Fed sticks to the script, BoE to cut with guidance key

- FOMC stays in “wait and see mode” with higher inflation and growth risks

- Dollar retains strength against peers after unchanged Fed rate decision

- Equity markets close higher on trade optimism, Fed offers no surprises

- Gold trades lower as USD rises and China-US agree to hold talks

FX: USD printed an inside day but finished in the green after the Fed left rates unchanged as expected. Policymakers acknowledged that uncertainty has increased with more upside risk for both inflation and unemployment. Stagflation even got a mention. This suggests little preference for moving rate until rate setters are confident of the direction the data is heading. That means rate cuts could be delayed, though the risk is of more when they do come. It also points to the Fed being behind the curve, reacting to events rather than being more proactive. There’s now just a 20% chance of a June rate cut, versus a 32% probability before the meeting.

EUR was the second strongest major after the buck, but the major did fall. Consolidation is the name of the game for the world’s most popular currency pair. There is little euro data out this week and ECB-speak has continued to lean dovish, backing the market pricing for near three more rate cuts this year. Trade developments will obviously be key.

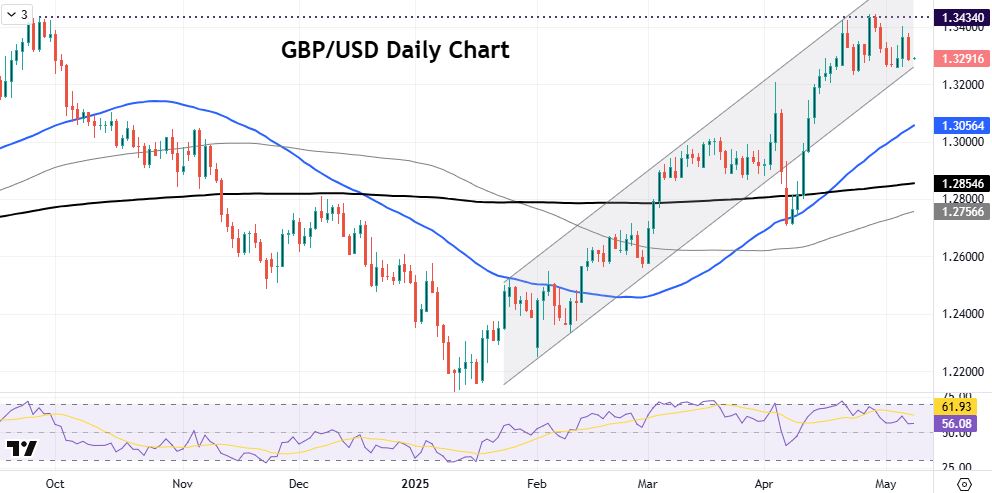

GBP also printed an inside day, with cable closing just below 1.33. markets are eyeing the fully priced in quarter point BoE cut today, and then what guidance is given by the MPC. See below for more detail.

USD/JPY made back all of yesterday’s losses as the major edged higher through most of the day.

AUD made a fresh cycle high at 0.6514 before underperforming and selling off through the day with added impetus after the Fed. The 200-day SMA sits at 0.6459. China stimulus measures didn’t help the antipodeans. CAD moved higher from multi-month lows. Trump/Carney talks were constructive though nothing concrete was said or agreed. Canadian jobs data is released on Friday.

US stocks: The S&P 500 gained 0.43% to settle at 5,631. The tech-heavy Nasdaq finished up 0.39% at 19,868. The Dow closed 0.7% higher at 41,114. The VIX eased fractionally but remained a touch elevated at 23.55. Only three sectors were in the red with communication services off 1.84%. That was heavily influenced by Alphabet, down 7.5%, after an Apple executive said it is exploring adding AI to its search browser, by using Perplexity or Anthropic. Apple said it had no intention of making its own general search engine. AMD announced EPS and revenue beats with strong data centre growth, though it warned of a $1.5bn revenue hit in 2025 from AI chip export controls to China. Disney reported better than expected top and bottom lines, with solid full-year EPS outlook.

Asian stocks: Futures are mixed. APAC stocks mostly rose on the positive US-China trade talks and China monetary easing. China’s CSI 300 rose 0.6% and the Hang Seng gained 0.13% helped by strong economic data and reduced reserve requirements from China’s central bank. The Nikkei 225 had its first down day in seven as it struggled into 37,000.

Gold gave back some of its recent strong gains as US-China trade tensions looked to be easing with the scheduled Switzerland meeting.

Day Ahead – BoE Meeting

Consensus unanimously expects the BoE to reduce the base rate by 25bps to 4.25%, with markets fully priced for this. The decision to cut rates is expected to be 9-0, though some expect external member Dhingra to back a larger 50bps move. A rate reduction would be in keeping with the MPC’s preferred pace of cutting at every other (and Monetary Policy Report – MPR) meeting.

Of greater interest will be how the MPC positions itself for rate cuts going forward. It is likely to keep the “gradual and careful” wording. But if it does drop that language, it will provide the MPC space to speed up cuts and would be a dovish signal. Services inflation in the UK remains particularly stubborn despite expectations that it is expected to decline. For the accompanying MPR, a reduction in the 2025 inflation forecast on lower energy is likely, and an upgrade to the 2025 growth forecast due to the better run of data seen in Q1.

Chart of the Day – Cable hovering just below recent highs

Money markets price in around 92bps of BoE easing in total for 2025. That implies just under another three quarter-point moves in five meetings after tomorrow’s nailed on move. That also breaks the current cycle of quarterly cuts at some point. The chance of another move in June is around a coin flip. With so much trade uncertainty and potential downside risks to growth and inflation, will the Old Lady turn more cautious and dovish in its guidance and quarterly updated projections? Much depends on the US and trade talks, especially if the UK economy doesn’t roll over and domestic inflation stays sticky.

GBP has been helped by positive trade updates recently, both with the US, India and the eurozone too. The idea of a closer relationship with Europe may result in a boost to the OBR’s growth prospects in November, allowing the Chancellor more room to spend. Cable remains in a bull channel, though at the lower band. The recent top and resistance is 1.3443 with the September high at 1.3434 reinforcing this area. Support sits around 1.3233/56.