Eurozone at a Crossroads – Is the Euro building up Steam for a Summertime Rally?

The Eurozone economy is finally showing promising signs of life. The HCOB Eurozone Manufacturing PMI has ticked higher from last month, and inflation cooled to 1.9% in May, dipping just below the European Central Bank’s (ECB) 2% target. This shift adds weight to expectations that the ECB will deliver another rate cut this month, a move that could further support the region’s fragile recovery.

However, headwinds persist for the Euro. Softer-than-expected inflation data, a downgraded global growth outlook from the OECD, and political turmoil in the Netherlands following the collapse of the Dutch government over immigration policy disputes have weighed on sentiment. Furthermore, U.S.-EU trade talks appear to be stagnating, while President Trump’s decision to double tariffs on steel and aluminium imports from 25% to 50% has further cast doubt on the Eurozone’s growth prospects.

Looking ahead, the Euro’s potential for a sustained rally will hinge on two key factors: clarity around U.S.-EU trade policy and the ECB’s stance on interest rates. Easing trade tensions and a firm path of rate cuts could reinvigorate confidence in the Eurozone and boost demand for the Euro. Additionally, a weaker U.S. dollar, driven by reduced demand for U.S. assets and broader institutional hedging, may lend the Euro further support.

EURUSD: Bullish Momentum Holds Steady

EURUSD continues to ride the wave of a softer greenback, even after the recent Euro weakness driven by trade jitters. Still, if the Eurozone recovery stays on course, the Euro could remain well-supported.

EURUSD continues to see bullish momentum, holding above the Ichimoku Cloud and 50-EMA. A clear break-and-close above 1.1570, which aligns with the 61.8% Fibonacci Extension, could open the door to further upside. The next key resistance lies around 1.1880, where the 161.8% and 100% Fibonacci levels coincide.

However, a deeper retracement could see the price dip below both the Ichimoku Cloud and the 50-EMA. In this case, we could see the price approach the 1.1050 support level, in line with the 61.8% Fibonacci Retracement and 50% Fibonacci Extension levels. Should the selling pressure intensify, a decline toward the 1.0750 support, in line with the 78.6% Fibonacci Extension level, may occur.

EURJPY: Eyes on a Breakout

EURJPY is showing tentative strength, but gains are capped as both currencies face competing pressures. The Japanese yen could find support from the Bank of Japan’s (BoJ) hawkish tone, with BoJ Governor Ueda signalling readiness to raise interest rates if economic conditions warrant. However, the recent weakness in demand for Japan’s super-long government bonds reflects broader market concerns. Adding to the uncertainty, Japan’s auto sector remains vulnerable to U.S. tariffs, which continue to pose a risk to the country’s export outlook and overall economic stability.

Meanwhile, the Euro continues to benefit from interest rate differentials against the Japanese yen and its role as an alternative to the increasingly less attractive U.S. dollar. EURJPY may stay rangebound in the short term, with upcoming central bank signals and trade developments acting as key catalysts.

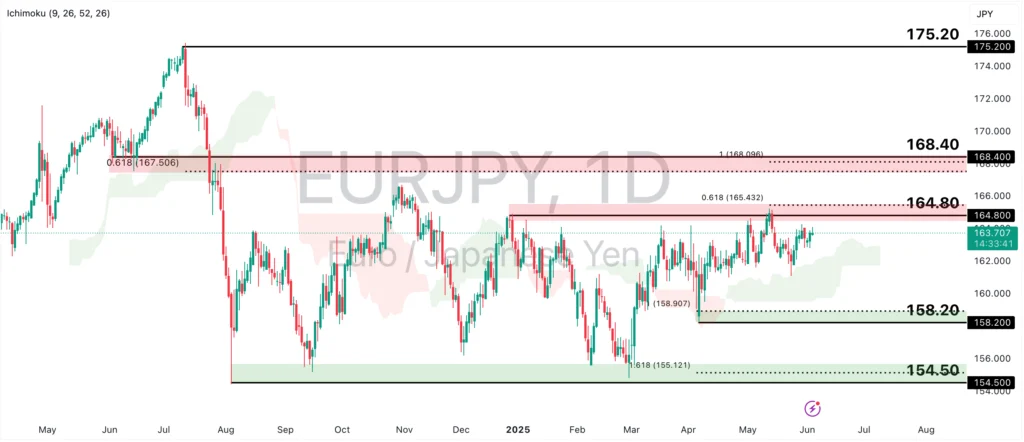

EURJPY is currently holding above the Ichimoku Cloud, indicating the potential for a bullish move. A decisive break above the swing high resistance at 164.80, in line with the 61.8% Fibonacci Extension level, could pave the way for further gains. The next key resistance zones are at 168.40, aligning with the 61.8% Fibonacci Retracement and 100% Fibonacci Extension levels, and then at the 175.20 swing high resistance level.

However, a retracement could see the price retest the 158.20 support instead, which is in line with the 100% Fibonacci Extension level. Further retracements suggest that EURJPY could remain in a sideways trend, where a retest of the 154.50 swing low support, in line with the 161.8% Fibonacci Extension level, may occur.

Although further ECB rate cuts and an improving Eurozone economy could be a boon for the Euro, traders should closely monitor key economic indicators, central banks’ commentary, and developments in U.S.-EU trade negotiations, which remain major swing factors for sentiment.