How Could Commodity Currencies Benefit from the Latest Tariff Truce?

With the recent easing of trade tensions between the U.S. and China, concerns about a global economic slowdown have moderated somewhat. This shift has renewed interest in risk assets, particularly commodity-linked currencies such as the Australian Dollar (AUD), New Zealand Dollar (NZD), and Canadian Dollar (CAD). Closely tied to exports of resources like crude oil, gold, and other minerals, these currencies are not only driven by global commodity demand but also serve as barometers of broader risk sentiment in the market.

The 90-day tariff truce announced by President Trump is widely seen as a constructive step, suggesting a possible de-escalation in trade conflict between the world’s two largest economies. This development has contributed to improved market confidence, supporting assets that typically perform well in risk-on environments. Nevertheless, uncertainties remain. Moody’s recent downgrade of the U.S. government’s credit rating from Aaa to Aa1, aligning with earlier moves by Fitch and S&P Global Ratings, has added a note of caution for traders navigating the evolving macro backdrop.

AUDUSD Holds Steady Ahead of RBA Meeting

The Aussie is stabilizing as traders look ahead to the Reserve Bank of Australia’s (RBA) upcoming policy decision. While the RBA is widely expected to cut interest rates today amid external headwinds, a surprisingly strong labour market print may limit the extent of dovishness. Official data showed the Australian economy added 89,000 jobs in April, far surpassing the forecast of 20,000 and pushing total employment to a record high. Continued signs of economic resilience could support further strength in the Aussie despite a rate cut.

Ticker: AUDUSD, Timeframe: Daily

AUDUSD saw a critical breakout above the descending trendline resistance and now holds above the 50-EMA, showing a bullish trend reversal may be in progress. A break and close above the 0.6500 level in line with the 61.8% Fibonacci Retracement could see the price rise further to test the next resistance levels at 0.6650 and 0.6940 swing high.

However, a deeper throwback could see the price retest the descending trendline at 0.6120 support, in line with 61.8% Fibonacci Retracement and 78.6% Fibonacci Extension as the price continues to hold above the 0.5930 swing low support.

USDCAD Drifts Lower But Finds Temporary Support

The Loonie took a hit and weakened against the U.S. dollar amidst dovish expectations for the Bank of Canada’s (BOC) interest rate cut and softer jobs data. A small gain of just 7,400 jobs added, alongside a rise in the unemployment rate to 6.9% in April, reinforced market views on rate cuts as early as June. However, the domestic political landscape has shown reason to stay confident in Canada’s economic recovery amidst lingering trade uncertainties. Prime Minister Carney’s appointment of former Goldman Sachs banker Tim Hodgson as the Minister of Energy and Natural Resources signalled a renewed effort to refocus on the country’s strategic advantages in energy and mining.

Ticker: USDCAD, Timeframe: Daily

USDCAD continues to trade below both the descending trendline resistance and the 50-EMA, with bearish momentum still intact. As the price retests the 1.4030 resistance, aligned with the 50-EMA, 38.2% Fibonacci retracement, and 78.6% Fibonacci extension, a reversal here could see the pair push lower toward the 1.3770 swing low support as the bears continue to take hold.

However, a break and close above the descending trendline resistance could send the price higher towards the 1.4480 swing high resistance.

NZDUSD Regained Its Footing Amidst Dollar Weakness

The New Zealand dollar snapped back to strength against the U.S. dollar this week, benefiting from USD weakness but also capitalising on NZD strength with strong sentiment following encouraging domestic data releases. Manufacturing activity in New Zealand expanded for the fourth consecutive month in April, reaching its highest level since August 2022. Markets still expect a rate cut from the Reserve Bank of New Zealand (RBNZ), but the expectation is that the rate cut cycle is coming to an end.

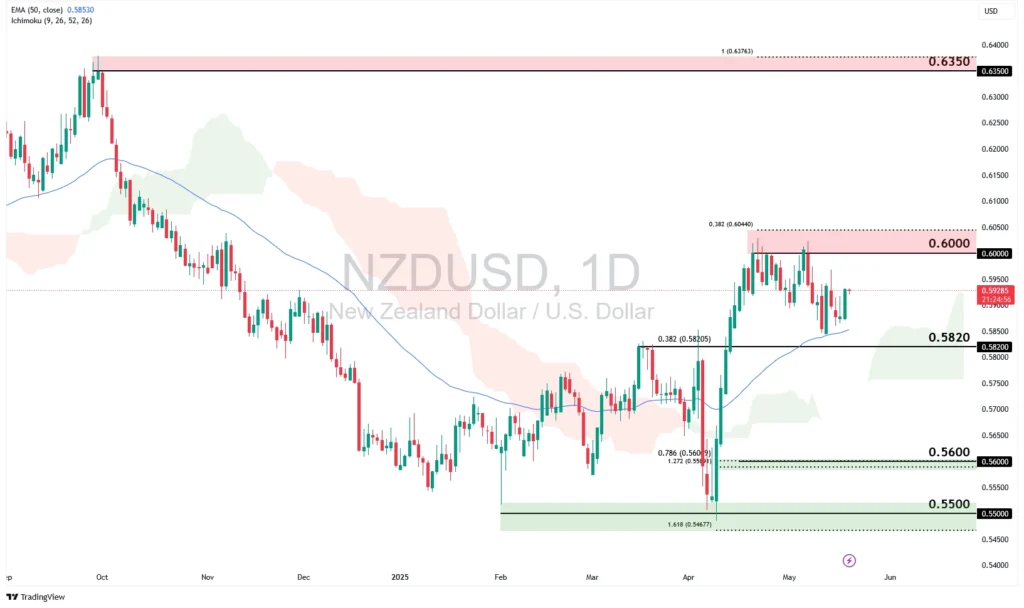

Ticker: NZDUSD, Timeframe: Daily

NZDUSD is now trading and holding above the 50-EMA as it approaches the 0.5820 support, in line with the 38.2% Fibonacci Retracement level. A continuation of the bullish move would see the price bounce and retest the 0.6000 swing high resistance zone, in line with the 38.2% Fibonacci Extension, or even further towards the 0.6350 swing high.

However, a deeper retracement could send the price lower towards the 0.5600 Fibonacci confluence zone, where the 78.6% Fibonacci Retracement and 127.2% Fibonacci Extension levels coincide. A break below the 0.5600 support could prompt a further decline towards the following support and swing low at 0.5500.

As the market sentiment shifts decisively towards risk-on, traders would do well to keep an eye out for commodity currencies. A good price-action setup could make the difference in catching the bullish wave early on.