Headline havoc hits risk mood amid tariff trauma

* Wall Street knocked lower by tariff jitters, Musk’s political plan hits Tesla

* Dollar bid on higher yields and downbeat risk sentiment

* Trump to levy 25% tariffs on Japan, South Korea in August

* EU will not be receiving letter setting out higher tariffs from the US

FX: USD gained amid huge uncertainty around trade policies and a sea of red in stock markets. As it stands, President Trump delivered trade letters to 7 countries with new tariff levels and ranges from 25-40%. Other countries are awaiting more Trump tariff letters while he threatened additional 10% tariffs on countries who align with BRICS anti-American policies. Treasury Secretary Bessent said if no trade deal is reached with partners who have received letters, they will revert to April 2nd tariffs, effective August 1st. The buck might also be getting a moderate boost from higher yields and a hangover bid from last week’s stronger jobs data, while consolidation is not unexpected after the multi-year lows hit recently.

EUR performed relatively well but was off versus the greenback. Trade tensions remain key, with US/EU talks showing signs of progress ahead of the 9 July deadline. Dovish ECB headlines have added to the euro’s latest trade-driven hit, as comments from Governing Council members have highlighted the risk of undershooting the 2% inflation target and leaned toward additional rate cuts.

GBP was down against the dollar but outperformed all of its major peers. A UK trade deal is sorted already. Stress in the UK Gilt market has eased after the fall-out from last week’s U-turn on welfare reform. Ultimately, that means taxes are likely going up in November. The weaker sterling story then switches from a sovereign risk premium story to a more conventional one of tighter fiscal and looser monetary policy.

JPY was the weakest major currency versus the dollar on the back of trade tensions and renewed concerns about the tone of US/Japan talks after Trump’s announcement of 25% tariffs in August. The tone of the talks had appeared to have shifted in recent weeks, impacting expectations for the BoJ and its tightening plans as a result of recent central bank communications closely tying the near-term policy path to the outcome of trade negotiations. The latest labour cash earnings data also disappointed.

AUD was hit by trade fears and was the third worst major currency after the yen and NZD. Focus turns to the RBA meeting and expected rate cut. See below for more details. CAD also slipped on the softer market sentiment. Ottawa is actually aiming for a deal by 21 July, so should not have received a tariff letter.

US stocks: The S&P 500 printed down 0.79% at 6,229. The Nasdaq closed off 0.79% at 22,685. The Dow Jones finished lower at 44,406, losing 0.94%. Nearly all sectors closed in the red, with losses led by Consumer Discretionary, Energy, and Materials, while Utilities solely outperformed in the green. Weighing on the Consumer Discretionary was downside in Tesla (-6.8%) after CEO Musk maintained his stance against Trump by launching the “America Party”. President Trump responded, calling him a “train wreck”. This political noise raises further investor concerns about its potential impact on the EV-maker. More importantly, following the trade announcements via Trump on Truth Social, immediate risk-off was seen across equities.

Asian stocks: Futures are in the red. APAC equities were muted again with risk sentiment cautious ahead of the tariff deadline. The ASX200 downside was limited by defensive resilience and the RBA announcement today. The Nikkei 225 was pressured by weak data showing the biggest drop in Japan’s real wages in nearly two years. The Shanghai Comp and Hang Seng was muted amid the trade uncertainty and China frictions. Investors were also braced for this week’s inflation data.

Gold traded around the 50-day SMA at $3,320. As we have said previously that indicator has proved to be decent support on a number of occasions this year. Prices remain stuck in a consolidation phase, which is extending into a twelfth week, with prices currently trading in a $3,245 to $3400 range.

Day Ahead – RBA Meeting

Markets fully expect the RBA to cut the cash rate by 25bps, taking it to 3.60%. The bank shifted the tone of its rhetoric at the last meeting in May. It noted its ability and willingness to cut rates further if inflation continued to fall sufficiently. Since then, May CPI was softer than forecast and Q1 GDP figures surprised to the downside, though recent jobs data was strong with wage growth rising.

Australia remains relatively insulated from reciprocal tariff issues. But the global backdrop is likely to be disinflationary for the country which further adds weight to cutting rates at this meeting. There could be a lingering concern about sticky inflation, as Q2 underlying inflation may remain in the top half of the bank’s 2-3% target range. But there should be enough evidence for policymakers to cut, with post-meeting language expected to be non-committal as the bank will continue to watch inflation and the uncertain external environment.

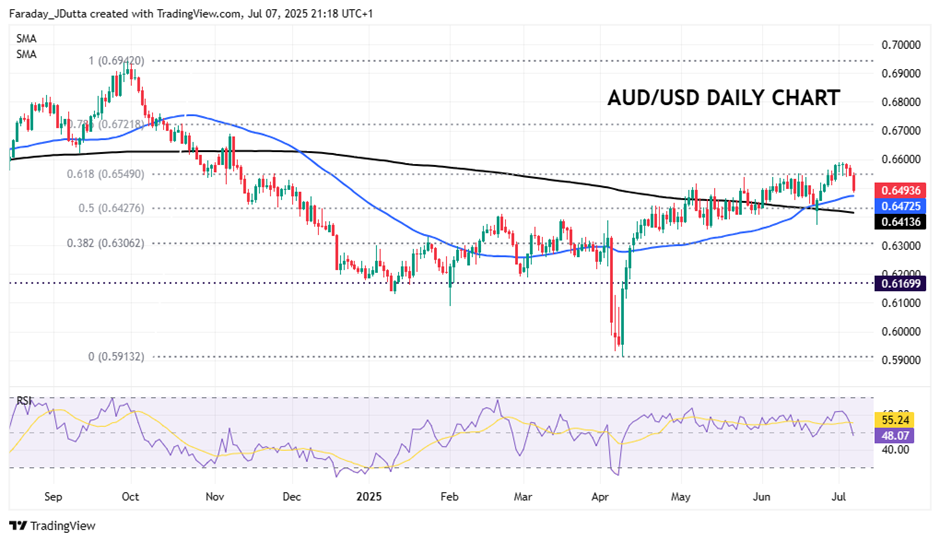

Chart of the Day – AUD/USD rolls over

The major recently broke to the upside after hitting resistance around the major Fib retracement level (61.8%) of the September 2024 to April 2025 move lower at 0.6549. But it could be a false break as 0.66 wasn’t pierced and prices rolled over on Monday, the third straight day of selling, with the aussie underperforming all other major currencies apart from the yen and kiwi. Initial support sits at the 50-day SMA at 0.6472 and then there’s a zone of support with the midpoint of that long-term move at 0.6427 and the 200-day SMA at 0.6413. A grudging message about the rate cut could underpin support for the aussie, albeit with trade war announcements also crucial.