovish, pointing to weak household consumption and improving inflation metrics as justification for further rate cuts.

What could this mean for the Australian dollar (AUD)? Fundamentally, lower cash rates spell trouble for the AUD as it represents a narrowing interest rate differential with other currencies, eroding its attractiveness and reducing demand. However, AUD continues to benefit from the general risk-on sentiment alongside other commodity currencies, as well as a systematic shift away from the U.S. dollar worldwide.

Going forward, keep an eye on the market’s appetite for risk. With U.S. stock indices continuing to scale new highs on upbeat expectations that the worst is behind us, we could be seeing continued bullish momentum for commodity currencies like the AUD.

However, any shock to the financial markets could suggest more trouble is on the horizon. With President Trump at the helm in the White House, market sentiment remains unpredictable, especially with looming tariff risks. The deadline for tariff hikes, originally set for July 9, has now been delayed to August 1. While this provides a brief reprieve, the uncertainty around new tariff rates, particularly the possibility of additional duties on countries aligning with BRICS, could continue to stir market volatility.

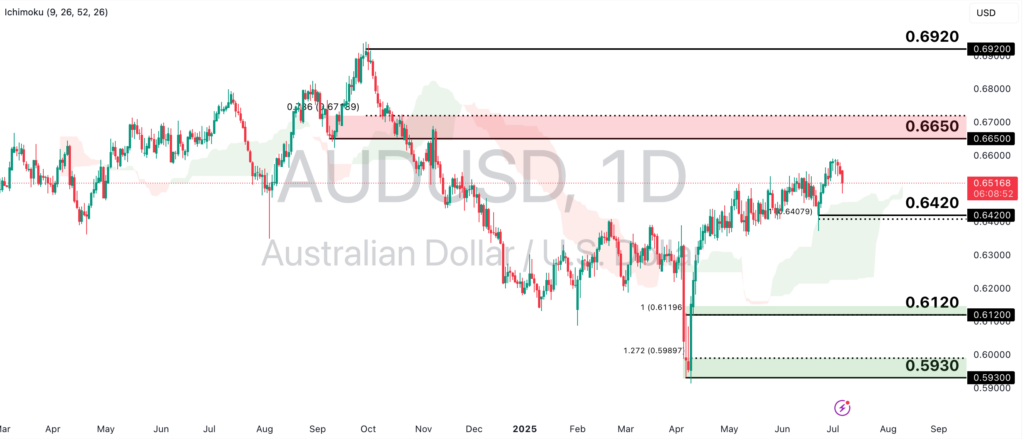

AUDUSD: Bullish Momentum Building

AUDUSD is now trading above both the Ichimoku cloud and 50-EMA, indicating a shift towards a bullish trend. Further bullish momentum could see the price move towards the 0.6650 resistance, in line with the 78.6% Fibonacci Retracement level. A clear break and close above this level would see the price approach the next 0.6920 swing high resistance.

On the flip side, a throwback could prompt a retest of the 0.6420 swing low support, which aligns with the 100% Fibonacci Extension level. A decisive break below this support could signal a pause in the bullish momentum and a potential move lower.

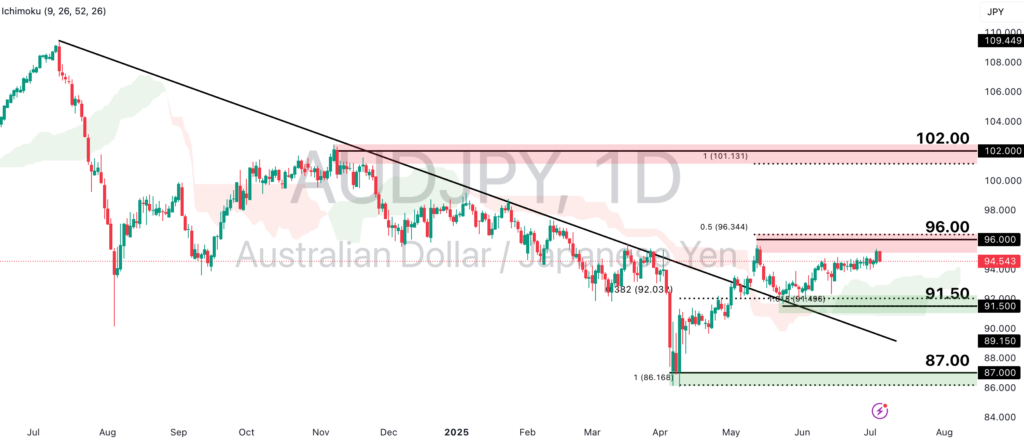

AUDJPY: Above Key Breakout Levels

AUDJPY has staged a strong bullish breakout, retesting the descending trendline resistance, and is now trading above the Ichimoku cloud. As it retests the 96.00 resistance, in line with the 50% Fibonacci Extension level, a convincing break and close would see the price move higher towards the 102.00 swing high resistance, in line with the 100% Fibonacci Extension level.

However, a rejection at the 96.00 resistance would likely see the price pull back and retest the 91.50 support, in line with the 38.2% Fibonacci Retracement and 161.8% Fibonacci Extension levels. Any deeper retracement would see the price approach the 87.00 swing low support, in line with the 100% Fibonacci Extension level.

AUDCAD: Nearing Overbought Territory

AUDCAD is edging closer to overbought levels, with the Stochastic Indicator showing signs of reversal from the 58.00 resistance. The price is likely to re-approach the 0.8800 swing low support, which is in line with the 38.2% Fibonacci Retracement and 78.6% Fibonacci Extension levels. A break below the 0.8800 support could prompt a steeper decline toward the 0.8500 swing low support, in line with the longer-term 78.6% Fibonacci Extension level.

However, if demand for the Aussie resurges, the price could rally toward 0.9010 and 0.9130 swing high resistances, which align with the 61.8% and 127.2% Fibonacci Extension levels, respectively.

The AUD could stay in demand as long as global risk sentiment remains upbeat. However, evolving geopolitical risks, particularly around tariffs, may temper its gains. As the market digests potential shifts in trade policies and new tariff hikes, any escalation in tensions may introduce volatility. Additionally, keep a close watch on both domestic and global monetary policy shifts for clearer signals on the Aussie’s direction.