Oil prices and markets whipsaw wildly on Middle East tensions

* Trump thanks Iran for ‘very weak’ response to US air strikes

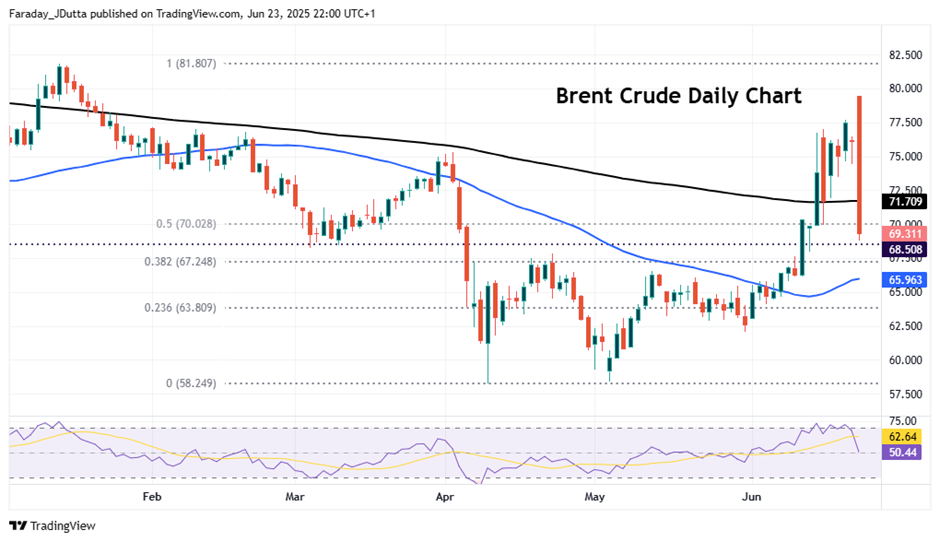

* Brent crude reverses 5% spike high to settle down over 8.5%

* Tesla jumps after ‘successful’ robotaxi Austin launch

* USD choppy and closes lower, stocks higher on improved risk mood

FX: USD moved higher in the Asian session as crude oil spiked higher. The dollar benefitted from strong oil last week too, and had a mild safe haven bid, though that has lessened in recent months with domestic US issues to the fore. But upticks have generally been sold in the greenback with a bearish bias maintained amid serious domestic fundamental challenges. The US session saw sharp selling of the buck as crude oil crashed. Markets looked through the ‘theatre’ of war with Iran’s telegraphed strike on Qatar bizarrely receiving a ‘thank you’ from US President Trump. The Dollar Index is back below its long-term downward trendline.

EUR fell to 1.1451 initially before finishing healthily in the green. Monday saw mildly disappointing PMI data with manufacturing unchanged below 50 while services climbed modestly to 50.0. There is a heavy schedule of ECB speakers throughout the week. Markets have been reining in rate cut bets with now only 20bps priced in for the rest of 2025.

GBP was relatively strong, in the top three best performing majors. The latest PMI’s saw better-than-forecast manufacturing alongside an as expected improvement in services. Both readings remain very close to the expansion/ contraction threshold at 50, offering little in terms of material growth. The 50-day SMA acted as support at 1.3399.

USD/JPY jumped higher in the early sessions and spiked up above 148 before retracing a lot of its gains. It was a day of slightly odd price action with lots of, not altogether, convincing reasons for the yen sell-off. It typically performs well in uncertainty and risk-off environments, hence CHF getting bid. Of course, that reversed through the day, but the major pared its gains during that time. Some investors remain concerned about BoJ dedication to policy normalisation.

AUD fell sharply and underperformed its peers though losses were pared through the day and the major settled in the green. Prices dropped to 0.6372 before closing above 0.64. CAD sold off for a fifth straight day though the major found resistance at the 50-day SMA at 1.3799. The loonie hasn’t correlated highly with crude oil prices recently.

US stocks: The S&P 500 added 0.96% to settle at 6,025. The Nasdaq closed up 1.06% at 21,856. The Dow Jones finished higher at 42,581, adding 0.89%. We got the biggest one-day point and percentage gain in over three weeks. The S&P 500 is now just under 2% from its record closing high as it snapped a three-day losing streak. Energy was the only sector in the red while consumer discretionary and real estate paced the gainers. Tesla was the top performer on the S&P 500, adding 8.23%. The EV-maker started offering rides in its robotaxis on Sunday in Texas, with a well-known analyst saying the trips exceeded his expectations. Despite a barrage of geopolitical developments and a packed calendar of macroeconomic and monetary policy news last week, it was striking how little movement we saw across major asset classes. Equities did end the week marginally lower overall, but the broad picture is one of stability. Cyclical sectors even slightly outperformed and this all points bullishly to new record highs.

Asian stocks: Futures are mixed. Asian markets traded lower as markets sold off on the US airstrikes on Iran nuclear facilities. The ASX 200 fell on broad risk sentiment while overlooking better PMI data. The Nikkei 225 slid but a weaker yen softened the downside. The Hang Seng and Shanghai Comp also confirmed to the muted risk mood. A WSJ report that the US is reportedly preparing action targeting allies’ chip plants in China also didn’t help.

Gold was choppy intraday with losses turning into gains into a flat day with a doji printed. Energy-related inflation could reduce the chances of gold-supportive Fed rate cuts. Policymakers may opt to hold rates at current relatively high levels, potentially strengthening the US dollar at the same time.

Day Ahead – Canada CPI, Fed Chair Powell testimony

Consensus sees headline Canada CPI remaining unchanged at 1.7% in May, fuelled by food and core goods. Core measures are expected to stabilise around 3%. Recent BoC minutes observed rising short-term inflation expectations but stated that further rate cuts may be warranted if tariff-related uncertainty spreads, and inflation cost pressures remain contained. Governor Macklem recently said similar but much depends on a trade deal.

Jerome Powell’s semi-annual Monetary Policy testimony to Congress should be interesting. In what is likely to be a highly partisan environment, he will face criticism from certain members of the Republican Party for not cutting interest rates, aligning with the views of President Trump. Instead, Powell will emphasise the importance of the Fed’s independence and that in uncertain economic and political times, there is no urgency to cut rates, reiterating the wait-and-see approach. Any clarity on the inflation story – whether tariffs are a one-off price shock or if they prompt more persistent inflation pressures – will be watched.

Chart of the Day – Oil performs a huge U-turn

Brent crude saw a near 13% intraday swing from high to low after a dramatic day of conflict in the Middle East. Fears of strong retaliation by Iran which caused crude to spike initially on the open were slowly reined in during the day. The eventual strike on Qatar was seen as symbolic and largely to save face. Oil prices had been fading through the day as it was recognised that the Strait of Hormuz was very unlikely to be impacted. A quarter of all seaborne oil flows through the Strait with more than 80% of that going to Asia and China. Iran also imports a lot of its food, while 20% of global LNG moves through the shipping channel too. “Escalation to de-escalate” seems to be the play with Middle east tensions heightened but easing. Prices didn’t get as far as the year-to-date January top at $81.80 and have plunged through the 200-day SMA at $71.70. The swing low from September 2024 is at $68.50 with the midpoint of this year’s sell-off at $70.02.