Gold pumps, soft data jumps and PPI slumps

- US considers possibility of revising Japan trade agreement

- Walmart warns it will raise prices within weeks because of tariffs

- UK economy outpaces G7 with strong Q1 growth, but risks loom

- US data suggests only modest tariff impacts so far, stocks, dollar mixed

FX: USD sagged in a relatively quiet day as the buck printed an ‘inside day’. That means its high and low took place ‘inside’ the previous day. Prices continue to trade around a previous long-term low at 100.61. Retail sales pointed to front-loading of buying ahead of tariff-related price hikes fading quickly after a March spending splurge. Money markets priced in around 56bps of easing in 2025 versus 46bps before the data release. PPI figures came in cooler than expected like the CPI.

EUR was very marginally higher on the day. The US and EU have agreed to intensify trade talks, while the Trump administration, according to media sources, told the EU it wants to discuss the EU’s food tariffs/non-tariff barriers in trade talks.

GBP outperformed most of its peers as it made its way back above 1.33. A better-than-expected GDP report helped, with 0.2% March growth and 0.7% quarterly activity, versus flat and 0.6% respectively. Eyes are on Monday’s first EU-UK summit since Brexit. Increased alignment should support the pound.

USD/JPY outperformed all other majors again as the major fell for a third straight day. Prices are back below the 50-day SMA, which capped the upside in late March, at 146.15. Just over half of economists in a Reuters poll expect the BoJ to raise rates by 25bps to at least 0.7% by year end.

AUD underperformed as higher beta suffered compared to its peers. Better-than-expected jobs data, with the Australian economy added 89k versus the forecast 20k, didn’t move the dial on next week’s RBA. The bank is likely to lower rates by 25bps to 3.85% on Tuesday. CAD found resistance again at the 200-day SMA at 1.4011. Lower oil prices and wider yield spreads are dealing a double blow for the loonie.

US stocks: The S&P 500 gained 0.41% to settle at 5,917. The tech-laden Nasdaq finished up 0.08% at 21,336. The Dow closed 0.65% higher at 42,323. Defensives came back into favour with utilities and consumer staples adding over 2%. On the flip side, three sectors were in the red – consumer discretionary, communication services and tech. All the Mag 7 names were under water.

Meta saw further weakness in late trade as the WSJ reported a delay to it rollout of its flagship AI model, Behemoth. That prompted internal concerns about the direction of its multibillion-dollar AI investments. Walmart results saw EPS and sales top expectations, but revenue missed. The CFO said it cannot hold off price increase forever and could start raising prices this month.

Asian stocks: Futures are mixed. Asian markets traded mostly lower after the mixed handover from Wall Street. The Hang Seng and Shanghai Composite were muted with Tencent traded subdued after its earnings. The Nikkei 225 underperformed on recent yen strength. The ASX 200 traded indecisively but in the green after a decent jobs report.

Gold did a U-turn after the European session opened. Weakness early on saw it post a low at $3120 before bugs stepped in. The precious metal closed near its highs at $3240 as Treasury yields reverted back below 4.5% on the 10-year.

Day Ahead – Longer-term US fiscal funding issues

With little major data on the calendar, markets will be watching for more trade headlines to finish the week. It seems we will get a drip feed of moderately positive “deals” announced, though how concrete these are with not a lot of detail supplied is open to question. Risk markets like stocks don’t mind, as they are also potentially focusing on tax cuts and deregulation to come – new all-time highs, anyone? They are less than 4% away on the benchmark S&P 500 and prices are not overbought even after this current historic rally we have seen over the past few weeks. Momentum also seems strong with dips potentially shallow as funds are forced to top up their allocations to US stocks.

Going forward, the issue might be that the fiscal measures, specifically tax cuts, are not funded. A rough estimate is that around $5 trillion is needed to pay for just an extension of the 2017 tax cuts. DOGE savings have severely underwhelmed while tariffs are not likely to impact massively. What markets may then focus on is rising inflation, as opposed to outright stagflation risks. That puts the Fed on hold until winter at least.

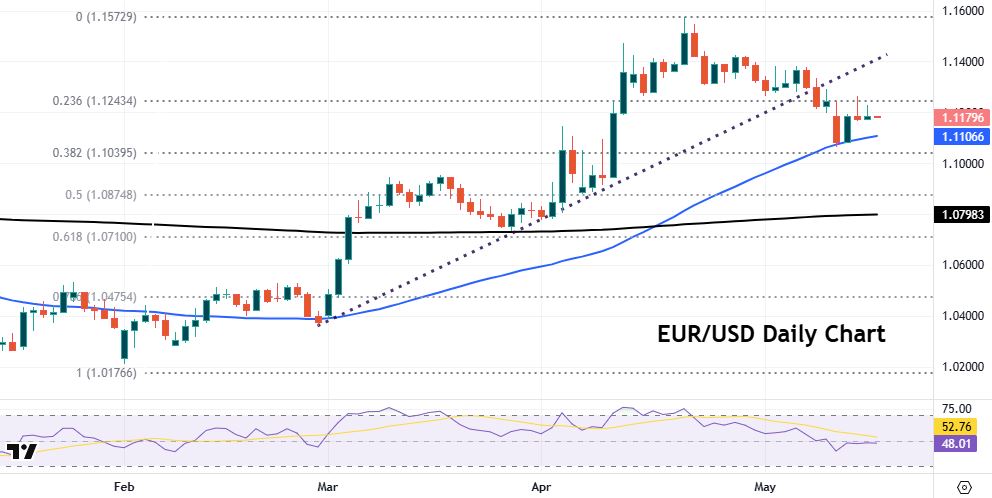

Chart of the Day –EUR/USD rally pauses for time being

It’s been a relatively low-key week for eurozone news. But next week could be more interesting as we may get more de-dollarisation evidence. The March Balance of Payments data for the eurozone might reinforce the February data, which had shown strong equity inflows into the eurozone. Another shift in focus toward the region would underpin support for moves away from the greenback, similar to recent figures out of Japan that has seen record foreign buying of domestic stocks and bonds.

Unsurprisingly, with little major news flow, this week’s recovery in EUR/USD looks to have stalled and we are seeing some congestion around 1.12. The RSI is remarkably quiet as it chops either side of 50, indicating limited momentum. Near-term support is seen at the 50-day SMA at 1.1106 and recent resistance has been observed around 1.1243. That is a minor Fib retracement level of this year’s rally. The upward trendline from the late February low has been broken but it’s not been majorly confirmed.