Tech lifts Nasdaq amid broader selloff, USD up after CPI

* US inflation ticks up in June, but tariff effects remain benign

* Traders stick to bets on September Fed rate cut following CPI data

* Yen softens to 15-week low amid Japan election jitters

* Nasdaq closes at another record high on Nvidia’s China chip cheer

FX: USD rebound continued as headline CPI data rose to 2.7%, up from 2.4% in May and expectations of 2.6%. But the core reading was modestly softer than forecast, which kept alive the chances of a Fed September 25bps rate cut. Money markets price din around 44bps of easing for 2025 versus around 50bps before the data release. There was some evidence of early tariff impacts, but weak shelter and falling car prices offset this. This all prompted another President Trump rant about Chair Powell not cutting rates. The Dollar Index is nearing the 50-day SMA, which has been resistance this year, at 98.81.

EUR dropped towards 1.16 as markets await nay news of a US-EU trade agreement. The WSJ reported that the EU has drawn up retaliatory tariffs for US goods in the event a trade deal is not reached, with aircraft and alcoholic drinks among the imports targeted. German ZEW data showed a better-than-expected improvement for the expectations and current conditions components but failed to have any sway on the euro.

GBP sunk for a fourth day in a row ahead of today’s CPI data and labour market figures on Thursday. See below for more detail.

JPY sold off again as the major hit a 15-week high. Prices are close to the midpoint of this year’s decline at 149.37 and the 200-day SMA at 149.60. The yen weakness comes as Japanese Government Bonds (JGBs) are trading defensively and long-end yields are hitting fresh multi-decade highs ahead of this weekend’s upper house election. That typically should give support to JPY but sentiment appears to be dominating.

AUD fell for a third straight day even though it performed better versus most of its peers helped by better China GDP data. CAD outperformed all of its peers apart from the buck, as the trimmed mean core CPI figure remained unchanged at 3%. That kept markets expecting a continued hawkish stance from the BoC.

US stocks: The S&P 500 printed down 0.41% at 6,243. The Nasdaq settled higher by 0.13% at 22,885. The Dow Jones finished off at 44,023, losing 0.98%. Sectors were all in the red apart from tech with materials, health and financials the worst underperformers. US equity indices closed mixed, with clear underperformance in the Russell (-1.9%) while chip names kept the Nasdaq buoyed after Nvidia and AMD secured export licenses to sell to China. On earnings, big banks largely finished the session lower despite profit beats, although some metrics disappointed. Blackrock, Wells Fargo and JP Morgan Chase closed in the red, while Bank of America and Morgan Stanley finished green.

Asian stocks: Futures are mixed. APAC equities traded mixed after the China data dump and ahead of CPI. The ASX200 gained on strength in tech and some defensive sectors as PM Albanese met with Chinese President Xi. The Nikkei 225 traded indecisively on yen weakness and rising JGB yields. The Shanghai Comp and Hang Seng diverged after mixed China data with GDP topping estimates, but retail sales and fixed asset investment missed forecasts.

Gold slipped but stayed just above the 50-day SMA at $3,323. Again, a rising dollar and Treasury yields dented bullion’s appeal.

Day Ahead – UK CPI

Analysts forecast UK headline inflation rising one-tenth to 3.5% and the core unchanged also at 3.5%. Fuel prices was a further decline with the volatility seen in global oil prices in the second half of the month likely to impact July figures. Crucial services inflation is expected to come in soft at around 4.6% y/y with the volatility in Easter having no unwound. However, base effects in core goods could counteract that cooling. This will the last CPI report ahead of the next BoE policy decision on August 7.

The latest MPC projections released in May forecast headline CPI in June at 3.4% while services inflation was predicted to come in at 4.6%. Today’s data release will likely underscore the tough balancing act facing rate setters, with growth appearing to be slowing and the labour market is loosening, but inflation stubborn and is set to remain the case. As it stands, an August cut is priced at around 80% for the August meeting, with a total of 52bps of loosening seen by year-end.

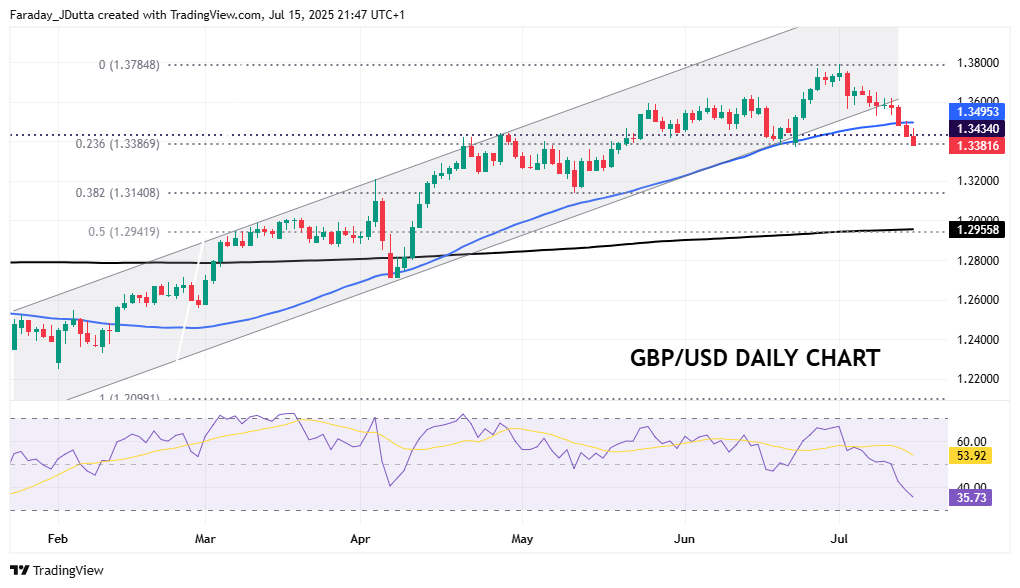

Chart of the Day – GBP rollover continues

The narrowing in shorter-dated interest rate differentials has been weighing on the pound recently. This is especially the case versus the euro and dollar. Questions have been getting louder over a pick up in the quarterly pace of rate cuts seen so far this year. Governor Bailey likely repeated his position overnight that faster easing is possible if the labour market worsens – we get fresh data on Thursday.

Cable has fallen seven days out of the last eight, having hit multi-year highs at 1.3748 at the start of July, primarily on dollar weakness. The long-term bull channel also looks to have been broken too. Prices have moved down through support at the 50-day SMA, now at 1.3495 and the long-term cycle high from September 2024 at 1.3434. The first Fib retracement point (23.6%) of this year’s rally is at 1.3386, near the June lows. Bearish momentum is solid and there’s not much major support until the mid-1.31s.