Stocks pare gains as US appeals tariff ban

- US appeals court reinstates Trump tariffs, US may take case to Supreme Court

- Nvidia CEO to sell $800mn of stock, closes 3.25% higher after earnings

- Dollar turns lower as investor prepare for court battle on tariffs

- Stocks rise but are muted on trade policy confusion

FX: USD dropped and it has now pared a lot of its gains it had made earlier in the week. The Court of International Trade (CIT) blocked US President Trump’s “Liberation Day” tariffs, adding to already high levels of uncertainty over the direction of US trade policy. A reinstatement of certain tariffs very late in the day simply adds to the confusion. There is likely to remain an underlying bearish tone to the greenback due to the weak fiscal environment and policy making credibility.

EUR moved lower below support at 1.1243 before bouncing higher and above 1.13 again. Sentiment was the chief driver with markets focusing on uncertain US growth prospects and the risk premium attached to the dollar. Germany is expected to announce a new economic package and flesh out the fiscally expansive outlook which could be euro bullish on June 25.

GBP traded in tandem with its major peers with obvious high headline risk around tariffs. Cable dipped below the previous cycle high at 1.3434 before rebounding. There has been very little UK news to move the pound this week.

USD/JPY popped higher to 146.28 early in Asian hours before falling through the day. Safe havens saw decent gains with Japan’s Finance Minister Kato overnight noting they will monitor financial market moves, including the super-long bond trade, and they can deepen discussions with US Treasury Secretary Bessent about a basic understanding of FX policy.

AUD found a bid after three straight days of selling. The aussie continues to trade around the 200-day SMA at 0.6445. CAD moved higher with the major down for the first day in four on the latest twist in the tariff saga.

US stocks: US stocks closed in the green. The S&P 500 added 0.40% to settle at 5,912. The Nasdaq closed up 0.21% at 21,364. The Dow Jones finished higher by 0.28% at 42,215. Only one sector finished in negative territory – communication services, while real estate led the gainers. Sentiment was buoyed by strong Nvidia earnings and the US Court of International Trade ruling that Trump’s tariffs are illegal and he overstepped his authority. However, the mood started to sour in the European morning with US equity futures ultimately bottoming out just after the opening bell before paring marginally into the close, with equities finishing the day slightly firmer. Note, in late trade, the appeals court temporarily halted the ruling against Trump tariffs as it needs time to consider filings. Focus will be on whether or not the appeal is successful

Asian stocks: Futures are mixed. Asian markets were mostly in the green with Nvidia’s earnings boosting sentiment. The Hang Seng and Shanghai Composite confirmed to the positive mood though frictions lingered after US chip designers were told to stop selling to China. The Nikkei 225 outperformed and rose above 38,000 after yen weakness. The ASX 200 moved higher due to energy, tech and telecoms outperformance.

Gold dipped below support at $3,272 before rebounding on more uncertainty around US trade policy. The falling dollar helped bugs too.

Day Ahead – Tokyo CPI, US Core PCE

We get more inflation data to finish off the week – this time from Tokyo and in the US, the core PCE figures, which is the Fed’s favoured inflation gauge. Tokyo data acts as a forerunner to the national numbers next week. Price pressures are forecast to remain strong and broad-based, with core figures possibly falling back but staying elevated. Key will be if momentum is maintained on a m/m basis.

The Fed’s favoured inflation metric is likely to cool after softer than expected CPI and PPI components that feed into this data. Both core and headline readings are expected to rise 0.1% m/m, and 2.5% and 2.1% respectively. This week’s FOMC minutes were modestly hawkish as almost all participants commented on the risk that inflation could prove to be more persistent than expected.

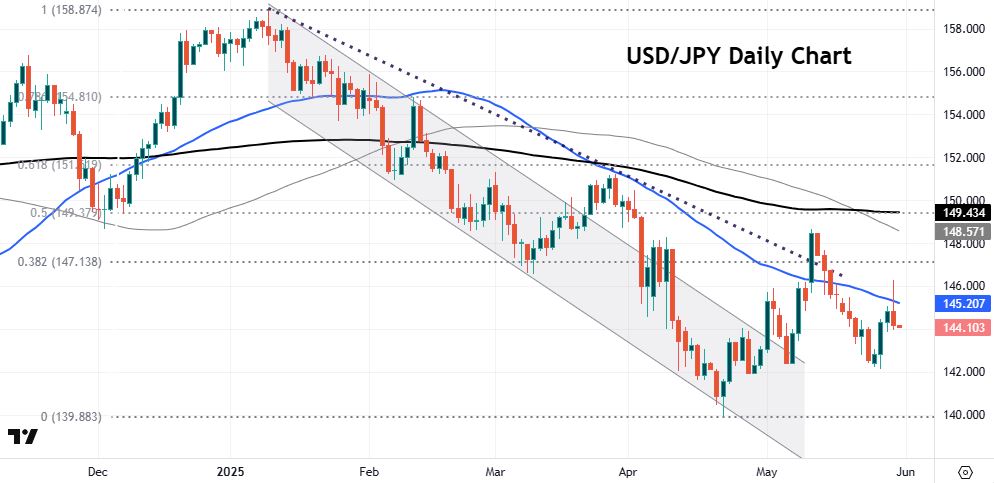

Chart of the Day –USD/JPY to resume downtrend?

Trade talks are ratcheting up between the US and Japan. The latter’s top trade negotiator arrives in Washington for a fourth round of talks, with intentions to continue discussions despite the latest confusion about the US court ruling and if tariffs are illegal. Japan’s bond markets look to have calmed for now and spreads are steady. Domestic fundamentals will be in focus to drive near-term price action with a heavy release calendar that includes employment, Tokyo CPI, industrial production, and retail sales data.

USD/JPY fell below 140 in late April but then rebounded above 148 in mid-May. Seven consecutive days of selling followed and a few days of buying recently may have been halted with the rejection of higher prices yesterday through the 50-day SMA. This has acted as resistance previously and currently sits at 145.20. Near-term support is around 142.10/20.