Dollar Stumbles While Gold Eyes Breakout

July’s nonfarm payrolls came in at just 73k, well below the 110k forecast, while June’s headline was dramatically revised down from 147k to 14k. The sharp downward revision and softer hiring pace suggest the labour market is cooling far faster than anticipated, raising concerns that the lagged effects of April’s tariff hikes are now weighing on business activity and hiring decisions.

The unemployment rate ticked up to 4.2% in July from 4.1% in June. Meanwhile, inflation remains sticky. June CPI rose 2.7% YoY against expectations for 2.6%, pointing to a stagflation risk where growth slows but price pressures persist. This combination complicates the Fed’s policy path, but markets are still assigning a probability of more than 93% for a 25 bps rate cut in next month’s FOMC meeting.

With the labour market showing cracks and inflation staying sticky, traders will be looking to the Jackson Hole Symposium (Aug 21–23) for any shift in the Fed’s reaction function, as well as upcoming PPI and retail sales data for confirmation of broader economic trends.

Dollar Retreats as Selling Pressure Mounts

Markets sold the dollar sharply after July’s NFP missed expectations and June’s figure was revised dramatically lower. The narrative has turned from “TINA” (There Is No Alternative) to “Sell America,” with traders increasingly pricing in rate cuts through year-end. Without a meaningful upside surprise in upcoming data to reignite dollar demand, we see the early August rebound as short-lived and expect the dollar to remain under pressure through the month.

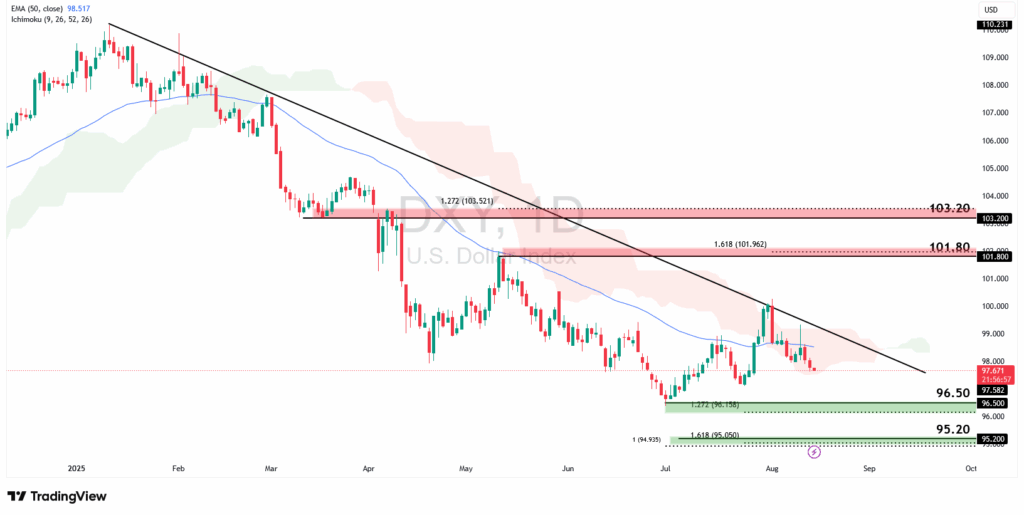

The dollar index remains under bearish pressure, trading below both the descending trendline resistance and the 50-EMA. A decisive break beneath the 96.50 swing-low support, aligned with the 127.2% Fibonacci retracement, would likely open the way toward the next support at 95.20, which coincides with the 161.8% retracement and 100% Fibonacci extension.

On the upside, a break above the trendline would target resistance at 101.80, in line with the 161.8% retracement. Sustained bullish momentum beyond that could extend toward 103.20, a pullback resistance aligned with the 127.2% retracement.

Gold Holds Ground Ahead of Potential Breakout

Gold has seen strong demand this year, particularly as an alternative store of value for central banks. This has allowed the price of the precious metal to soar year-to-date, also buoyed by a weaker dollar. However, the price is trading sideways now as markets consider whether such demand is sustainable. A return of risk-off sentiment amid uncertainties over Trump’s tariffs may bring back demand for the precious metal going forward. Inflation fears may also reignite gold demand, which is commonly looked to as a traditional safe haven and store of value.

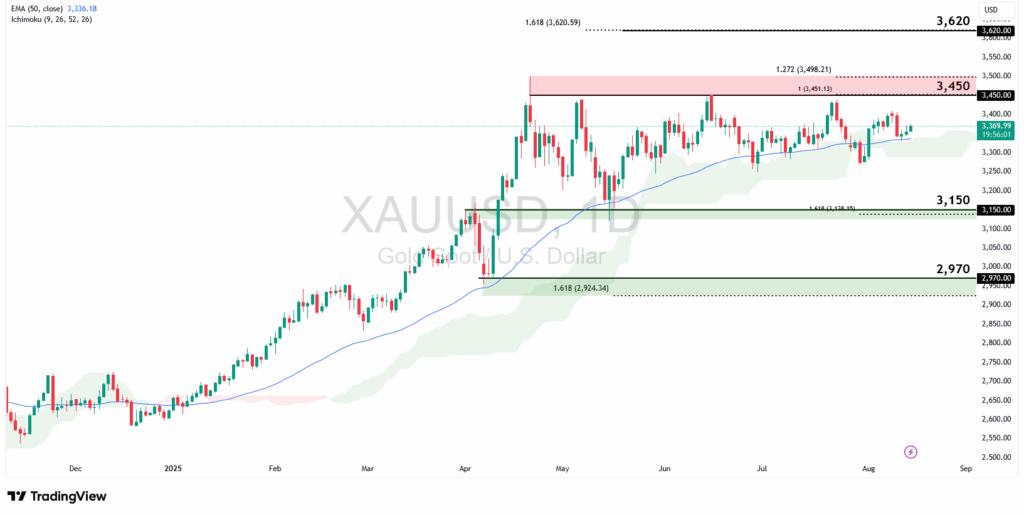

Gold remains above the 50-EMA, signalling that bullish sentiment is intact. Holding above the $3,150 support aligned with the 161.8% Fibonacci retracement would keep the upside bias in play, with the $3,450 swing-high resistance as the next key level, which coincides with the 100% Fibonacci extension and 127.2% retracement. A breakout above $3,450 could open the way toward $3,620, which is in line with the 161.8% retracement.

On the downside, a deeper pullback could see the price retest the $2,970 swing-low support, also aligned with the 161.8% Fibonacci retracement.

While DXY has seen a modest rebound, positioning remains skewed toward a bearish dollar. Upcoming data will be critical in shaping the next leg for the dollar. In the meantime, gold is likely to maintain its slow but steady grind higher amid the uncertainty.