Stocks up again, USD too on decent data

- Dollar rebounds from six-week low helped by stronger jobs figures

- S&P 500 hits a 13-week high led by Nvidia and chip stocks

- Gold edges down as USD rises and OECD cuts growth outlook

- Oil prices rise again as Iran talks falter and wildfires cut into supply

FX: USD found some buyers amid better trade reports with the US extending exemptions from tariffs for some Chinese goods including Covid-related and solar manufacturing products. The White House Press Secretary also stated that President Trump and Chinese President Xi will likely talk this week, though there has been no confirmation from Beijing. On the labour data, JOLTs figures showed job openings unexpectedly rose, signalling ongoing strength ahead of Friday’s NFP.

EUR was mid-pack in the major currency losers versus the dollar. The euro area CPI data for May offered little in terms of support, with both headline and core delivering a slight disappointment at 1.9% y/y and 2.3% y/y respectively. That is compared to expectations of 2.0% and 2.4%. Undershooting the inflation target is still a possibility for the ECB, who are expected to cut the deposit rate by 25bps on Thursday to 2%.

GBP pulled back from recent highs. The UK trade minister is set to meet the US equivalent to discuss the implementation of a trade deal. Comments from BoE Governor Bailey were cautiously neutral with the near-term risk of inflation balanced against concerns further out about the labour market.

USD/JPY found a bid after dipping to 142.36. Governor Ueda was on the wires reiterating that policymakers will continue to raise interest rates if the economy and prices move in line with forecasts. But he also noted there was no preset plan for rate hikes and that they will raise interest rates only if the economy and prices turn up again and outlooks are likely to be realised.

AUD fell back once again near to the 200-day SMA at 0.6443. NZD popped up to a fresh high at 0.6053 before pulling back below 0.60. CAD outperformed all of its peers but traded in a narrow range ahead of the BoC meeting. See below for more details.

US stocks: US stocks closed in the green. The S&P 500 added 0.59% to settle at 5,970. The Nasdaq closed up 0.80% at 21,662. The Dow Jones finished higher by 0.51% at 42,519. The benchmark could be breaking out to the upside to new record highs, after mixed two-way trading over the last couple of weeks. Outperformance was seen in tech, energy and materials while communication services, real estate and consumer staples lagged. The communications sector was weighed on by losses in Alphabet (-1.56%) after more reports that Apple is considering Perplexity as an iPhone search alternative from Google search. Nvidia was the best performer on the Dow, rising over 2.8%. That saw the giant chipmaker overtake Microsoft as the most valuable company in the US.

Asian stocks: Futures are mixed. Asian markets were mostly in the green as Wall Street’s recovery helped the risk mood, though gains were capped by disappointing China Caixin Manufacturing data. The Hang Seng and the Shanghai Composite were helped by potential Trump-Xi talks happening later this week. The latter was hindered by the weak PMI figures which showed the first contraction in eight months. The Nikkei 225 was lacked firm conviction after recent currency fluctuations and a deluge of comments from BoJ Governor Ueda. The ASX 200 was helped by mining stock strength, but defensives lagged.

Day Ahead – Australia GDP, Bank of Canada meeting

Economists expect Q1 economic growth to slow to 0.4% from the prior 0.6%, lifting the annual rate to 1.5%. Front-loading of orders ahead of Liberation Day likely offset softer domestic demand and household consumption growth. Australia’s growth recovery is gradual with business and consumer surveys pointing to some pessimism while adverse weather may have impacted. Public sector spending may offset this as it has been a key driver of activity over the past year.

The Bank of Canada is likely to leave rates unchanged at 2.75%. There is just over a one in five chance of a 25bps rate cut. Tariffs remain the chief headwind for the economy and firms may begin to cut jobs and consumers pare back spending with continued uncertainty. Unemployment is rising with the latest print the highest since January 2017, but core inflation is moving north again. That makes it possibly another tough call for rate setters as we get very close to the end of the cutting cycle.

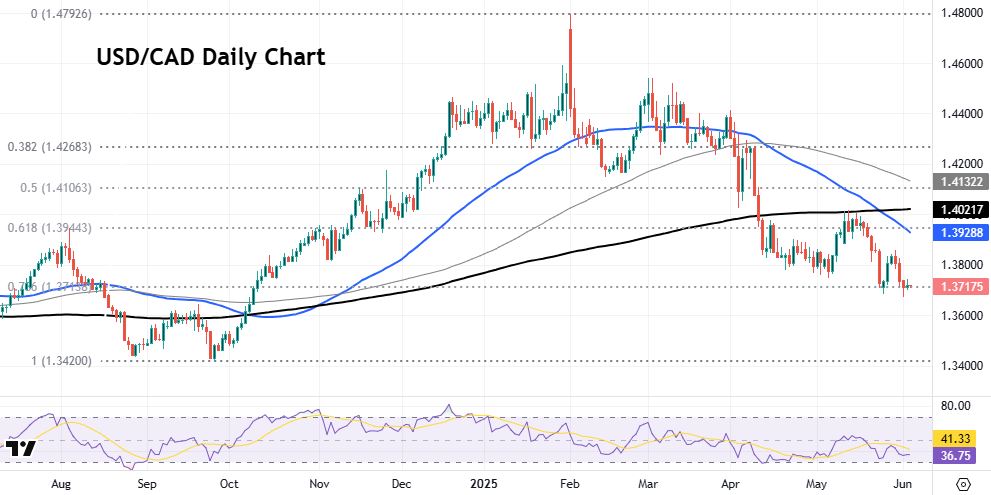

Chart of the Day –USD/CAD teetering on support

We got another bounce on Monday from the upper 1.36s, leaving a potential bullish “hammer” candle on the daily chart. That price action looks similar to the previous Monday’s price action which saw the major push higher to the mid/upper 1.38s before turning lower again. The broader downtrend in the USD is still well-entrenched across various timeframes and oscillators, which means the scope of USD gains looks limited. Resistance resides between 1.3850/60 while prices are currently sitting on top of a minor fib retracement level (78.6%) of the September to February rally at 1.3713. If we do lose that support, there’s some previous swing lows just below 1.36. For what it’s worth, the 50-day SMA (Blue line) is dropping below the 200-day SMA (Black line) which is bearish.