BoE cut but vote split raises doubts over more easing

* Nasdaq hits record closing high, but Eli Lilly plunges

* Waller now seen as the current frontrunner for the next Fed Chair

* GBP surges on ‘hawkish cut’, split MPC and concerns about persistent inflation

* Gold rises on Fed rate cut expectations and safe haven demand

FX: USD sold off for a second day as it dipped below the 50-day SMA at 98.21. The dollar initially went bid on reports Waller was favoured for the next Fed chair, before giving up gains on the appointment of Stephen Miran to fill a short-term void as a Fed Governor. There are seemingly three in the running for the Fed chief spot – the two Kevins, Hassett and Warsh, and Waller. The former is seen a more dovish than Kevin Warsh. Initial jobless claims data was very slightly worse than expected.

EUR printed a rare doji candle with prices closing modestly higher and in the middle of the days’ range. Optimism over supposed peace talks next week between President Trump and Putin are feeding into euro strength. Any kind of truce should give further legs to the rebound from support around 1.14 and the big bounce after NFP last Friday. The euro could now be well supported on dips with intraday trends bullish.

GBP outperformed after the BoE cut rates as expected to a two-year low but on a revote after the first round failed to reach a majority – the first time ever that has happened. Within the statement, the central bank reiterated “careful” and “gradual” language surrounding monetary policy, but omitted language that “monetary policy needs to remain restrictive”. Ultimately, this hinted that the easing cycle could be nearing its end. Persistent inflation is worrying officials with the headline print way higher than target. Bets on more rate cuts got pared back – 19bps by year end versus 24bps before the cut – with cable currently enjoying five straight days of buying.

JPY moved higher and the major lower, but it found support around a major Fib level just above 147. The latest domestic wage data saw labour cash earnings rise more than expected.

AUD and NZD both rose as they were supported by Chinese trade overnight, positively surprising on growth in imports and exports. CAD was flat versus the dollar with eyes on Canadian jobs data released later today.

US stocks: The S&P 500 printed down 0.08% at 6,340. The Nasdaq settled higher, by 0.32% at 23,390. That was a record closing high. The Dow Jones finished down at 43,969, losing 0.51%. Defensive names generally outperformed with Utilities and Staples leading gains, albeit healthcare lagged. That was partially down to Eli Lilly which tumbled more than 14% after its weight loss pill underwhelmed in late-stage trials. Intel fell over 3% on criticism to their CEO from President Trump who cited concerns over his ties to Chinese firms. Apple jumped another 3.2% as it pledged another $100bn investment in the US. Trump has largely exempted industry heavyweights from hid 100% chip tariff threat. The 200-day SMA sits just above at $221.13.

Asian stocks: Futures are mixed. APAC equities were again mixed after reciprocal tariffs took effect overnight, though tech boosted most indices as the region’s largest chipmakers were expected to win tariff exemptions. The ASX200 pulled back from record highs despite the surprising growth of imports from Australia’s biggest trading partner. The Nikkei 225 reclaimed the 41k mark amid a busy slate of company earnings. The Shanghai Comp and Hang Seng were very marginally in the green. Pharma names dragged in the latter. Mainland China saw muted trading after July trade data showed stronger than expected exports and surprise growth in imports.

Gold broke higher after a couple of days of consolidation. The downward trendline from the record $3,500 top comes in around $3,418.

Day Ahead – Canada jobs

Canada’s monthly employment report gets released later today, with some give back likely on the bumper 83k jobs added in the prior print. Employment increases in June in wholesale and retail trade, plus in the tariff-exposed manufacturing sector, saw the first net increase in new jobs added since January.

But unemployment remains elevated at 6.9%, with more weakness potentially in industries sensitive to trade. Most firms in Canada continue to say they will look through tariff effects at least for some time while retaining staff. Weather effects might continue to be positive after relatively high hours lost due to weather in May and June.

The next BoC meeting is on September 17, and there is another labour force survey plus two inflation data releases to come before that decision. Trade policy deadlines will also be significant with talks ongoing between the two sides.

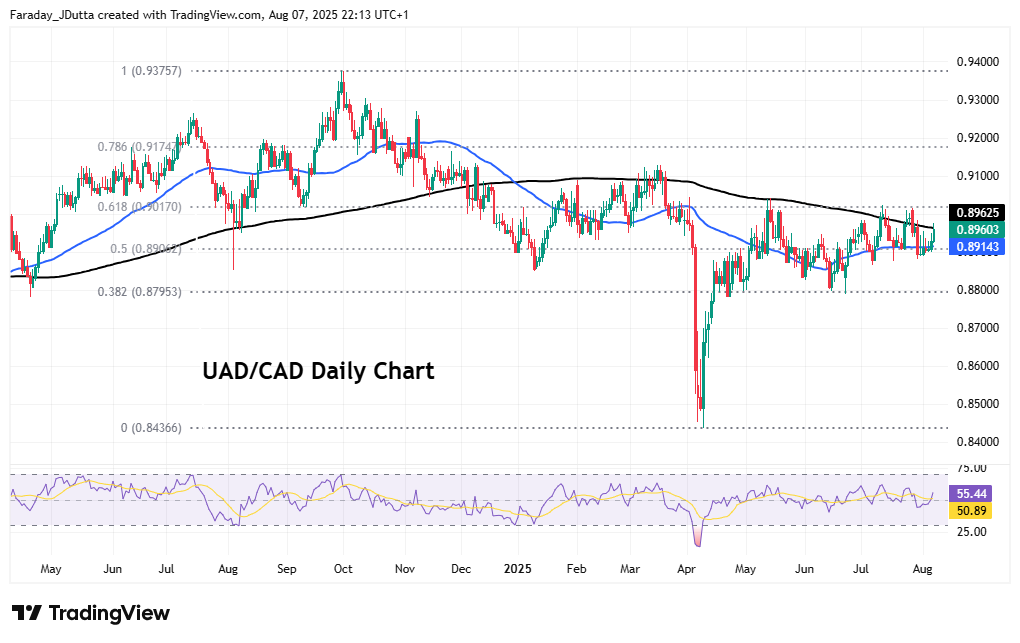

Chart of the Day – AUD/CAD currently rangebound

This pair is one of the most popular to trade at Vantage. The battle between two heavyweight commodity dollar currencies has kind of been at a stalemate recently. Prices have tracked sideways between 0.89 and 0.90 more or less, for several weeks. Support has been found at the 50-day SMA at 0.8914 and also the halfway point of the September to April move at 0.8906. But moves to break higher have stalled at the 200-day SMA at 0.8962. Above here is a major Fib retracement level (61.8%) at 0.9017.