Dollar Weakness Sparks Euro and Pound Rally – Could This Last?

The euro and pound have been in the spotlight lately as possible alternatives to the U.S. dollar amid a broader shift away from overreliance on US dollar-denominated assets. While a rapid pivot away from the US dollar is unlikely anytime soon, a long-term move toward more balanced global currency holdings is gaining traction, with both the euro and pound emerging as key players in this transition.

Risk-On Momentum Driving Demand for EUR and GBP

Both the euro and pound are considered risk-on currencies – those that tend to perform better when risk sentiment is bullish and economic growth is expected to continue. Recently, they have also benefited from broad U.S. dollar weakness, as large institutions actively hedge USD exposures amid uncertainties around Trump’s policies. This shift toward European and UK assets has boosted demand for EUR and GBP.

On a fundamental level, the euro and pound seem to have a slight edge over the US dollar. While the Federal Reserve remains cautious about cutting interest rates despite growing political pressure, the European Central Bank (ECB) is nearing the end of its easing cycle, and the Bank of England (BoE) may have its hands tied on further rate cuts.

With Fed rate cuts increasingly seen as inevitable, narrowing interest rate differentials could pressure the US dollar while supporting further strength in EUR and GBP. Watch upcoming BoE and ECB interest rate decisions and speeches for clearer signals on monetary policy.

Euro Shines Against the Dollar but Stands on Shaky Fundamentals

The euro has made solid gains against the US dollar lately, supported by broad dollar weakness. However, doubts remain about whether the eurozone economy can sustain this momentum. Growth remains sluggish across the bloc, with recent optimism largely driven by Germany’s new fiscal expansion plans.

The ECB is expected to hold rates steady at its next meeting, suggesting fewer policy-driven tailwinds ahead. While the euro may continue to climb, its ability to sustain strength will depend on whether the eurozone economy can position itself as a viable alternative to the US.

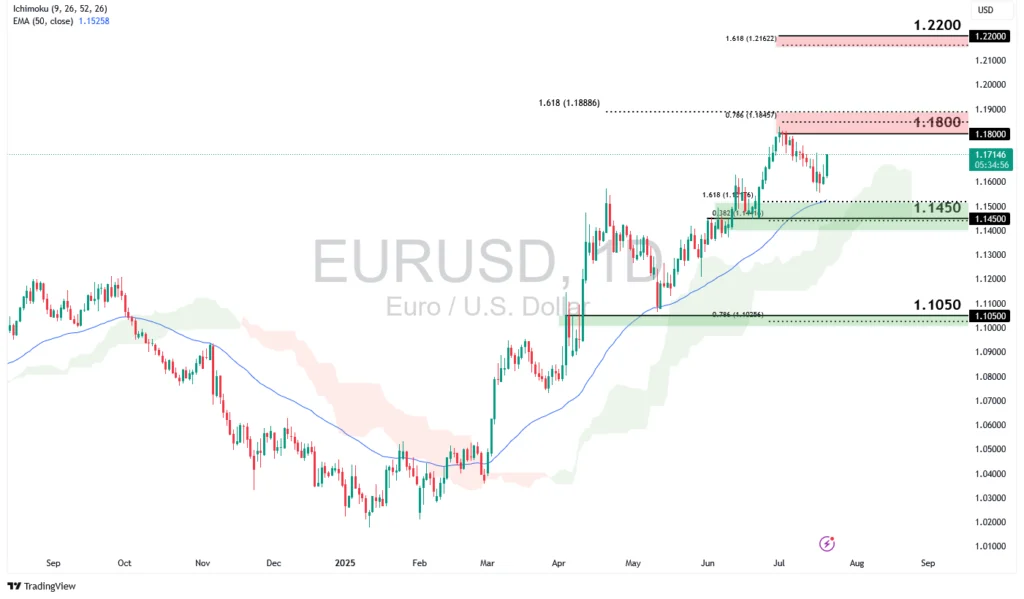

EURUSD is approaching the 1.1450 support level, which aligns with the 38.2% and 161.8% Fibonacci extensions, Ichimoku cloud, and 50 EMA. This is a closely watched zone, where a strong price reaction is likely. If EURUSD bounces here, it could climb toward the 1.1800 swing high resistance, supported by a Fibonacci confluence area. Beyond that, the next resistance lies at 1.2200.

However, a break below 1.1450 may signal fading bullish momentum and could lead to further downside. The next support to watch is 1.1050, in line with the 78.6% Fibonacci Extension.

Pound Outperforms Even Amid Economic Struggles

Pound has also benefited from broad dollar weakness, but it stands on even weaker ground in terms of economic fundamentals. The UK continues to grapple with persistent inflation and a cooling job market. With the cost of living remaining high and the labour market showing signs of strain, the BoE has taken a cautious approach to interest rate cuts. Policymakers are wary of easing too aggressively, as further interest rate cuts could risk reigniting inflationary pressures, especially in an environment where the cost of living is still rising.

Given these challenges, the pound may continue to benefit from a softer US dollar in the near term, but any sustained upward momentum is likely to be limited by the UK’s fragile economic backdrop.

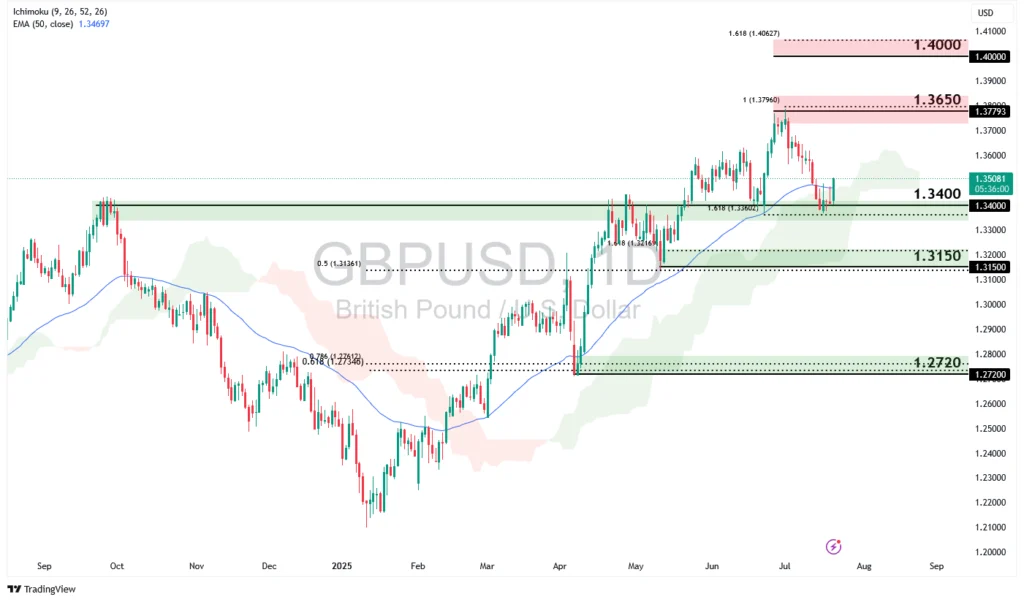

GBPUSD is currently testing the 1.3400 support level, which aligns with the Ichimoku cloud and the 161.8% Fibonacci Extension level. A break below this level could push the price lower toward the 1.3150 swing low support, or even the 1.2720 support, an area marked by strong Fibonacci confluence.

However, if bullish momentum holds, the price could bounce from here and retest the 1.3650 swing high resistance, aligned with the 100% Fibonacci Extension level, followed by the 1.4000 resistance, near the 161.8% Fibonacci Extension level.

The euro and pound may continue to ride the wave of U.S. dollar weakness for now, but whether both rallies can last will depend on more than just external factors. As markets begin to rebalance global currency exposure, the sustainability of euro and pound strength hinges on how well the eurozone and U.K. economies hold up under pressure and how their central banks navigate the path ahead.

Keep a close eye on inflation data, GDP figures, and policy signals from the ECB and BoE. These will offer clues as to whether the moves mark the beginning of a long-term shift or just short-lived rallies.