Strong Google boosts tech, indices but not the DJIA

- Dollar holds steady with tariffs and next week’s Fed and NFP in focus

- ECB keeps interest rates steady, points to resilient economy

- S&P 500, Nasdaq extend record run, lifted by Alphabet

- Cyclicals continue to outperform defensives, leaves Dow lagging

FX: USD found a bid for the first time this week, on broad-based strength. Higher US Treasury yields were likely the reason for dollar strength, with initial jobless claims lower possibly helping too as PMIs were mixed. There remains around a two in three chance of a 25bps September Fed rate cut. The outcome of the US-EU trade deal remains unclear with the EU said to have supported tariffs on €93bn of US goods. On the Dollar Index chart, the recent cycle trough is at 96.37 with a long-term upward trendline from lows in 2011, just above here.

EUR outperformed all the other majors, though finished lower versus the dollar printing a doji candle. The ECB left rates unchanged as expected but raised doubts about further easing with the bar a touch higher after President Lagarde’s presser. She reiterated the meeting-by-meeting, data dependent stance as we foretold, but growth was better than forecast and the undershoot in inflation due to euro strength was downplayed. Money markets moved the odds of a September 25bps rate cut to around 26% from 50% before the US-EU trade deal was touted on Wednesday.

GBP underperformed all its peers as services PMI disappointed ahead of today’s retail sales data. This shouldn’t alter the BoE decision in a few weeks, with a 25bps rate cut widely expected. A continued dovish outlook is also predicted, though the meeting may see mixed views and a split vote as the MPC navigate lower hiring and sticky inflation.

JPY was mid-pack after a mixed set of PMI data. Interest rate differentials are offering the yen some support ahead of next week’s BoJ meeting. No rate hike is expected but the bank may signal relative hawkishness after new economic projections and the agreed trade US-Japan deal, with a rate move into the autumn.

AUD and NZD outperformedmost of their peers as risk sentiment remained solid and in the absence of any major antipodean drivers. CAD underperformed all other majors apart from GBP. Seasonal trends are poised to turn less favourable for the loonie over the late summer period. That trend coincides with (and may be contingent on) stock markets typically experiencing more volatility over the period.

US stocks: The S&P 500 printed up 0.07% at 6,363, another fresh record closing high. The Nasdaq settled higher, by 0.25% at 23,220, also a new all-time closing top. The Dow Jones finished down at 44,694, losing 0.7%. All sectors were in the red except for Energy, Tech and Communication Services. The tech-heavy Nasdaq was buoyed by Alphabet and broad-based G7 strength, while the small-cap Russell 2000 (-1.4%) lagged and pared some of its weekly gains. The two tech titans, Alphabet (+0.9%) and Tesla (-8.2%) saw contrasting fortunes, and as such, Communications and Consumer Discretionary sat as the respective out/underperforming sectors. Materials was the next laggard, hit by Dow’s (-17.5%) dismal report. Tesla was hit by Elon Musk’s ‘rough few quarters’ comment, with the EV-maker in a transitory period as it evolves from an EV leader into a future tech (AI and robotics) leader. Alphabet displayed its wide moat with a booming cloud division and a search business that is still delivering, with 90% of global share.

Asian stocks: Futures are mixed. APAC equities were mostly higher after more record highs on Wall Street. The ASX200 stalled at cycle highs as losses in gold miners hit the index. The Nikkei 225 jumped again, above 42,000 before paring gains. Electrical equipment manufacturers led the gainers amid trade deal euphoria. The Shanghai Comp and Hang Seng were higher on the optimistic risk mood. Positive comments from US Treasury Secretary Bessent also helped with China negotiations seemingly back on track.

Gold turned lower for a second day as the safe haven bid on trade tensions eased back.

Day Ahead – Tokyo CPI and UK Retail Sales

Events around Japan this week have come thick and fast with the trade deal and domestic political issues ongoing. We get Tokyo inflation released today, which is the forerunner to nationwide inflation. It is forecast to ease to 3% y/y with the core unchanged at 3.1%. CPI prints have been stronger than the BoJ’s expectations and the bank may raise its outlook at its upcoming meeting. The trade agreement has lifted bets on a rate hike with October coming into view.

Consensus sees UK June headline retail sales activity printing at 1.1% and core at 1.0%. Warm weather may have boosted non-essential sectors like retail, but spending might have been cautious due to ongoing economic uncertainty. While the UK-US trade deal has eased some economic tensions, the domestic picture is clouded by potential tax rises in the Autumn. GBP has struggled this month after making multi-year highs at 1.3784 in cable.

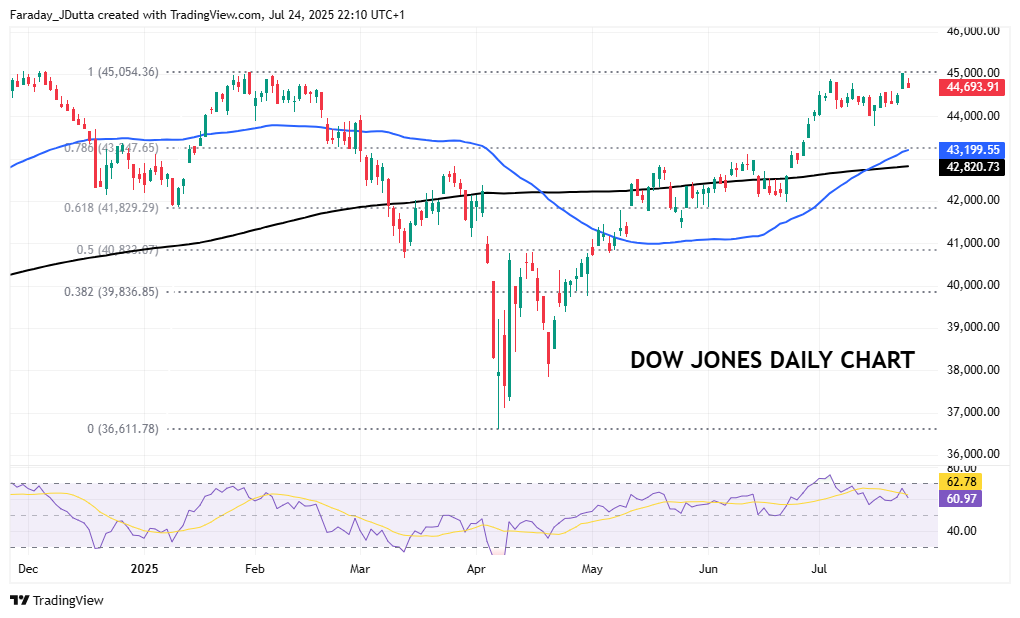

Chart of the Day – Dow rally pauses just below record high

The Dow Jones has lagged the other major US indices. Defensives have struggled over cyclicals, while it has not been boosted by the tech megacaps which dominate the weightings in the S&P 500 and Nasdaq. Yesterday highlighted this difference as losses in UnitedHealth and IBM hit the Dow, while the Nasdaq was boosted by strength in Alphabet, Amazon and Nvidia. Remember the Dow works differently to its larger index peers which weight on market cap, whereas the Dow does not, ranking its 30 members by share price, highest to lowest. The record high is just above 45,000 while the mid-July low sits at 43,758 as support. The first Fib retracement level is just above 43,000.