Bearish or Bottoming? Traders Eye U.S. Dollar’s Next Move

The US dollar has been on shaky ground, weighed down by challenges including volatile trade policies, an unpredictable Trump administration, and waning confidence in US government creditworthiness. Since Trump returned to the White House, the US dollar has been on a steady decline, a trend many traders expect to continue, especially amid speculations that the Trump administration may favour a weaker greenback.

The latest move by President Trump to delay the imposition of 50% tariffs on the European Union (EU) until 9 July did little to support the U.S. dollar. Instead, the greenback slid to its lowest level in over a year, underscoring how headlines are now driving market flows.

Adding to the pressure, trade diplomacy outside the US appears to be gaining traction. China and the EU are stepping up their engagement, with trade chiefs from both sides scheduled to meet again early next month. While these diplomatic moves may help ease trade tensions globally, they could also dent the US dollar’s appeal further, especially as confidence shifts toward other major economies and their currencies, following signs of strengthening economic alliances.

On the fiscal front, renewed discussions around a new stimulus package, dubbed the “Big Beautiful Bill” are also raising eyebrows. Markets are increasingly concerned that increased government spending could widen deficits, potentially sparking fresh fears around the long-term sustainability of US debt.

Economic data has not helped sentiment either. April’s US CPI showed inflation easing slightly to 2.3% year-on-year, down from 2.4% in March, a modest improvement, but far from a turning point. The US labour market also showed signs of strain. Nonfarm payrolls rose by 177,000 in April, surpassing expectations but still falling short of the previous month’s figure.

Meanwhile, the Fed maintained a cautious tone, lowering the likelihood of quick and aggressive interest rate movements. As widely expected, the Fed kept the Federal Funds Rate unchanged at 4.25% – 4.5% in the latest meeting, citing mixed economic signals. The central bank’s “wait-and-see” stance suggests that monetary conditions are likely to remain tight in the near term, adding another layer of complexity for markets already grappling with political and fiscal uncertainty.

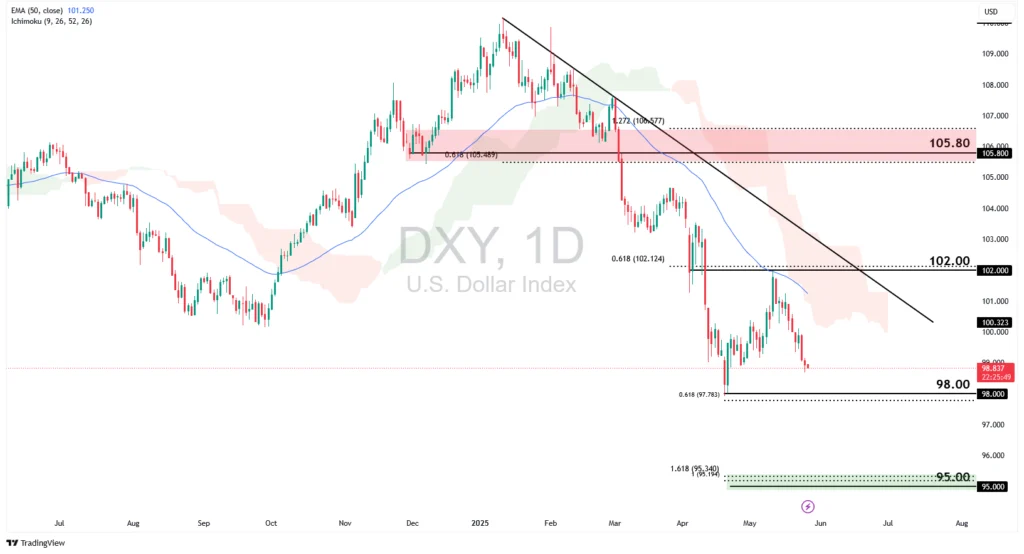

DXY – Bearish momentum continues to take hold

The US dollar index (DXY) has been sliding since the start of the year, driven by reduced demand for US assets and rising doubts over the dollar’s safe-haven appeal. These concerns have grown more pronounced as institutional investors, including pension and endowment funds, reassess their exposure to US dollar-denominated assets due to concerns about rising hedging costs, US fiscal policy and debt sustainability. Going forward, it seems as though a bearish environment for the DXY remains likely.

However, the DXY may find some room for recovery due to seasonal factors. This week marks the corporate month-end, a period when demand for the US dollar typically rises as US companies repatriate overseas profits for reporting purposes. Additionally, the S&P 500 historically performed better between May and July, which could further support the U.S. dollar’s demand. Despite this seasonal boost, it is unlikely to fundamentally change the broader negative outlook for the US dollar.

DXY’s price action remains firmly bearish, as it continues to trade below key technical indicators: the Ichimoku cloud, the 50-day EMA, and the descending trendline. A decisive break and close below the 98.00 swing low support, aligned with the 61.8% Fibonacci Extension would signal a continuation of the downward trend. If this occurs, the price could further test the 95.00 support level, which corresponds to both the 100% Fibonacci Extension and the 161.8% Fibonacci Retracement levels.

On the other hand, a deeper pullback could push the price to retest the descending trendline and the horizontal resistance at 102.00, near the 61.8% Fibonacci Retracement level. A successful break above this level could indicate a potential trend reversal, with the next resistance zone to watch at 105.80, aligning with the 61.8% and 127.2% Fibonacci Retracement levels.

XAUUSD – Gold continues to shine

Gold continues to benefit from ongoing uncertainty and volatility in global financial markets. This trend is further reinforced as central banks worldwide increasingly view gold as a reliable alternative to the US dollar during times of market uncertainty. However, traders should remain vigilant and closely monitor gold demand as the price approaches new highs.

XAUUSD continues to hold above the Ichimoku cloud and 50-EMA after the price bounced off the $3,150 support zone, in line with both the 61.8% Fibonacci Retracement and Extension levels. With the continuation of bullish momentum, we could potentially see the price retest the $3,450 swing high resistance, in line with both 61.8% and 161.8% Fibonacci Extension levels. If the rally continues, XAU/USD could climb toward a new high at $3,650, which aligns with the 100% Fibonacci Extension.

However, if the price breaks and closes below the $3,150 support, a deeper retracement could be on the cards. In that scenario, gold may retest the $2,970 support zone, corresponding to the 127.2% Fibonacci Extension level.

Traders should keep a close eye on key data releases this week, including the core PCE report and FOMC minutes, as well as the upcoming US 2-year and 5-year treasury note auctions, especially amid recent concerns around US government debt. For now, unless the narrative changes significantly, bearish sentiment could continue to dominate the US dollar.