Stocks stall, USD up again as focus turns to NFP

* Dollar set for first monthly gain of 2025 as trade deal ease uncertainty

* Apple posts strong iPhones sales, Amazon cloud results fail to impress

* Stocks reverse record intraday highs after Meta and Microsoft jump

* US non-farm payrolls expected to post softer, but still solid numbers

FX: USD dipped into the start of the European session but then climbed higher to finish in the green. Yen weakness was the big kicker for more upside in the Dollar Index. US data pointed to a hotter economy than forecast with PCE and employment costs beating estimates. Trade talks saw Mexico agree a 90-day extension ahead of today’s deadline. Canada is obviously now in the spotlight with its backing for Palestine cited as a reason for it to be tough to agree a deal, according to President Trump. NFP is on the radar to wrap up a busy week!

EUR outperformed after falling for sixth straight days and traded marginally higher, though it closed on its lows having giving up nearly all the day’s gains. Support sits at a minor Fib level at 1.1439. French headline inflation printed 10bps firmer-than-expected but weaker for the normalised print, while German inflation held steady at 2% y/y. The zone’s inflation data is released today – see below for details.

GBP underperformed as cable fell for a sixth day in a row. We note the big bullish positioning in GBP eased last week and is now neutral. A major Fib level (38.2%) of this year’s rally resides at 1.3140.

JPY underperformed sharply after the BoJ kept rates unchanged as expected, but emphasised the data dependent stance of the decision. There was no explicit nod to an October rate hike even though there was a notable upward revision to the inflation outlook. The domestic political picture is an added source of uncertainty, with growing worries over the fiscal situation.

AUD gave back lots of its gains after initially finding buyers on solid building approvals and retail sales data. Inflation figures earlier in the week have cemented a RBA rate cut in August. CAD sold off for a sixth straight day versus USD. Comments from both President Trump and PM Carney have pushed back on expectations for an agreement by the August 1 tariff deadline. Trade policy uncertainty remains a core concern for the BoC, as per Governor Macklem.

US stocks: The S&P 500 printed down 0.37% at 6,340. The Nasdaq settled lower, by 0.55% at 23,218. The Dow Jones finished down at 44,131, losing 0.74%. Only three sector were in the green – Communication Services (+2.11%), Utilities (+0.61%) and Industrials (0.02%). Health led the losers, down 2.79% as Trump took action towards the pharma sector ultimately aiming to lower drug prices. Meta beat on quarterly metrics and guided above expectations for Q3, and also lifted the bottom end of capex guidance. This saw the stock finish up 11.25%. Microsoft beat on quarterly numbers and raised capex guidance with revenue guidance also strong, with the stock settling 3.95% higher. Index futures had been pointing higher after these megacap reported after the close yesterday, but the cash markets gave up the gains through the US session. Amazon reported after the US closing bell and slid on soft profit guidance and declining AWS margins, losing around 2.6% in the after-market. Apple gained 1.1% after revenues surged as iPhone sales soared. This was partly due to customer buying ahead of tariffs.

Asian stocks: Futures are mixed. APAC equities were again mixed after a hawkish Fed rate hold. Chinese PMI data disappointed while markets digested the US-South Korea trade deal and the mildly dovish BoJ meeting. The ASX200 was subdued on a record plunge in copper prices and weak Rio Tinto earnings. The Nikkei 225 outperformed on yen weakness, better data and a steady BoJ meeting. The Shanghai Comp and Hang Seng were sold on weak PMIs as the manufacturing figure remained in contractionary territory.

Gold steadied around a Fib level (23.6%) of this year’s rally at $3,283. Treasury yields softened while the dollar eased marginally.

Day Ahead – EZ CPI, US non-farm payrolls

Consensus sees eurozone headline inflation one-tenth lower at 1.9% amid stabilisation in food and energy prices. The core is also forecast to print one-tenth down, at 2.2%. That would be the lowest rate since October 2021. The disinflationary impact of a firmer euro on goods prices likely offset upward pressure from services price inflation. The ECB sees inflation stabilising over the medium-term, very close to its 2% target.

The monthly US labour market report has been consistently strong in recent months with a three-month average of 150k. Wall Street expects 110k jobs added, down from the prior 147k. The unemployment rate is predicted to tick one-tenth higher to 4.2%. Wage growth is seen steady at 0.3% m/m. Seasonal summer weakness could be a factor in private employment, along with slowing population growth and possible government funding cuts. But weather impacted the last two reports and typically sees a job bounce. There could be more focus on the jobless rate going forward as it’s not just about labour demand now, but more about labour supply.

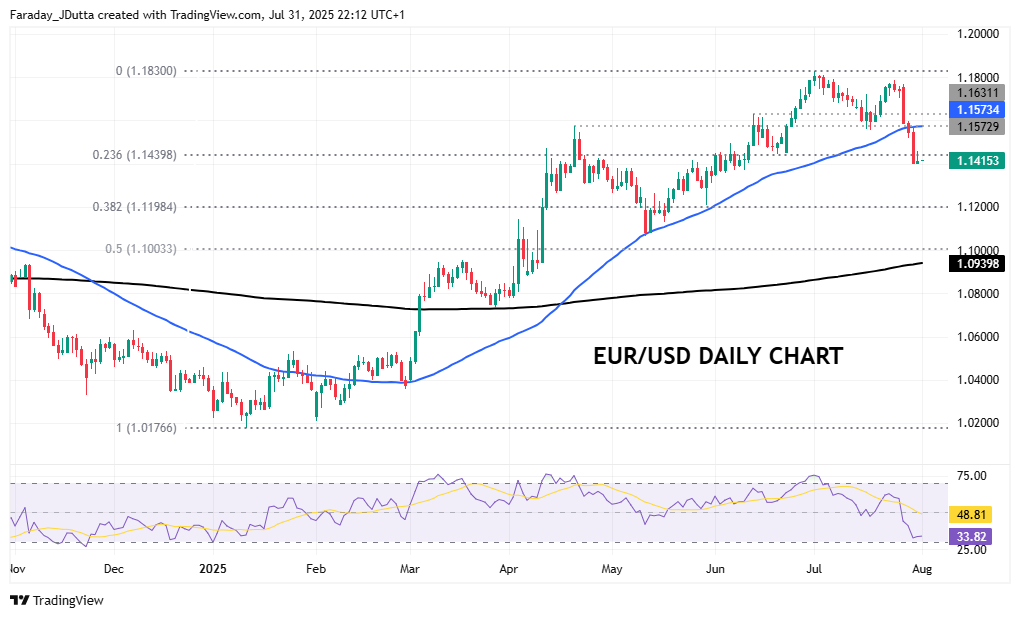

Chart of the Day – EUR/USD find support after bad week

It’s been a bad week for the euro as heavy long positioning heads for the exit in a change of sentiment. Fed Chair Powell’s tough talk – he said policymakers were looking through inflation by not hiking – propelled the dollar to its highest level since late May. The world’s most traded currency pair has found some support at a minor Fib retracement level (23.6%) of this year’s rally at 1.1439. Yield spreads actually remain supportive of the euro as markets have recently priced out ECB easing. Thr major really needs to get back above the 50-day SMA, now resitance, at 1.1572 to resume its bull trend.