BoE Rate Cut Incoming? The Pound’s Pain Deepens

The pound slumped in July, marking its worst monthly performance since September 2022, as concerns over the UK’s fragile economic outlook and fiscal position continued to dampen sentiment. The UK’s GDP contracted by 0.1% MoM in June, missing expectations for a 0.1% increase. Labour market data also disappointed, as the ILO unemployment rate rose to 4.7% in June, higher than the 4.6% forecast.

Inflation, however, painted a more persistent picture. Headline CPI rose by 3.6% YoY in June, surpassing the 3.4% forecast, suggesting that price pressures may not be fading as quickly as policymakers had hoped. Still, with sluggish growth and deteriorating labour dynamics, the Bank of England is widely expected to cut interest rates by 25 basis points at its August meeting, bringing the benchmark rate down to 4%.

The FTSE extended gains in July, buoyed by strong corporate earnings, even as some major miners such as Antofagasta, Anglo American, Glencore, and Rio Tinto retreated from recent highs. This followed an unexpected move by US President Donald Trump to exempt refined copper from fresh US tariffs, unwinding a previously priced-in premium and sparking volatility across global commodities.

Market sentiment around the UK remains bearish, with traders increasingly sceptical about the country’s growth prospects. BoE Governor Andrew Bailey signalled a dovish shift, stating that the central bank would be ready to ease further if the job market shows more signs of softening. Markets are now pricing in one more rate cut by year-end.

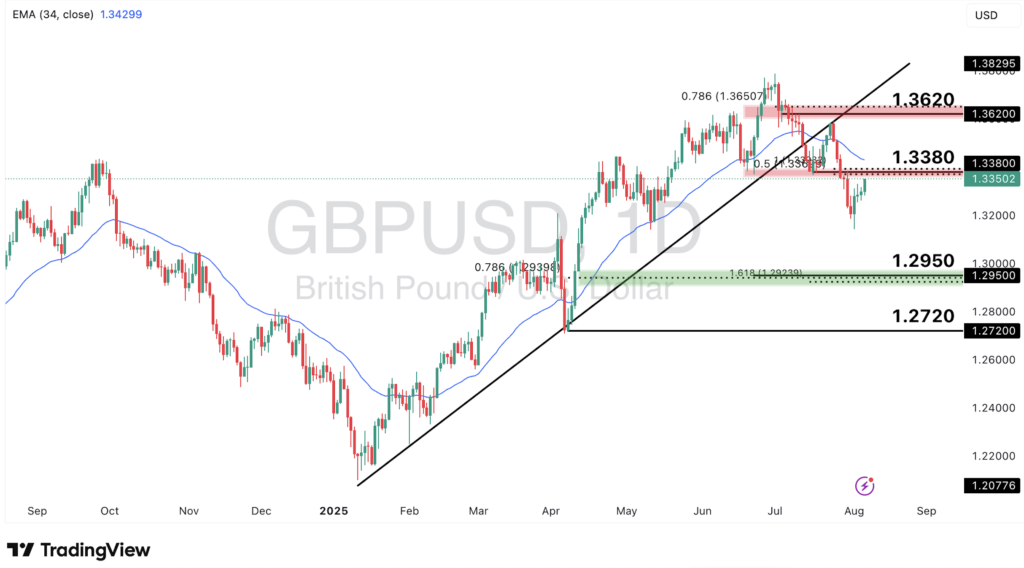

GBPUSD Slips Below Key Support, More Downside Ahead

GBPUSD is now trading below the ascending trendline and the 34-EMA, indicating continued bearish momentum. Further downside could see the price move towards the 1.2950 support level, in line with the 161.8% Fibonacci Extension and the 78.6% Fibonacci Retracement levels. A clear break and close below this support could pave the way for a deeper move towards the 1.2720 swing low support.

However, a pullback in price could see GBPUSD retest the 1.3380 level, which serves as a near-term pullback resistance. A stronger corrective move may drive prices higher towards the 1.3620 resistance level, aligning with the 78.6% Fibonacci Retracement and the previous swing high.

GBPJPY Continues to Consolidate Near the Top of the Range

GBPJPY is currently trading within a broad consolidation range between 187.80 and 199.50. The price has recently rejected the 199.50 resistance level and closed below the 34-EMA, indicating a potential shift toward bearish momentum. If this momentum continues, we could see a move towards the 192.50 support level, which aligns with the previous swing low and the 161.8% Fibonacci Retracement level. A clear break and close below this level may drive the price lower toward the support at 187.80.

On the flip side, a decisive break above the 199.50 resistance level could trigger renewed bullish momentum, potentially driving the price above the psychological 200.00 level, with a breakout paving the way for further gains toward the 204.20 resistance. However, until a breakout occurs, GBPJPY is expected to continue showing weak directional conviction while trading within the established range.

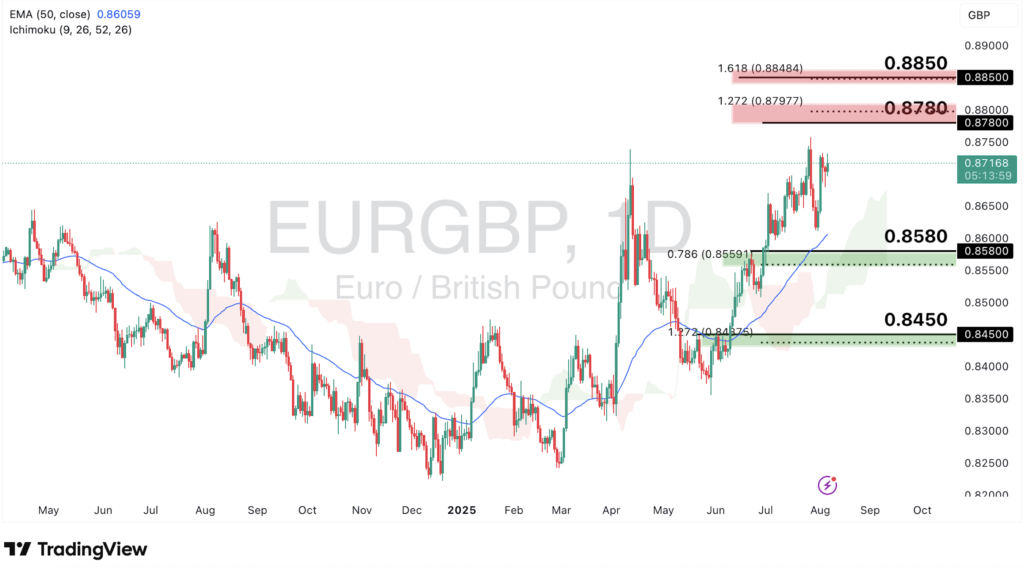

EURGBP Gains Ground as the Pound Weakens

EURGBP continues to climb, holding above the Ichimoku cloud with bullish momentum building. A sustained push higher could see the pair rise towards the 0.8780 resistance level, in line with the 127.2% Fibonacci Retracement. A clear break and close above this level may open the door for further upside towards the next resistance at 0.8850. Price has also recently bounced above the 34-EMA, reinforcing the strength of the ongoing bullish trend.

However, if price struggles to break above July’s high and shows signs of stalling, a retracement could occur towards the 0.8580 support, which aligns with the 78.6% Fibonacci Retracement. A break below this support could lead to deeper downside, with the next potential support near the 0.8450 zone, in line with the 127.2% Fibonacci extension.

Going forward, the pound remains under pressure amid weak data and growing expectations of a Bank of England rate cut, leaving the currency vulnerable to further downside unless sentiment improves or economic data surprises to the upside.