Gold Rises, Dollar Falters: Are Trump’s Policies Reshaping Safe Havens?

U.S. financial markets are grappling with the profound impacts of President Trump’s aggressive tariff policies, which have heightened the risks of higher inflation and slower economic growth. Traders now wait with bated breath on every move by President Trump, as his unpredictable decision-making has effectively turned markets into a high-stakes guessing game.

The lack of policy consistency has amplified short-term swings and clouded the outlook for the U.S. dollar, turning the tide against the world’s largest economy. Amid this uncertainty, gold has emerged as a clear beneficiary, drawing renewed demand as a safe-haven hedge, which has fueled the price rally.

While the Fed has held interest rates steady, as widely expected, the market remains fixated on the progress of trade negotiations and the potential for further policy shifts and tariff adjustments. This has created an atmosphere of caution, with both the U.S. dollar and gold outlooks being heavily shaped by these macroeconomic factors.

DXY – The Dollar’s Descent

The U.S. dollar continues to struggle as Trump’s flip-flops and tariff troubles spell the end of U.S. exceptionalism. With demand for U.S. assets waning, the U.S. dollar’s appeal continues to fade. On top of this, rising inflation risks and a weakening U.S. economy are likely to keep bearish momentum in play, suggesting further downside for the DXY in the near future.

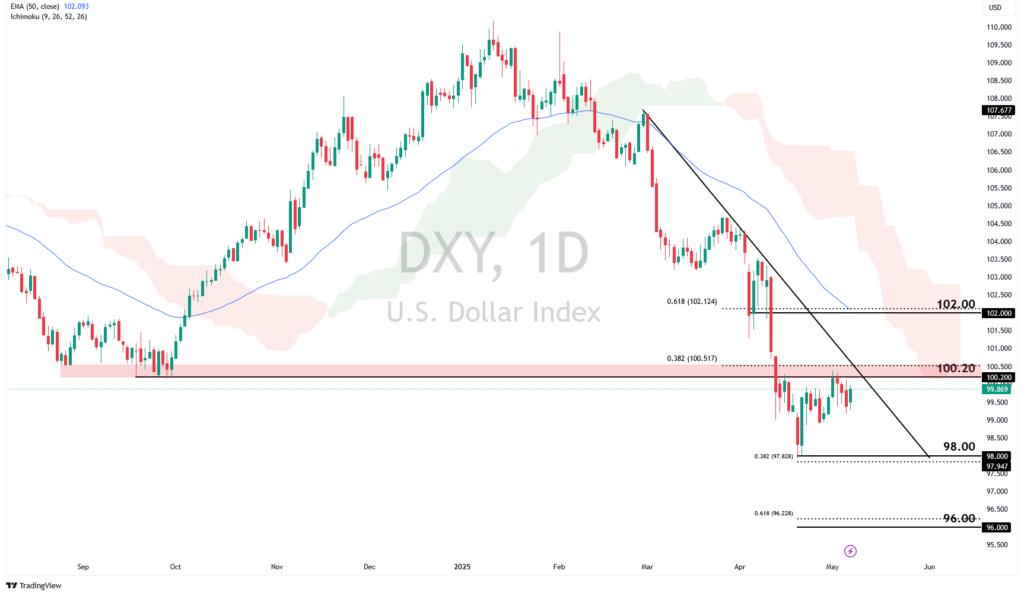

Ticker: DXY, Timeframe: Daily

The DXY remains pressured below key resistance levels, including the 50-EMA, the Ichimoku cloud, and a descending trendline. As it tests the 100.20 resistance, aligned with the 38.2% Fibonacci Retracement, a further move lower seems likely.

If the DXY extends its decline below the 100.20 resistance, the next support could be at 98.00, in line with the 38.2% Fibonacci Extension, followed by 96.00, which aligns with the 61.8% Fibonacci Extension. However, a deeper pullback could see the DXY retest the 102.00 resistance, which coincides with the 61.8% Fibonacci Retracement and the 50-EMA.

XAUUSD – Gold’s Golden Age

Gold continues to shine as a safe-haven asset, with traders moving away from the U.S. dollar and seeking alternatives to preserve value. In particular, Asian central banks and traders worldwide have ramped up their demand for gold amid ongoing economic uncertainty, supporting the bullish momentum in gold prices.

Ticker: XAUUSD, Timeframe: Daily

XAUUSD is retreating below the $3,450 resistance, in line with the last swing high and the 50% Fibonacci Extension. A breakout and close above this resistance should see the price push higher towards the next $3,600 level, in line with the 78.6% Fibonacci Extension and 127.2% Fibonacci Retracement. Price continues to hold above both the 50-EMA and Ichimoku cloud, showing strong bullish momentum.

However, if bullish momentum falters, a deeper retracement may be on the cards. In that case, the first support to watch would be around the $3,230 support zone, which coincides with the 50% Fibonacci Retracement and 61.8% Fibonacci Extension. A more extended decline could see the price approach the subsequent support at $3,150, where multiple Fibonacci levels converge with the 50-EMA.

Trump’s unpredictable tariff policies have thrown markets into flux, upending the US dollar’s dominance and driving gold to new highs. As uncertainty becomes the norm, traders are forced to adapt to shifting dynamics and look beyond traditional playbooks.

With geopolitical tensions, inflation risks, and mixed policy signals all in play, market relationships are being redrawn in real-time. In this environment, the ability to stay agile, reassess narratives, and lean on technical signals becomes crucial. Whether it is a deepening US dollar slide or a sustained gold rally, the path forward will demand both caution and conviction.