Markets trade quiet on Trump trade tariff fatigue

* Trump announces increased tariffs, more trade deal demand and letters

* Latest FOMC minutes underscores divisions over pace of rate cuts

* Nvidia hits market cap of $4trn as CEO plans Beijing trip

* Stock markets close higher on tech rally despite tariff and Fed caution

FX: USD printed a very narrow range doji with prices trading well within Monday’s range. As we mentioned in our Weekly, the fixation on 9 July has proven to be a damp squib. Tariff threats have been beefed up – copper tariffs might be 50%, pharma 200% and there will be no further pauses after August – but markets are serene. Has broader sentiment turned less bearish on the dollar, or is it just fatigue with the long-term trend still down? The fed minutes noted that increased tariffs were likely to exert upward pressure on prices.

EUR also traded in a narrow range, posting an inside day where the day’s high and low stays within the previous day’s range. This denotes some indecision. Markets await any concrete news on a US-EU trade deal, with the FT writing that Brussels is ready to sign a temporary “framework” agreement that sets Trump’s reciprocal tariff at 10% while talks continue.

GBP printed an inside day in quiet trade. Friday’s trade and industrial production figures remain this week’s domestic highlights, as they will inform BoE discussions into the August meeting, which includes a forecast update. Support is the 50-day SMA at 1.3481, with a bullish trend but momentum has shifted back to neutral.

JPY was small down reflecting lower yields in the US Treasury market. Yield spreads appear to be rolling over and narrowing which would typically support the yen. Trade policy is front and centre. See below for more.

AUD traded relatively contained with Monday’s 0.6564 peak remaining intact. The NZD was also quiet after the RBNZ left rates on hold as expected. The bank did guide towards further cuts if data moves as projected, essentially taking a data dependent stance.

US stocks: The S&P 500 printed up 0.61% at 6,263, the second highest close in history. The Nasdaq settled higher by 0.72% at 22,865. The Dow Jones finished up at 44,458, gaining 0.49%. Only three sectors were in the red, real estate, energy and consumer staples. Utilities, tech and communication services led the gainers. Nvidia grabbed the headlines as it eclipsed the $4trn market cap mark. The chipmaker had already surpassed Apple’s $3.92trn record from last December. The stock has risen over 40% since early May with new sources of AI demand “kicking into turbocharge”, according to CEO Huang. Shares hit $3trn in June last year and $2trn in February 2024. Amazon reported that Chair Bezos sold nearly 3mn shares worth $665.8mn over two days in July, part of a plan to offload up to 25mn shares by May 2026. On the other side, small caps continued their recent bull run, with the Russell 2000 up for the seventh time in eight sessions. These stocks are more insulated from tariffs and should benefit more from Fed rate cuts if they come.

Asian stocks: Futures are mixed. APAC equities also trade mixed after the relatively quiet Wall Street session. The ASX200 was subdued with most sectors in the red. The Nikkei 225 moved between gains and losses amid the trade uncertainty. The BoJ’s Koeda stated it is inappropriate to say the specific timing of the next rate hike now due to high uncertainty. The Shanghai Comp and Hang Seng were also mixed as property names dragged the Hang Seng lower while the mainland reflected on mixed inflation data.

Gold carried on trading around the 50-day SMA at $3,320. As we have said previously, this have been a decent indicator of support on a number of occasions this year.

Day Ahead

The benchmark S&P 500 looks to be in bullish consolidation mood with a recent pause in buying resuming yesterday, and with Nvidia’s historic market cap boosting risk sentiment. It’s also evident that US equity markets can seemingly cope with the ongoing trade uncertainty which means that is good news for risk assets and suggests that current interest in international equities and emerging markets may also continue.

For FX, it appears that investors are more likely to trade based on the broader economic impact of the tariff measures, rather than the measures themselves. That leads to many questions, for example, do these higher tariffs hurt business confidence even more, hit profits and result in layoffs? Or is the dominant theme a stable labour market, with businesses able to pass on costs and higher inflation? This latter position could trigger a modest dollar rebound as rates also stay higher for longer. We mentioned this on Tuesday – the economic data also won’t truly reflect the trade war after 1 August, and this date might again be pushed out. That could result in policymakers at the Fed sitting on their hands for a long time, much to the annoyance of the POTUS.

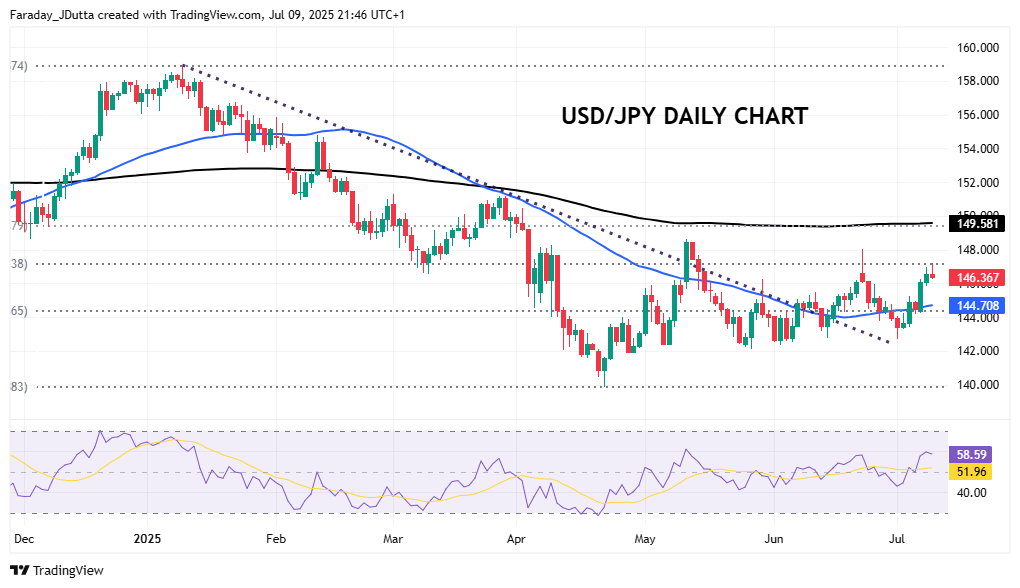

Chart of the Day – USD/JPY bumps into resistance

USD/JPY has been in the crosshairs of the trade war with Japan receiving a letter from President Trump saying the US will impose reciprocal tariffs of 25% on goods from Japan on 1 August, unless a trade deal has been agreed by then. This is likely a tool to show Trump’s intention to accelerate trade talks. However, crucially, Prime Minister Ishiba is fighting a crucial Upper House election on 20 July and does not want to be seen to be rolling over and accepting more US rice imports. But that position could potentially change after the election, although if the ruling coalition fails to secure a majority, it may trigger further complications and delay trade negotiations.

Recent BOJ chatter has been cautiously hawkish given this trade uncertainty and bond market volatility. The major has struggled to bounce strongly from its year-to-date low from April at 139.88. Prices have moved above the 50-day SMA at 144.70 but have failed at the major Fib level of this year’s decline at 147.13. Above here is the 200-day SMA and 50% level at 149.58 and 149.37 respectively.